Blockchain infrastructure is at the forefront of financial innovation, providing the needed backbone for modern transaction systems. As banks navigate the complexities of digital finance, upgrading their blockchain infrastructure from private to public layers becomes crucial. This transition not only enhances interoperability but also leverages advanced solutions like zero-knowledge proofs to maintain privacy while ensuring compliance. The dichotomy between private vs public blockchains presents a significant choice for financial institutions, highlighting the need for resilience in an ever-evolving landscape. With the rise of decentralized finance (DeFi), embracing robust public blockchain systems is essential for banks aiming to remain competitive and relevant.

As we explore the world of decentralized technologies, the term “distributed ledger technology” often surfaces, synonymous with the evolution of traditional finance sectors. Financial institutions are faced with a crucial decision regarding their reliance on centralized systems versus adopting a broader public network. Enhanced solutions like layer 2 protocols are instrumental in providing scalable options while preserving user privacy through mechanisms like zero-knowledge proofs. This landscape transformation also raises important discussions around private chains compared to their public counterparts, emphasizing a shift from isolated to collaborative frameworks in capital markets. Ultimately, the modernization of banking through adaptable and open infrastructures is imperative for thriving in today’s dynamic financial ecosystem.

The Importance of Upgrading Blockchain Infrastructure for Banks

As the financial landscape continues to evolve, banks must prioritize upgrading their blockchain infrastructure to remain competitive. While private blockchains have offered a semblance of control, they hinder interoperability and restrict access to the wider decentralized finance ecosystem. Modern financial transactions increasingly rely on public blockchains that facilitate tokenized assets and stablecoin settlements, ensuring that institutions can operate within a globally connected market.

Failure to adopt these advancements not only risks falling behind more agile competitors but also alienates institutions from valuable public liquidity sources. The shift towards public, permissioned layer-2 networks can lead to enhanced operational efficiency, allowing banks to carry out seamless transactions while still adhering to necessary compliance measures. It is, therefore, crucial for financial institutions to recognize that isolation from public blockchains may translate into grave strategic setbacks.

Navigating Public vs. Private Blockchains

The debate between public and private blockchains often hinges on security versus accessibility. While private blockchains like Hyperledger offer enhanced data control, they often lack the scalability and interoperability that public blockchains provide. This becomes increasingly apparent as financial institutions attempt to engage with a broader base of decentralized finance protocols, which thrive on open-source collaboration and transparency.

Moreover, public blockchains have begun to integrate advanced technologies such as zero-knowledge proofs, which allow entities to validate transactions without exposing sensitive information. This mitigates concerns about privacy while unlocking the vast potential of public finance. Financial institutions must evaluate the long-term implications of their blockchain choices—staying with private solutions may ultimately inhibit their ability to adapt to dynamic market demands.

Leveraging Layer 2 Solutions to Enhance Scalability

Layer 2 solutions serve as a critical component in addressing the scalability challenges faced by blockchain networks. For banks, adopting these solutions empowers them to operate efficiently within a public blockchain framework without compromising on transaction speed or security. By incorporating layer 2 technology, institutions can ensure high throughput while minimizing costs, critical factors in maintaining competitiveness in the fast-paced financial sector.

Furthermore, integrating layer 2 solutions enables banks to facilitate complex financial transactions seamlessly while embedding privacy measures through technologies like zero-knowledge proofs. This not only enhances the customer experience but also aligns with the evolving demands of compliance within financial transactions. As banks transition to these advanced infrastructures, they not only gain operational advantages but also position themselves favorably within the interconnected financial ecosystem.

The Role of Zero-Knowledge Proofs in Maintaining Privacy

Zero-knowledge proofs represent a groundbreaking advancement in blockchain technology, allowing for the verification of transaction authenticity without revealing any underlying details. For financial institutions, this technology presents a unique opportunity to engage with open, public blockchains while still safeguarding client confidentiality and proprietary information.

By embedding zero-knowledge proofs into their blockchain strategies, banks can perform necessary compliance checks without compromising the privacy of their transactions. This shift towards transparency combined with privacy paves the way for greater financial inclusivity and trust, essential elements in today’s competitive landscape. As the market evolves, those who leverage these technologies will likely stand out as leaders in the new wave of financial innovation.

The Shifting Landscape of Financial Institutions and Blockchain

The transition to blockchain technology within financial institutions reflects broader trends in global markets and consumer expectations. Banks are increasingly aware that the rigid structures of private blockchains may not suffice in a landscape demanding flexibility and rapid innovation to meet customer needs. Decentralized finance (DeFi) is rapidly redefining how capital is mobilized, and institutions must adapt to this reality or risk obsolescence.

