The Cardano Network has recently been the center of attention following a significant disruption caused by a so-called ‘poisoned’ transaction attack. This unexpected incident led to a validation mismatch, triggering a rare blockchain fork that separated the ledger into two distinct chains. A public apology from the user involved, who unintentionally submitted a malformed transaction, highlighted the potential vulnerabilities in the Cardano ecosystem. As a result, the price of Cardano (ADA) saw a notable decline, raising concerns among investors and users alike. With cries for increased vigilance among stake pool operators, this event underscores the importance of maintaining robust protocols within blockchain technology.

The blockchain platform, commonly associated with Cardano, faced critical challenges due to an incident involving a malformed transaction that inadvertently triggered a fork in its ledger. Users across the network experienced disruption as the ecosystem grappled with this unforeseen attack, which a participant later claimed was a careless experiment rather than a deliberate hack. In the wake of this fault, various stakeholders, including prominent stake pool operators, emphasized the need for enhanced security measures and software updates to prevent similar occurrences in the future. Additionally, the situation poses questions about the resilience of cryptocurrency networks, especially in maintaining stability amid potential vulnerabilities.

Understanding the Cardano Network Incident

The recent disruption of the Cardano network marks a significant event in the blockchain world, primarily due to a malformed transaction that led to an unintentional fork. This incident raised substantial concerns regarding the security and stability of the Cardano blockchain. It illustrated vulnerabilities within the network’s validation processes, drawing the attention of both users and developers alike. As blockchain technology becomes more prevalent, events like this highlight the critical need for robust safeguards against potential attacks, especially those that exploit coding flaws.

The division in the Cardano blockchain created two distinct ledgers, causing a ripple effect that affected transaction processing across the network. The affected transactions were labeled as ‘poisoned,’ creating a distinction between valid transactions and those leading to the fork. The response from Intersect, the governing body of the Cardano ecosystem, was swift; they urged all stake pool operators to update their node software to mitigate risks and restore network integrity. This incident underscores the importance of maintaining updated systems to avoid disruptions that could lead to financial losses and reputational damage for the Cardano community.

Impact on Cardano Price and Market Perception

Following the fork incident, the price of Cardano (ADA) experienced a noticeable dip, with market observers keenly analyzing the implications of the event. Investors are often sensitive to disruptions in the blockchain functionality, and a significant drop in price can indicate waning confidence in the asset and its underlying technology. The over 6% decrease in ADA’s value post-incident reflects a direct response from the market to the perceived risks associated with such blockchain vulnerabilities. Potential investors might reconsider their positions or choose to delay entry into the Cardano ecosystem until the network’s stability is assured.

Market perception of Cardano has been further complicated by the narrative surrounding the incident, particularly the notion that it was a cyberattack orchestrated by a disgruntled stake pool operator. This explanation not only points to internal discord but raises questions about governance within the Cardano community. Should such attacks become a trend, they could impact long-term investments and collaborations. As the ecosystem works diligently to rectify the situation, the hope remains that swift and decisive actions will restore confidence in Cardano’s resilience and commitment to security.

Responses from Cardano’s Governance and Developers

In light of the attack, Cardano’s governance body, Intersect, has taken significant steps to address the vulnerabilities that led to the fork. Their proactive response involved coordinating with developers and service providers to ensure that operators were promptly informed and encouraged to upgrade their node software. Such actions are crucial in solidifying the community’s trust, demonstrating a commitment to transparency and robust protocols. By engaging effectively with users and stakeholders, Cardano aims to mitigate any potential long-term damage to its reputation.

Furthermore, Cardano co-founder Charles Hoskinson has actively participated in communications regarding the incident. His remarks suggest a deep concern for the community and an understanding of the implications such breaches can have on the network. By reassuring users that no funds were lost and that steps were in place to correct the fork, he aims to instill a sense of security among users and investors alike. This open communication is vital in turbulent times, showcasing a leadership model that prioritizes user welfare and community resilience.

