In an intriguing development within the cryptocurrency landscape, a savvy investor has initiated a BTC short position, employing 10x leverage to amplify potential returns. This strategic move, valued at $36 million and involving 409.58 BTC, highlights a significant player leveraging whale trading strategies amid a turbulent market. As Bitcoin predictions fluctuate, investors closely monitor such short selling activities, which can offer valuable insights into market sentiment. As the cryptocurrency market analysis reveals, these large positions often indicate where the market might be heading and can impact overall prices. For those involved in Bitcoin leverage trading, understanding the implications of such short positions is crucial for making informed decisions.

In the ever-evolving world of digital currencies, the actions of influential investors often shape market dynamics. Recently, one notable trader has opted for a bearish stance by establishing a short position on Bitcoin, utilizing leveraged funds to increase their exposure. The hefty investment, valued at $36 million, draws attention to the strategies employed by market whales who engage in high-stakes trading. As analysts delve into cryptocurrency market trends, these short-selling ventures provide a unique lens through which to gauge investor sentiment and potential market shifts. Understanding the mechanics of such trades is essential for anyone navigating the complexities of cryptocurrencies and seeking to optimize their trading strategies.

Understanding BTC Short Selling and Whale Trading Strategies

BTC short selling is a strategy that enables traders to profit from a decline in Bitcoin prices. Whales, or large holders of Bitcoin, often employ this technique, using significant amounts of leverage to amplify their gains. In this regard, the case of a whale recently opening a 10x leveraged short position on BTC serves as a prime example. By doing so, this trader not only positions themselves to benefit from potential downward price movement but also demonstrates a deep understanding of the mechanics of the cryptocurrency market.

The whale’s prior experience, highlighted by their successful sale of 255 BTC, suggests that they possess sophisticated whale trading strategies that include careful market analysis and risk management. Their recent actions in initiating a new BTC short position of 409.58 BTC, valued at approximately $36 million, indicate that they are likely leveraging technical indicators and market sentiment to gauge future price movements. This knowledge allows them to navigate the volatility of Bitcoin effectively, making informed decisions that can significantly impact their overall portfolio.

The Role of Leverage in Bitcoin Trading

Leverage in Bitcoin trading allows traders to open larger positions than their initial capital would normally permit. In this context, the whale’s use of 10x leverage means that they can control a trade worth ten times their investment, multiplying potential gains or losses. This high-risk, high-reward approach is attractive to many traders in the cryptocurrency market. When a whale like this one strategically utilizes such leverage to initiate a short position, it can quickly ripple through the market, potentially influencing other traders’ decisions.

However, with increased leverage comes greater risk, especially in the highly volatile world of cryptocurrency. A small price movement against the position can result in significant losses, necessitating careful risk assessment. For this whale, the current market analysis and Bitcoin predictions must suggest a strong likelihood of price decline. This calculated risk reflects a profound understanding of market dynamics, emphasizing that leverage is not merely a tool for greater profits, but also a critical element in the management of potential losses.

Conducting thorough cryptocurrency market analysis is essential for leveraging positions to be successful. Traders utilize various tools, such as technical analysis and sentiment indicators, to predict market trends. For the whale who has taken a short position on Bitcoin, employing these strategies aligns with their demonstrated history of trading effectively.

Analyzing Onchain Metrics: Insights from Whale Trading

Onchain metrics have become an invaluable resource for understanding the behaviors of significant market players, such as whales. The recent monitoring by Onchain Lens provides critical insights into how this whale is managing their BTC holdings. By analyzing the movements of this whale, traders can gain perspective on market sentiment and potential future price movements. When a whale decides to short Bitcoin, it often signals a broader trend or impending price correction, making this data essential for market participants.

Furthermore, such analysis allows traders to align their strategies with those of influential market participants. For instance, this particular whale has successfully identified an opportunity after profiting from their previous BTC transactions, indicating that many traders are closely observing their actions. The way this whale has times their entry into a BTC short position can provide other traders with cues on how to adjust their own trading strategies in response to market fluctuations.

Implications of Whale Activity on Bitcoin Predictions

The activities of whales in the Bitcoin market often carry significant weight in shaping Bitcoin predictions. When a prominent whale initiates a large short position, as seen with the whale who recently opened a short position valued at $36 million, it tends to create ripples through the market. Traders are likely to interpret such actions as signs of impending bearish trends, which could lead to others taking similar actions, thus further driving down the price of BTC. The psychological effect of whale trading strategies is a well-documented phenomenon in the crypto community.

Moreover, when examining Bitcoin predictions, it is vital to consider the influence of whales, as their capital can sway market decisions and drive price movements. This whale’s aggressive short position cannot be viewed in isolation; it serves as a reflection of broader market conditions and expectations. For active traders and investors, tracking these whales and understanding their motivations can provide valuable insights for making informed trading decisions.

