BTC derivatives have become a pivotal component in the ever-evolving cryptocurrency market, catching the attention of investors and analysts alike. They serve as instruments that can potentially amplify price fluctuations, a phenomenon recently highlighted by Arthur Hayes on the X platform. Unlike many might believe, these derivatives do not originate conspiratorial risks behind market crashes; rather, they expose the vulnerabilities of over-leveraged investors. As traders respond to market trends, the influence of these derivatives becomes increasingly pronounced, shaping the trajectory of Bitcoin‘s valuation. Understanding BTC derivatives is essential for anyone looking to navigate the complexities of modern digital asset investments.

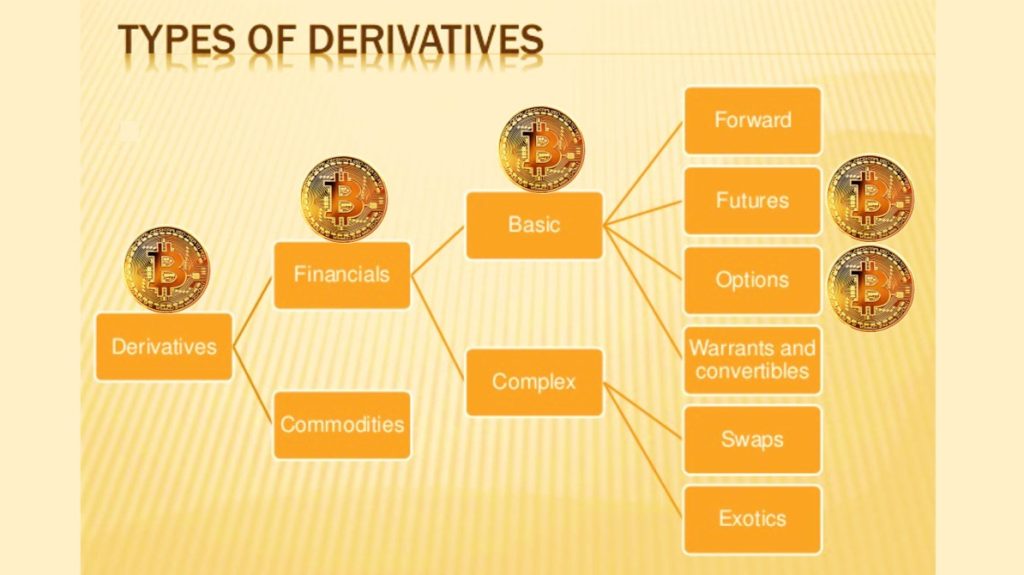

In the realm of Bitcoin trading, derivative contracts play a significant role in determining price dynamics and investor behavior. These financial instruments, including futures and options, allow market participants to speculate on the value of Bitcoin without directly holding the asset. Insights from industry experts like Arthur Hayes reveal that such derivatives do not directly trigger market downturns, but rather magnify existing price movements, especially during volatile periods. As traders engage with these products, it is crucial to recognize the risks posed to those who are over-leveraged and how market trends can shift rapidly. Exploring the intricate world of Bitcoin derivatives provides a deeper understanding of the forces at play in today’s cryptocurrency landscape.

| Key Point | Explanation |

|---|---|

| BTC Derivatives and Price Fluctuations | BTC derivatives do not inherently cause price fluctuations; they amplify existing movements in the market. |

| Conspiracy Theories | There is no hidden conspiracy in the cryptocurrency market that contributes to price crashes. The market operates independently. |

| Market Recovery | In the absence of government bailouts, the cryptocurrency market can swiftly eliminate over-leveraged investors and pave the way for recovery, |

Summary

BTC derivatives play a crucial role in the cryptocurrency market by influencing price movements rather than directly causing them. As explained by Arthur Hayes, the nature of derivatives is to magnify existing volatility. This understanding dispels the myth of conspiracies behind market crashes, highlighting that the crypto landscape reacts to market dynamics instead of hidden agendas. Without external financial interventions, the market is capable of self-correcting, allowing it to recover from periods of instability. Understanding the dynamics of BTC derivatives is essential for investors looking to navigate the market effectively.

Understanding the Impact of BTC Derivatives

BTC derivatives are financial instruments that derive their value from the performance of Bitcoin. According to Arthur Hayes, these derivatives do not create price fluctuations by themselves but tend to amplify existing movements, meaning that they can increase volatility in the cryptocurrency market. Investors need to be aware that while derivatives trading can present opportunities for profit, they also come with significant risks, particularly during periods of price instability. The amplifying effect of BTC derivatives means that small price changes in Bitcoin can result in much larger fluctuations for derivative assets, which can have a cascading effect on the broader market.

