CME gaps are an intriguing phenomenon in the cryptocurrency market, specifically concerning Bitcoin price movements. These gaps arise from the disparity between trading hours of the CME Group Bitcoin futures and the continuous trading of Bitcoin, creating empty spaces on charts that traders closely monitor. While many speculate whether these CME gaps will eventually fill, the truth is more complex, often tied to market behavior and liquidity dynamics. As investors look for decisive Bitcoin price predictions, understanding the implications of CME gaps and the gap theory in trading becomes essential. In periods of volatility, recognizing how gaps impact trading strategies can lead to profitable insights, reshaping our comprehension of market movements.

In the world of Bitcoin trading, the concept of gaps on CME charts refers to the noticeable differences between closing and opening futures prices due to market hours discrepancies. These gaps, often highlighted in discussions of Bitcoin futures, represent vacant sectors on the trading graph where no transactions occur during weekends. The phenomenon prompts traders to ponder the reasons behind these price disparities and whether they will correct during subsequent trading sessions. As enthusiasts anticipate Bitcoin’s movement in light of the gap theory in trading, it becomes vital to explore the mechanisms behind these market anomalies. Ultimately, recognizing how these openings can influence trading decisions holds key significance for future strategies.

| Key Point | Explanation |

|---|---|

| CME Gaps Explained | A CME gap occurs when there is a disparity between Friday’s closing price and Sunday night’s opening price due to the CME’s trading schedule. |

| Market Behavior | While CME gaps often fill as market conditions normalize, they do not have to, especially in volatile periods. |

| Arbitrage Opportunity | When there’s a significant gap, traders can exploit price discrepancies between CME futures and spot Bitcoin, creating conditions for potential closure of the gap. |

| Importance of Context | In volatile markets, the relevance of previously formed gaps diminishes as price movements are driven by current market dynamics rather than historical data. |

| Conclusion on Gap Dynamics | CME gaps highlight potential price trajectories but are not guarantees; actual trading behavior is influenced by ongoing market sentiment. |

Summary

CME gaps do not always have to fill, as demonstrated by recent Bitcoin volatility, showing that these gaps are more of a reflection of market behavior rather than rigid price rules. They arise due to discrepancies in market timings between CME futures and ongoing spot Bitcoin trading. Understanding CME gaps is crucial for traders and investors, but recognizing the variability based on current market conditions is paramount.

Understanding Bitcoin CME Gaps

Bitcoin CME gaps occur when there is a discrepancy between the last traded price of Bitcoin before the CME weekend break and the first traded price when the market reopens. This gap highlights the difference between continuous spot Bitcoin trading and the structured trading hours of CME Bitcoin futures. Essentially, a CME gap serves as a blank space on the chart, making it visible that a price movement has occurred while CME was closed. This phenomenon can create confusion and uncertainty, especially among new traders who may see these gaps as significant indicators of future price movements.

While many traders speculate on whether these gaps will get filled, it’s important to understand that they do not have to fill at all. The market dynamics that occur over weekends can lead to significant price changes, resulting in gaps that remain open for extended periods. Additionally, the belief that gaps must fill is rooted more in the trading culture rather than a rigid rule governed by market behavior. Hence, the CME gap serves as a reminder of market conditions during trading breaks but does not dictate future price movements definitively.

The Mechanics Behind CME Gaps

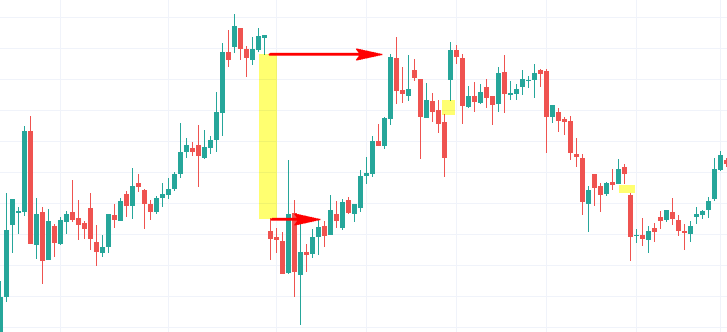

A CME gap is fundamentally a product of the trading schedule of the CME Group’s Bitcoin futures, which only operate within set hours. When substantial market movements occur during the weekend, as with Bitcoin, CME cannot reflect those changes in real time. The gap, therefore, represents a historical snapshot of where prices diverged, creating an awareness among traders of potential levels to watch when the market reopens. Understanding the mechanics of how these gaps form is crucial for traders looking to strategize around opening prices.

