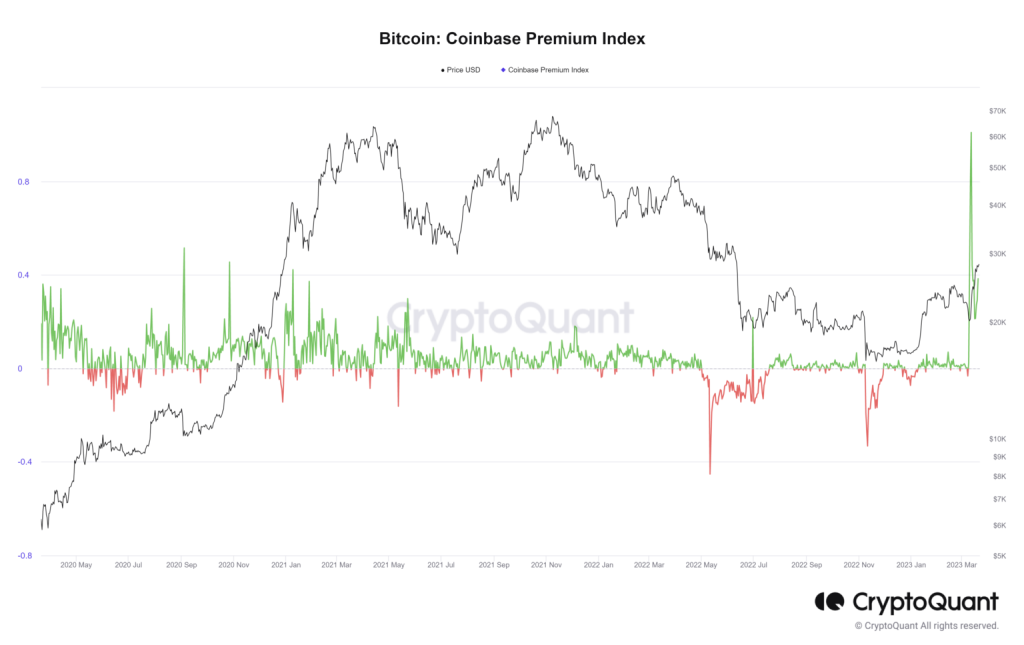

The Coinbase Bitcoin Premium Index has recently captured the attention of cryptocurrency enthusiasts, as it has remained in a negative premium for 17 consecutive days, currently at -0.1011%. This sustained negative premium indicates that Bitcoin’s price on Coinbase is consistently lower than its prices on other exchanges, a factor that may significantly influence investor decisions and market dynamics. Understanding the reasons behind this phenomenon may provide crucial insights for traders engaged in Bitcoin and cryptocurrency trading, as it reflects underlying Bitcoin price dynamics. According to data from Coinglass, this trend of negative premium is sparking widespread discussion amongst crypto investors, who are eager to analyze its implications for future market performance. Therefore, keeping a close watch on the Coinbase Bitcoin Premium Index is essential for anyone involved in market analysis and investment strategy planning in the digital asset landscape.

Recently, the Coinbase Bitcoin Premium Index has generated considerable buzz within the cryptocurrency market, particularly as it has indicated a prolonged instance of negative premium. This situation, where Bitcoin’s trading value on Coinbase is lagging behind that of other exchanges, begs further investigation into its impact on price trends and trading behaviors. Investors are carefully examining these market signals to make informed decisions, while market analysts seek to unravel the underlying forces driving these price dynamics. By interpreting the ongoing fluctuations in the premium index, both traders and analysts can gain essential insights that inform their strategies and approach to cryptocurrency trading. A better grasp of these trends is invaluable not just for individual investors but for the entire market’s understanding of Bitcoin’s evolving position.

Understanding the Coinbase Bitcoin Premium Index

The Coinbase Bitcoin Premium Index serves as a critical indicator of the Bitcoin market’s health and investor sentiment. Recently, the index has been hovering in a negative premium for an astonishing 17 consecutive days, currently standing at -0.1011%. This consistent negative reading signifies that Bitcoin is traded at a lower price on Coinbase compared to some other exchanges, presenting a unique aspect of Bitcoin price dynamics. Investors closely monitor these fluctuations as they can be pivotal in shaping trading strategies and market trends.

For cryptocurrency traders and analysts, the significance of the Coinbase Bitcoin Premium Index cannot be overstated. When the premium shifts into negative territory, it often raises alarms regarding the overall demand for Bitcoin. Traders might interpret this as a bearish signal, prompting them to adjust their strategies to mitigate potential losses. In contrast, savvy investors might view this as a potential buying opportunity if they believe the market will rebound. Thus, understanding these shifts can provide invaluable insights into market psychology and trading behaviors.

