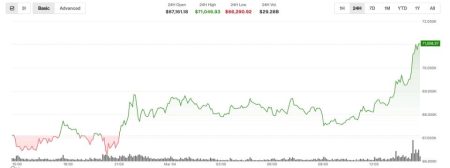

In a significant turn for cryptocurrency enthusiasts, the BTC price drop has seen Bitcoin tumble below the pivotal threshold of 90,000 USDT, currently resting at 89,964.9 USDT. According to recent OKX market data, this decline reflects a 0.97% dip over the last 24 hours, raising concerns among traders and investors alike. As the world closely monitors cryptocurrency trends, this drop brings Bitcoin’s overall performance into focus, prompting a deeper BTC analysis. Market fluctuations like these are crucial indicators of investor sentiment and can signal potential further volatility in the digital asset space. Understanding the dynamics behind this Bitcoin decline is essential for anyone looking to navigate the ever-evolving cryptocurrency landscape.

The recent downturn in Bitcoin’s value signals a noteworthy shift in the cryptocurrency market, where Bitcoin has recently slipped beneath the 90,000 USDT mark. This shift may reflect broader trends within the trading environment, revealing insights into recent BTC USDT performance, bolstered by the latest data from OKX. Such events prompt a comprehensive analysis of BTC, guiding investors to make informed decisions amidst the fluctuating economic climate. Engaging with these developments not only highlights the importance of real-time data tracking but also emphasizes the many complexities that characterize digital currency trading. Consequently, staying abreast of these market movements is vital for both seasoned traders and newcomers alike.

Understanding the Recent BTC Price Drop

The recent news about Bitcoin (BTC) falling below 90,000 USDT has raised concerns among traders and investors alike. According to data from OKX market analysis, BTC is currently trading at 89,964.9 USDT, marking a 24-hour decline of 0.97%. This shift is significant within the cryptocurrency landscape, as it indicates a broader trend of volatility that BTC has experienced lately.

This notable decline in BTC price is not an isolated event. Many market analysts are suggesting that such fluctuations are common in the cryptocurrency space, and understanding the driving forces behind them is crucial. Factors such as market sentiment, regulatory news, and macroeconomic trends can considerably impact the price of Bitcoin, leading to bullish or bearish movements in the space.

Analyzing Cryptocurrency Trends: BTC in Focus

The current trends surrounding Bitcoin exhibit a complex interplay of market forces that every investor should consider. The decline to 89,964.9 USDT has ignited discussions regarding future performance, as traders watch for signals in OKX market data that could indicate a reversal or further decline. Among the critical considerations are trading volumes and patterns that emerge from real-time data.

Moreover, the BTC analysis suggests that traders should pay attention to how BTC reacts in these bearish trends. With a 24-hour decrease of nearly 1%, there is a chance that panic selling might exacerbate the declines, while savvy investors may see this as an opportunity to buy at a lower price point. Understanding these trends is vital for making educated trading decisions in an unpredictable market.

BTC USDT: Implications of Price Declines

The BTC price trading under 90,000 USDT holds various implications for investors. For one, it signals a potential support level that traders closely monitor. Falling below this threshold could lead to a more extensive sell-off, further impacting the overall market sentiment and leading to a more pronounced Bitcoin decline if not reversed soon.

On the flip side, such price dips often attract attention to potential buying opportunities. Investors with a long-term vision may view the decrease in BTC value as a chance to accumulate more assets at a discounted rate. It’s essential for participants in this dynamic field to analyze both macro and micro factors influencing BTC to make informed decisions.

Market Analysis: BTC and Its Recent Performance

Market analysis of Bitcoin’s current performance reveals notable trends that can aid traders in forecasting future movements. The report shows that BTC’s latest figures are in stark contrast to the bullish predictions made earlier this year. Analysts focusing on BTC USDT transactions have noted that the crypto environment is fraught with uncertainties that can change any market predictions.

Additionally, understanding market data can offer insights into equilibrium points where buying pressure may emerge. With the current trading status of BTC, investors must assess their strategies meticulously, especially given OKX market data that highlights the fragile nature of recent price actions.

The Role of OKX Market Data in Bitcoin Trading

OKX market data plays a significant part in tracking Bitcoin’s performance and providing traders with crucial insights. The real-time analytics can help participants gauge market sentiment and make strategic decisions based on the latest available data. With BTC’s recent drop, traders should leverage this data to understand better the trends shaping the cryptocurrency landscape.

Furthermore, the role of platforms like OKX in disseminating timely information cannot be understated. They serve as a resource for those analyzing BTC trends, allowing them to react quickly to price fluctuations, assess volatility, and adapt their trading strategies accordingly. In a market where seconds can make a significant difference, having access to accurate market data is vital.