Moreover, the role of BTC derivatives is critical to understand in the context of market trends. For instance, when Bitcoin’s prices are trending downward, the existence of derivatives can lead to further sell-offs as traders react to market signals. This reaction can lead to an exacerbation of price drops fueled by panic selling among over-leveraged investors. Therefore, it’s crucial for participants in the cryptocurrency market to have a solid grasp of derivatives and their potential influence on Bitcoin’s price dynamics. Monitoring these instruments can be essential for developing better trading strategies and minimizing vulnerabilities.

Debunking Myths About Cryptocurrency Market Crashes

Arthur Hayes strongly asserts that there isn’t a secret conspiracy behind price crashes in the cryptocurrency market. Instead, he emphasizes that these downturns often occur due to market fundamentals and the natural purging of over-leveraged investors. When significant price shifts occur, many poorly positioned traders get liquidated, which can create a swift and dramatic fall in Bitcoin prices. Understanding the causes of these crashes—rather than attributing them to hidden agendas—can help investors make informed decisions in uncertain times. This transparency is essential for fostering trust in cryptocurrency as a legitimate asset class.

In the absence of government bailouts, the cryptocurrency market has the ability to self-correct through these purges. While this mechanism can initially appear harsh, it serves to cleanse the market and allows it to rebound more robustly in the long term. Understanding the cyclical nature of price fluctuations and the inherent risks associated with over-leveraging can help investors mitigate losses during downturns while capitalizing on their recovery. Overall, having a clear-eyed view of market dynamics is essential for sustainability within the cryptocurrency ecosystem.

The Role of Market Sentiment in Price Volatility

Market sentiment plays a pivotal role in how BTC derivatives influence price volatility. As traders react to news, trends, and price movements, their collective actions can result in significant shifts. For example, positive sentiment can lead to rapid increases in price, while negative sentiment may cause swift sell-offs. This behavior creates feedback loops where the effects of BTC derivatives come into play, amplifying the initial sentiment-driven movements. Consequently, understanding market sentiment and its intertwined relationship with price trends is crucial for anyone involved in trading Bitcoin and its derivatives.

Additionally, the psychological factors that drive investor behavior in the cryptocurrency market cannot be overstated. Over-leveraged investors tend to panic during downturns, often pulling out under pressure, which can lead to further depreciation in price. The volatility caused by emotional trading is often exacerbated by the dramatic leverage that derivatives offer. As such, it’s important for traders to maintain a disciplined approach and avoid letting emotion drive their trading strategies. Recognizing the impact of sentiment in this volatile market can not only help investors navigate better but also enhance their overall trading efficacy.

Arthur Hayes’ Predictions on Cryptocurrency Trends

Arthur Hayes has made several predictions about the future of the cryptocurrency market, particularly referencing BTC derivatives and their ongoing influence. He suggests that while BTC derivatives can amplify price movements, they also offer unique opportunities for savvy investors to capitalize on market trends. By understanding these financial instruments, traders can strategically position themselves during significant market shifts, ultimately benefiting from the volatile nature of cryptocurrencies. Hayes’ insights encourage a proactive approach to trading, emphasizing the importance of market awareness and analysis.

Furthermore, Hayes’ assertion that market trends can shift independently of external manipulation suggests a need for investors to cultivate a foundational understanding of market dynamics. By prioritizing education and analysis, traders can develop strategies that align with market trends rather than relying solely on speculation or herd mentality. This perspective empowers investors to make better-informed decisions, potentially leading to greater success in navigating the complexities of the cryptocurrency market. Thus, keeping an eye on Hayes’ analyses and insights may prove beneficial for those serious about thriving in these turbulent waters.

Navigating Risks in the Cryptocurrency Market

Investing in BTC derivatives poses significant risks that traders must navigate wisely, especially with the threat of over-leveraged positions becoming liquidated during market downturns. Arthur Hayes points out that without governmental bailouts, the market has a unique capacity for correction through a natural purge of these over-leveraged investors. This self-correcting mechanism is an essential characteristic of the cryptocurrency landscape but requires investors to remain vigilant about their exposure. A sound risk management strategy can help mitigate potential losses, allowing investors to participate in the market without overly exposing themselves to significant downturns.

Additionally, a proper understanding of market trends can equip traders with the necessary insights to capitalize on price fluctuations rather than fall victim to them. Keeping abreast of the latest news, market analyses, and trend data is vital for anyone involved in cryptocurrency trading. By developing these skills and knowledge, investors can not only safeguard their investments but also identify new opportunities for growth. Learning to navigate the precarious nature of cryptocurrency investments is essential for long-term success and sustainability in this rapidly changing market.

Investment Strategies in an Uncertain Cryptocurrency Landscape

In light of the unpredictable nature of the cryptocurrency market, developing effective investment strategies is paramount. Arthur Hayes highlights the potential for BTC derivatives to both influence and reflect market conditions, suggesting that strategic use of these instruments can enhance investment outcomes. Successful investors should focus on aligning their strategies with current market trends, making informed moves based on analysis rather than reaction. Creating a flexible strategy can help capitalize on favorable conditions while protecting against downturns.

