Block layoffs have taken center stage as Jack Dorsey’s payments company, Block Inc., prepares for a significant restructuring that may see up to 10% of its workforce impacted. As part of its annual performance reviews, the company is informing employees of potential job eliminations, a move aimed at improving operational efficiency and aligning its Cash App and Square services more cohesively. This strategic overhaul comes on the heels of strong financial performance projected for Q4, with Block expected to report a profit of $403 million and revenue of $6.25 billion. Amidst these layoffs, Block continues to innovate, particularly in its Bitcoin revenue stream and other emerging technologies. As the company navigates these changes, updates concerning Block company news are eagerly awaited by analysts and investors alike.

In the face of challenging market conditions, Block Inc. is implementing measures that may involve significant workforce reductions, often referred to as corporate downsizing. This process is a part of a broader corporate restructuring strategy led by CEO Jack Dorsey, focusing on aligning the company’s diverse operations, notably its popular Cash App with the Square merchant services. The impending layoffs reflect the ongoing changes within the organization as it seeks to adapt to market dynamics while also expanding its profit avenues, particularly in sectors like Bitcoin and innovative payment solutions. As Block prepares to announce its quarterly earnings, the financial community is closely monitoring developments, as these staffing changes could have wide-reaching implications for the company’s future performance.

| Key Points |

|---|

| Block Inc. plans to cut up to 10% of its workforce as part of a broader restructuring effort. |

| The restructuring aims to enhance efficiency and integrate Cash App with Square’s services. |

| Block is expanding initiatives in Bitcoin mining and AI, indicating a push for innovation. |

| Expected quarterly earnings for Q4 are around $403 million on $6.25 billion in revenue. |

| Block’s recent performance showed a decline in Bitcoin revenue but an overall profit increase in traditional services. |

Summary

Block layoffs are part of a strategic overhaul intended to enhance operational efficiency and align the company’s services. As Block Inc. aims to strengthen its market position and innovate in areas like Bitcoin and artificial intelligence, the decision to cut staff reflects a significant pivot in its business strategy. With a promising forecast for upcoming quarterly profits and a focus on integrating payment solutions, Block is taking bold steps to secure its future in a competitive landscape.

Understanding Block’s Layoff Strategy under Jack Dorsey

Block, founded by Jack Dorsey, is undergoing significant changes as the company gears up to inform employees about possible layoffs. As part of a strategic overhaul, their restructuring plan could impact up to 10% of the workforce, emphasizing a shift towards enhancing operational efficiency. This is not just a reaction to immediate financial pressures, but a systematic approach to align the company’s various services, particularly its Cash App and Square platforms.

The decision to initiate layoffs comes amid reports indicating robust gross profit growth, highlighting that while the company is performing well financially, it still seeks to streamline processes to better serve its users. As Block targets a closer integration of its payment offerings, layoffs may be seen as a necessary step in eliminating redundancies that inhibit innovation and agility in a rapidly evolving financial sector.

Block Inc’s Restructuring Efforts and Future Growth

Block Inc’s restructuring not only aims to cut costs but also seeks to reposition the company for future growth. Analysts are optimistic about the upcoming quarterly earnings, predicting a profit significantly bolstered by successful initiatives, including Cash App’s performance. The goal is to create a seamless ecosystem where customers can easily transition between different payment methodologies, whether it be traditional fiat or cryptocurrency, reflecting the contemporary needs of a diversified user base.

Moreover, the integration of newer initiatives such as Bitcoin mining through Proto and the AI project Goose suggests a forward-thinking approach at Block. Emphasizing growth in these sectors could mitigate the effects of any layoffs and position the company as a leader in both the fintech and cryptocurrency landscapes. Thus, while the layoffs indicate an immediate contraction, they also hint at preparations for a robust expansion into newer, high-potential areas.

The Financial Implications of Block’s Business Overhaul

The potential layoffs at Block, along with restructuring efforts, are crucial as the company prepares to reveal its quarterly earnings. Analysts predict a solid revenue of approximately $6.25 billion, with profits reaching around $403 million, reflecting Block’s resilience despite operational changes. The adaptation to evolving market trends, which includes diversifying revenue streams beyond just peer-to-peer payments, underscores the company’s long-term strategy for financial stability.

This financial overview is significant, particularly as Bitcoin still constitutes a substantial portion of Block’s revenue. Despite a year-on-year decrease, the performance of Bitcoin as a revenue stream emphasizes an ongoing commitment to cryptocurrency solutions, which are becoming increasingly vital to their business model. The anticipated success in leveraging Bitcoin revenue, coupled with a streamlined workforce, could ultimately enhance Block’s market presence and investor confidence.