The Role of Stake Pool Operators in Network Security

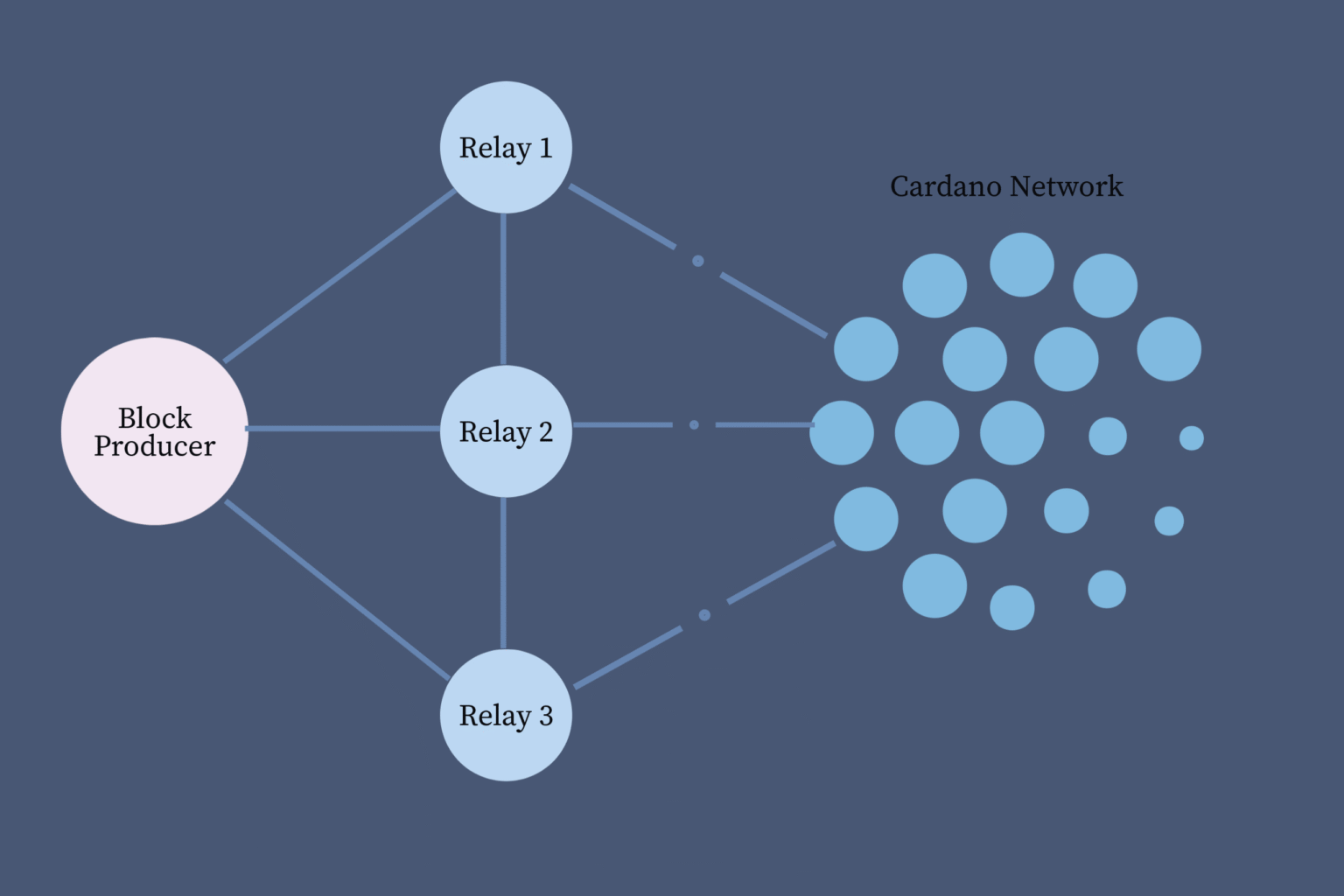

Stake pool operators play a crucial role in the overall security and operation of the Cardano network. As the entities that validate transactions and create new blocks, their actions significantly influence the network’s reliability. The recent incident has highlighted the importance of reliable and responsible behavior among these operators, as their involvement directly ties into the integrity of the blockchain. With allegations of a rogue operator being responsible for the attack, this incident serves as a wake-up call to ensure that all participants commit to their roles ethically and professionally.

Training and educating all stakeholders about best practices for network security is vital. Cardano must continue to strengthen its governance model, ensuring that all operators understand the consequences of their actions. Additionally, implementing stricter oversight mechanisms could help detect malfeasance before it leads to significant disruptions. As the Cardano network evolves, collaborating with stakeholders to foster a culture of accountability will bolster its defenses against future attacks.

Examining the Forensic Analysis of the Attack

Forensic analysis following the Cardano network disruption has uncovered potential links to participants from the Incentivized Testnet (ITN) era, shedding light on the complexities surrounding the attack. The insights gained from this investigation are crucial as they help developers identify weaknesses and enhance the overall security of the blockchain. By analyzing the transaction and understanding how it bypassed existing safeguards, Cardano can refine its validation processes to ensure that similar events do not recur in the future.

The involvement of authorities such as the Federal Bureau of Investigation emphasizes the seriousness of the threat posed by cyberattacks on blockchain networks. Engaging law enforcement not only highlights the potential legal ramifications for the offending party but also serves as a cautionary tale for others considering malicious acts within blockchain ecosystems. This collaborative effort could enable the development of better tools and frameworks for securing Cardano and similar platforms against future risks.

Technological Vulnerabilities in Blockchain Systems

The Cardano incident draws attention to inherent technological vulnerabilities present in blockchain systems. The discrepancies in transaction validation across different node versions reveal a critical gap that can be exploited by malicious actors. As the blockchain landscape continues to evolve, developers must remain vigilant in identifying such weaknesses and implementing fixes to bolster security measures. Continuous testing and auditing of node software are essential practices that can help ensure the stability of blockchain networks like Cardano.

Moreover, the understanding of how a single transaction can lead to widespread disruption serves as a reminder of the complexities involved in blockchain technology. Although designed to be secure and tamper-proof, vulnerabilities can arise from unforeseen interactions within the code. Cardano’s team must prioritize transparency and collaboration with the broader developer community to stay ahead of potential attack vectors and enhance the robustness of the platform.

