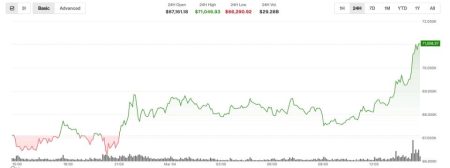

The recent BTC price drop has left traders and investors watching closely as Bitcoin slips below 91,000 USDT, currently hovering around 90,989.9 USDT. This notable decline highlights a shift in the Bitcoin price trajectory, stirring significant interest in BTC market news among cryptocurrency enthusiasts. As the digital asset’s 24-hour increase narrows to a mere 0.03%, analysts are scrutinizing current cryptocurrency trends for insights into future price movements. This shift not only impacts the BTC USDT pairing but also raises questions about overall investor sentiment. In today’s volatility-laced climate, conducting thorough Bitcoin analysis has never been more vital for those engaged in this dynamic market.

In the ever-evolving landscape of digital currencies, the recent downturn in Bitcoin’s value, often referred to as the decline in BTC’s market price, has captured the attention of many. As Bitcoin struggles to maintain its foothold above 91,000 USDT, its price movements are becoming critical to evaluate for market participants. The narrowing growth of just 0.03% over 24 hours further complicates the current cryptocurrency climate, making BTC a focal point of trading discussions. Investors are increasingly turning to various Bitcoin analyses to gauge the implications of this shift and to bolster their strategies in navigating this turbulent market. Understanding these price dynamics is essential for anyone looking to thrive within the cryptocurrency ecosystem.

Understanding the Recent BTC Price Drop

The cryptocurrency market has recently witnessed a noticeable decline as Bitcoin’s price fell below the significant threshold of 91,000 USDT. This downturn has raised concerns among investors who closely monitor Bitcoin price trends. The current trading figure stands at around 90,989.9 USDT, reflecting a slight 24-hour increase of merely 0.03%. Such fluctuations highlight the volatility inherent in the BTC market and underscore the importance of ongoing market analysis and timely information for traders.

While a price drop can be alarming, it’s essential to look at this change within the broader context of BTC market news. Factors such as regulatory developments, macroeconomic conditions, and cryptocurrency trends significantly influence Bitcoin’s behavior. Investors are advised to stay informed and evaluate how these elements can impact the BTC USDT pairing moving forward.

Current BTC Market Analysis and Trends

In the wake of BTC’s recent decrease, it is crucial to conduct a thorough Bitcoin analysis to understand the underlying reasons for this trend. For instance, examining the market sentiment, trade volume, and external economic factors can provide insights into why BTC has faced downward pressure. With Bitcoin hovering just under the 91,000 USDT mark, traders may be more cautious as they assess their positions during this uncertain period.

Additionally, staying ahead in the cryptocurrency space involves recognizing emerging market trends related to Bitcoin and other altcoins. As investors digest this latest BTC price drop, many are turning their attention to related cryptocurrencies and market movements that could influence future investor decisions. Keeping up with cryptocurrency trends will be critical for anyone looking to navigate the current market landscape effectively.

Factors Influencing Bitcoin Price Movements

Numerous factors contribute to the ongoing fluctuations in the Bitcoin market, particularly during significant price drops like the recent fall below 91,000 USDT. One pivotal element is the trading behavior of large holders, often referred to as whales, who can substantially impact market liquidity and pricing. Moreover, global economic conditions and regulatory updates further complicate the landscape, making it imperative for traders to follow BTC market news closely.

In addition to external influences, internal dynamics within the cryptocurrency ecosystem play a crucial role. Changes in transaction fees, mining activities, and the market’s overall sentiment regarding Bitcoin against fiat currencies can lead to varying reactions from traders. Understanding these factors can assist investors in predicting potential BTC price trends and making informed decisions in the highly volatile crypto market.

The Significance of BTC USDT Pairing in Trading

The BTC USDT pairing serves as a critical indicator for cryptocurrency traders and investors looking to gauge market movements. The stability offered by Tether (USDT), a stablecoin, allows traders to hedge against Bitcoin’s volatility, especially during downturns like the recent drop below 91,000 USDT. Analyzing this pairing can provide insights into trader sentiment and market confidence regarding Bitcoin.

Furthermore, understanding the BTC USDT relationship enables traders to develop more strategic trading approaches. As Bitcoin continues to fluctuate, leveraging technical analysis based on this pairing can help predict short-term price movements and identify the best times to enter or exit trades. Overall, a comprehensive understanding of how BTC interacts with USDT is essential for effective trading.

Impact of Market Sentiment on BTC Prices

Market sentiment plays a pivotal role in the movements of Bitcoin prices and can be especially pronounced during downturns, such as the recent dip when BTC dropped below 91,000 USDT. The fear of further declines can cause a ripple effect among investors, leading to a sell-off that exacerbates the price drop. Monitoring social media, news trend analysis, and trading forums allows traders to gauge public perception and sentiment towards Bitcoin effectively.

