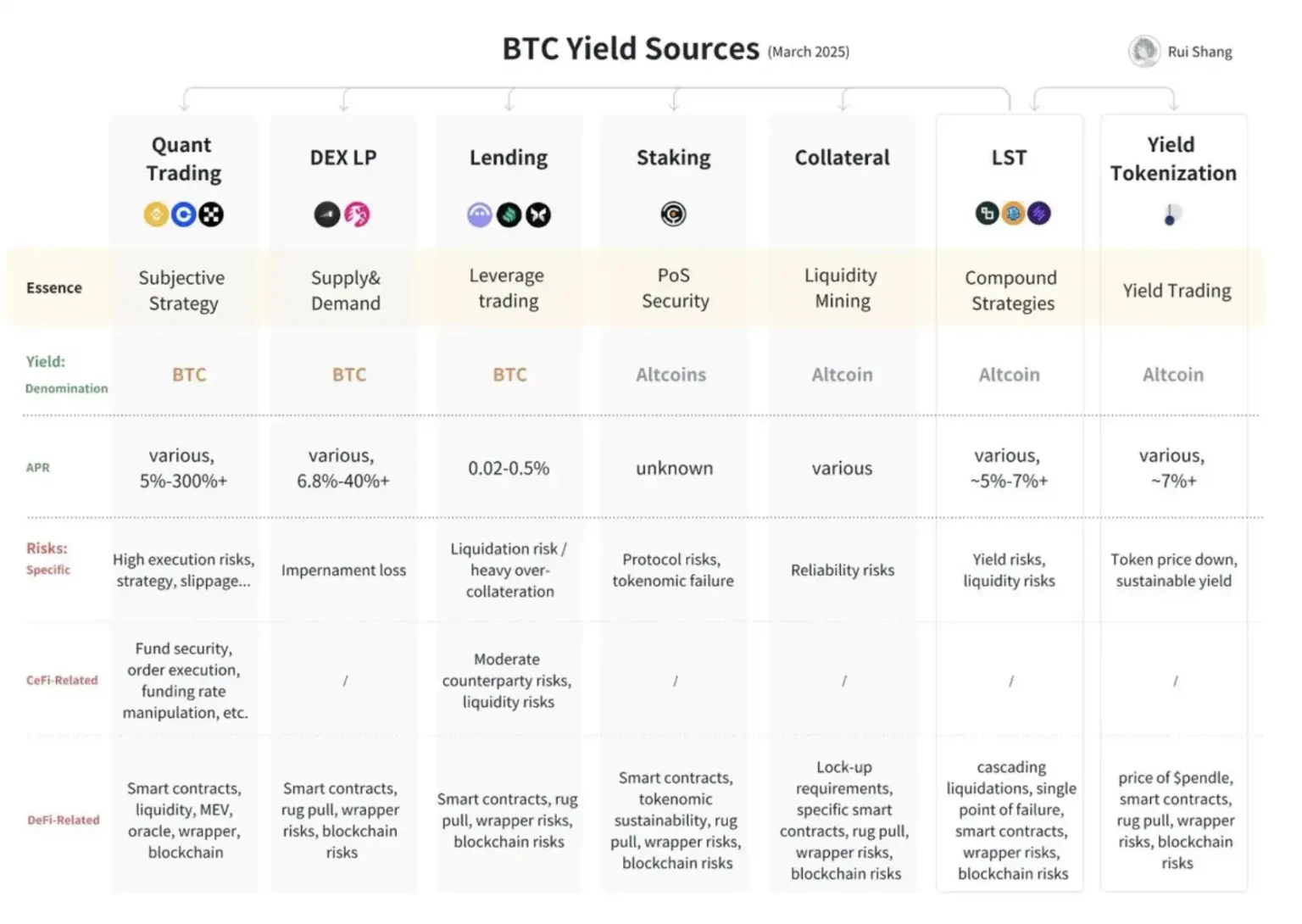

BTC yield strategies are gaining momentum as institutional investors increasingly gravitate towards methods reminiscent of traditional finance. Reports indicate a notable shift among these investors, who are now prioritizing lower-risk yield generation techniques that align with their conservative financial practices. By adopting fully collateralized and market-neutral strategies, hedge funds and financial institutions are steering clear of the high risks associated with DeFi alternatives and complex smart contracts. This cautious approach not only reflects an evolving landscape in crypto risk management but also enhances their confidence in generating sustainable yields from Bitcoin assets. As the market continues to mature, the preference for BTC yield strategies that mirror established financial systems may become the norm among institutional players.

