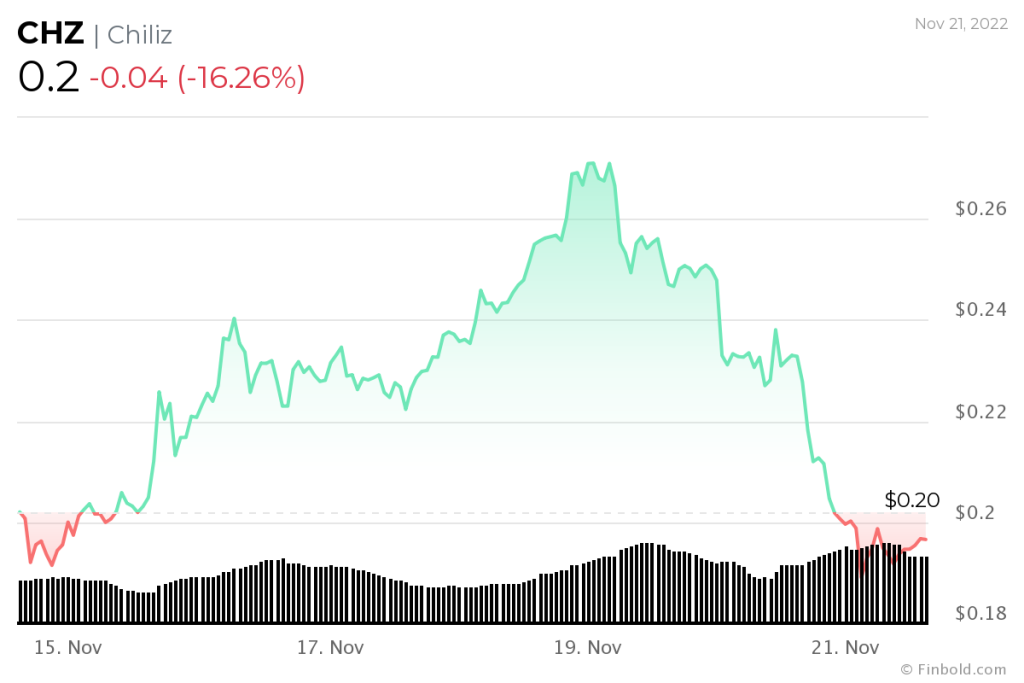

The recent Chiliz price drop has sent shockwaves through the cryptocurrency community, with a staggering decline of over 15% pushing the value down to lows of $0.046. This significant price drop reflects broader market instability, primarily influenced by a sharp downturn in Bitcoin and its subsequent ripple effects on altcoin performance. Investors are closely monitoring Chiliz price analysis, especially as anticipation builds ahead of the FIFA World Cup 2026, which could potentially rejuvenate demand for the platform’s fan tokens. Despite this setback, many remain optimistic about Chiliz’s future, particularly as it gears up for significant roadmap developments aimed at enhancing user engagement and market presence. As cryptocurrency news highlights the ongoing fluctuations, understanding the factors driving the Chiliz market trends will be crucial for potential investors.

In light of the recent plunge in the value of Chiliz, many are exploring the implications of this altcoin’s performance in a beleaguered market. This downturn, characterized by a notable decline in price, raises essential questions regarding investor sentiment and future market dynamics. As the blockchain activities associated with fan engagement amplify, the Chiliz token could reap benefits if major sporting events like the FIFA World Cup spark renewed interest. Observers must consider the broader landscape of cryptocurrency fluctuations while evaluating the factors influencing the digital asset ecosystem. Enhanced insights into market trends and price trajectories of Chiliz may pave the way for informed investment decisions as volatility remains a hallmark of the current climate.

| Key Point | Details |

|---|---|

| Chiliz Price Drop | Chiliz’s price fell over 15%, settling at $0.046 as Bitcoin’s price dropped. |

| Market Impact | The decline in CHZ is linked to a broader altcoin pullback affecting many cryptocurrencies. |

| Previous Surge | Chiliz had experienced a strong 30% rally earlier in January, reaching near $0.06. |

| Future Outlook | Anticipation for the FIFA World Cup 2026 and roadmap upgrades could boost CHZ’s price. |

| Potential Support Levels | Analysts are watching the $0.040-$0.035 support zone as a potential price target. |

| Bullish Catalysts | Upcoming transaction fee burning model and DeFi initiatives may attract long-term investors. |

Summary

The recent Chiliz price drop of 15% reflects the challenges facing the altcoin market amid Bitcoin’s downturn. Despite this decline, there are optimistic signs on the horizon, including potential catalysts such as the FIFA World Cup 2026 and exciting upgrades to the Chiliz platform. Investors should keep an eye on support levels and upcoming developments that could rejuvenate interest in CHZ, particularly in a market eager for bullish momentum.

Chiliz Price Drop: Navigating Market Volatility

The recent 15% decline in the Chiliz (CHZ) price marks a significant shift in the token’s performance amidst a broader downturn in the altcoin market. As Bitcoin registered a sharp drop, causing panic among investors, the ripple effects were felt across many top altcoins, including CHZ. Falling to lows around $0.046, this price drop overshadowed the earlier momentum that CHZ had gained, illustrating how sensitive the cryptocurrency markets can be to shifts in Bitcoin’s valuation. Such price movements are often indicative of broader market trends, reflecting investor sentiment and market psychology.