Traditional models that rely heavily on legacy systems are dwindling as clients seek better, faster, and more cost-effective solutions. The rise of public blockchains and layer 2 infrastructures allows banks to meet these demands head-on while also securing a place in the burgeoning decentralized economy. Instead of resisting the change, banks should embrace the opportunities presented by these shifting dynamics, ensuring they remain relevant in an increasingly interconnected market.

The Impact of Geopolitical Factors on Blockchain Adoption

Geopolitical events and macroeconomic trends can dramatically influence the pace of blockchain adoption within financial institutions. As markets become more interconnected, the need for secure, adaptable solutions like public blockchains has never been more urgent. In uncertain times, banks must not only consider regulatory compliance but also the strategic insights garnered from a robust blockchain presence, which can provide resilience against volatile market conditions.

In this context, adopting public, permissioned layer 2 infrastructures facilitates better communication and collaboration among institutions while enhancing overall financial stability. By connecting to a wider network of stakeholders, banks can navigate geopolitical risks more effectively, ensuring they remain agile and responsive to changes in the financial environment. The proactive embrace of blockchain technology thus becomes a pivotal strategy for long-term financial resilience.

Financial Institutions and Decentralized Finance (DeFi) Integration

As decentralized finance (DeFi) continues to disrupt traditional financial systems, banks must find innovative pathways to integrate these practices into their operations. DeFi presents opportunities for institutions to offer a wider range of financial products and services through blockchain technology, expanding their market reach and enhancing customer engagement.

Embracing DeFi requires shifts in strategy, including leveraging public blockchains and adopting layer 2 solutions to ensure scalability without compromising compliance. By actively participating in this movement, banks can enhance their liquidity and provide unique offerings that cater to a tech-savvy clientele. The future of finance may lie in the symbiotic relationships formed between traditional institutions and blockchain innovations.

The Future of Banking in a Blockchain-Driven World

Looking ahead, the future of banking is undeniably tied to the advancements in blockchain technology. Financial institutions that successfully transition to public, permissioned layer 2 infrastructures will likely lead the charge in redefining customer experiences, operational efficiencies, and compliance adaptability. The incorporation of zero-knowledge proofs will allow banks to navigate privacy concerns while capitalizing on the capabilities of public networks.

As traditional banking models evolve, those that embrace openness and collaboration are likely to thrive. Businesses will demand not just transactional control but also the ability to engage with diverse financial ecosystems. Hence, the shift towards a blockchain-driven world will redefine what it means to be a financial institution, highlighting the necessity for adaptability in a rapidly changing economic environment.

Compliance and Security Standards in Transitioning to Blockchain

Transitioning to a blockchain infrastructure necessitates a comprehensive understanding of compliance and security standards. As banks shift from legacy systems to public, permissioned environments, they must ensure that their practices meet regulatory requirements while also safeguarding sensitive data. This dual focus on adherence to legal frameworks and the protection of client anonymity is crucial for building trust in the emerging blockchain landscape.

Moreover, the security landscape evolves alongside technological advancements. As financial institutions integrate layer 2 solutions and zero-knowledge proofs, adopting new security measures to protect against emerging threats becomes paramount. By prioritizing compliance and security, banks can ensure they take full advantage of blockchain innovations while minimizing risks associated with data breaches or regulatory infractions.

Frequently Asked Questions

What is blockchain infrastructure and why is it important for banks?

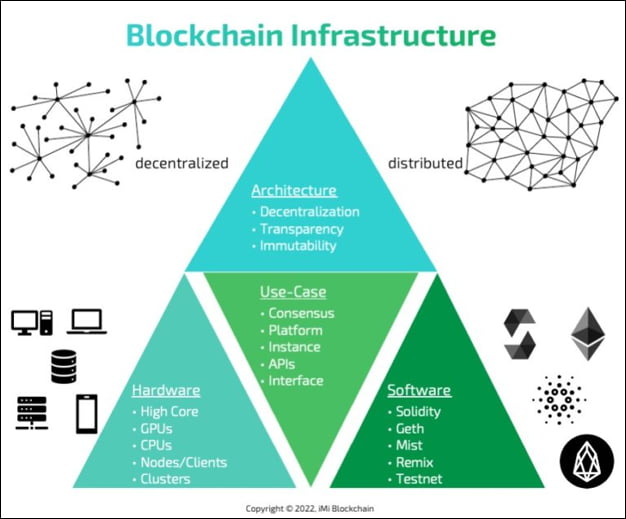

Blockchain infrastructure refers to the underlying technology that supports blockchain networks, including public and private blockchains. For banks, upgrading their blockchain infrastructure is crucial to leverage modern technologies like layer 2 solutions, which enhance scalability and interoperability, ensuring they remain competitive in the evolving financial landscape.