Yield generation strategies for Bitcoin are transforming as institutional participants seek safer avenues for their investments. Desiring options that echo the familiarity of conventional finance, these investors are turning their backs on the highly volatile DeFi practices and are instead embracing collateralized methodologies. The emphasis is on reducing exposure to crypto risks while leveraging innovative yet stable approaches that promise reliable returns. This trend signals a growing maturity in the crypto space, where traditional investors are merging their established financial frameworks with the burgeoning world of Bitcoin. As a result, new yield strategies are reshaping how assets are managed and optimized in the ever-evolving landscape of cryptocurrency investing.

| Key Point | Explanation |

|---|---|

| Institutional Investors’ Shift | Institutional investors are moving towards BTC yield strategies similar to traditional finance rather than high-risk options. |

| Preference for Low-Risk Strategies | Fully collateralized and market-neutral strategies have become more popular, indicating a trend away from decentralized finance (DeFi) and smart contracts due to perceived risks. |

| Evolving Infrastructure | As financial infrastructure improves, institutions are leaning towards familiar methods that align with regulations and risk management practices. |

| Growing Demand for BTC Yield | Investors are now increasingly seeking yields from their BTC holdings, reflecting a notable shift in expectations. |

Summary

BTC yield strategies are evolving as institutional investors seek to minimize risks while maximizing returns in the vibrant crypto landscape. The shift towards traditional finance-like yield methods indicates a growing preference for stability and familiarity, moving away from the high-risk avenues previously considered. As these strategies develop, institutional participation in BTC yield products is likely to increase, aligning with their risk management and regulatory compliance needs.

Understanding BTC Yield Strategies for Institutional Investors

As institutional investors increasingly turn towards Bitcoin as an asset class, their preferences for yield strategies are evolving significantly. Instead of seeking out high-risk, high-reward opportunities found in decentralized finance (DeFi), they are gravitating towards BTC yield strategies that mirror traditional finance structures. This shift emphasizes the importance of security and predictability—two characteristics that institutional investors have historically favored. Fully collateralized and market-neutral strategies are becoming the preferred methods for these large entities, as they allow for a better risk-return profile amidst the volatile landscape of cryptocurrency.

The need for familiar frameworks is driving institutional investors to adopt BTC yield strategies that adhere more closely to traditional finance norms. With the increased scrutiny from regulatory bodies and the risks associated with DeFi—such as smart contract vulnerabilities—investors are looking for safer, more transparent yield options. The approaches that institutional investors are favoring prioritize risk mitigation and regulatory compliance, suggesting that the foundations of traditional finance are increasingly influencing crypto investment strategies.

Frequently Asked Questions

What are BTC yield strategies that institutional investors are considering?

Institutional investors are gravitating towards BTC yield strategies that resemble traditional finance methods. These include fully collateralized and market-neutral strategies, which minimize risk while generating yields on Bitcoin holdings.

How do BTC yield strategies compare to traditional finance methods for institutional investors?

BTC yield strategies are increasingly being designed to mimic traditional finance methodologies, focusing on lower risk profiles. This shift allows institutional investors to engage with Bitcoin yields without the volatility typically associated with DeFi alternatives.

Why are institutional investors avoiding riskier BTC yield strategies?

Institutional investors are cautious about riskier BTC yield strategies due to the historical instability of collateralized strategies and the uncertainties associated with smart contracts. They prefer established methods that offer regulatory compliance and better risk management.

What role do collateralized strategies play in BTC yield generation for institutional investors?

Collateralized strategies are essential for institutional investors seeking BTC yield generation. These strategies provide a safety net by ensuring that assets are backed adequately, thus aligning with the investors’ risk management frameworks.

How are DeFi alternatives influencing institutional investors’ BTC yield strategies?

DeFi alternatives have prompted a reevaluation of BTC yield strategies. While some institutions have historically avoided them due to concerns over smart contract risks, the evolving landscape is encouraging a blend of traditional and DeFi methods to optimize yield with controlled exposure.

What are the benefits of market-neutral BTC yield strategies for institutional investors?

Market-neutral BTC yield strategies benefit institutional investors by reducing exposure to Bitcoin price volatility. These approaches allow for consistent yield generation, aligning with their investment objective of predictable performance in a compliant framework.

What makes the current BTC yield strategies attractive to institutional investors?

Current BTC yield strategies attract institutional investors because they are increasingly similar to traditional finance methods. With a focus on collateralization and reduced risk, these strategies promise more secure and reliable returns, appealing to those wary of the complexities of DeFi.

What future trends are expected for BTC yield strategies among institutional investors?

Future trends for BTC yield strategies among institutional investors may include increased adoption of fully collateralized options and enhanced risk management practices. As infrastructure improves, strategies that resemble traditional finance models will likely gain more traction in the crypto market.

How can institutional investors manage crypto risk in BTC yield strategies?

Institutional investors can manage crypto risk in BTC yield strategies by selecting market-neutral and collateralized approaches. These methods allow for systematic risk assessment while still participating in the growth and yield potential of Bitcoin.

Why is understanding BTC yield strategies critical for institutional investors?

Understanding BTC yield strategies is critical for institutional investors as it enables them to navigate the complexities of crypto while minimizing risks, aligning their financial goals with the realities of the evolving digital asset landscape.