The Coinbase 50 Index (COIN50) is a pivotal tool for investors looking to navigate the rapidly evolving world of digital assets. Set to undergo adjustments in the fourth quarter of 2025, the index will introduce six new cryptocurrencies: Hedera Hashgraph (HBAR), Mantle (MANTLE), VeChain (VET), Flare (FLR), Sei (SEI), and Immutable X (IMX). By providing a comprehensive overview of the top 50 investable assets available on the Coinbase exchange, this cryptocurrency index serves as a reliable benchmark for gauging market trends. Investors can benefit from its insights, allowing for informed decisions in their portfolio management strategies. As the cryptocurrency landscape continues to expand, the Coinbase 50 Index remains a crucial element for anyone aiming to stay ahead in the digital currency market.

The COIN50, often regarded as a cryptocurrency tracker, represents a collection of the most promising digital currencies currently available for investment. With the imminent integration of new assets such as Hedera Hashgraph and VeChain, this index will reflect the dynamic nature of investable digital tokens. Designed for enthusiasts and investors alike, the Coinbase 50 Index highlights the performance of the leading digital assets on the Coinbase trading platform. It provides an essential resource for those seeking to capitalize on market opportunities within the cryptocurrency sector. This ongoing evolution underscores the index’s role as a vital resource for understanding the landscape of digital investable assets.

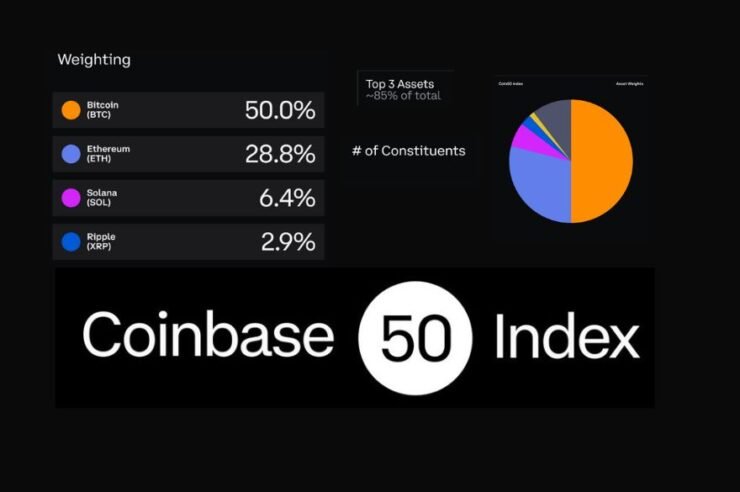

Understanding the Coinbase 50 Index (COIN50)

The Coinbase 50 Index, designated as COIN50, serves as a vital benchmark for investors navigating the bustling world of digital assets. Designed to encapsulate the performance of the top 50 investable assets listed on the Coinbase exchange, it offers a comprehensive overview of the cryptocurrency market’s evolving dynamics. With the upcoming adjustments in the fourth quarter of 2025, the addition of six new assets—Hedera Hashgraph (HBAR), Mantle (MANTLE), VeChain (VET), Flare (FLR), Sei (SEI), and Immutable X (IMX)—signifies a pivotal moment for index performance and investment strategies alike.

This adjustment reflects Coinbase’s commitment to incorporating thriving, innovative projects within the cryptocurrency ecosystem. Each of the new assets selected for inclusion in the Coinbase 50 Index has demonstrated significant potential for growth and adoption, thereby enhancing the index’s robustness and appeal for investors seeking to diversify their portfolios. As digital assets continue to gain traction, understanding indices like COIN50 becomes essential for informed decision-making within the investable assets landscape.

The Impact of New Assets on Investment Strategies

With the introduction of new assets such as Hedera Hashgraph and Seele, investors will need to recalibrate their strategies to align with the updated Coinbase 50 Index. Hedera Hashgraph (HBAR), known for its unique distributed ledger technology, offers scalability and efficiency, making it a promising addition for those looking to invest in next-generation technologies within the cryptocurrency index. Likewise, VeChain (VET) is recognized for its focus on supply chain solutions, a sector that has attracted substantial interest, adding further depth to the offerings within COIN50.

As investors analyze their approaches to digital assets, understanding the nuances of each new entrant in the index is vital. For instance, Mantle (MANTLE) and Flare (FLR) present intriguing use cases that could appeal to various segments of the market. By incorporating such high-potential cryptocurrencies into their portfolios, savvy investors can leverage the enhanced performance capabilities of the Coinbase 50 Index and position themselves favorably within the burgeoning cryptocurrency landscape.