How do public blockchains differ from private blockchains in financial applications?

Public blockchains are open and decentralized, allowing for greater transparency and liquidity, while private blockchains restrict access and control. For financial institutions, transitioning from private to public blockchains can unlock new opportunities for tokenized assets and compliance, essential for adapting to modern finance.

What are layer 2 solutions and their significance in blockchain infrastructure?

Layer 2 solutions are protocols built on top of existing blockchain networks that enable faster transactions and lower fees, while still benefiting from the security of the underlying blockchain. They are particularly important for banks as they enhance scalability and facilitate real-time transactions necessary for a competitive edge in the financial sector.

What are zero-knowledge proofs, and how do they enhance blockchain infrastructure?

Zero-knowledge proofs (ZK proofs) are cryptographic techniques that allow one party to prove to another that a statement is true without revealing any specific information. In blockchain infrastructure, the use of ZK proofs enables financial institutions to conduct transactions privately and securely while complying with regulations, balancing transparency and confidentiality.

What are the advantages of using public, permissioned layer 2 infrastructures for banks?

Public, permissioned layer 2 infrastructures provide banks with a scalable and interoperable framework that maintains compliance and privacy while enabling participation in broader financial ecosystems. This allows banks to access public liquidity sources and engage in innovative financial services without sacrificing security.

Why is the shift from private to public blockchains critical for financial institutions?

The transition from private to public blockchains is critical for financial institutions because it allows them to access liquidity on public infrastructures, engage with decentralized finance (DeFi) protocols, and remain relevant in a rapidly evolving financial landscape. Staying isolated on private blockchains risks obsolescence as the industry moves toward open systems.

How do financial institutions integrate compliance within open blockchain systems?

Financial institutions can integrate compliance within open blockchain systems using advanced technologies like zero-knowledge proofs, which allow them to conduct necessary verification processes without exposing sensitive transaction details. This approach ensures adherence to regulatory standards while participating within a public, composable financial ecosystem.

What challenges do banks face in upgrading their blockchain infrastructure?

Banks face several challenges in upgrading their blockchain infrastructure, including the need to adopt new security standards, navigate regulatory compliance, and overcome internal resistance to change. Failure to adapt may result in losing market relevance and missing out on the advantages offered by modern blockchain technologies.

How does the evolution of blockchain impact capital markets and traditional financial systems?

The evolution of blockchain is reshaping capital markets by enabling quicker, more efficient transactions through public infrastructures. Traditional financial systems that cling to outdated methods risk being left behind as the emphasis shifts toward open, transparent networks that facilitate faster settlements and innovative financial products.

What future trends can we expect in blockchain infrastructure for financial services?

Future trends in blockchain infrastructure for financial services will likely include wider adoption of public blockchain technologies, increased utilization of layer 2 solutions for scalability, and the growing implementation of zero-knowledge proofs to ensure privacy and compliance. This evolution will transform how financial institutions operate in a collaborative financial ecosystem.

| Key Point | Description |

|---|---|

| Need for Upgrade | Banks must transition from private blockchains to public layer-2 infrastructures to stay competitive. |

| Current Challenges | Reliance on private distributed ledger systems limits banks’ participation in tokenized assets and stablecoin transactions. |

| Geopolitical Context | At present, financial institutions must evolve from legacy systems to meet new privacy and interoperability standards. |

| Public vs. Private Chains | The volatility of public chains is often overstated, as remaining isolated can hinder banks’ adaptability. |

| Interoperability | There is a growing preference for connections over control, emphasizing low-cost, high-speed transfers. |

| Liquidity Considerations | Banks should tap into public liquidity sources to avoid strategic failures. |

| Future of Financial Services | Transitioning to empowered layer-2 solutions is vital for gaining liquidity and streamlining operations. |

| Security and Compliance | New security standards and compliance measures must be adopted during the transition. |

| Conclusion | Embracing open, scalable systems allows privacy and compliance to coexist, unlike outdated models. |

Summary

Blockchain infrastructure is crucial for modern banking, as it represents not only a technological upgrade but also a strategic alignment with contemporary financial needs. With the rapid shift towards decentralized finance (DeFi) and tokenized assets, banks must move away from outdated private blockchain systems. Embracing public, permissioned layer-2 infrastructures that leverage zero-knowledge proofs will enhance interoperability and scalability, allowing banks to stay relevant in the evolving financial landscape.