Despite the current downturn, the backdrop of the FIFA World Cup 2026 and developments in the Fan Token ecosystem signal potential recovery points. The Chiliz network, known for connecting fans to their favorite sports teams, has laid groundwork for resilience through its ongoing roadmap planning. While short-term volatility is apparent, it’s crucial for investors to consider long-term strategies and wait for indicators of stabilization, especially as the market adjusts to recent fluctuations.

Understanding Chiliz Market Trends and Performance

Chiliz has positioned itself uniquely within the cryptocurrency ecosystem, particularly by capitalizing on market trends that intersect sports engagement and blockchain technology. As the events leading up to the FIFA World Cup 2026 gain momentum, CHZ’s fluctuations reflect shifting investor interest and speculative behavior. Historical performance data shows that CHZ previously benefitted from key events, such as the notable 30% uptick seen earlier this year, fueled by anticipation surrounding major sports events and enhancements to the Chiliz Chain.

However, the current market landscape reveals a complex tapestry of factors influencing CHZ’s performance. With significant profit-taking by short-term holders and bearish momentum sweeping through altcoins, the outlook for many tokens, including Chiliz, remains cautiously optimistic. Understanding these trends is vital for investors, as they help contextualize the potential for recovery and future growth in spite of momentary setbacks.

Altcoin Performance: Chiliz Amidst a Challenging Environment

The current conditions in the cryptocurrency market have prompted considerable scrutiny of altcoin performance, with Chiliz emerging as a notable case study. The recent price drop exemplifies how interconnected these assets are within the crypto space, often moving in tandem with Bitcoin’s price fluctuations. The decline to $0.046 is a reflection of broader market sentiments, which favor caution and risk management amidst heightened volatility. As investors analyze altcoins’ potential, understanding these correlations becomes essential.

Chiliz’s position within the altcoin market not only hinges on its individual performance but is also tied to external events, including sports marketing strategies and engagement through its Fan Token model. Market watchers are particularly paying attention to how upcoming sporting events like the FIFA World Cup could reshape Chiliz’s market trajectory as new partnerships and token launches may invigorate investor interest. Balancing these factors helps position Chiliz strategically against a backdrop of broader market uncertainty.

FIFA World Cup Chiliz: Catalyst for Future Growth

The impending FIFA World Cup in 2026 is expected to serve as a significant growth catalyst for Chiliz, potentially driving increased engagement and financial inflows into the CHZ ecosystem. As fans worldwide look forward to this massive sporting event, the demand for Fan Tokens is likely to surge, leveraging Chiliz’s unique position in the marketplace. Investors are keenly monitoring developments, as the momentum from such global events often translates to heightened interest and investment in associated cryptocurrencies.

Moreover, Chiliz’s strategic partnerships with major soccer clubs, combined with its forward-thinking plans for token integrations and enhancements, position it favorably for market rebounds. The anticipation surrounding Fan Tokens could lead to substantial trade volumes and price appreciation, suggesting that while current conditions may be bearish, the horizon is bright with growth potential driven by fan engagement during high-profile events.

Why the Chiliz Price Drop Signals a Buying Opportunity

Market drops can often create valuable entry points for savvy investors, and the recent decline in the CHZ price provides just such an opportunity. With many investors likely to be cautious after the recent price plunge, those willing to embrace the volatility may find attractive valuations of CHZ. Traditionally, such price corrections are seen as healthy for the market, setting the stage for potential upward momentum when broad market conditions stabilize.

Furthermore, the implementation of innovative features like a transaction fee burning model has the potential to create upward price pressure on CHZ in the long term. Reducing the circulating supply through strategic burns can increase scarcity, thereby enhancing demand. This strategy, coupled with the anticipated Fan Token activations leading up to global sporting events, suggests that the current price drop might not reflect an end to profit potential but rather a temporary setback in Chiliz’s growth trajectory.

Chiliz Price Analysis: Key Indicators for Recovery

Effective price analysis is crucial for identifying recovery signals, especially after a notable drop like the one experienced by Chiliz. The recent decline highlights key trading levels, including the crucial psychological support at $0.050. A rebound above this mark may indicate a shift in investor sentiment, suggesting the potential for a bullish reversal. Additionally, technical indicators, such as moving averages and MACD histograms, can provide insights into whether accumulation is returning.

Investors should also keep an eye on broader market trends outside of Chiliz, as shifts in Bitcoin’s price and overall altcoin performance will influence CHZ’s trajectory. If Bitcoin stabilizes and reclaims critical support levels, there may be optimism that altcoins like Chiliz could mirror this recovery, benefiting from the overall market resurgence traditionally following such movements.

