In the latest BTC price update, Bitcoin has surged past the impressive mark of 89,000 USDT, with its current value sitting at 89,005 USDT. This significant movement represents a 24-hour increase of 1.27%, attracting attention from cryptocurrency enthusiasts and investors alike. As the BTC market news unfolds, traders are keenly observing the factors driving this rise and what it means for the overall cryptocurrency landscape. The latest OKX Bitcoin data indicates a robust performance, echoing growing investor confidence and contributing to a broader cryptocurrency price increase. Meanwhile, the BTC USDT exchange rate remains a focal point for those looking to capitalize on the currency’s upward trajectory, highlighting the dynamic nature of the market today.

The recent developments in the Bitcoin market have turned heads as the digital currency continues its ascension. With Bitcoin’s current valuation surpassing 89,000 USDT, many are closely monitoring this upward trend highlighted by a 24-hour growth of 1.27%. Investors are particularly interested in understanding the driving forces behind this cryptocurrency rally and how it influences trading strategies. As market analysts dissect the latest OKX data, sentiments indicate a potential further strengthening of Bitcoin’s position within the market. The ongoing fluctuations in the BTC to USDT exchange rate showcase the volatility that is characteristic of the cryptocurrency sector, making it an exciting time for both seasoned investors and newcomers.

BTC Price Update: Breaking Through 89,000 USDT

In a significant uptick for the cryptocurrency market, Bitcoin (BTC) has recently surpassed the 89,000 USDT mark. Currently priced at 89,005 USDT, this rise reflects a 24-hour increase of 1.27%, indicating a renewed investor confidence in Bitcoin. As the leading cryptocurrency, Bitcoin’s price movement is often seen as a bellwether for the entire crypto market, influencing trading behaviors across various platforms.

The recent surge in Bitcoin’s price can be attributed to a confluence of market factors, including increased institutional adoption, positive market sentiment, and a broader acceptance of cryptocurrencies in mainstream financial systems. As news surrounding Bitcoin continues to stay positive, traders and investors are more inclined to capitalize on this upward trend, contributing to an overall increase in BTC market news and related activities.

Factors Driving the Cryptocurrency Price Increase

Several key factors are driving the cryptocurrency price increase seen recently. For one, heightened institutional interest in Bitcoin is paving the way for a more robust market environment. Major financial institutions are increasingly incorporating Bitcoin into their portfolios, suggesting a growing acceptance of digital assets as legitimate investment vehicles.

Moreover, advancements in blockchain technology and a surge in decentralized finance (DeFi) applications have further fueled investor enthusiasm. The increasing availability of Bitcoin data, particularly from reputable exchanges like OKX, allows traders to make informed decisions. Continued education on cryptocurrency and emerging trends also play a vital role in educating the market, driving more individuals towards cryptocurrency investments.

The Importance of BTC Market News for Investors

Staying updated with BTC market news is crucial for both new and seasoned investors in the cryptocurrency space. Real-time insights provide a strategic advantage, allowing traders to react promptly to market changes. For example, understanding the latest shifts in BTC USDT exchange rate can determine when to buy or sell Bitcoin, optimizing profit potential.

Furthermore, reliable market news sources provide essential data that helps demystify the complexities of crypto trading. Investors who remain informed about market trends, regulatory developments, and technological advancements are better equipped to navigate the volatile landscape of cryptocurrencies, ultimately leading to more sound investment strategies.

Understanding Bitcoin’s Role in the Modern Financial System

Bitcoin’s emergence as a digital currency has prompted a reevaluation of traditional financial systems. As a decentralized asset, Bitcoin offers an alternative to fiat currencies, particularly in the face of inflation and economic uncertainty. Investors are increasingly viewing Bitcoin not just as a speculative asset but as a form of digital gold that can protect against currency devaluation.

The role of Bitcoin in the modern financial landscape extends beyond individual investment. Companies are beginning to accept Bitcoin as a form of payment, further solidifying its place in everyday transactions. This growing integration into commerce emphasizes Bitcoin’s potential to revolutionize how we perceive and use money in our daily lives.