High-Risk Trading: The Dangers of Excessive Leverage

Trading with excessive leverage, especially in the cryptocurrency space, entails a considerable risk. While leveraging allows for potential high rewards, it can equally lead to devastating losses if the market does not move as anticipated. The whale’s recent utilization of 10x leverage while short selling BTC underscores this volatility, where even minor adverse price movements could trigger significant losses. Thus, traders must exercise extreme caution when implementing leveraged trades.

Additionally, excessive leverage can result in margin calls, where traders are required to deposit additional funds to maintain their positions. This scenario can lead to further downward pressure on prices, particularly if multiple traders are forced to liquidate their leveraged positions simultaneously. The dynamics introduced by whale trading strategies and leverage in Bitcoin can create a precarious situation for the broader market, underlining the importance of prudent risk management and strategic planning.

Market Sentiment: How Whales Shape the Bitcoin Landscape

Market sentiment plays a crucial role in the cryptocurrency world, influencing how traders react to price movements and perceived trends. Whales, by virtue of their significant holdings and trading actions, can manipulate market sentiment. When a high-profile trader opens a BTC short position, it often causes fear and uncertainty, leading other investors to reconsider their strategies. The potential to follow suit can exacerbate market declines or fuel bullish runs, making whale activities a key consideration in market analysis.

Understanding the implications of whale trading on overall market sentiment can assist smaller traders in navigating the complexities of Bitcoin trading. Monitoring whale actions, as highlighted by the recent short position of the $36 million whale, provides context in terms of their larger strategy, potentially guiding smaller traders toward more informed decisions about their positions.

The Impact of Bitcoin News on Whale Trading Trends

News events significantly influence trading behaviors and can drive volatility in the cryptocurrency market, thus impacting whale strategies. Positive developments, such as regulatory approvals or institutional adoption, often encourage bullish sentiment. Conversely, negative news such as security breaches or unfavorable regulations can trigger panic selling and influence whale decisions profoundly. By understanding how news affects market dynamics, traders can better anticipate whale movements and adjust their strategies accordingly.

Recent market developments may have played a role in the whale’s decision to pursue a short position on Bitcoin. By evaluating the broader context of the news, traders can gain insight into potential price movements. The actions of the whale may not only stem from individual analysis but also be influenced by overall market reactions to current events, which ultimately paint a clearer picture of future cryptocurrency price trajectories.