The Impact of Negative Premium on Investor Decisions

A negative premium in the Coinbase Bitcoin Premium Index can heavily influence investor decisions within the cryptocurrency market. As the trading price of Bitcoin falls below that of other exchanges, it raises questions about the liquidity and desirability of Bitcoin on specific platforms, ultimately affecting market sentiment. Investors may reconsider their positions, especially if they interpret the prolonged negative premium as a signal of waning confidence in Bitcoin’s stability. Such market reactions underscore the delicate balance of cryptocurrency trading and the importance of market analysis.

Furthermore, the implications of a sustained negative premium can lead to a ripple effect across the entire cryptocurrency landscape. Investors might turn their attention to rival exchanges, where Bitcoin is trading at a premium, thereby skewing trading volumes and possibly leading to volatility. More importantly, these shifts can result in broader market dynamics that impact not only Bitcoin but also other cryptocurrencies, reflecting the interconnected nature of the crypto ecosystem. As the panorama of cryptocurrency trading evolves, staying informed about the Coinbase Bitcoin Premium Index becomes increasingly crucial for making sound investment choices.

Market Analysis: Trends Emerging from the Coinbase Index

In the realm of cryptocurrency, market analysis is fundamentally driven by indices like the Coinbase Bitcoin Premium Index, which offers a glimpse into price dynamics and trading behavior. The current situation of a -0.1011% premium might suggest a bearish moment for Bitcoin, prompting analysts to dig deeper into potential causes and effects. Identifying patterns in the premium changes can reveal broader market trends, guiding both short-term traders and long-term investors in their strategies. This index, coupled with other market data, allows for comprehensive market evaluations.

The ongoing scrutiny of Bitcoin’s price dynamics, particularly in the context of its premium on various exchanges, indicates a need for vigilant market analysis. Analysts often utilize the Coinbase Bitcoin Premium Index to anticipate shifts in investor behavior, as a negative premium could highlight underlying issues within the market. As a result, understanding the nuances behind this index is vital for anyone engaged in cryptocurrency trading, providing insights that extend beyond mere numbers and into the realm of strategic planning and informed decision-making.

Investor Sentiment and Market Dynamics

Investor sentiment plays a substantial role in cryptocurrency markets, and indices like the Coinbase Bitcoin Premium Index can serve as barometers of this sentiment. A prolonged negative premium can evoke a sense of caution among traders, potentially leading to decreased buying activity as investors reconsider their strategies. The fear of downturns or further price declines can dominate trading floors, contributing to an atmosphere of apprehension that affects overall market dynamics. Awareness of this sentiment is essential for traders looking to understand and navigate volatile crypto markets.

Conversely, some investors may interpret a negative premium as an opportunity for acquisition, especially if they believe in the long-term potential of Bitcoin. An understanding of how the market reacts to shifts in the Coinbase Bitcoin Premium Index can provide valuable insights into investor psychology. Ultimately, monitoring the interplay between investor sentiment and market dynamics is crucial for making informed trading decisions in an environment that is often subject to rapid changes.

Bitcoin Price Dynamics and Trading Opportunities

The current state of the Coinbase Bitcoin Premium Index, sitting in a negative premium, has significant implications for Bitcoin price dynamics and presents unique trading opportunities. Traders must remain cognizant of the potential for price recovery as market conditions shift, suggesting that buying into a period of negative premiums may yield lucrative returns if the market rebounds. This understanding of price dynamics encourages traders to analyze various indicators, including volumes and trends across different exchanges, to capitalize on these opportunities.

Moreover, the trends emerging from the specific behavior of Bitcoin on Coinbase, relative to broader market conditions, can also dictate trading strategies. Those active in cryptocurrency trading often look for corresponding indicators to validate their trades. The negative premium observed on Coinbase may align with similar patterns across other exchanges, suggesting a collective market tendency that can amplify or mitigate price volatility. By leveraging these insights, traders can make more informed decisions that align risk tolerance with market dynamics.

What the -0.1011% Premium Means for Cryptocurrency Trading

The -0.1011% premium recorded by the Coinbase Bitcoin Premium Index provides essential guidance for participants in cryptocurrency trading. This negative figure suggests that traders may find Bitcoin to be undervalued on Coinbase compared to other exchanges, affecting their trading behaviors and possibly leading to increased trading activity on rival platforms. Understanding the implications of this premium helps traders formulate strategies that consider pricing discrepancies, ensuring that they align their financial actions with the current market environment.

Additionally, the sustained negative premium could indicate a broader trend of price movements that affect cryptocurrency trading’s overall health. Investors aware of the current index might analyze potential correlations with other market factors like investor sentiment, regulatory news, and technological developments within the blockchain space that could influence price dynamics. Thus, capitalizing on insights drawn from the Coinbase Bitcoin Premium Index can enhance strategic planning and investor decision-making amidst fluctuating market conditions.