Conversely, positive sentiment often drives price increases, creating opportunities for traders to capitalize on BTC’s recovery potential. Tracking sentiment analysis can thus be a valuable tool for understanding market reactions to current events in Bitcoin and making informed trading decisions based on anticipated investor behavior.

Analyzing Long-Term Bitcoin Price Trends

Beyond short-term fluctuations, it is essential to conduct a long-term analysis of Bitcoin price trends to fully grasp its market behavior. Despite recent drops, historical data has shown that Bitcoin tends to recover over time, making it a potentially lucrative investment for those who can withstand the volatility. A careful examination of price history, along with macroeconomic factors, can offer insight into BTC’s long-term trajectory.

Furthermore, long-term investors often look beyond immediate price movements to assess Bitcoin’s fundamental growth within the cryptocurrency market. Such analysis encompasses evaluating network adoption rates, technological advancements, and changes in regulatory frameworks, all of which can significantly influence Bitcoin’s future price potentials and overall market health.

The Role of News in Shaping BTC Trends

Current events and news narratives play a significant role in influencing Bitcoin prices, especially during critical periods like the recent drop below 91,000 USDT. Breaking news related to regulation, market developments, and technological advancements can create waves of optimism or fear, directly impacting investor behavior. Staying informed about BTC market news is crucial for traders aiming to make sense of these rapid changes.

Additionally, the proliferation of social media has amplified the speed at which news spreads, allowing market participants to respond in real time. As such, being proactive about monitoring relevant news can provide traders with an edge in anticipating market movements and understanding potential fluctuations in BTC prices.

The Future of BTC: Predictions and Speculations

While no one can predict the future with certainty, analyzing current trends and historical patterns can offer insights into the potential direction of Bitcoin prices. After the recent drop below 91,000 USDT, many analysts are speculating on whether this marks a temporary setback or a more significant downturn. Key indicators, such as trading volume and market sentiment, will be pivotal in shaping these predictions moving forward.

Moreover, upcoming technological developments and market conditions can also affect Bitcoin’s future position. As the cryptocurrency space continues to evolve, those keeping a close eye on BTC analysis and trends will be better equipped to make informed decisions about potential investments and trades. The future remains uncertain, but informed speculation based on thorough analysis can provide valuable guidance.

Strategies for Navigating BTC Market Volatility

As the cryptocurrency market remains highly volatile, especially during phases such as the recent BTC price drop, developing effective trading strategies is essential for success. Strategies may include setting stop-loss orders to limit potential losses, diversifying selections across various cryptocurrencies, and maintaining a disciplined approach to trading based on researched insights. Understanding key elements within the BTC market can lead to smarter trading choices.

Additionally, taking advantage of cryptocurrency trends and leveraging market analysis can provide traders with a solid foundation for their decisions. Investors who focus on long-term strategies rather than reacting to short-term price shifts are more likely to achieve sustainable success in the volatile world of Bitcoin trading.

Frequently Asked Questions

What caused the recent BTC price drop below 91,000 USDT?

The recent BTC price drop below 91,000 USDT can be attributed to various market factors including investor sentiment, macroeconomic influences, and fluctuations in trading volume. As of the latest report, BTC is currently at 90,989.9 USDT, reflecting a slight narrowing of the 24-hour increase to 0.03%.

How does the current BTC price drop affect cryptocurrency trends?

The current BTC price drop may significantly influence cryptocurrency trends by impacting market confidence and investor behavior. A drop below 91,000 USDT indicates potential volatility in the BTC market, which could lead to broader implications for cryptocurrency valuations and trends overall.

What does the BTC USDT exchange rate indicate during this price drop?

The BTC USDT exchange rate, now at 90,989.9 USDT, indicates a slight decline in Bitcoin’s value against the USDT. This price drop reveals market reactions to ongoing economic conditions and influences trading decisions among investors in the cryptocurrency landscape.

What insights can be gained from the Bitcoin analysis related to the recent drop in price?

Recent Bitcoin analysis suggests that the drop below 91,000 USDT may be part of a larger trend in the cryptocurrency market. Analysts are noting the narrowing of the 24-hour increase to just 0.03% as a sign of market uncertainty, prompting traders to reconsider their strategies regarding BTC.

Are there any signs of recovery following the BTC price drop?

As of now, there are no definitive signs of recovery following the BTC price drop below 91,000 USDT. The minimal 24-hour increase of 0.03% indicates that buyers are currently hesitant, and further market developments will be closely watched for any potential recovery signals in Bitcoin.

| Key Points | |

|---|---|

| BTC price has dipped below 91,000 USDT, currently at 90,989.9 USDT. | The 24-hour increase in BTC’s price has narrowed to 0.03%. |

Summary

The recent BTC price drop below 91,000 USDT has raised concerns among investors as it indicates a narrowing 24-hour increase to just 0.03%. This decline could suggest market volatility and demand a closer watch on future price movements. As traders monitor the situation, market sentiment remains cautious following this sudden drop.

Related: More from Bitcoin News | JPMorgan: New Legis. Could Spark Bitcoin Growth | Bitcoin Fork Proposal Fails to Gain Support