What to Expect from Bitcoin Prices in the Coming Months

As Bitcoin continues to navigate fluctuations in the market, analysts are closely monitoring current trends to forecast its price trajectory. With the recent break above 89,000 USDT, many experts speculate that this may signal a bullish trend, which could bring even higher prices in the future. It’s crucial for traders to keep an eye on key indicators and market sentiment to assess whether this upward momentum can be sustained.

Market analysts also suggest that upcoming events, such as potential regulatory changes or large-scale institutional investments, may impact Bitcoin’s price dynamics. Investors should prepare for volatility and consider diversifying their portfolios by including other cryptocurrencies alongside Bitcoin, thereby spreading risk and maximizing potential returns.

The Impact of Global Events on BTC Prices

Global economic events have a profound effect on Bitcoin’s price, influencing investor behavior and market sentiment. For instance, news regarding inflation rates, interest changes, and geopolitical tensions can lead to a surge in Bitcoin prices as investors seek safe-haven assets. Understanding these external factors is pivotal for predicting future price movements.

Additionally, the rise of digital currencies in central banks globally signals a potential shift in financial paradigms. As governments experiment with Central Bank Digital Currencies (CBDCs), the relationship between Bitcoin and traditional currencies may evolve, possibly affecting its price in the long run.

Why Investors Should Monitor OKX Bitcoin Data

Monitoring OKX Bitcoin data can offer invaluable insights for cryptocurrency traders. As one of the leading exchanges, OKX provides real-time information on Bitcoin prices, trading volumes, and market trends. This data assists investors in making informed decisions, ultimately impacting their trading strategies and potential profitability.

Moreover, OKX offers various analytical tools and resources that help dissect market trends and predict price fluctuations. By leveraging such data, traders can better understand market dynamics, thereby gaining a competitive edge in the exciting world of cryptocurrency trading.

