In the ever-evolving landscape of the crypto market, recent BTC insider whale transfer activity has caught the attention of traders and analysts alike. According to Odaily Planet Daily, the renowned whale, referred to as the “BTC OG insider,” executed a remarkable transfer of 1,599 BTC, equivalent to around 112 million USD, to a newly created wallet within just two hours. This significant movement raises eyebrows as it could signal bullish or bearish trends in Bitcoin trading. As the community eagerly taps into the latest BTC news, the implications of such whale activity often reverberate through the market, affecting blockchain transactions and investor sentiment. By analyzing this event, enthusiasts are keen on deciphering strategies that could shape future Bitcoin transfers and overall market behavior.

In the world of cryptocurrency, the movement of large amounts of digital assets, particularly through substantial Bitcoin transactions, can indicate shifting tides in the market. Recent monitoring has revealed that a prominent figure in the Bitcoin investment sphere, often dubbed a crypto whale, shifted a staggering amount of 1,599 BTC, valued at approximately 112 million USD, to a new address. This event not only highlights the ongoing intrigue surrounding whale activity but also serves as a crucial touchpoint for investors keen on understanding the nuances of the blockchain landscape. As traders sift through this pivotal transfer, discussions around Bitcoin dynamics and their broader impact on crypto market analysis are ignited. The insights gained from such large-scale transfers are invaluable for those looking to predict potential market movements.

| Key Point | Details |

|---|---|

| Transaction Type | Transfer of BTC by an insider whale |

| Amount Transferred | 1,599 BTC |

| Value of Transfer | Approximately 112 million USD |

| Time Frame | Within the past two hours |

| Source of Information | Odaily Planet Daily via Lookonchain monitoring |

Summary

BTC insider whale transfer has sparked considerable interest as it reveals significant movement within the cryptocurrency market. Recently, Lookonchain monitoring reported that an insider whale transferred a staggering 1,599 BTC, valued at approximately 112 million USD, to a new wallet. This transaction occurred within just two hours, indicating a rapid response to market conditions. Such movements by well-known players in the crypto space often cause speculation and can influence market trends.

Understanding Insider Whale Transfers in the Bitcoin Market

Insider whale transfers, particularly those involving significant amounts like the recent move of 1,599 BTC worth around 112 million USD, highlight key moments in the crypto market. These transactions typically indicate a level of insider activity that can influence Bitcoin price movements and overall market sentiment. With such large volumes transacted, even minor changes in wallet balances can trigger waves of speculation within the crypto community, resulting in heightened interest from investors and analysts alike.

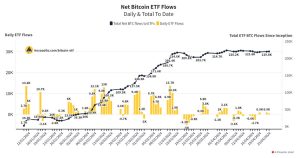

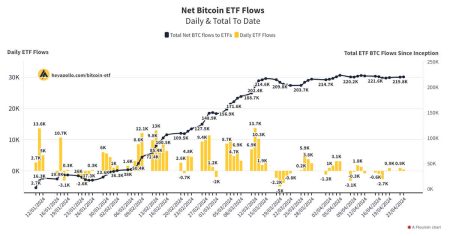

Monitoring platforms like Lookonchain have become essential tools for tracking these significant movements, as they provide real-time insights into whale activity on the Bitcoin blockchain. Understanding these transfers not only aids investors in making informed decisions but also offers a glimpse into the strategies employed by large holders of cryptocurrencies. In this way, tracking insider whale activities can serve as a valuable component of a comprehensive crypto market analysis.

The Impact of Whale Activity on BTC Prices

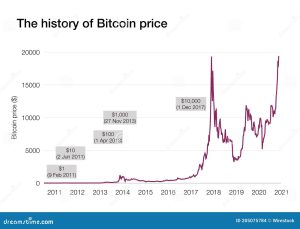

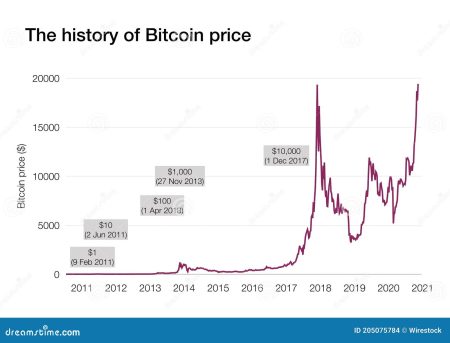

Whale activity plays a vital role in shaping the price dynamics of Bitcoin. When large holders, like the aforementioned ‘BTC OG insider whale’, transfer significant amounts of BTC, it often causes market participants to adjust their positions based on expected price movements. The sale or transfer of such large quantities can create momentum that affects not just the immediate market but also informs traders regarding future buying or selling patterns.

Furthermore, these sizeable transactions can lead to increased volatility within the Bitcoin market. When a whale transfers a significant amount of BTC, it may signal either a bullish or bearish sentiment, depending on the direction of the transfer. For example, transferring BTC to an exchange could indicate impending sales and a bearish outlook, while moving BTC to a cold wallet may signal long-term holding and bullish sentiment. The ability to interpret these signs from insider whale movements is crucial for effective crypto market analysis.

Bitcoin Transfers: Decoding Blockchain Transactions

Each Bitcoin transfer is logged on the blockchain, providing transparency to the crypto community. A transaction like the one made by the ‘BTC OG insider whale’ is recorded in a public ledger, allowing anyone to access transaction details such as volume, time, and involved wallet addresses. This transparency is essential as it underpins the trust in blockchain technology, yet it can also lead to anxious speculation regarding the intentions behind each transfer.

