Browsing: Latest News

Breaking news and fresh updates from global markets, tech, and crypto — all in one place at Bpaynews.

Bitcoin derivatives have become a focal point in the evolving landscape of cryptocurrency trading, particularly as Bitcoin’s recent price rally reaches $71,500.Despite this impressive rebound, metrics from the BTC options market reveal a cautious sentiment among traders, who are wary of the sustainability of such gains.

The recent Bitcoin price drop has sent shockwaves through the cryptocurrency market as traders try to decipher the catalysts behind this dramatic shift.In just 24 hours, Bitcoin’s value plummeted to around $60,000, resembling the chaos of the 2022 FTX market collapse.

The crypto market volatility is an ever-present factor that shapes both investor sentiment and financial strategies within the ever-expanding digital asset landscape.Recently, we’ve observed significant fluctuations, with the Bitcoin price drop impacting countless investors and institutions alike, leaving them grappling with new challenges.

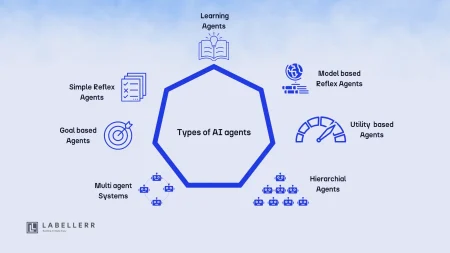

AI agents are revolutionizing how everyday users engage with the fast-paced world of crypto trading and financial activities.Recently launched by Kris Marszalek, the co-founder of Crypto.com, this innovative technology uses autonomous AI to streamline various processes, from executing trades to managing social media updates.

In a surprising turn of events, Bithumb confirmed a reward payout error amidst a spike in Bitcoin trades during a recent promotional event.This South Korean cryptocurrency exchange faced an internal malfunction that temporarily led to the misallocation of Bitcoin across certain user accounts, causing significant price fluctuations on its platform.

The recent Ethereum crash has sent shockwaves through the cryptocurrency landscape, as the second-largest digital asset plummeted below the critical $2,000 mark.This downturn was significantly exacerbated by the unexpected movement of cryptocurrencies from Ethereum co-founder Vitalik Buterin and other major investors to exchanges, revealing fragile liquidity in the ETH market.

The recent Bitcoin price dip has stirred significant attention in the cryptocurrency market, marking a crucial moment for traders and investors alike.As Bitcoin’s value fell toward $60,000, a staggering $2.56 billion was lost in liquidity across crypto derivatives markets, highlighting the severity of this sell-off.

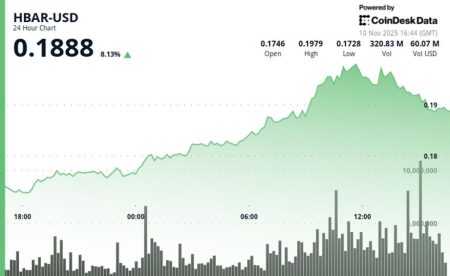

The recent HBAR surge has captured the attention of cryptocurrency enthusiasts as it soars 15%, paralleling the positive momentum seen with XLM, which has gained 10%.This sudden leap in Hedera’s price comes as the broader market looks for signs of a cryptocurrency recovery following a tumultuous decline that wiped out over $2.6 billion in leveraged positions.

The recent Bitcoin crash has sent shockwaves through the cryptocurrency market, leaving many investors anxious about the future.After months of relentless downturn, the question on everyone’s lips is whether this decline signals a long-term bearish trend or merely a temporary setback.

China stablecoin regulations are undergoing significant changes as the People’s Bank of China (PBOC) takes decisive measures to control the issuance of Renminbi-pegged stablecoins.Recently, the PBOC, along with several regulatory agencies, announced a ban on the unapproved release of these stablecoins, emphasizing the need for compliance from both local and international issuers.