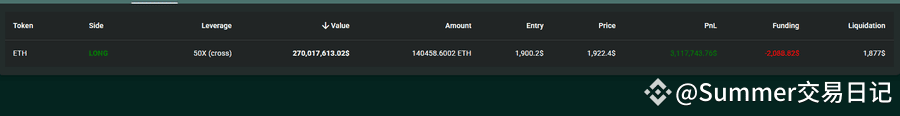

| Date | Position Details | Current Holdings | Unrealized Loss | Liquidation Price |

|---|---|---|---|---|

| January 20, 2026 | 25x long position in Ethereum; partial liquidation due to market downturn | 4,300 ETH | Nearly $800,000 | $3,034 |

Summary

Brother Maji’s Ethereum position has faced challenges with a partial liquidation due to a temporary market downturn. Currently, Brother Maji holds a substantial amount of 4,300 ETH but is grappling with an unrealized loss nearing $800,000. The liquidation threshold is set at $3,034, indicating the critical price point to monitor for potential further impacts on his investment. This situation highlights the volatility within the cryptocurrency market and the risks associated with high-leverage trading strategies.

Brother Maji Ethereum position has recently come under scrutiny following a notable partial liquidation. Amidst a turbulent crypto market downturn, Brother Maji’s substantial 25x long position in Ethereum faced significant challenges, resulting in an unrealized loss of nearly 800,000 USD. Currently, he maintains a total of 4,300 ETH, raising concerns over Ethereum liquidation pressures. As the prices fluctuate, many are eager to follow Brother Maji crypto news to understand the implications for ETH long position strategies. For investors watching the Ethereum trading losses, this situation highlights the risks associated with leveraged trading in volatile conditions.

The current scenario surrounding Brother Maji’s stake in Ethereum reveals the complexities faced by traders in the cryptocurrency space. His investments illustrate the high stakes of maintaining a leveraged long position in ETH, particularly during adverse market conditions. This situation has led many to examine the broader impact of the recent crypto market downturn and how such fluctuations can precipitate significant trading losses. As the community looks for insights, alternative analyses of Brother Maji’s position offer valuable lessons in risk management. Understanding the dynamics at play is essential for both seasoned investors and newcomers navigating the evolving landscape of digital assets.

Brother Maji’s Ethereum Position: Analyzing Partial Liquidation

Brother Maji’s recent experiences with his Ethereum position provide a crucial perspective on the impacts of market volatility in the crypto realm. His long position, leveraged at 25x, faced partial liquidation due to a temporary downturn, illustrating the inherent risks that come with high leverage trading. Currently holding 4,300 ETH, Brother Maji finds himself facing an unrealized loss close to $800,000. This precarious state highlights the importance of effective risk management and understanding market dynamics, especially in a landscape as tumultuous as cryptocurrency.

The liquidation price for Maji’s position stands at $3,034, indicating a tight threshold for maintaining his ETH investments. As the crypto market continues to witness unpredictable fluctuations, traders must stay vigilant and well-informed. Understanding the implications of liquidation events can help traders like Brother Maji better strategize their positions, whether it’s converting to a safer asset or recalibrating their investment strategies in response to market signals.

Frequently Asked Questions

What happened to Brother Maji’s Ethereum position during the recent market downturn?

Brother Maji’s Ethereum position experienced partial liquidation due to a brief market downturn, affecting his 25x long position. Despite this, he currently holds 4,300 ETH with an unrealized loss of nearly 800,000 USD.

How has the recent crypto market downturn impacted Brother Maji’s ETH long position?

The recent crypto market downturn led to a partial liquidation of Brother Maji’s ETH long position. He has maintain 4,300 ETH, but is facing an unrealized loss of around 800,000 USD.

What is Brother Maji’s current status in Ethereum trading after the liquidation?

Following the partial liquidation, Brother Maji still holds a total of 4,300 ETH. His position is currently reflecting a significant unrealized loss due to the market downturn.

What are the risks of long positions in Ethereum as highlighted by Brother Maji’s situation?

Brother Maji’s situation underscores the risks of maintaining long positions in Ethereum, especially with high leverage, as evidenced by the partial liquidation he encountered during a market downturn.

What is the liquidation price for Brother Maji’s Ethereum position?

Brother Maji’s Ethereum position has a liquidation price set at 3,034 USD, which indicates the threshold at which additional losses may occur.

How does Brother Maji’s unrealized loss compare to the current Ethereum market conditions?

Brother Maji currently faces an unrealized loss of nearly 800,000 USD on his Ethereum holdings due to the recent downturn in the crypto market impacting ETH prices.

What can traders learn from Brother Maji’s Ethereum liquidation experience?

Traders can learn about the importance of risk management and the potential volatility of the crypto market from Brother Maji’s experience with his 25x long position in Ethereum.

Where can I find the latest Brother Maji crypto news regarding his Ethereum position?

The latest Brother Maji crypto news concerning his Ethereum position, including his current holdings and market challenges, can be found on financial news websites and crypto analysis platforms.