As the market reopens on Sunday evening, traders often analyze the gap to understand potential trading opportunities. If the spot price has moved significantly from the previous Friday’s close, it sets the stage for the opening futures price. Traders utilize this information to either enter or exit positions based on their predictions about the likelihood of a gap fill. However, many factors influence whether or not a gap will be filled, such as market sentiment, trading volume, and key events in the broader economic landscape, making it a complex decision.

Myth vs. Reality: Do CME Gaps Have to Fill?

The belief that CME gaps must always be filled is a myth that persists in trading communities, largely due to historical examples where gaps have filled quickly. However, the reality is that while many gaps do get filled, it is not a guaranteed outcome. In fact, during periods of volatility, gaps may remain open indefinitely as the market reacts to other pressing factors, such as significant price declines or news impacting Bitcoin’s valuation. Understanding the reasons behind this market behavior is crucial for traders seeking to make informed decisions.

Traders should recognize that gaps can act as psychological barriers or attractants for price action, but they ultimately reflect past market activity rather than dictate future movements. In trending markets, for instance, gaps may linger and not fill for extended periods. This insight can help traders manage their expectations and prepare strategies that take into account both market volatility and the context in which gaps occur.

Analyzing the CME Gap Strategy in Bitcoin Trading

Utilizing a gap strategy in Bitcoin trading involves understanding the nuances behind CME gaps and how they impact price forecasts. Traders often look for patterns where gaps have historically filled as potential buy or sell signals; however, it’s essential to apply rigorous analysis. For example, if a gap opens wide after a market event, traders need to assess the fundamentals driving Bitcoin’s price rather than blindly expecting the gap to close. Successful trading strategies depend on combining gap analysis with broader market indicators.

Moreover, the gap theory in trading suggests that gaps may serve as strong support or resistance levels that traders can leverage to implement their strategies. By evaluating how often gaps fill in particular market conditions, traders can create statistical models to forecast future movements. By embracing a more holistic understanding of market behavior and risk management, traders may find themselves better equipped to navigate the complexities of trading Bitcoin around CME gaps.

CME Group Bitcoin Futures: A Key Market Player

The CME Group is one of the largest derivatives exchanges in the world, and its Bitcoin futures have a significant impact on the cryptocurrency market. CME Bitcoin futures provide institutional investors with a regulated environment to trade Bitcoin, effectively bringing a level of legitimacy and stability to the market. The introduction of these products has also led to the creation of CME gaps, showcasing how traditional financial products interact with the volatile crypto space.

Investors and traders often start their analysis of Bitcoin’s price movements by looking at CME Bitcoin futures and the associated gaps. These futures contracts not only allow for speculation but also serve as a hedging instrument against Bitcoin’s inherent volatility. Understanding how the CME’s trading hours and pricing mechanisms work, especially in relation to spot pricing, is vital for any trader looking to understand the larger Bitcoin market dynamics.

The Impact of Market Sentiment on CME Gaps

Market sentiment plays a critical role in determining whether a CME gap will be filled. During periods of high volatility or significant market events, traders often find that the emotional response to price movements causes a disconnect between futures prices and spot prices. For instance, after a sharp decline in Bitcoin’s price, as witnessed during stressful market conditions, traders may exhibit a reluctance to re-enter at previous levels, thereby leaving gaps unfilled.

Furthermore, during bearish trends, traders may be less likely to see the $60,000 mark as an attractive entry point, preferring to wait for stronger signals of recovery. Consequently, CME gaps in such environments become less critical as traders adjust to a changing sentiment landscape. This highlights the necessity of coupling gap analysis with an understanding of market psychology when assessing potential future price actions.

Strategies for Trading CME Gaps Effectively

Trading CME gaps effectively requires a blend of technical analysis and an understanding of market psychology. Traders often look at previous gap patterns to predict potential fill behaviors, combining this with tools like trendlines and RSI (Relative Strength Index) to gauge overbought or oversold conditions. Setting up alerts for gap levels can also help traders monitor opportunities without having to constantly watch the charts.

In addition, risk management becomes crucial in gap trading. Since gaps can remain unfilled for extended periods, traders should define their risk thresholds and avoid over-leveraging positions based on the assumption that a gap must fill. By utilizing stop-loss orders and diversifying their trading strategies, traders can protect themselves from unexpected market movements, which are commonplace in the volatile world of cryptocurrency.

