BTC Drops Below 69,000 USDT as the cryptocurrency market faces significant turbulence. Recent data from OKX shows that Bitcoin has declined by 7.46% in just 24 hours, now trading at approximately 68,988 USDT. This latest Bitcoin price drop has raised concerns among investors and analysts alike, prompting a closer look at the current BTC market analysis. The decline marks a pivotal moment in Bitcoin news for 2026, as traders speculate on the implications for upcoming crypto trends in February. Understanding this shift is crucial for those looking to navigate the uncertain waters of cryptocurrency investment and trading.

The recent dip in Bitcoin value, with BTC falling below 69,000 USDT, signals a broader contraction in the cryptocurrency sector. This downturn has sparked discussions around the latest developments in digital currency dynamics, highlighting a major 24-hour decline of 7.46%. As traders analyze the shifting landscape of Bitcoin prices and seek to grasp the ongoing trends in the crypto market, many are turning to BTC market analysis for insights. The fluctuations observed are critical, especially in light of the news surrounding cryptocurrency for 2026. Staying informed on these changes is essential for any investor hoping to make informed decisions in this fluctuating environment.

| Date | BTC Price (USDT) | 24H Decline (%) |

|---|---|---|

| 2026-02-05 15:03 | 68,988 | 7.46 |

Summary

BTC Drops Below 69,000 USDT marks a significant decline in Bitcoin’s value, with a 24-hour decrease of 7.46% bringing the price down to 68,988 USDT. This notable drop is important for investors and market watchers alike, as it reflects the current volatility in the cryptocurrency market. With increasing speculation and various economic factors influencing prices, keeping track of losses like this can help stakeholders make informed decisions.

Bitcoin Price Drops: Analyzing the Current Market Situation

The cryptocurrency market has seen unprecedented fluctuations in recent weeks, and the recent Bitcoin (BTC) price drop below 69,000 USDT is a significant indicator of changing trends. With BTC currently sitting at 68,988 USDT and a reported 24-hour decline of 7.46%, traders and investors are closely monitoring market sentiment. This decline reflects broader trends in the cryptocurrency market, where volatility is becoming the norm as various external factors influence investor confidence.

Market analysts are examining this BTC price drop through the lens of cryptocurrency decline forecasts for 2026. With increasing scrutiny on digital currencies and evolving regulations, many speculate how these factors will impact Bitcoin’s future value. As crypto trends in February 2026 unfold, it is essential for investors to stay informed about potential price movements and market analysis to navigate these turbulent waters effectively.

Understanding Cryptocurrency Decline: Factors Behind BTC’s Decrease

The drop of Bitcoin below 69,000 USDT has raised questions regarding the underlying reasons for this shift. Factors contributing to the current BTC market analysis include macroeconomic conditions, regulatory news, and changes in investor behavior. Economic uncertainties and concerns about inflation are prompting many to reconsider their investment strategies, leading to reduced demand for cryptocurrencies and, consequently, the price decline.

Additionally, BTC’s price drop has also been influenced by various market trends and events. Analysts are tracking Bitcoin news and developments in the industry to predict future movements. Understanding these variables is crucial for investors, as they shape the landscape of cryptocurrency trading and investment risks associated with market decline.

BTC Market Analysis: Insights and Predictions for 2026

As we analyze the current situation where BTC drops below 69,000 USDT, it becomes clear that a strategic approach is needed for navigating the evolving cryptocurrency landscape. BTC market analysis for 2026 implies that while current declines may pose threats, they also present potential opportunities. Speculations in Bitcoin’s future value need to incorporate global economic trends and potential regulatory changes that could impact trading activities.

In viewing the future of Bitcoin following this recent downturn, traders are examining related economic indicators, as well as emerging cryptocurrency trends. Observations indicate that patterns from previous price corrections could serve as a guide, allowing traders to gauge optimal entry points amidst market volatility. By leveraging insights from various analyses, investors could make informed decisions despite the current 7.46% drop.

Key Indicators During Bitcoin’s 24H Decline

The decline in Bitcoin’s price by 7.46% within 24 hours serves as a pivotal indicator of market sentiment. Investors often turn to technical analysis and indicators such as resistance and support levels to forecast future trends. By observing such key indicators during BTC’s recent downtrend, traders can make educated assessments regarding potential recovery or further declines in the cryptocurrency market.

In addition to traditional financial indicators, the integration of sentiment analysis within crypto communities is becoming increasingly significant. Platforms offering detailed analytics can help traders understand how broader trends are impacting Bitcoin’s fluctuation. Thus, keeping a pulse on these dynamics is essential for predicting how BTC price movements might evolve over the coming weeks.

Long-Term Perspectives on Cryptocurrency Pricing Trends

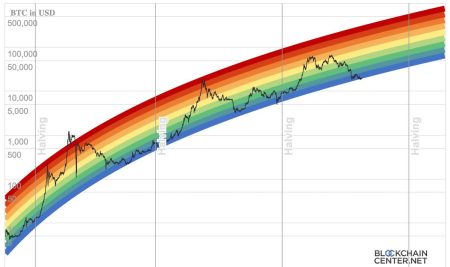

As the cryptocurrency market reflects on the recent drop of BTC below 69,000 USDT, it is crucial to contemplate long-term pricing trends. While short-term declines can result from sudden sentiment shifts or external pressures, the overarching trajectory of Bitcoin often follows cyclical patterns influenced by supply and demand dynamics. By focusing on these long-term perspectives, investors may identify broader trends that could determine Bitcoin’s value into 2026 and beyond.

Moreover, understanding historical pricing trends helps investors rationalize today’s volatility. The cryptocurrency space is known for both rapid surges and steep declines, making it essential for stakeholders to adopt resilient strategies. Long-term bullish sentiment remains prevalent amongst many investors, who still see Bitcoin as a pivotal asset despite short-term setbacks like the recent decline.