Understanding Bitcoin Decline: Causes and Effects

The recent Bitcoin decline to just below 90,000 USDT raises questions about the causes behind this trend. Economic factors, such as inflation fears and changing regulatory landscapes, often catalyze such market movements. Investors frequently reevaluate their positions during these periods, leading to increased volatility in trading behavior and price adjustments.

Moreover, the effects of such declines are far-reaching, impacting not only individual investors but also the broader cryptocurrency market. A notable drop in BTC can trigger a wave of cautious sentiment among traders, affecting altcoins and other invested assets. Thus, understanding the causes and long-term implications of Bitcoin’s performance is critical for all market participants.

Short-Term vs Long-Term BTC Strategies Amidst Price Drops

In light of the recent BTC price drop, different trading strategies may be executed depending on whether investors are looking to capitalize on short-term or long-term opportunities. For short-term traders, swift reactions to the drop can yield profits, especially if they capitalize on subsequent market rebounds.

Conversely, long-term investors should contemplate whether the current depreciation creates a buying opportunity based on their faith in Bitcoin’s value proposition. By focusing on the long-term potential of BTC amidst short-term price decreases, investors can align their strategies with their investment objectives while remaining resilient to short-term fluctuations.

Future Predictions for BTC Amid Volatile Market Conditions

As the cryptocurrency market continues to navigate through turbulent waters, future predictions for BTC in light of the recent price drop become critical for stakeholders. Analysts often rely on historical patterns and market behavior as indicators of future performance. With the current valuation close to 90,000 USDT, predictions may vary widely based on prevailing investor sentiment and external economic factors.

Beyond immediate technical analysis, expert predictions also take into account potential catalysts, such as regulatory changes, technological advancements, and macroeconomic shifts, that could either buoy BTC back above key price levels or lead to further declines. Hence, evaluating these potential scenarios becomes imperative for anyone involved in cryptocurrency trading or investing.

Conclusion: Navigating BTC’s Uncertain Future

As we navigate BTC’s uncertain future, keeping an eye on market data from sources like OKX will be essential. With the recent drop below 90,000 USDT, the implications for both short and long-term traders need to be understood thoroughly. Continuous monitoring of BTC analysis and market trends will equip investors to make informed decisions.

Ultimately, while Bitcoin’s price volatility poses challenges, it also presents opportunities for astute investors. As the cryptocurrency space evolves, those who stay informed and agile in their trading approaches are more likely to succeed in this dynamic environment.

Frequently Asked Questions

What caused the recent BTC price drop below 90,000 USDT?

The recent BTC price drop below 90,000 USDT can be attributed to various factors influencing cryptocurrency trends, including market sentiment, regulatory developments, and liquidity constraints. According to the latest OKX market data, BTC has seen a decline of 0.97% over the past 24 hours, with the current price reported at 89,964.9 USDT.

How does the current BTC decline affect cryptocurrency trends?

The current BTC decline below 90,000 USDT is significant as it reflects broader cryptocurrency trends, including increased volatility and market corrections. Investors often look at BTC’s performance as an indicator for the overall health of the crypto market, and periods like this can lead to heightened caution among traders.

What is the significance of the 0.97% decline in BTC price?

The 0.97% decline in BTC price, as reported by OKX market data, is noteworthy as it signifies a potential short-term downward trend. This minor decline may provide insights into market psychology, and further analysis of BTC can help investors understand potential price movements and make informed trading decisions.

Where can I find real-time OKX market data for BTC USDT?

Real-time OKX market data for BTC USDT can easily be accessed on the OKX exchange website or through cryptocurrency tracking platforms. Monitoring this data allows traders to stay updated on BTC price fluctuations, including any sharp declines that could impact investment strategies.

What should investors consider during a Bitcoin decline?

During a Bitcoin decline, such as the recent drop below 90,000 USDT, investors should consider various factors including market sentiment, technical analysis, and economic indicators. Evaluating BTC analysis can provide valuable insights into price trends, helping investors gauge whether it’s a good time to buy, hold, or sell.

How can I analyze BTC trends after a price drop?

Analyzing BTC trends after a price drop requires examining historical price data, market sentiment, and trading volumes. Tools like chart analysis, indicators, and news analysis can help identify patterns and predict future movements, giving traders a clearer picture of the market following a decline.

| Date | Current BTC Price (USDT) | 24-Hour Decline (%) | Source |

|---|---|---|---|

| 2025-12-01 | 89,964.9 | 0.97% | Odaily Planet Daily |

Summary

The recent BTC price drop has been significant as it fell below 90,000 USDT, currently standing at 89,964.9 USDT with a decline of 0.97% in the past 24 hours. This decline reflects ongoing volatility in the market and highlights the challenges that cryptocurrency investors face in maintaining stable profits. It’s essential for investors to stay informed about market trends and adjust their strategies accordingly to navigate potential losses.

Related: More from Bitcoin News | JPMorgan: New Legis. Could Spark Bitcoin Growth | Bitcoin Fork Proposal Fails to Gain Support