Understanding Bitcoin Price Predictions in Context of CME Gaps

Bitcoin price predictions often incorporate CME gap analysis as a part of the broader forecast. Traders utilize gap occurrences to speculate on future movements, suggesting that the price may gravitate towards prior levels for a number of reasons, including market corrections and liquidity imbalance. However, these predictions require a nuanced understanding of the surrounding market conditions—gaps are just one piece of the puzzle.

As traders analyze potential price action related to CME gaps, it’s vital to synthesize that information with other factors such as macroeconomic indicators and Bitcoin’s overall trend. Predictions based solely on gaps can lead to misguided expectations, particularly in a rapidly changing market environment where sentiment and external news can greatly influence price behavior. Thus, while gaps can offer insights, they should always be contextualized within the larger scope of market dynamics.

The Role of Arbitrage in CME Gaps and Market Efficiency

Arbitrage plays a significant role in the world of CME gaps and the efficiency of the cryptocurrency market. Traders who engage in arbitrage look for price discrepancies between the CME futures and the spot Bitcoin market, aiming to capitalize on those gaps. When CME gaps occur, these arbitrageurs can bring prices closer together, increasing market efficiency. Their actions help in filling gaps more quickly when trading resumes after a weekend.

This phenomenon reinforces the concept that markets are intertwined; as futures and spot prices inevitably gravitate toward each other, gaps may close as liquidity returns. Understanding how arbitrage influences market behavior can equip traders with insights into their strategies, helping them better predict when a gap might fill and how to time their trades in line with broader market movements.

Frequently Asked Questions

What is a CME gap and how does it impact Bitcoin trading?

A CME gap refers to the price difference on the CME Group Bitcoin futures chart between the last traded price on Friday and the first traded price when the market reopens on Sunday evening. This gap occurs because Bitcoin trades continuously while CME futures have a weekend break. Traders often monitor these gaps as they can indicate potential price movements or reversals when the market reopens.

Do Bitcoin CME gaps always get filled?

No, Bitcoin CME gaps do not always have to fill. While many gaps do get filled eventually due to market behavior, there is no guarantee of this happening on any specific schedule. In times of high volatility, such as significant market drops, gaps may remain open for extended periods.

Why are Bitcoin CME gaps significant in price predictions?

Bitcoin CME gaps are significant in price predictions because they often act as areas where the price tends to gravitate back towards once CME starts trading again. However, this is not a guarantee; market conditions, liquidity, and overall sentiment play crucial roles in whether these gaps will fill.

What is the gap theory in trading, especially in relation to Bitcoin?

The gap theory in trading posits that gaps in price charts, such as those seen in Bitcoin CME futures, can signal areas of potential support or resistance. Traders analyze these gaps to anticipate price movements, aiming to benefit from the filling of these gaps or to avoid making decisions based solely on them.

Are there any historical trends in Bitcoin CME gap fills?

Historically, many Bitcoin CME gaps have filled quickly after the futures resume trading. Studies show a high frequency of gap fills, especially during calm market conditions. However, during volatile periods or trend weeks, gaps may remain open longer as market dynamics shift.

What should traders focus on when dealing with Bitcoin CME gaps?

Traders should focus on CME gaps as potential trading levels rather than certainties. Understanding that gaps can act as psychological markers during trading sessions can benefit positioning, but it’s important to also consider current market conditions and liquidity when making decisions.

How do arbitrage opportunities relate to Bitcoin CME gaps?

Arbitrage opportunities arise around Bitcoin CME gaps because when the futures and spot prices diverge, traders can profit by buying Bitcoin on the lower-priced market and selling on the higher-priced market. This convergence helps close the gap, driven by the desire to capitalize on the price discrepancies.

What can cause the Bitcoin price to diverge from the CME futures price creating a gap?

Factors like high volatility in the spot Bitcoin market during CME’s weekend trading hiatus can cause significant price changes, leading to a gap when the CME reopens. This divergence often reflects market reactions to news, large sell-offs, or significant purchases that occur outside CME’s trading hours.

What does it mean for Bitcoin traders when a CME gap remains open?

When a CME gap remains open, it often indicates that the market is experiencing a significant trend or volatility that overshadows typical trading patterns. Traders may interpret an open gap as a sign of strong directional momentum, and it may prompt them to reassess their trading strategies.

How often do Bitcoin CME gaps occur and why should traders care?

Bitcoin CME gaps occur regularly due to the trading schedule of CME Group futures, which pauses on weekends. Traders should care about these gaps as they reflect potential price anomalies and help in understanding market psychology and price trends.