BNB Price Surges — Is a Decline Looming?

In a stunning display of bullish momentum, Binance Coin (BNB), the native cryptocurrency of the Binance exchange, has recently experienced a significant surge in price. This has left both investors and analysts wondering whether this uptrend will continue or if a market correction is on the horizon.

The Surge

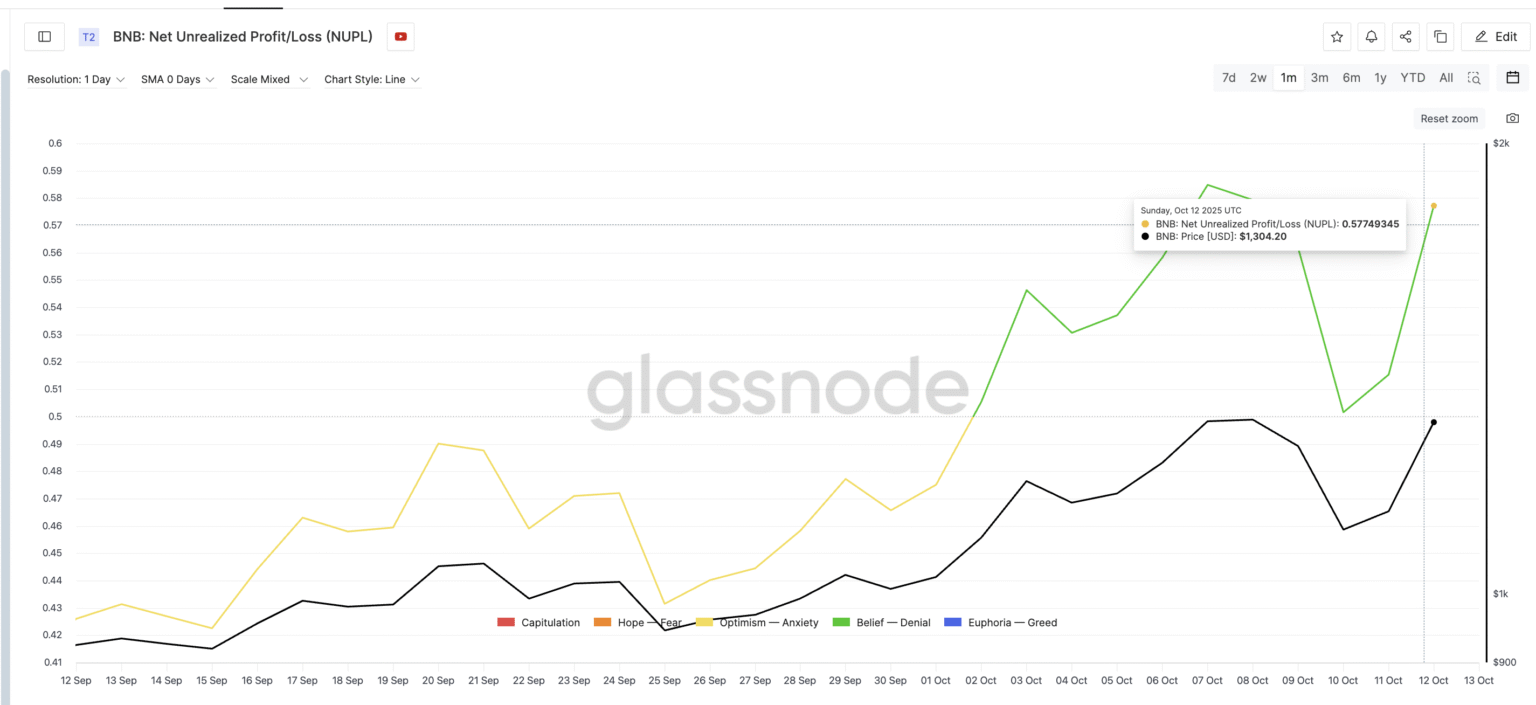

BNB has witnessed remarkable growth in recent times, with its price increasing by over 50% in just a few weeks. As of the latest data, the coin is trading at a price not seen since its peak in 2021. This surge has been attributed to a variety of factors including increased adoption of Binance’s platforms, expansion in services that leverage BNB, and broader market recoveries.

Why BNB is Rising

Several factors can be credited with the dramatic rise in BNB’s market value:

-

Expansion of Binance’s Ecosystem: Binance has been continually expanding its ecosystem, integrating more features that require or incentivize the use of BNB. From Binance Chain and Binance Smart Chain enhancements to increased utility in token swaps, lending, and staking, the demand for BNB continues to climb.

-

Strategic Developments and Partnerships: Binance has entered into numerous partnerships that enhance the utility and visibility of BNB. This includes collaborations with payment processors and fintech platforms that allow more users to access BNB easily.

-

Crypto Market Recovery: The crypto space is seeing a significant uptick after several hauls of bearish trends. As one of the leading cryptocurrencies, BNB has benefited from this general market bullishness.

- Buy-back and Burn Policy: Binance conducts quarterly burns of BNB, reducing the overall supply and theoretically boosting the value of the coin. This scarcity factor plays into the strength BNB has shown on price charts.

Potential Risks and Causes for a Decline

Despite the optimistic outlook, there are several reasons why a downturn might be imminent:

-

Regulatory Challenges: Binance has faced scrutiny from regulators around the world, which could impact its operations and the utility of BNB. Stricter regulations or negative outcomes from legal proceedings could result in a loss of confidence among investors.

-

Market Volatility: The cryptocurrency market is inherently volatile. The same forces driving the price up can shift rapidly, leading to equally fast declines.

-

Profit-Taking: After such a significant spike, investors might decide to lock in profits, leading to a sudden sell-off. This action could trigger a price decline.

- Technical Overstretch: From a technical analysis perspective, when any asset experiences a fast and substantial increase, it is often considered “overbought” in trading terms, making it ripe for a correction.

Forward-Looking Strategies for Investors

Investors in BNB should keep a keen eye on both market trends and fundamental analysis:

- Stay Updated on Regulatory News: Any advancement on the regulatory front can affect BNB’s price.

- Risk Management: Implement strategies such as stop-loss orders to mitigate potential losses.

- Diversification: Avoid putting all investments into one asset, even one as promising as BNB.

Conclusion

BNB’s surge has been driven by a confluence of positive factors, but potential risks loom that could drive a price correction. Investors should navigate BNB’s volatile waters with care, balancing optimism with a healthy level of caution. Despite possible declines, Binance Coin’s foundation appears solid, supported by a strong ecosystem and continuous developmental efforts by Binance. The future path BNB will take from here remains a closely monitored one, with significant interest from various stakeholders in the cryptosphere.