Browsing: Latest News

Breaking news and fresh updates from global markets, tech, and crypto — all in one place at Bpaynews.

Bitcoin market analysis has become increasingly vital in understanding the fluctuations and emerging trends in the cryptocurrency landscape.On February 5, the market witnessed notable volatility amidst rising concerns about risk unwinding within traditional financial structures, as articulated in Jeff Park’s latest evaluation.

Crypto market volatility has become a defining characteristic of the digital currency landscape, capturing the attention of investors and analysts alike.Recently, Coinbase CEO Brian Armstrong highlighted that such fluctuations are typical, cyclic occurrences within the cryptocurrency market cycles.

The recent discourse surrounding IBIT options position limits has sparked significant interest and confusion among investors and market participants.Notably, claims that Nasdaq has removed these limits, granting Wall Street unlimited leverage, have been met with scrutiny.

Tokenized equities are revolutionizing the financial landscape, providing investors with a novel way to access stock markets through blockchain technology.As this innovative asset class gains prominence, the investment in tokenized stocks is drawing attention from both retail and institutional investors alike.

The recent anticipation surrounding an interest rate cut has captured the attention of traders, with over 23% expecting a shift at the upcoming FOMC meeting.This surge in expectations is fueled by market reactions to Kevin Warsh’s nomination as the next Federal Reserve Chair, a prospect that has raised concerns about the future trajectory of Federal Reserve policy.

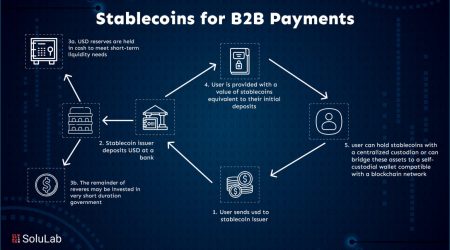

Payment stablecoins have emerged as a prominent topic in the financial landscape, particularly following the Commodity Futures Trading Commission (CFTC)’s recent updates.By including national trust banks in the criteria for these fiat-pegged tokens, the CFTC acknowledges their unique role in the evolving ecosystem of digital currencies.

The recent crypto market crash has shaken the foundations of what was once considered a flourishing digital asset landscape, erasing nearly $2 trillion in value within months.Triggered by macroeconomic pressures and investor speculation, this dramatic decline has left many wondering about the future of cryptocurrencies like Bitcoin and Ethereum, which have both faced significant price declines during this tumultuous period.

Recent developments in Bitcoin mining have seen a notable drop in mining difficulty, decreasing by approximately 11.16%.This substantial decline marks the sharpest adjustment since the significant mining challenges triggered by the China crypto mining ban in 2021.

Bitcoin prices have been on a rollercoaster ride as market dynamics shift dramatically beneath the surface.Recent analyses reveal that while consumers are eager to acquire this leading cryptocurrency, factors such as leveraged trading and synthetic exposure are reshaping the landscape.

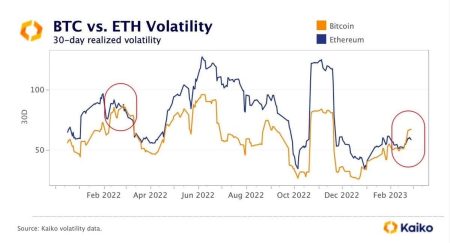

Abnormal volatility in BTC and ETH has become a hot topic among crypto enthusiasts and investors, particularly as the market navigates unpredictable price fluctuations.Recent market data reveals that both BTC and ETH have been experiencing significant swings, with single-minute amplitudes exceeding 3% during peak trading hours.