Analyzing Market Response to Bitcoin Premium Changes

As the cryptocurrency market evolves, the assessment of responses to changes in the Coinbase Bitcoin Premium Index becomes integral to effective trading strategies. The current trend of a negative premium for Bitcoin has sparked discussions among investors and analysts about potential causes and future implications. In this context, historical data can serve as a useful reference point for predicting how market participants may react based on past behaviors when similar conditions arose.

Moreover, understanding how traders react to the Coinbase Bitcoin Premium Index can reveal broader market cycles, enabling investors to project future price movements. Observing the market’s response to the -0.1011% premium can illustrate patterns in buying and selling activity, providing traders with more robust frameworks for their decisions. Thus, by analyzing these dynamics, market participants are better positioned to navigate the complexities of cryptocurrency trading effectively.

The Future of Bitcoin: Implications of the Coinbase Index

Predicting the future of Bitcoin amidst fluctuations indicated by the Coinbase Bitcoin Premium Index will require a multifaceted approach. With the index currently indicating a negative premium for 17 consecutive days, investors must consider how this prolonged period may reshape expectations for Bitcoin’s valuation. Analysts will likely scrutinize the data to identify potential red flags or opportunities that may arise from these unique circumstances, focusing on factors that may contribute to a recovery or further downturn in prices.

Looking forward, the trends identified through monitoring the Coinbase Bitcoin Premium Index could guide investor sentiment and market dynamics. The activity surrounding this index can provide clues on trading behaviors and overall confidence levels in Bitcoin as a viable asset. As market conditions continue to fluctuate, staying attuned to these indicators will be essential for navigating the ever-changing landscape of cryptocurrency trading and making informed investment choices.

Frequently Asked Questions

What is the Coinbase Bitcoin Premium Index and why is it significant?

The Coinbase Bitcoin Premium Index measures the difference between Bitcoin’s trading price on Coinbase compared to other exchanges. A significant aspect of this index is when it reflects a negative premium, which occurs when Bitcoin’s price on Coinbase is lower. This can indicate market dynamics affecting investor decisions and overall cryptocurrency trading strategies.

How does a negative premium in the Coinbase Bitcoin Premium Index impact Bitcoin price dynamics?

A negative premium in the Coinbase Bitcoin Premium Index suggests that Bitcoin is being traded at a lower price on Coinbase than on other platforms. This can lead to shifts in Bitcoin price dynamics, as traders may seek to capitalize on price discrepancies, influencing market analysis and potentially affecting investment decisions.

Why has the Coinbase Bitcoin Premium Index been in a negative premium for 17 consecutive days?

The ongoing negative premium of the Coinbase Bitcoin Premium Index for 17 consecutive days highlights a trend where the price of Bitcoin on Coinbase remains lower than on rival exchanges. This situation could be driven by various market factors, and it has drawn significant attention for its implications on cryptocurrency trading and investor sentiment.

What does the current -0.1011% premium indicate about investor decisions?

The current -0.1011% reading in the Coinbase Bitcoin Premium Index signals to investors that Bitcoin may be undervalued on Coinbase relative to other exchanges. Such indicators can heavily influence investor decisions, prompting them to reassess their trading strategies in the context of ongoing market analysis and potential buying opportunities.

How should traders respond to changes in the Coinbase Bitcoin Premium Index?

Traders should closely monitor the Coinbase Bitcoin Premium Index for signs of market shifts, including periods of negative premium. By understanding how these fluctuations impact Bitcoin price dynamics, traders can make better-informed decisions, aligning their strategies with prevailing market conditions in cryptocurrency trading.

What role does market analysis play in understanding the Coinbase Bitcoin Premium Index?

Market analysis is crucial for interpreting the Coinbase Bitcoin Premium Index, particularly when it exhibits a negative premium. Analysts use this data to gauge investor behavior, predict price trends, and understand overall market dynamics, helping traders navigate the complexities of cryptocurrency trading more effectively.

| Key Point | Details |

|---|---|

| Current Status | The Coinbase Bitcoin Premium Index has been at -0.1011% for 17 consecutive days. |

| Market Reaction | The negative premium has sparked widespread attention and discussion among investors and analysts. |

| Impact of Negative Premium | A negative premium means Bitcoin’s price on Coinbase is lower than on other exchanges, influencing trading decisions. |

| Investor Caution | The data serves as a warning for investors regarding market trends and potential outcomes. |

| Importance of Monitoring | Understanding the Premium Index trends is crucial for cryptocurrency traders due to its market impact. |

Summary

The Coinbase Bitcoin Premium Index plays a crucial role in the cryptocurrency market by reflecting the price discrepancies of Bitcoin across exchanges. With the index showing a negative premium of -0.1011% for 17 days, it has generated significant discussion among traders and analysts. This situation indicates that Bitcoin is trading at a lower price on Coinbase compared to its value on other exchanges, which may lead to cautious trading behaviors and influence market dynamics. Therefore, staying informed about the Coinbase Bitcoin Premium Index is essential for anyone involved in cryptocurrency trading.