Cardano Price Dips 9% as Bulls Face Market Turmoil – CoinJournal Analysis

The cryptocurrency market has witnessed significant turbulence recently, and Cardano (ADA) is no exception. Over the past 24 hours, ADA has seen a sharp 9% decrease in its price amidst broader market downturns, which have been notably chronicled by CoinJournal in their latest financial analysis reports.

What’s Driving the Price Dip?

The current decline in Cardano’s price can be largely attributed to several key factors:

-

Overall Market Sentiment: The crypto market has been experiencing widespread bearish sentiments, influenced largely by global economic uncertainties, concerns over inflation rates in the US, and potential tightening of monetary policies by central banks around the world.

-

Network Developments: Although Cardano is celebrated for its scientific approach to blockchain development and significant technological innovations, the delay in some expected updates on the network may have caused anxiety among investors. These updates are crucial for scaling solutions and enhancing transaction capabilities, pivotal factors for the network’s long-term viability.

- Profit-Taking: Cardano experienced substantial gains in the previous months, leading some investors to sell their holdings to capture profits, particularly in uncertain economic times, contributing further to the downward pressure on ADA’s price.

Technical Analysis

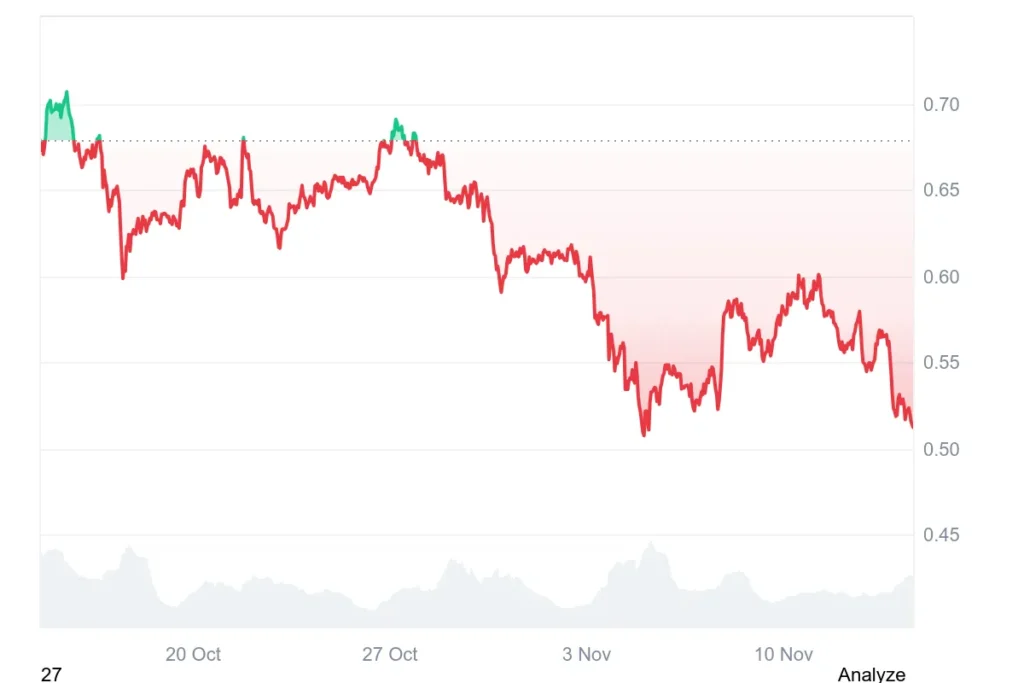

From a technical standpoint, ADA’s price movement has breached several support levels. Prior to this dip, ADA was trading around a support level of $0.95. However, with the current market conditions, the price has plummeted to roughly $0.85. Chart analysts from CoinJournal suggest that if the price fails to hold this new support level, there might be a potential further drop to lower support levels, possibly around the $0.80 or even $0.75 marks.

Market Reactions and Adaptations

This downward trend has sparked a mixed reaction among the Cardano community and broader investor audiences. While some view this as a buying opportunity, seeing the dip as a temporary setback, others express concerns about the immediate future of ADA amid increasing market volatilities.

Long-Term Outlook

Despite the current dip, many analysts remain optimistic about Cardano’s long-term prospects. The network’s emphasis on sustainability, and its robust roadmap promising upgrades like Hydra — a layer 2 scaling solution — are expected to significantly enhance the platform’s performance and appeal.

Furthermore, Cardano’s growing partnerships in various sectors, including education, retail, and healthcare across different continents, continue to bolster confidence in its utility and adoption.

Conclusion

While the 9% dip in Cardano’s price reflects current market turmoil, it also opens up discussions about the volatility inherent in cryptocurrency investments. For seasoned investors, these fluctuations are part of the broader narrative of digital currency markets, which are still in their relative infancy and prone to rapid changes influenced by external economic factors.

Investors are encouraged to keep a keen eye on market trends and to consider their investment horizons and risk tolerance levels carefully. As always, the importance of conducting thorough research and possibly consulting with financial experts before making investment decisions remains paramount.

By staying informed and strategically responsive, stakeholders in the Cardano ecosystem can navigate through these turbulent periods, potentially emerging even stronger on the other side.