Moreover, one effective approach is to diversify across various cryptocurrencies and derivatives. This method helps to spread risk, ensuring that if one asset class underperforms, others may compensate for potential losses. Additionally, investors should keep a close watch on over-leveraged positions within the market. Understanding the fluctuations and behavior of their peers can shed light on broader market trends, informing their investment decisions. By remaining adaptable and informed, investors can navigate the uncertainties of the cryptocurrency landscape with greater confidence.

The Future of BTC Derivatives and Market Dynamics

The future of BTC derivatives is likely to be shaped by ongoing changes in technology and regulation, both of which can significantly impact market dynamics. As Arthur Hayes points out, the influence of BTC derivatives continues to increase, potentially leading to amplified price movements as the market evolves. Investors will need to stay abreast of regulatory developments and technological advancements that could reshape how BTC derivatives function within the broader financial landscape. Understanding these components is crucial for anyone looking to operate effectively in this space.

Furthermore, the continued maturation of the cryptocurrency market may lead to a more institutional approach to trading BTC derivatives. As large financial players enter the space, they may bring with them new strategies and practices that could stabilize the marketplace over time. This evolution may mitigate extreme price fluctuations, relying instead on more measured responses to market changes. However, traders must maintain a keen sense of awareness and adaptability, always ready to recalibrate their strategies in response to shifting dynamics within the market.

Analyzing Historical Trends in Bitcoin Pricing

Analyzing historical trends in Bitcoin pricing provides valuable insights into market behavior and can inform future investment strategies. Hayes notes that while BTC derivatives exist to amplify price movements, understanding past price behaviors can help investors make predictions about potential future trends. By examining historical data, traders can identify patterns that have preceded major price fluctuations, allowing for a more calculated approach to their investments. Historical analysis serves not only as a learning tool but as a way to gauge market sentiment and investor behavior over time.

Moreover, the cyclic nature of Bitcoin’s price movements has shown investors that the market often responds predictably to certain triggers, such as regulatory news or macroeconomic shifts. Recognizing and understanding these triggers are essential. A historical perspective allows traders to anticipate possible outcomes based on previous events, helping them to navigate their investment strategies more effectively. By merging historical analysis with current market data, investors can look at the cryptocurrency market more holistically, increasing their chances for successful trades.

Creating a Sustainable Cryptocurrency Portfolio

Building a sustainable cryptocurrency portfolio involves not only selecting assets wisely but also implementing robust risk management practices. Hayes emphasizes the need to consider how BTC derivatives can affect one’s investments. A well-balanced portfolio takes into account the volatility of various cryptocurrencies and their derivatives. Allocating multiple assets can diversify risk, enhancing the portfolio’s resilience against sudden market shifts and price fluctuations. Focus on a range of investments that can perform well across different market conditions is essential for long-term sustainability.

Furthermore, ongoing education and market research play crucial roles in sustaining an effective investment strategy. Keeping up to date with market trends, understanding the implications of derivative trading, and analyzing potential risks can empower investors to make informed decisions. As the cryptocurrency space continues to evolve rapidly, adaptability and knowledge will be key determinants of success. By committing time and resources to understanding the market, investors can create a portfolio that not only withstands the vicissitudes of the market but thrives within them.

Frequently Asked Questions

How do BTC derivatives impact price fluctuations in the cryptocurrency market?

BTC derivatives do not inherently cause price fluctuations; they can amplify existing price movements in both upward and downward directions. This amplification is especially true in a volatile cryptocurrency market where leverage plays a significant role.

What did Arthur Hayes say about BTC derivatives and market trends?

Arthur Hayes indicated that BTC derivatives have the potential to amplify price fluctuations rather than initiate them. He emphasized that the cryptocurrency market operates without conspiracies, and the effects of derivatives are a natural result of market dynamics.

Can BTC derivatives lead to crashes in the cryptocurrency market?

While BTC derivatives can amplify price movements, Arthur Hayes pointed out that there are no secret conspiracies leading to market crashes. Crashes may occur due to the sudden liquidation of over-leveraged investors, which the derivatives market can exacerbate.

What role do over-leveraged investors play in the cryptocurrency market regarding BTC derivatives?

Over-leveraged investors can significantly impact the cryptocurrency market, particularly in relation to BTC derivatives. When prices decline, these investors are often forced to liquidate their positions, leading to further price drops and broader fluctuations in the market.

How can the cryptocurrency market restore an upward trend after a downturn involving BTC derivatives?

A quick purge of over-leveraged investors can help the cryptocurrency market stabilize and restore an upward trend. Without external bailouts, as noted by Arthur Hayes, the market tends to correct itself after experiencing significant price fluctuations.