Analyzing the Possibility of a 9% Surge in HBAR Price Amid a Market Downtrend

In the volatile world of cryptocurrencies, Hedera Hashgraph (HBAR) stands out not only for its unique technology but also for its potential in defying broader market trends. As investors and enthusiasts look for signs of strength in the crypto markets, there’s a growing curiosity whether HBAR can surge by 9% and effectively buck the prevailing downtrend.

Understanding HBAR: The Tech Behind the Token

Before diving into price predictions and market analysis, it’s crucial to understand what Hedera Hashgraph is and why it matters. Unlike traditional blockchains, Hedera uses a novel form of distributed ledger technology called hashgraph. This technology promises faster transaction speeds, higher security, and improved scalability compared to many blockchain-based counterparts. These attributes make HBAR inherently attractive to investors looking for innovative crypto investments.

Current Market Environment

The crypto markets have been experiencing widespread bearish movements, primarily driven by macroeconomic factors such as higher interest rates, inflation concerns, and broader economic uncertainties. Many major cryptocurrencies have seen significant drops, pulling down the overall market sentiment.

Factors that Could Drive HBAR’s Price Surge

-

Superior Technology and Adoption: One of the main drivers for an increase in HBAR’s price could be its underlying technology and increasing adoption rates. As businesses and developers look for more efficient alternatives to blockchain, Hedera’s offer of lower costs and higher throughput could see increased utilization, thereby potentially pushing up HBAR’s price.

-

Strategic Partnerships and Developments: Recently, Hedera has announced several partnerships that could play a critical role in boosting HBAR’s market price. Collaborations with major corporations and governments for various applications of its DLT technology could reassure investors about Hedera’s utility and long-term viability.

- Crypto Market Cycles: The cryptocurrency market is known for its rapid and often unpredictable cycles. A shift in investor sentiment or a resurgence in crypto enthusiasm could naturally lift HBAR if the coin is viewed as undervalued or having strong fundamentals, regardless of current trends.

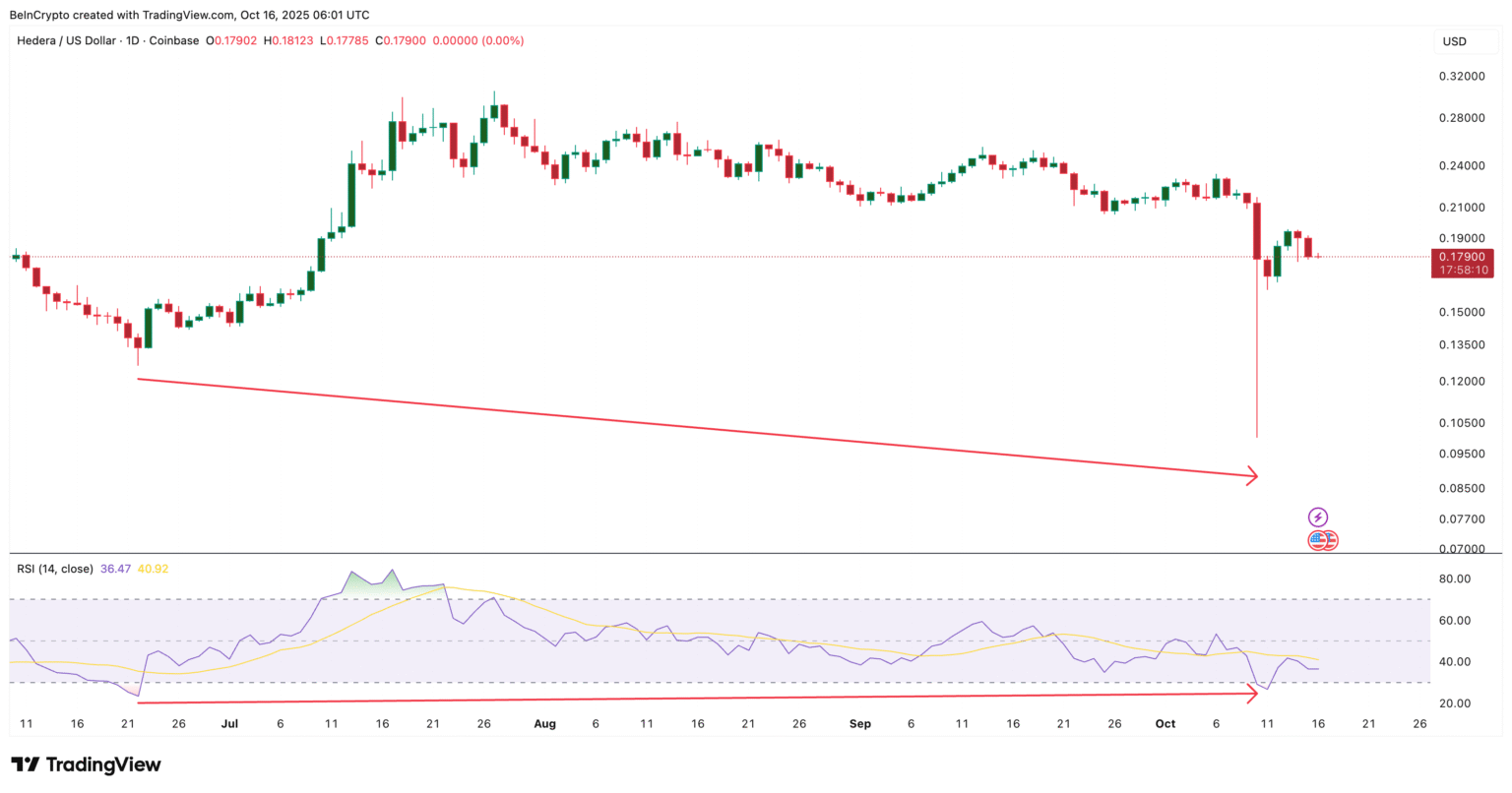

Technical Analysis

From a technical standpoint, crypto analysts have been eyeing key resistance and support levels for HBAR. A consistent trading volume increase and a move above certain technical resistance, like moving averages or Fibonacci levels, might indicate a potential bullish reversal. However, this would also require broader market support or a significant reduction in macroeconomic pressures.

Community and Sentiment

The role of community support and sentiment can’t be overstated in the crypto world. Positive news, strong community backing, and influential endorsements can drive short-term price increases. Platforms like Twitter, Reddit, and various crypto forums are filled with discussions and speculations that can sometimes translate to immediate price actions.

Conclusion: Is a 9% Surge Feasible?

Predicting prices in the crypto market is challenging, given its complex and multifactorial influences. However, given Hedera Hashgraph’s strong fundamentals, recent positive developments, and its unique position within the crypto space, a 9% price surge is within the realm of possibility, especially if the broader market conditions stabilize or if Hedera continues to announce impactful partnerships and developments.

Investors should keep a close eye on both Hedera-specific news and broader market trends. As always, a prudent approach involves diversification and careful risk management, considering the inherently volatile nature of cryptocurrency investments.

In conclusion, while the market continues to show signs of struggle, HBAR showcases potential to not only endure but also prosper, possibly beating the odds with a significant uptick. However, nothing in the crypto world is guaranteed, and vigilance is the key.