Enhancing Portfolio Diversification with Coinbase’s COIN50

Investment diversification is a fundamental principle in risk management, and the Coinbase 50 Index (COIN50) provides an effective means to achieve this within the realm of digital assets. By encompassing a broad spectrum of the top investable cryptocurrencies, including recent entrants like Immutable X and Sei, COIN50 enables investors to spread their risk across various innovative projects. This diversification is crucial in the volatile environment characteristic of cryptocurrency markets, where asset performance can swing significantly.

Utilizing an index such as COIN50 allows investors to engage with the cryptocurrency market more strategically, as it aggregates multiple assets into a singular benchmark. This is particularly beneficial for those individuals navigating the complexities of blockchain technology and digital currencies, as it simplifies the investment process while potentially enhancing returns. For investors keen on stabilizing their exposure to cryptocurrencies, leveraging the Coinbase 50 Index is a sound approach towards building a resilient portfolio.

Exploring the Future of Cryptocurrency Indices

As the cryptocurrency landscape evolves, so do the indices that track their performance. The Coinbase 50 Index (COIN50) is at the forefront of this evolution, adapting to the rapidly changing dynamics as new projects and technologies emerge. The inclusion of assets like Hedera Hashgraph and Immutable X illustrates a trend towards recognizing innovative blockchain solutions that have the potential to disrupt traditional finance and various industries.

Future developments in the index will likely continue to reflect broader market trends, as more investors turn to cryptocurrency as a viable class of investable assets. With indices such as COIN50 bringing transparency and analytical rigor to the digital asset market, we can expect their role to expand, providing essential insights that guide investment decisions and foster greater participation across the investor spectrum.

Challenges and Opportunities in Crypto Investment

Investing in cryptocurrencies presents both significant opportunities and formidable challenges. With the Coinbase 50 Index (COIN50) now expanding to accommodate a wider range of digital assets, investors must remain vigilant about the risks inherent in this volatile market. Factors such as regulatory changes, market sentiment shifts, and technological advancements could significantly influence asset performance, necessitating a proactive approach to investment management.

However, alongside these challenges come significant opportunities for growth. The rising prominence of assets like Hedera Hashgraph, known for its speed and security, showcases the potential for high returns in the crypto space. By leveraging tools like the COIN50 index, investors can capitalize on these emerging opportunities while maintaining an informed perspective on the risks involved. Balancing risk with the potential for rewards is a crucial skill that will distinguish successful investors in the rapidly evolving world of cryptocurrency.

How Coinbase’s Adjustments Reflect Market Trends

The adjustments to the Coinbase 50 Index (COIN50) serve as a barometer for market trends and investor sentiment within the cryptocurrency landscape. As new assets are introduced, such as Mantle and VeChain, they exemplify the shifting preferences and innovations that attract capital flow in the digital assets domain. Keeping track of these changes allows investors to understand broader market dynamics and make informed decisions.

Additionally, Coinbase’s proactive approach in curating its index by adding assets that highlight breakthroughs in blockchain technology reveals its commitment to staying relevant in a competitive space. The addition of Hedera Hashgraph, for instance, signals a growing recognition of platforms that prioritize efficiency and scalability, factors that are increasingly important to investors seeking sustainable digital asset opportunities.

The Role of Coinbase Exchange in Cryptocurrencies

The Coinbase exchange plays a pivotal role in the cryptocurrency ecosystem, serving as a primary venue for trading the top 50 investable assets. With an extensive selection of cryptocurrencies available, including those recently added to the Coinbase 50 Index, users can easily access and trade their preferred assets in a secure environment. Moreover, Coinbase’s user-friendly platform facilitates new investors’ entry into the market, allowing them to become part of the rapidly expanding world of digital assets.

As the cryptocurrency market matures, the importance of an established exchange like Coinbase cannot be overstated. It not only provides liquidity and stability but also nurtures trust among investors. By listing reputable assets and updating the Coinbase 50 Index to include promising cryptocurrencies, the exchange enhances the credibility of the digital asset marketplace and reinforces its position as a leader among cryptocurrency exchanges.

Key Considerations When Investing in Digital Assets

Investing in digital assets requires a thoughtful approach and a clear understanding of the unique complexities involved. The addition of new cryptocurrencies to the Coinbase 50 Index signifies an evolving landscape, but potential investors must still conduct thorough research before diving in. Factors such as market capitalization, technological capabilities, and the team behind a project are crucial in assessing risk and potential returns.

