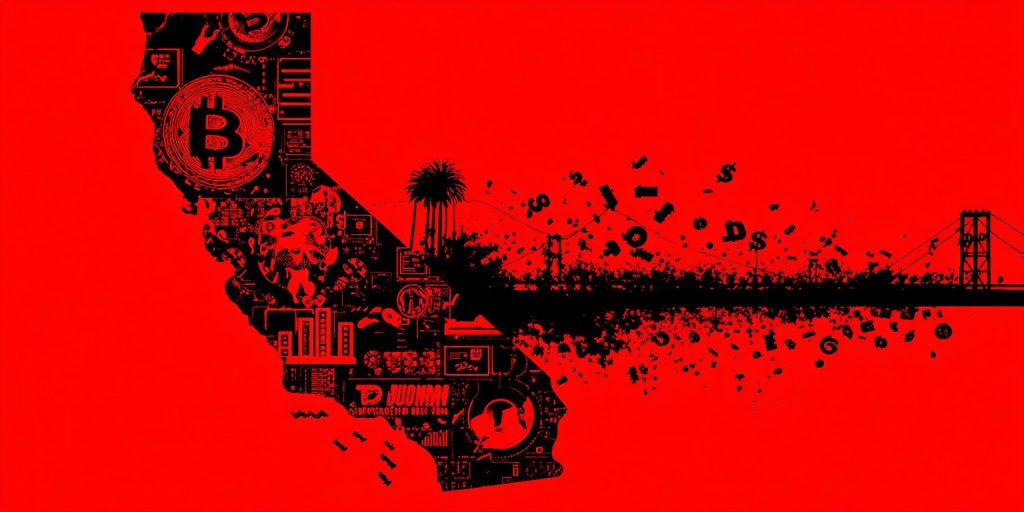

The California billionaire tax exodus is becoming a hot topic among wealthy individuals in the state, particularly after the Service Employees International Union proposed a 5% wealth tax on assets exceeding $1 billion. This controversial wealth tax proposal for 2025 aims to generate substantial revenue, potentially reaching $100 billion, which has left many billionaires, including notable crypto figures, contemplating relocation. Critics argue that California’s tax increase could drive vital sources of tax revenue out of the state, flooding states like Texas and Florida with these affluent citizens. Yet, historical data hints that despite their relocation threats, very few billionaires actually leave, as established social and business connections often outweigh tax concerns. As this trend of billionaire relocation gains attention, the implications of California’s new asset tax on economic stability could shape the future landscape for wealth in the Golden State.

As discussions heat up around the impending wealth tax proposal and its potential impacts, the concept of a “billionaire exodus” is taking center stage in California. Many affluent individuals in the tech and finance sectors are expressing their dissatisfaction and considering alternative states with more favorable tax regimes. With proposals like a new asset tax looming, the real estate and overall business climate in California may soon experience shifts as billionaires evaluate their options. Alongside the growing narrative of billionaire migration, the discourse also encompasses broader themes of economic policy and the repercussions of increased taxation on high-net-worth individuals. The ongoing dialogue about billionaires leaving California not only highlights personal financial decisions but also raises questions about fiscal responsibility and state revenue generation.

The California Billionaire Tax Exodus: A Closer Look

In recent months, California has seen a resurgence of discussions surrounding its taxation policies, particularly with the proposed wealth tax aimed at billionaires. With prominent figures in the tech and crypto sectors, like PayPal’s Peter Thiel and Google co-founder Larry Page, threatening to leave the state, the potential for a California billionaire tax exodus has become a hot topic. The proposed 5% asset tax, which targets individuals with assets exceeding $1 billion, is presented as a solution to bolster California’s healthcare system amidst escalating federal funding cuts.

Critics argue that imposing such a significant tax could drive valuable talent and wealth out of California, leading to a decrease in tax revenue. Historical trends, however, suggest that while threats of relocation are common among billionaires, the actual movements have been limited. As seen in other countries with wealth taxes, such as Norway and Sweden, the reality is that less than 0.01% of the wealthiest residents relocated despite high tax rates. This indicates that the relationship between taxation and relocation may not be as straightforward as it appears.

Implications of the Wealth Tax Proposal 2025 on Billionaires

The wealth tax proposal for 2025 is set against a backdrop of California’s already high tax burden, igniting fears among billionaires about potential asset losses. The additional one-time tax on residents with assets exceeding $20 billion raises concerns about asset seizure and unrealized gains taxation, reinforcing a narrative that California is becoming an unwelcoming environment for the ultra-wealthy. Proponents argue that these taxes are essential for funding social programs and maintaining public infrastructure, especially in light of recent budget constraints.