Advanced blockchain explorers enable enthusiasts and investors to track such transactions easily. These tools not only display the immutability of Bitcoin transfers but also provide critical insights into market behavior influenced by these significant wallet activities. Understanding how blockchain transactions work can enhance overall knowledge in the field of cryptocurrency and unlock the potential for more informed trading strategies.

Analyzing BTC News: The Role of Market Sentiment

BTC news surrounding significant whale transfers often impacts market sentiment significantly. When news breaks about a large transfer like the 1,599 BTC movement, market analysts scramble to interpret the potential implications. They analyze whether such a move is likely to spark increased selling pressure or if it indicates a shift in accumulation strategy by the whale.

Investor behavior frequently reacts to such news cycles, leading to a temporary spike in trading volume as traders adjust their positions. Therefore, understanding the context of BTC news and how it relates to whale activity becomes crucial for investors looking to navigate the volatile landscape of cryptocurrency trading.

The Significance of Crypto Market Analysis for Traders

In the ever-evolving landscape of cryptocurrencies, effective market analysis serves as a cornerstone for successful trading strategies. Observing insider whale transfers can provide traders with actionable insights into market trends and shifts. For instance, the event where a prominent whale transfers 1,599 BTC can lead to ripple effects throughout the market, influencing everything from price movements to trading volumes.

Traders should employ a blend of technical analysis and sentiment analysis when interpreting such whale activities. By correlating the timing of whale transfers with historical price data, traders can better predict potential future movements and develop strategies that leverage this information intelligently.

Tracking Blockchain Transactions for Investment Insights

Tracking blockchain transactions is not just about knowing who is transferring BTC but also understanding the broader implications of these movements in the context of market trends. Inside transactions, such as those made by the ‘BTC OG insider whale’, can provide valuable insight into the behavior of large investors. This can guide smaller investors about when to enter or exit positions.

Various platforms offer tools for monitoring these blockchain activities, giving traders real-time data and analytics. By using these tools, investors can identify patterns over time, helping to create a more informed approach to investing in Bitcoin and other cryptocurrencies.

How Whale Activity Fuels Speculative Trading

The speculative nature of cryptocurrency trading means that whale activity can often serve as a trigger for broader market speculation. A sudden transfer of significant amounts of Bitcoin can lead to fear, uncertainty, and doubt (FUD) or excitement across the trading community. When the ‘BTC OG insider whale’ executes a large transfer, other traders may react by either buying in anticipation of price increases or selling to mitigate potential losses.

This cycle of speculative trading can amplify volatility in the crypto market, reinforcing the importance for traders to have a robust risk management strategy. By understanding whale movements, traders can better prepare for potential market fluctuations and align their trading strategies accordingly.

Implications of Whale Movements for Long-term Holders

Long-term holders of Bitcoin often watch whale movements closely to gauge market conditions. When large amounts are transferred, it can significantly influence their holding strategies. If insiders show signs of offloading their Bitcoin, it might prompt long-term holders to reconsider their positions or to be more vigilant about market conditions.

On the other hand, if whale movement suggests accumulation is happening, long-term holders might feel more confident in holding their investments. Tracking these movements, alongside other market indicators and BTC news, helps long-term investors navigate through potential bear markets and capitalize on bullish trends.

Using LSI Keywords to Enhance Crypto Market Insights

Utilizing Latent Semantic Indexing (LSI) keywords is pivotal for anyone looking to improve their understanding of the crypto landscape. For example, incorporating terms related to ‘BTC news’, ‘whale activity’, and ‘blockchain transactions’ enhances both content depth and search optimization, making analysis more accessible to a broader audience. These keywords form the basis for connecting various concepts related to Bitcoin and trading dynamics.

Additionally, mastering LSI can elevate market analysis by providing a more comprehensive view of the crypto environment. This ensures that readers are not only aware of major Bitcoin transfers but also the underlying factors that contribute to the health of the crypto market.

Frequently Asked Questions

What does the recent BTC insider whale transfer of 1,599 BTC signify in Bitcoin news?

The recent BTC insider whale transfer of 1,599 BTC, valued at around 112 million USD, highlights significant movement in the Bitcoin ecosystem. Such large transfers often signal potential market shifts and can influence Bitcoin’s price dynamics.

How does whale activity impact the crypto market analysis related to Bitcoin transfers?

Whale activity, such as the recent BTC insider whale transfer, plays a critical role in crypto market analysis. Large transactions can lead to market volatility as they may affect supply and demand, thereby impacting Bitcoin prices in the short term.

What should investors consider when observing BTC insider whale transfers?

Investors should monitor BTC insider whale transfers as they can signal potential market trends and price movements. By analyzing these transfers along with blockchain transactions, investors can gain insights into market sentiment and possible future volatility.

Are BTC insider whale transfers an indication of Bitcoin’s future price movements?

Yes, BTC insider whale transfers can indicate potential future price movements. When significant amounts of Bitcoin are transferred, such as the recent transfer of 1,599 BTC, it may suggest upcoming buying or selling pressure in the crypto market.

How are blockchain transactions involved in BTC insider whale transfers?

Blockchain transactions document BTC insider whale transfers, providing transparency in the crypto space. The transfer of large sums like the recent 1,599 BTC transaction is recorded on the blockchain, allowing observers to analyze and verify whale activity.

What can we learn from the recent BTC insider whale transfer for future crypto market events?

The recent BTC insider whale transfer can serve as a precursor to future crypto market events. Such transfers often precede significant price changes, urging investors to remain vigilant and informed about the implications of whale activity on market conditions.