Loonie surges to 10-week high as jobs shock sparks BoC repricing; USD/CAD slips below October low

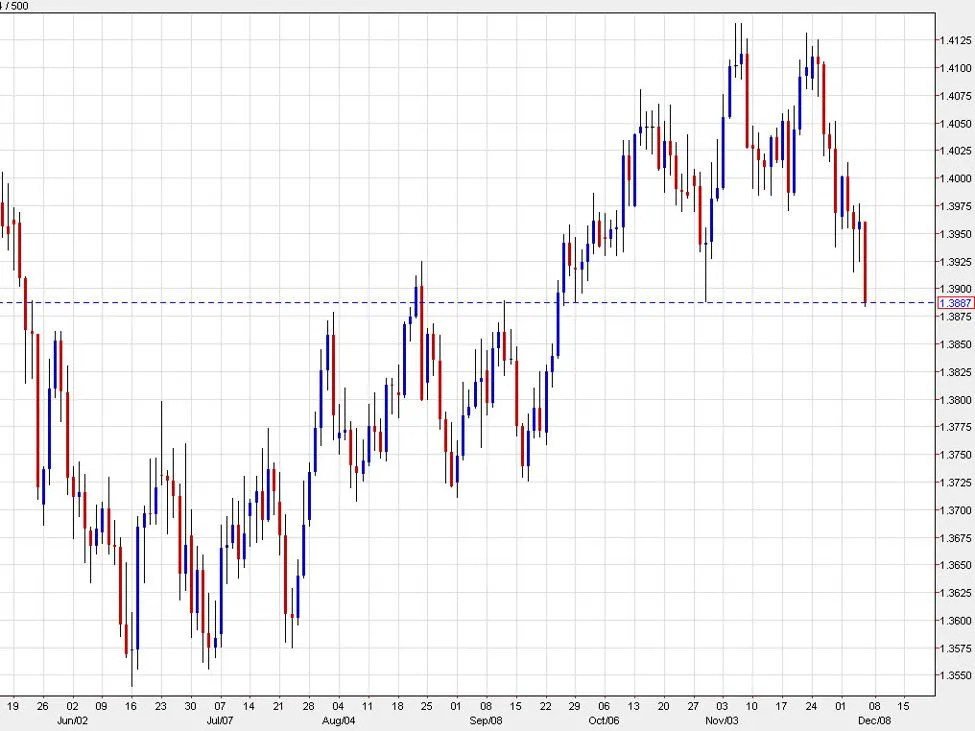

The Canadian dollar rallied sharply after a blockbuster employment report, knocking USD/CAD down roughly 70 pips to 1.3886—the lowest since September 23 and a marginal break of the October trough. Bonds sold off as traders swiftly priced a higher chance of near-term Bank of Canada hikes, lifting front-end yields.

Jobs surprise reignites Canadian rate debate

Canada’s labor market has strung together three strong months, with employment gains of 60.4k, 66.6k and 53.6k, pushing the unemployment rate down to 6.5% from 7.1%. The resilience, underpinned by robust consumer spending flagged in several corporate updates—including from Walmart—has traders reassessing the risk that inflation could re-accelerate if momentum persists.

Rates market reprices: July risk back on the table

Following the data, money markets now assign roughly a 50% probability to a Bank of Canada hike at the July meeting, with nearly one full hike priced by year-end 2026—a notable shift from the limited odds seen before the release. Liquidity was thin around the headlines, but the directional move was clear: Canadian 2-year yields jumped to 2.63% from 2.48%, tightening financial conditions and supporting the loonie.

Macro headwinds still loom

Despite the impressive labor prints, significant drags remain:

– A stretched housing market and elevated household debt burdens

– Tariff uncertainty from Washington that could weigh on cross-border trade flows

– Fresh industrial strains, including 1,000 layoffs announced at an Ontario steel mill and persistent stress in forestry

– Corporate investment caution ahead of the USMCA review in mid-2026

Offsetting those negatives, Canadian bank stocks have pushed to record highs and fiscal deficits remain sizable—factors that complicate the macro picture and the BoC’s reaction function.

FX and technicals: critical levels in USD/CAD

The break lower in USD/CAD is nudging chart watchers toward a bearish setup. The profile increasingly resembles a potential double top, which would point toward a medium-term target near 1.36 if confirmed. Near term, traders highlight support around 1.3725, with price action likely to “float” toward that zone absent fresh catalysts. Volatility may rise as the market seeks confirmation that growth and consumer strength can persist without reigniting inflation pressures.

Market context

Risk appetite remains cautious but constructive, with FX volatility concentrated in North American dollar pairs post-data. Energy-sensitive CAD is benefiting from the domestic rates impulse, while broader G10 flows reflect a tug-of-war between soft-landing hopes and lingering policy uncertainty. According to BPayNews analysis, sustained labor momentum would keep the BoC in play and could extend CAD outperformance, though trade policy risks and housing fragilities argue for measured positioning.

Key Points

- USD/CAD fell to 1.3886, a 10-week low, slipping below the October trough.

- Canada added 60.4k, 66.6k, and 53.6k jobs over the past three months; jobless rate down to 6.5% from 7.1%.

- Markets price roughly a 50% July BoC hike risk and nearly one full hike by year-end 2026.

- 2-year Canada yields jumped to 2.63% from 2.48%.

- Headwinds persist: housing stresses, tariff uncertainty, industrial layoffs, forestry weakness, and USMCA review risk.

- Technical focus: potential double top in USD/CAD; targets include 1.3725 support and a bearish objective near 1.36 if confirmed.

FAQ

Why did USD/CAD drop today?

A stronger-than-expected Canadian jobs report drove a sharp repricing of Bank of Canada rate expectations, boosting the loonie and pushing USD/CAD to a 10-week low.

What did the Canadian jobs data show?

Canada posted three consecutive robust months of job gains—60.4k, 66.6k, and 53.6k—bringing the unemployment rate down to 6.5% from 7.1%.

How did rate expectations change after the report?

Traders now see about a 50% chance of a BoC hike in July and nearly one full hike priced by the end of 2026, a notable shift from minimal odds pre-release.

What happened in Canadian bond markets?

Two-year government yields climbed to 2.63% from 2.48%, reflecting tighter policy expectations and supporting CAD.

What are the main risks to Canada’s outlook?

Housing market fragility, potential U.S. tariff actions, sector-specific layoffs, and investment caution ahead of the USMCA review in mid-2026 could cap growth and business confidence.

Which USD/CAD levels are in focus now?

Immediate attention is on support near 1.3725. A confirmed break of the recent structure could open a move toward 1.36, consistent with a potential double-top formation.