BNB Price Hits New High: Potential Bull Trap Alert — Reasons to Be Cautious

In the volatile world of cryptocurrencies, BNB, the native coin of the Binance exchange, has recently experienced a surge, hitting a new all-time high. This bullish trend has caught the attention of investors globally. However, financial analysts and crypto experts are waving a flag of caution, suggesting this could be a potential bull trap. Here are the critical reasons to stay prudent and consider the risks involved before jumping on the bandwagon.

1. Market Volatility and Emotional Trading

Cryptocurrency markets are characterized by their high volatility, which can lead to rapid price swings. The current spike in BNB’s price might be driven more by speculative trading and emotional reactions rather than fundamental value. Prices driven by hype and speculation can lead to sharp corrections, leaving late buyers at a loss as the early entrants cash out.

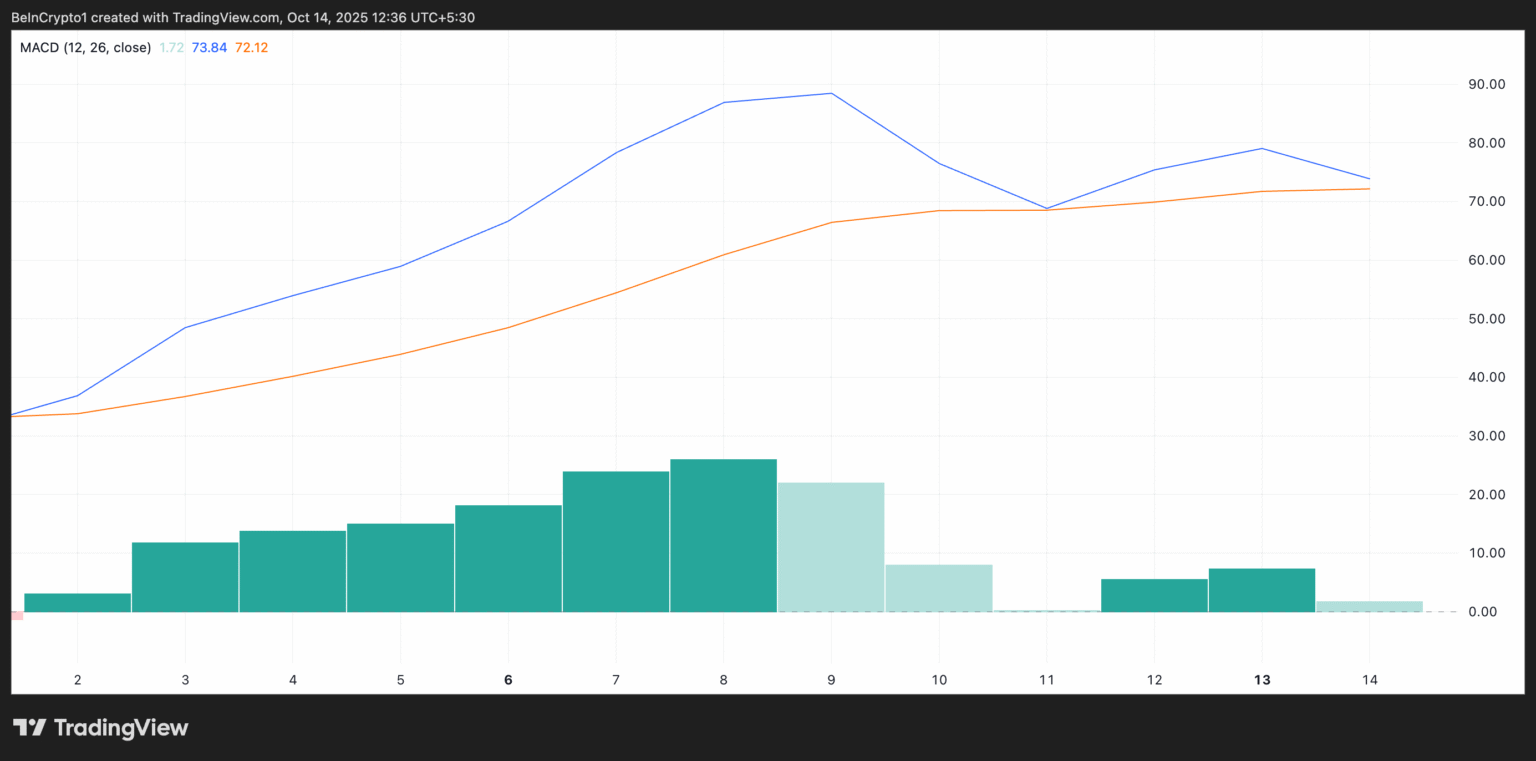

2. Overstretched Technical Indicators

Technical analysis of BNB’s price charts suggests that the coin could be overbought. Indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are at levels typically indicative of a potential pullback. When assets reach new highs quickly, they often retrace some of these gains as traders take profits.

3. Regulatory Concerns

Binance, the platform backing BNB, has faced scrutiny from various global regulators concerning compliance issues. Any adverse regulatory interventions or negative news could lead to a decrease in investor confidence, impacting BNB’s price negatively. The regulatory landscape for cryptocurrencies is still evolving, and potential policy changes or legal challenges could pose risks.

4. Market Manipulation Risks

The possibility of market manipulation in crypto markets is a significant threat, especially for coins that have a large portion of their total supply held by a small number of addresses. Whales (large holders) can manipulate the price by orchestrating coordinated buy or sell-offs. Investing during a high could increase the risk of being caught in such manipulative schemes.

5. The Bull Trap Scenario

A bull trap occurs when a declining trend in an asset’s price briefly reverses, misleading investors into thinking that the upward trend will continue long-term. Once enough investors buy into the asset at the high price, the early sellers sell off their holdings, causing the price to plummet and trapping newer investors at high purchase prices. The current unprecedented high in BNB’s valuation could very well be a setup for a bull trap.

6. Alternative Investment Opportunities

Diversification is a key principle in investing. With the crypto market comprising thousands of different cryptocurrencies, putting an excessive portion of one’s investment into a single cryptocurrency, especially one that has just reached an all-time high, might not be the wisest strategy. Exploring other cryptocurrencies or investment classes could mitigate risk and increase potential returns.

Conclusion

While the recent performance of BNB is undoubtedly impressive, investors should proceed with caution. The sparkling highs might be enticing, but they bring with them a heightened risk of a crash, particularly under current market conditions influenced by speculation and potentially transient factors. As always, doing thorough research and possibly consulting with financial experts before making significant investment decisions in the volatile crypto market is advisable.