The Impact of Cryptocurrency News on Chiliz Price Dynamics

The cryptocurrency market is heavily influenced by news sentiment, as seen in the ripple effects of Bitcoin’s recent fall on the entire altcoin landscape, including Chiliz. News regarding regulatory developments, technological advancements, or shifts in market sentiment can lead to swift changes in price. Thus, staying updated on cryptocurrency news is critical for understanding potential price movements and navigating the complexities of investing in assets like CHZ.

Additionally, headlines concerning upcoming events, like the FIFA World Cup, play a significant role in shaping investor perception. Positive developments or endorsements can create bullish sentiment, promoting upward trends in token value. Keeping a pulse on both cryptocurrency-specific news and the broader financial environment is essential for investors looking to capitalize on price dynamics within the Chiliz ecosystem.

Chiliz’s Future Roadmap: Vision 2030 and Its Implications

Chiliz’s ambition outlined in the ‘2030 Vision’ roadmap positions it to become an integral player in the decentralized finance (DeFi) space and illustrates strategic plans for sustained growth. This roadmap focuses on enhancing blockchain applications and developing institutional partnerships, providing a pathway for CHZ to gain more significant traction within the crypto landscape. As the ecosystem evolves, these initiatives could invigorate user engagement and currency adoption.

Furthermore, as Chiliz integrates more advanced technology and complies with regulatory frameworks, it bolsters its standing, particularly among institutional investors. Understanding the implications of these long-term strategies is essential for investors as they navigate the fluctuating landscape of Chiliz in conjunction with upcoming market catalysts, such as major sports events and potential partnerships.

Technical Indicators for Chiliz: Navigating Price Fluctuations

Investors looking to navigate the volatile world of Chiliz will benefit significantly from understanding the technical indicators that inform price predictions. Following the recent price drop to around $0.046, technical indicators such as resistance levels, moving averages, and volume trends become essential tools for analyzing future movements. The critical levels to watch will be whether CHZ can establish and maintain support at $0.050, which could signal a prospective upward trend if surpassed.

Additionally, using trend analysis to observe price movements in relation to trading volumes can provide insights into investor sentiment. A surge in buying volume after a price dip often denotes renewed confidence in that asset, suggesting that recovery may be on the horizon for Chiliz. Investors who effectively consolidate technical data with market news can position themselves wisely amidst the inherent uncertainties of cryptocurrency trading.

Frequently Asked Questions

What factors contributed to the recent Chiliz price drop?

The recent Chiliz price drop of over 15% was primarily influenced by a sharp decline in Bitcoin’s price, which impacted the entire altcoin market, including Chiliz (CHZ). As Bitcoin fell below $85,000, major altcoins, including Ethereum and Solana, also experienced significant sell-offs, leading to increased volatility and downward pressure on CHZ prices.

How does the Chiliz price analysis reflect on altcoin performance?

Chiliz price analysis indicates that despite recent declines, the long-term outlook remains optimistic due to the upcoming FIFA World Cup 2026 and the potential for new Fan Token launches. The sharp drop is seen as part of the broader altcoin performance trends, where profit-taking by short-term holders has exacerbated market weakness, but significant catalysts could reverse this trend.

What are the implications of the FIFA World Cup on Chiliz market trends?

The FIFA World Cup 2026 is expected to have a positive impact on Chiliz market trends, as it could increase demand for Fan Tokens associated with various clubs, thereby boosting CHZ’s value. Anticipation surrounding the event has historically driven prices up, although current market fluctuations due to Bitcoin’s performance are causing temporary setbacks.

What should investors consider following the Chiliz price drop?

Investors should consider the potential for recovery in Chiliz’s price by monitoring key support levels, such as $0.040-$0.035. Additionally, upcoming developments like the Chiliz roadmap and transaction fee burning model could serve as bullish catalysts, encouraging long-term investment despite the current price drop.

Is there any potential for Chiliz recovery after the recent price dip?

Yes, there is potential for Chiliz recovery following the recent price dip. Analysts suggest that if CHZ can rebound above the $0.050 mark, it may indicate resilience. Furthermore, bullish sentiment driven by the FIFA World Cup and infrastructural upgrades under the ‘2030 Vision’ roadmap could positively influence future price action.

How does cryptocurrency news affect Chiliz’s price and market perception?

Cryptocurrency news significantly affects Chiliz’s price and market perception by influencing investor sentiment. Reports on major events, regulatory developments, and market trends can prompt traders to adjust their positions, leading to both bullish and bearish movements in CHZ prices. Staying updated on such news is crucial for predicting future performance.

Can the Chiliz price drop be attributed solely to Bitcoin’s performance?

While Bitcoin’s performance is a major factor in the recent Chiliz price drop, it is not the only reason. The overall market’s volatility, profit-taking by short-term holders, and external events impacting market sentiment also contributed to CHZ’s decline. It’s essential to analyze multiple factors to understand price movements accurately.

What role does the Chiliz Fan Token ecosystem play in price fluctuations?

The Chiliz Fan Token ecosystem significantly influences price fluctuations by driving demand and engagement from sports fans. As new tokens are launched and as events like the FIFA World Cup approach, heightened interest can lead to increased trading volumes and positive price movements for CHZ. The success of this ecosystem is pivotal for Chiliz’s long-term value.