Anticipating Market Movements: The Importance of Technical Analysis

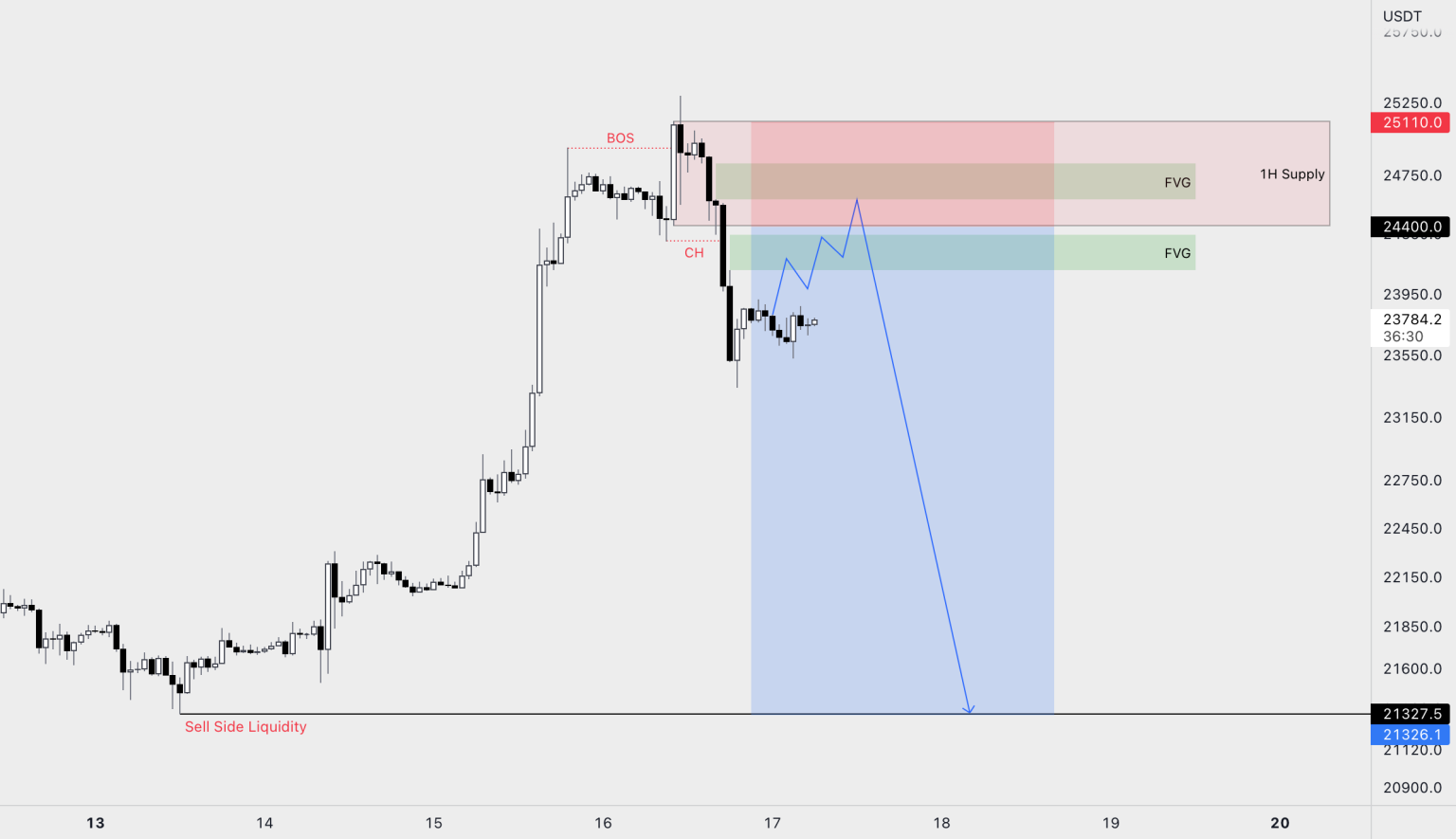

Technical analysis serves as a vital tool for traders in predicting future market movements, particularly in the volatile landscape of Bitcoin. This approach involves analyzing historical price data and patterns to identify potential supports, resistances, and opportunities for trading. Given the whale’s decision to short BTC, it is likely that they relied on advanced technical indicators and chart patterns that signaled potential price decline.

Traders looking to follow in the footsteps of whales must integrate technical analysis into their trading strategies. This may include using tools like moving averages, Fibonacci retracement levels, and RSI indicators to build a comprehensive trading plan. By aligning their strategies with technical indicators, traders can better position themselves to react effectively to major market movements driven by whale trading strategies.

Frequently Asked Questions

What is a BTC short position in cryptocurrency trading?

A BTC short position refers to a strategy where traders borrow Bitcoin to sell it at the current market price, anticipating a price drop. This allows traders to profit if the price of Bitcoin decreases, particularly favored in bearish markets.

How do whale trading strategies influence BTC short positions?

Whale trading strategies, such as opening significant BTC short positions like the one analyzed with 409.58 BTC, can significantly affect market sentiment and price dynamics. When whales short Bitcoin, it often indicates bearish predictions, impacting overall cryptocurrency market analysis.

What does it mean to use Bitcoin leverage trading for short selling?

Bitcoin leverage trading involves borrowing funds to increase the size of a BTC short position, like the 10x leverage noted in some whale trades. This amplifies potential gains but also increases risks, making it critical for traders to manage their positions effectively.

What should traders consider before executing BTC short selling?

Traders should analyze market conditions, especially when observing whale activity, such as significant BTC short positions. Understanding Bitcoin predictions, sentiment analysis, and the overall cryptocurrency market can help in making informed decisions about short selling.

How do BTC short positions impact Bitcoin market predictions?

BTC short positions held by whales can signal potential downward trends in Bitcoin prices, contributing to market predictions. For instance, a whale’s decision to open a $36 million short position can suggest bearish sentiments, influencing trader behavior and market analysis.

What risks are associated with Bitcoin leverage trading in short positions?

Bitcoin leverage trading can magnify both gains and losses. Engaging in short positions, especially with high leverage like 10x, means that even a slight increase in Bitcoin price can lead to significant losses, necessitating careful risk management in cryptocurrency trading.

How can investors analyze whale activity for BTC short positions?

Investors can utilize tools like Onchain Lens to monitor whale activities, including sizable BTC short positions. Analyzing these movements provides insights into market trends and helps assess the strength of potential price movements in the cryptocurrency market.

| Key Point | Details |

|---|---|

| Whale Activity | A whale that previously sold 255 BTC. |

| Short Position | The whale opened a short position on BTC with 10x leverage. |

| Position Value | The short position is valued at $36 million. |

| Current Holding | The current BTC short position includes 409.58 BTC. |

| Monitoring Source | The activity was tracked by Onchain Lens. |

Summary

The recent actions indicate that the whale’s BTC short position reflects a strategic move in a volatile market. A BTC short position could signify an expected decline in Bitcoin prices, impacted by market trends and investor sentiment. The whale’s significant holdings and leveraged positions could influence market dynamics, presenting both risks and opportunities for traders.