USD/CAD Retreats as the Trump Administration Tests the Supreme Court

In a remarkable twist of events, the USD/CAD currency pair experienced a retreat following the latest political maneuvers by the Trump administration, testing the resilience of the United States Supreme Court. This development comes amid a tumultuous period in the financial markets, where political uncertainties often translate into currency volatility.

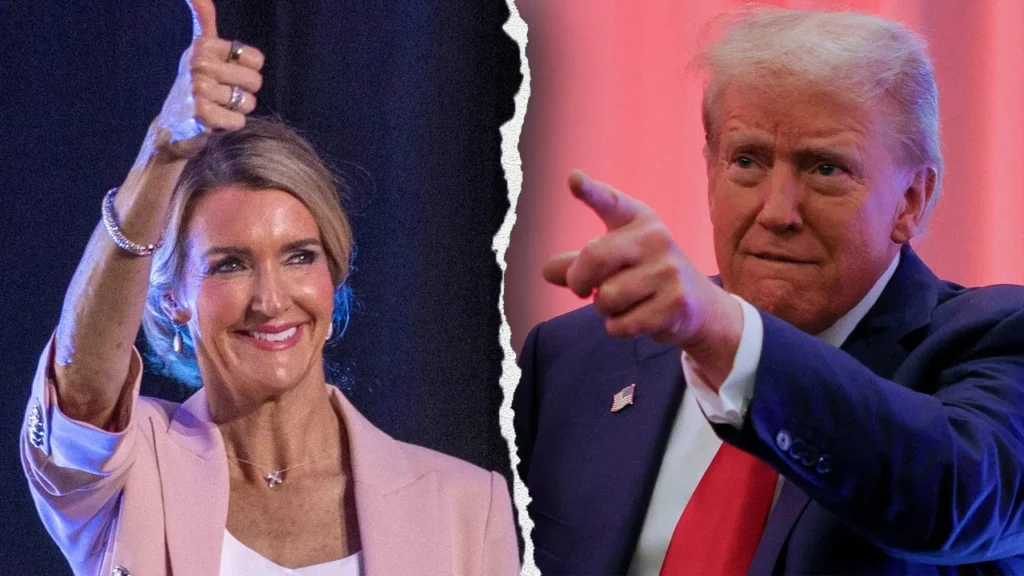

The Catalyst: Trump Administration’s Supreme Court Challenge

The Trump administration has recently undertaken actions to test the boundaries of the U.S. Supreme Court’s decisions on several key issues, including immigration and corporate regulation. These moves have stirred significant debate and uncertainty, affecting investor confidence and perceptions of the U.S. political landscape’s stability. The specifics of these challenges, while rooted deeply in ideological motives, have profound implications for the policy environment affecting both domestic and international economic activities.

Impact on USD/CAD

The USD/CAD pair, sensitive to changes in U.S. economic policies, has reacted to this uncertainty by retreating. The Canadian dollar, often seen as a more stable counterpart amidst U.S. political unsteadiness, found firmer ground. Analysts observe that the loonie has capitalized on this opportunity, bolstered by Canada’s comparatively stable political environment and its steady handling of domestic affairs.

Market Reaction and Investor Sentiment

This recent development has led to a risk-off sentiment among investors, causing shifts in the forex markets. A risk-off environment typically sees investors pulling away from riskier assets, such as the U.S. dollar in this scenario, and moving towards safer investments. The Canadian dollar, along with other perceived safe currencies, has appreciated as a result.

Investing circles have also expressed concerns about the long-term impacts of such political tests on trade relations, particularly between the U.S. and its North American neighbors. Any sign of instability or unpredictability in U.S. governance is closely scrutinized by market participants who recall the trade tensions induced by previous policy decisions under the Trump administration.

Forward-Looking Perspectives

Financial experts suggest keeping a close watch on the developments stemming from the Supreme Court challenges. The outcomes could potentially reshape the regulatory landscape in the U.S., impacting sectors ranging from technology to healthcare, and subsequently, the forex markets. The trajectory of the USD/CAD will likely hinge on forthcoming legal and political interpretations, which will either restore investor confidence or create additional layers of complexity.

Conclusion

The retreat of USD/CAD amidst the latest political test by the Trump administration serves as a stark reminder of the intricate relationship between politics and financial markets. As investors and policymakers alike navigate this landscape, the key lies in monitoring the shifts in the geopolitical climate and their cascading effects on economic relations and currency valuations. The days ahead promise a continuous need for adaptive strategies in response to an ever-evolving global political theater.

In the midst of uncertainties, investors should remain agile, vigilant, and perhaps most importantly, informed, as they make decisions in a world where politics and economics are more intertwined than ever.