The Future of Bitcoin: Predictions and Trends

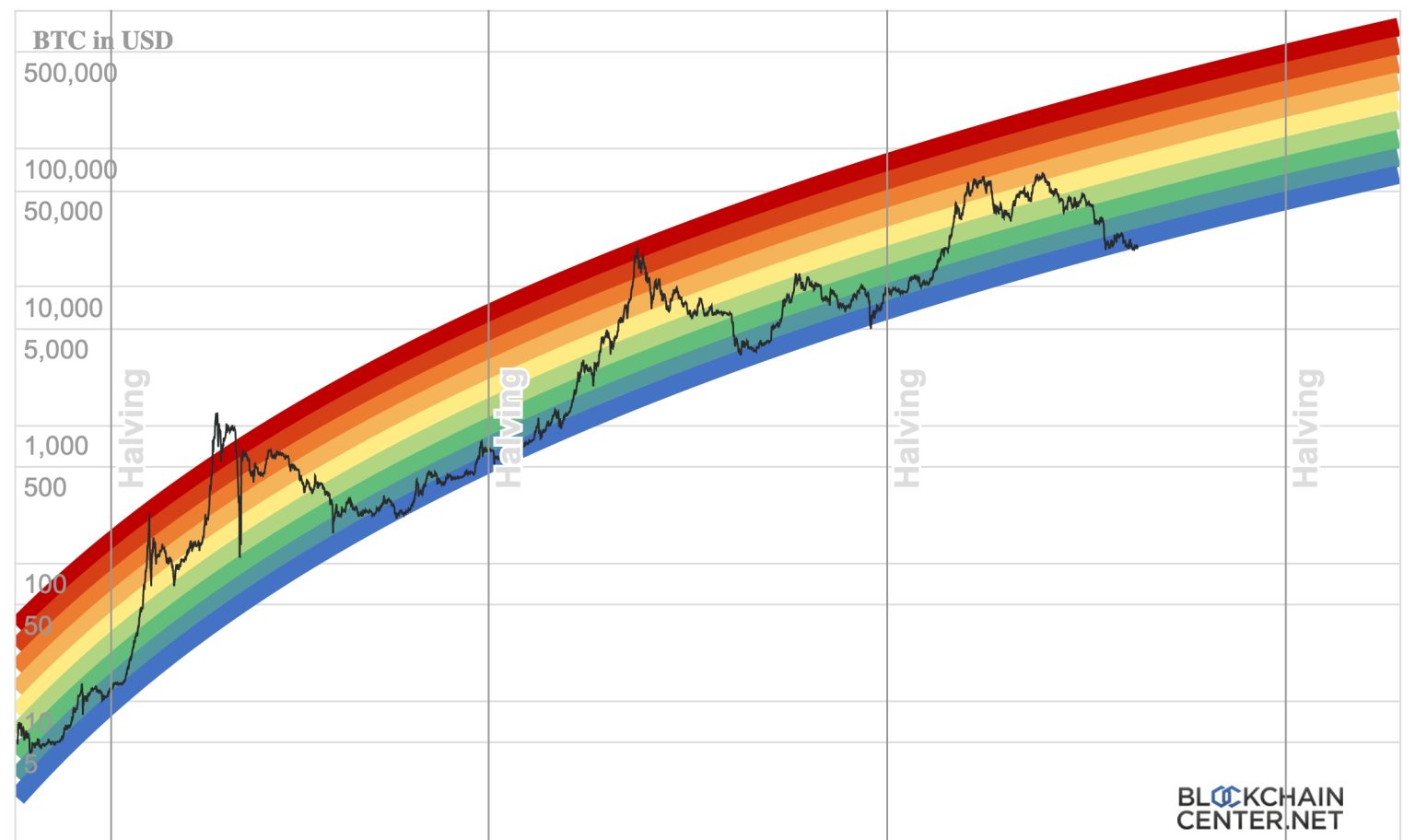

As we progress into an increasingly digital future, Bitcoin’s role continues to evolve. Predictions suggest that Bitcoin may further solidify its status as a deflationary asset as its scarcity becomes evident over time. The halving events and the overall capped supply of Bitcoin essentially create a supply squeeze, which may lead to increased demand and, consequently, higher prices in the long term.

Emerging trends in technology, finance, and consumer behavior will also play a crucial role in determining Bitcoin’s trajectory. The growing acceptance of cryptocurrency in various sectors may foster a more stable marketplace, reducing volatility and increasing mainstream usage of Bitcoin as a currency, thus reshaping our financial landscape.

Investing in Bitcoin: Tips for New Investors

For those new to cryptocurrency, investing in Bitcoin can be a daunting task. It’s essential to do thorough research and become familiar with the underlying technology, market trends, and potential risks involved. New investors should consider starting small, using reputable exchanges to buy Bitcoin while monitoring price movements and market sentiment.

Additionally, joining online communities and forums can provide valuable insights and peer support. Engaging with other investors can equip newcomers with tips and strategies that lead to more successful trading experiences in Bitcoin and the broader cryptocurrency market.

Frequently Asked Questions

What is the current Bitcoin price today?

As of the latest update, Bitcoin (BTC) is priced at 89,005 USDT, showing a 24-hour increase of 1.27%.

How has the BTC market news impacted Bitcoin’s price today?

Recent BTC market news indicates a surge, with Bitcoin breaking through the 89,000 USDT mark, indicating positive momentum in the cryptocurrency market.

What factors are contributing to the cryptocurrency price increase for Bitcoin?

The cryptocurrency price increase for Bitcoin can be attributed to favorable market conditions, investor confidence, and positive BTC market news making headlines.

Where can I find the latest OKX Bitcoin data?

The latest OKX Bitcoin data can be accessed on the OKX exchange platform, where you can monitor real-time Bitcoin prices and market trends.

What is the current BTC USDT exchange rate?

The current BTC USDT exchange rate stands at 89,005 USDT, reflecting a recent increase in Bitcoin’s market price.

| Key Point | Details |

|---|---|

| Current BTC Price | 89,005 USDT |

| Price Breakthrough | BTC has surpassed 89,000 USDT |

| 24-Hour Increase | 1.27% |

| Source | OKX market data and Odaily Planet Daily |

Summary

The latest BTC price update reveals that Bitcoin has successfully broken through the $89,000 mark, currently trading at $89,005 USDT. This significant milestone comes with a 24-hour increase of 1.27%, indicating a positive trend in the market. Investors and traders should closely monitor these developments, as fluctuations in BTC pricing can signal potential opportunities.