Headline: Bitcoin Sinks to Six-Month Low as Liquidity Thins and Risk Appetite Fades

Bitcoin (BTCUSD) slid to a six-month low near 89,270, extending a roughly 30% retreat from its October peak as market liquidity tightened and institutions pared exposure. Diminishing hopes for a U.S. rate cut in December and softer performance in major tech stocks further weighed on crypto risk sentiment.

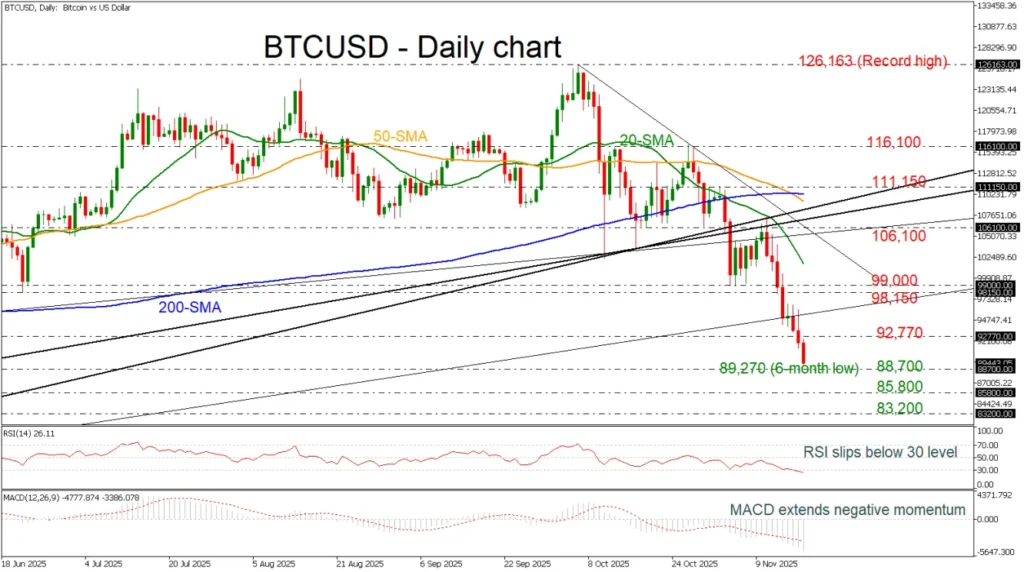

Technically, the break beneath long-standing uptrend lines keeps downside risks in focus. Immediate support sits around 88,700; a decisive move lower could expose 85,800 and then 83,200, levels last visited in mid-April. Momentum remains negative, with the RSI deeply oversold and the MACD below both its signal and zero lines—conditions that can fuel short-lived rebounds but do not, on their own, signal a trend reversal.

On the upside, a recovery attempt would first face resistance near 92,770, followed by the 98,150–99,000 area. To rebuild a durable bullish structure, traders would look for a daily close above roughly 106,000, aligning with key diagonal trend lines. The bearish crossover of the 50- and 200-day simple moving averages around 110,000 is another critical zone, as reclaiming it would help neutralize medium-term downside momentum.

Key Points: – Bitcoin falls to a six-month low near 89,270, down about 30% from the October high – Selling pressure tied to thinning liquidity and institutional de-risking, alongside weaker risk appetite – Key supports: 88,700, then 85,800 and 83,200 if losses extend – First resistance at 92,770; next at 98,150–99,000, with a stronger bullish case above 106,000 – RSI is deeply oversold; MACD stays negative below its signal and zero lines – Bearish 50/200-day SMA cross near 110,000 remains a pivotal area to watch