Yet, many influential figures in the crypto and tech industries vehemently oppose these measures, claiming that they amount to theft. They argue that the proposed taxes could reverse California’s standing as a cutting-edge hub for innovation and entrepreneurship. The polarization around the wealth tax proposal reflects deeper societal tensions about wealth distribution, corporate responsibility, and the role of government in regulating the financial contributions of billionaires.

Billionaire Relocation Trends: A Historical Perspective

Examining historical trends regarding billionaire relocations reveals a complex landscape. While many billionaires have openly discussed moving to states with favorable tax structures, such as Texas and Florida, the actual movement has not consistently followed these threats. Analysts have noted that despite financial incentives to leave, factors such as established social networks, business opportunities, and lifestyle preferences keep many affluent individuals anchored in California.

Recent studies show that, even in the face of substantial tax increases in regions like Washington and Massachusetts, the wealth of the top tiers has continued to grow. This indicates that the anticipated mass exodus of billionaires does not materialize at the same rate that it is discussed in the media. Fear of relocation often serves more as a negotiating tool than a reality, which is an important consideration for policymakers attempting to balance fiscal responsibility with the interests of their most affluent residents.

Impact of California’s Asset Tax on Tech Innovators

California’s proposed asset tax could significantly impact the state’s tech innovators, who have historically contributed greatly to its economy. The looming taxation is seen as a hindrance to creativity and investment in new technologies, prompting prominent figures like Jesse Powell of Kraken to decry it as a deterrent to industry growth. Many argue that such taxes could ultimately stifle the entrepreneurial spirit that has fueled California’s economy for decades.

David Sacks, another influential voice in the tech world, has criticized these financial measures, arguing that they fund misallocated resources rather than meaningful development. The concerns raised by tech billionaires illustrate a broader worry that punitive taxes may lead to a stagnation of innovation as talented individuals choose to relocate to more tax-friendly environments. The ongoing debate around the asset tax reflects the challenges California faces in maintaining its status as a leading hub for technological advancement.

California’s Tax Increase: Consequences for the Wealthy

The proposed increase in taxes on the wealthy has raised alarms among California’s richest residents. They fear that such changes could lead to an outflow of capital and talent, undermining the state’s economy. This concern is compounded by reports that billionaires like Chamath Palihapitiya have already relocated due to persistent tax pressures, suggesting that the notion of a tax exodus is more than just idle chatter.

Moreover, the proposed 5% asset tax could exacerbate existing tensions between state officials and high-income earners. As wealthy individuals assess their options in light of potential tax hikes, many are considering jurisdictions that offer more favorable tax policies, where they can retain a larger share of their earnings. This trend could signify a shift in the landscape of wealth concentration, with potential long-term implications for California’s economic health.

The Role of Social Networks in Retaining Wealthy Residents

Despite the discussions surrounding tax increases, many experts suggest that social, professional, and familial ties play crucial roles in retaining wealthy residents in California. Established networks foster a sense of community and provide support systems that are hard to replicate elsewhere. This interconnectedness often outweighs the financial allure of relocating to states with lower tax burdens, allowing California to hold onto a significant portion of its affluent population.

Further, the cultural and lifestyle attributes unique to California, such as its temperate climate and the vibrancy of Silicon Valley, remain attractive to many billionaires. These factors create a compelling case for remaining in the state, even in the face of increased taxation. As highlighted by the ongoing discourse among tech leaders, the quality of life in California may ultimately have more influence on their decisions than the prospect of tax savings elsewhere.

Public Sentiment on Billionaires and Taxes in California

Public sentiment regarding billionaires and taxes in California is increasingly polarized. Many residents support taxation on the wealthy as a means to generate funding for vital public services. The narrative surrounding wealth taxes often paints billionaires as out-of-touch individuals who can afford to contribute more to society. This perspective is fueled by the visible wealth disparities in the state, leading to calls for greater contributions from those who amassed considerable fortunes.

On the other hand, there is a growing sentiment among certain groups that excessive taxation could drive innovation and wealth creators out of California. As public debates continue, the balance between ensuring adequate funding for state services and maintaining an attractive environment for billionaires will be crucial in shaping tax policies. This ongoing discussion will determine how California navigates its economic challenges while addressing the needs of its diverse population.

Potential Economic Effects of the Wealth Tax on California

The potential economic effects of the proposed wealth tax in California could be profound, affecting everything from state revenues to local economies. Supporters argue that the tax could provide much-needed funding for healthcare and education, crucial sectors that have suffered from budget cuts. By generating substantial revenue, proponents believe, the wealth tax can help mitigate disparities and bolster community resources across the state.

However, there are apprehensions about how such a tax could impact investment in California. Individuals who face new asset taxes may reconsider their contributions to local businesses or philanthropic efforts, potentially harming sectors that rely on the support of wealthy donors. The challenge for California will be to implement policies that allow for necessary funding without discouraging the continued involvement of its affluent residents.