The Importance of User Education in Blockchain

In the wake of the Cardano fork incident, the need for user education in blockchain technology is more critical than ever. Many users engage with blockchain systems without a full understanding of the mechanisms at play. This lack of knowledge can lead to unintended consequences, as illustrated by the ‘poisoned’ transaction incident. By educating users about the technical aspects of blockchain operations, platforms like Cardano can foster a more responsible and informed user base, reducing the likelihood of mishaps that can jeopardize network security.

Additionally, providing resources for users to understand how to manage their transactions effectively and securely can greatly enhance their interaction with the network. Workshops, webinars, and well-documented guidelines can serve as valuable tools for educating both novice and experienced users. The more informed the community is about potential pitfalls and safety measures, the more resilient the Cardano network will become against future disruptions.

Future Implications for Cardano and Its Community

As Cardano navigates the aftermath of the recent incident, the implications for its future are significant. The way in which the network addresses the vulnerabilities exploited during the attack will shape user confidence and investor sentiment moving forward. Proactive measures, such as enhancing security protocols and improving governance structures, will be crucial for rebuilding trust within the ecosystem. Cardano’s commitment to transparency and user engagement will play a pivotal role in determining its resilience against future threats.

Looking ahead, the Cardano community must also focus on innovation and adaptation. The blockchain landscape is continually evolving, and maintaining relevance requires agility in responding to market changes and technological advancements. By fostering a culture of continuous learning and improvement, Cardano can not only recover from this incident but position itself as a leader in the blockchain space. The lessons learned from this experience will be instrumental in guiding future developments and ensuring the network’s long-term success.

Frequently Asked Questions

What was the recent ‘Poisoned’ transaction attack on the Cardano Network?

The ‘Poisoned’ transaction attack on the Cardano Network occurred when a malformed delegation transaction triggered a validation flaw within the blockchain software, leading to an unexpected chain fork. While no user funds were lost, this incident raised concerns over the security of Cardano’s blockchain.

How did the malformed transaction affect the Cardano price?

Following the chain split caused by the malformed transaction, the price of Cardano (ADA) dropped over 6%. The incident prompted concerns among investors, affecting market sentiment and ultimately leading to a decrease in Cardano’s price.

What actions did Intersect recommend for Cardano stake pool operators after the incident?

After the disruption caused by the malformed transaction, Intersect advised Cardano stake pool operators to urgently upgrade their software to rejoin the main chain and prevent further inconsistencies in block production.

What impact did the network fork have on the Cardano user experience?

The network fork split Cardano into two distinct chains, causing temporary issues for users, although most wallets continued to operate safely. Intersect confirmed that most retail wallets were protected and did not suffer from the malformed transaction.

Was there any financial loss associated with the malformed transaction on the Cardano Network?

No, according to Intersect, no user funds were lost during the incident caused by the malformed transaction. Most users’ experiences were safeguarded through secure node operating systems.

What measures are being taken to address the attack on Cardano’s network?

In response to the attack, forensic analysis is underway, involving relevant authorities such as the FBI. Developers and service providers have also coordinated to deploy patched software to fix the validation flaw exposed by the attack.

How does a blockchain fork occur on the Cardano Network?

A blockchain fork on the Cardano Network occurs when validation mismatches between nodes result in divergent chains. In this case, the validation of a malformed transaction by newer node versions led to an unintended fork.

What can Cardano stakeholders do to prevent future incidents similar to the ‘Poisoned’ transaction?

To prevent future incidents, Cardano stakeholders, including developers and stake pool operators, should ensure they regularly update their node software and actively participate in community discussions to remain informed of potential vulnerabilities.

Who claimed responsibility for the malformed transaction that disrupted the Cardano Network?

A user identified on social media as Homer J. claimed responsibility for submitting the malformed transaction, describing their actions as negligent rather than malicious, and apologized for causing disruption to the Cardano network.

What did Charles Hoskinson say about the Cardano attack?

Charles Hoskinson, the co-founder of Cardano, categorized the incident as a ‘premeditated attack from a disgruntled stake pool operator’ that aimed to harm the Cardano brand and reputation, emphasizing that user safety was a priority.

| Key Point | Details |

|---|---|

| Fork of Cardano Network | Caused by a malformed transaction due to a validation flaw. |

| User Responsibility | A user took responsibility for the faulty transaction, claiming negligence in a personal challenge. |

| Impact on Users | Despite the split, no user funds were lost and most wallets were unaffected. |

| Response from Intersect | Operators were urged to upgrade their software to fix the issue and rejoin the main chain. |

| Investigation | The incident is being investigated as a potential cyberattack with authority engagement. |

| Market Response | ADA price dipped over 6% following the incident. |

Summary

The Cardano Network experienced a significant disruption due to a ‘poisoned’ transaction attack that caused a fork in its blockchain. This incident highlights the vulnerabilities within blockchain systems and serves as a reminder of the importance of robust software validation processes. Thankfully, user funds remained safe, and prompt actions were taken to remedy the situation, although the market was affected negatively. Cardano’s proactive response emphasizes the resilience of its community and the necessity for continued vigilance in network security.