The Impact of Regulatory Environment on BTC’s Price

Regulatory discussions surrounding cryptocurrency continue to evolve, and these conversations are increasingly influencing market movements. The recent plunge of Bitcoin below 69,000 USDT has sparked debates on potential regulatory impacts that could lead to further significant volatility in 2026. As governments assess digital currencies, traders need to stay updated on shifts in legislation that may directly affect Bitcoin’s performance.

Historically, regulatory clarity has often resulted in price stabilization, while uncertainties have led to market panic. Investors must analyze the implications of these developments and their potential long-term effects on cryptocurrencies. Keeping abreast of these changes is crucial for understanding the phases of BTC’s price growth or decline as regulatory environments adapt.

Analyzing Crypto Trends in February 2026

February 2026 marks an important month for analyzing cryptocurrency trends, especially following Bitcoin’s recent price drop below 69,000 USDT. This period presents an opportunity to delve into the prevailing market factors that shape the trajectory of cryptocurrencies. Collectively, trends observed during this timeframe will offer insights into industry sentiments and expectations moving forward.

Additionally, examining emerging trends during February 2026 can help construct predictive models for the market. Factors such as trading volumes, adoption rates of cryptocurrency technologies, and investor interest levels can serve as indicators for potential recoveries or further declines. Utilizing this data, traders can strategize for upcoming months while considering the fluctuations observed in the market.

Short-Term Trading Strategies in Crypto Markets

In light of Bitcoin’s recent price drop of 7.46% which pushed it below 69,000 USDT, short-term trading strategies are becoming increasingly relevant for investors looking to mitigate losses or capitalize on market volatility. Traders are actively searching for tactical entry points that align with market signals, leveraging both fundamental and technical analysis to inform their decisions.

Short-term strategies often involve day trading or swing trading methods, where traders aim to take advantage of price movements within brief periods. By maintaining flexibility and being responsive to market changes, investors may successfully navigate fluctuations resulting from updated market news and trends within the cryptocurrency landscape.

The Future of Bitcoin Pricing: Investor Sentiment Analysis

The future of Bitcoin pricing is often swayed by investor sentiment, particularly after significant events such as the recent drop to 68,988 USDT. As sentiment shifts between fear and optimism, it profoundly impacts market dynamics. Understanding the psychological factors influencing investor behavior is crucial for anticipating Bitcoin’s price trajectory moving forward.

Tools such as sentiment analysis through social media and trading platforms are essential for gauging the mood of the market. By observing trends in sentiment, investors can position themselves favorably. Strategic decisions based on comprehensive market sentiment analysis could be key as Bitcoin’s price continues to adjust to external pressures including regulatory changes, technological advancements, and evolving financial landscapes.

Frequently Asked Questions

What caused the BTC drop below 69,000 USDT recently?

The recent BTC drop below 69,000 USDT, currently at 68,988 USDT, can be attributed to a combination of market volatility and various external factors impacting cryptocurrency prices. A reported 24-hour decline of 7.46% reflects broader trends in the cryptocurrency market as investors react to economic news and trading patterns.

How does the BTC market analysis look after the price drop below 69,000 USDT?

BTC market analysis following the price drop below 69,000 USDT indicates increased bearish sentiment among traders. With a significant 24-hour decline, analysts are closely monitoring support levels and potential recovery strategies in response to this downturn.

What are the crypto trends February 2026 after Bitcoin drops below 69,000 USDT?

Crypto trends in February 2026 show a mixed response following Bitcoin’s drop below 69,000 USDT. Market analysts are predicting cautious trading behavior as investors digest the implications of recent declines and external economic conditions on future price movements.

How should investors react to the Bitcoin price drop below 69,000 USDT?

Investors reacting to the Bitcoin price drop below 69,000 USDT should consider evaluating their current holdings and strategies. Diversifying portfolios and keeping abreast of Bitcoin news in 2026 will be crucial to navigate the volatility in the cryptocurrency market.

What does Bitcoin news 2026 say about the recent decline below 69,000 USDT?

Bitcoin news in 2026 highlights the recent decline below 69,000 USDT as a critical moment for the cryptocurrency market, emphasizing the need for investors to stay informed about market dynamics and potential recovery signals.

Is the drop below 69,000 USDT a sign of a broader cryptocurrency decline?

Yes, the drop below 69,000 USDT may indicate a broader cryptocurrency decline, as many digital assets often move in correlation with Bitcoin. The reported 7.46% decline could suggest a shift in market sentiment affecting the overall cryptocurrency landscape.

What support levels are important after BTC drops below 69,000 USDT?

After BTC drops below 69,000 USDT, key support levels to watch include 68,500 USDT and 67,000 USDT. Traders are focusing on these thresholds to determine if there is potential for recovery or if further declines may occur.

How can traders prepare for further declines in Bitcoin prices after the recent drop below 69,000 USDT?

Traders can prepare for potential further declines in Bitcoin prices after the recent drop below 69,000 USDT by setting stop-loss orders, diversifying their assets, and keeping a close eye on market news and trends to anticipate future movements.

What impact does market sentiment have on Bitcoin price drops like the one below 69,000 USDT?

Market sentiment has a significant impact on Bitcoin price drops, such as the recent fall below 69,000 USDT. Negative sentiment can lead to panic selling, while positive news may encourage buyers, directly influencing price fluctuations.

Are there long-term implications for Bitcoin after dropping below 69,000 USDT?

Yes, there could be long-term implications for Bitcoin after dropping below 69,000 USDT, depending on how the market reacts. Continued declines may challenge investor confidence, while stabilization or recovery could reinforce the asset’s long-term prospects.