Looking Ahead: The Future of Wealth Taxes in California

As California grapples with the implications of the proposed wealth tax and potential taxation changes, its future remains uncertain. Historical patterns suggest that while threats of relocation are common, the actual migration of billionaires may not be as significant. Analysts will need to monitor the outcomes of the upcoming 2026 vote closely, as the results could pave the way for similar measures in other states. Should the tax pass, California may set a precedent that could shift the dynamic of wealth taxation nationwide.

The decisions made over the coming years in California could define not only the state’s economic future but also the broader conversation on wealth taxation across the United States. As policymakers evaluate the effectiveness and public support for wealth taxes, the experience of California will likely influence discussions in other regions grappling with similar fiscal challenges. Therefore, the outcome of this situation will resonate far beyond California, potentially reshaping the landscape of wealth taxation in America.

Frequently Asked Questions

What are the potential implications of the California billionaire tax exodus on state revenue?

The California billionaire tax exodus could significantly impact state revenue, particularly if high-profile residents like crypto billionaires decide to relocate. However, historical patterns show that threats of relocation often do not result in actual moves. Experts indicate that the wealthiest individuals typically maintain their presence due to established networks and complex relocation processes.

How does the wealth tax proposal for 2025 affect crypto billionaires in California?

The wealth tax proposal for 2025 includes a 5% tax on assets exceeding $1 billion, directly affecting many crypto billionaires in California. This has raised concerns among wealthy individuals about potential relocations, as noted by prominent figures in the industry. Yet, evidence suggests that actual relocation trends among the wealthy may be minimal.

Are California’s billionaire relocation trends a real concern for lawmakers?

While California’s billionaire relocation trends are frequently highlighted, lawmakers may not need to worry excessively. Historical data shows that the actual outflow of billionaires is often negligible, even in light of tax increases. Past instances, like in Scandinavian countries, indicate that these high-net-worth individuals tend to stay put despite proposed tax reforms.

What are the key features of the California asset tax suggested by the Service Employees International Union?

The proposed California asset tax includes a 5% tax on residents with assets over $1 billion and a one-time $1 billion tax on individuals with assets exceeding $20 billion. This proposal aims to generate substantial revenue for state healthcare and has sparked significant backlash from the crypto and tech communities in California.

Will the California tax increase lead to a mass exodus of billionaires?

Experts suggest that while the California tax increase may prompt discussions of relocation among billionaires, the actual mass exodus is unlikely. Historical data indicates that a small percentage, often less than 1%, of wealthy individuals relocate following tax reforms. This suggests that many choose to remain in California despite higher taxes.

What reactions have crypto billionaires in California had to the proposed wealth tax?

Crypto billionaires in California have reacted strongly against the proposed wealth tax, labeling it as theft and a disincentive for innovation and investment. Prominent figures in the tech and cryptocurrency sectors argue that such taxation measures could drive billionaires to seek opportunities in states with more favorable tax environments.

Is the threat of a California billionaire tax exodus a bluff?

Many analysts argue that the threat of a California billionaire tax exodus is largely a bluff. Historical trends show that perceived tax burdens have not led to significant relocations among the wealthy. Factors like community ties and established business networks often outweigh the desire for lower taxes.

What historical evidence exists regarding billionaire relocations in response to tax reforms?

Historical evidence suggests that significant relocations in response to tax reforms are rare. For instance, the Tax Justice Network found that in Scandinavian countries like Norway and Sweden, less than 0.01% of the wealthiest families moved after wealth taxes were enacted. This indicates that although the topic is a hot-button issue, actual relocations are not widespread.

| Key Points |

|---|

| California crypto billionaires consider leaving following a proposed 5% asset tax for residents with over $1 billion. |

| The tax proposal, introduced by SEIU-UHW, aims to raise $100 billion from 200 residents to offset federal funding cuts in healthcare. |

| Notable figures like Peter Thiel and Larry Page have expressed intentions to relocate due to the tax. |

| Experts believe that past threats of relocations by wealthy individuals have often been bluffs. |

| The proposal includes an additional $1 billion one-time tax for individuals with assets exceeding $20 billion. |

| Concerns arise about potential loss of tax revenue if billionaires leave California. |

| Despite fears of billionaire exodus, studies show that when similar taxes were imposed elsewhere, relocations were minimal. |

| The complexities of moving and established connections often keep wealthy individuals from relocating. |

Summary

The California billionaire tax exodus has become a significant topic of discussion as prominent crypto billionaires threaten to leave the state in light of a proposed tax on their assets. This proposal, aimed at generating substantial funds to support healthcare initiatives, has prompted skepticism about if such wealthy individuals will actually follow through with leaving. Historical evidence suggests that while the discourse around departing billionaires is frequent, actual relocations are rare due to entrenched social and business ties. Therefore, the fears surrounding the California billionaire tax exodus may be more of a warning than an imminent reality.