Furthermore, considering the volatility of cryptocurrency markets is essential for any investment strategy. Investors should be prepared for market fluctuations and adopt a long-term perspective to navigate the inherent risks wisely. The Coinbase 50 Index can serve as a useful reference point, allowing investors to gauge market performance and make data-driven decisions about their digital asset investments.

Navigating the Future of Blockchain Technology

The future of blockchain technology is promising, with new innovations continuously reshaping the cryptocurrency landscape. The Coinbase 50 Index, by including assets such as Flare and Sei, highlights the increasing diversity of projects that leverage blockchain for various applications. As these technologies mature and gain wider acceptance, they may redefine existing business models and create entirely new market segments, providing savvy investors with numerous opportunities across the investable assets spectrum.

Moreover, the ongoing evolution of blockchain technology invites increased collaboration among developers, enterprises, and regulators, paving the way for standardized practices that can further legitimize digital assets. As the market matures, the insights gleaned from indices like COIN50 will be invaluable in understanding and capitalizing on the shifts in trends, ensuring that investors are well-positioned to harness the advancements in both technology and adoption.

Frequently Asked Questions

What is the Coinbase 50 Index and how does it work?

The Coinbase 50 Index (COIN50) is a cryptocurrency index designed to track the performance of the top 50 investable digital assets available on the Coinbase exchange. It provides a benchmark for investors and helps them gain insights into the market movements of significant cryptocurrencies.

Which new digital assets will be added to the Coinbase 50 Index in the fourth quarter of 2025?

In the fourth quarter of 2025, the Coinbase 50 Index will expand to include six new digital assets: Hedera Hashgraph (HBAR), Mantle (MANTLE), VeChain (VET), Flare (FLR), Sei (SEI), and Immutable X (IMX). This adjustment aims to enhance the index’s representation of the cryptocurrency market.

How can I invest in digital assets listed on the Coinbase 50 Index?

Investing in digital assets on the Coinbase 50 Index can be done through the Coinbase exchange. Investors can create an account, deposit funds, and then purchase any of the cryptocurrencies featured in the index, which reflects the performance of the top 50 investable assets.

What is the significance of the Coinbase 50 Index for cryptocurrency investors?

The Coinbase 50 Index is significant for cryptocurrency investors as it offers a diversified exposure to a curated selection of the top 50 digital assets. This index serves as a valuable tool for tracking market performance and making informed investment decisions in the rapidly evolving cryptocurrency landscape.

How often does Coinbase update its 50 Index and what influences these changes?

Coinbase updates its 50 Index periodically based on market conditions and the performance of the listed digital assets. Factors influencing changes may include market capitalization, liquidity, and overall investor interest in the cryptocurrency index.

Is Hedera Hashgraph included in the Coinbase 50 Index?

Yes, Hedera Hashgraph (HBAR) will be included in the Coinbase 50 Index starting from the fourth quarter of 2025, as part of its expansion to incorporate new digital assets.

Why is the Coinbase 50 Index important for tracking digital asset performance?

The Coinbase 50 Index is essential for tracking digital asset performance because it encompasses a wide range of investable cryptocurrencies, allowing investors to see trends, benchmark returns, and make informed investment strategies based on comprehensive market data.

Can I use the Coinbase 50 Index for cryptocurrency trading strategies?

Yes, traders can utilize the Coinbase 50 Index as part of their cryptocurrency trading strategies. By analyzing the performance of the index, investors can identify trends and potential opportunities in the cryptocurrency market.

| Key Point | Details |

|---|---|

| Adjustment of CoinBase 50 Index | In Q4 2025, Coinbase will adjust its COIN50 by adding six new assets. |

| New Assets Being Added | 1. Hedera Hashgraph (HBAR) 2. Mantle (MANTLE) 3. VeChain (VET) 4. Flare (FLR) 5. Sei (SEI) 6. Immutable X (IMX) |

| Purpose of COIN50 | The CoinBase 50 Index tracks the overall performance of the top 50 investable digital assets listed on Coinbase. |

Summary

The Coinbase 50 Index (COIN50) is set to undergo significant changes in the fourth quarter of 2025 with the introduction of six new digital assets. This adjustment aims to enhance the index’s representation of the top investable assets available on the Coinbase exchange, allowing investors to have a more diversified portfolio. The inclusion of assets like Hedera Hashgraph and VeChain reflects the evolving landscape of cryptocurrency investment. Investors should keep a close eye on these updates for potential opportunities in their portfolios.

Related: More from Exchange News | Irans Crypto Shadow Economy Evades Sanctions in Crypto Exchange | BSP Proposes Stablecoin Yield Rules: Will It Impact Coinbase? in Crypto Exchange