Exploring Cash App’s Role in Block’s Evolution

Cash App has become a pivotal element in Block’s overall strategy and its operations. As the platform continues to grow, providing essential payment solutions to millions, it stands as a driving force behind the company’s expansion plans. The expected growth of Cash App, projected to contribute to a favorable revenue trajectory, highlights the significance of the platform in terms of user engagement and profitability for Block Inc.

The integration of Cash App with Block’s other services aligns with the broader fintech trend aimed at offering holistic financial solutions. Enhancing Cash App’s capabilities—and potentially reducing operational redundancies through workforce adjustments—could amplify user experience and customer satisfaction. This focus on Cash App not only supports Block’s restructuring efforts but also demonstrates the company’s ambition in fostering innovative financial ecosystems that cater to diverse user needs.

Navigating the Market Reaction to Block’s Announcements

The market’s reaction to Block’s recent announcements, including news of potential layoffs and restructuring, reflects a complex interplay of investor sentiment and company performance. Even with a notable jump in Block’s share prices—nearly 5%—concerns linger regarding the implications of the layoffs and their potential impact on overall company morale and productivity. Investors often scrutinize these developments, weighing them against the backdrop of past performance metrics and future growth prospects.

In a landscape defined by volatility, investor confidence can be easily swayed by such corporate restructurings. Yet, Block’s projected earnings showcase a compelling narrative of resilience and adaptability. By focusing on merging its various services and emphasizing innovation, the company seeks to reassure investors that these layoffs are not a sign of weakness, but rather a strategic maneuver to thrive amidst changing economic conditions. This nuanced outlook will play a critical role as Block prepares for its next quarter.

Impacts of Bitcoin Revenue on Block’s Financial Strategy

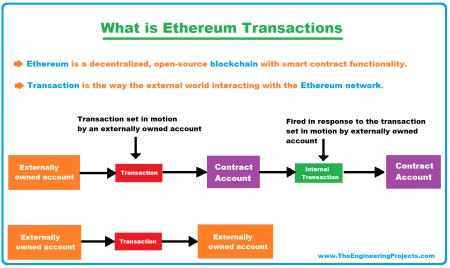

Bitcoin revenue has emerged as a crucial component of Block’s financial framework, representing a significant income source even amidst fluctuations in the cryptocurrency market. The recent financial reports indicating a drop in Bitcoin revenue from previous years underscore the necessity for Block to adapt its strategies. The fact remains that Bitcoin-related services continue to be a strong draw for users, presenting opportunities for both expansion and diversification within their product offerings.

Looking ahead, Block’s approach to incorporating Bitcoin into its business model reflects a commitment to remaining at the forefront of the cryptocurrency revolution. With the rollout of features allowing merchants to accept Bitcoin payments directly through Square, Block not only enhances its service portfolio but also positions itself to capitalize on the growing adoption of cryptocurrency among consumers. As Block navigates the implications of Bitcoin revenue fluctuations, the integration of these features will likely be central to its strategy moving forward.

Block’s Vision for Innovation in Financial Services

Innovation is at the heart of Block’s mission, with initiatives like Goose, the artificial intelligence project, aiming to revolutionize how financial services are delivered. By leveraging AI, Block can enhance its data analysis capabilities, personalize user experiences, and optimize service delivery like never before. As they look to reshape the customer interaction model, Block recognizes that innovation must be continuous to stay relevant and competitive in the ever-evolving tech landscape.

Furthermore, the embrace of emerging technologies is essential as Block seeks to attract a broader audience. Coupled with its Bitcoin mining initiatives, the focus on creating an innovative ecosystem can help Block build a resilient platform that can withstand market pressures while delivering value to its clients. This commitment to innovation, alongside necessary restructuring, sets a positive tone for Block’s future, aligning with user expectations and market demands.

Anticipating the Future: Insights on Block’s Strategic Directions

As Block navigates its current restructuring phase, all eyes are on the company’s strategic directions and how well it adapts to market changes. With Jack Dorsey leading the company, there’s an ever-present emphasis on creating sustainable growth through innovation and adaptation. The anticipated synergy between Cash App and Square is expected to enhance service offerings, paving the way for increased user engagement and, ultimately, profitability.

Future insights indicate that by addressing inefficiencies and focusing on emerging technologies, Block can solidify its standing in the crowded fintech arena. The need for operational excellence will drive the company’s perpetual evolution, encouraging further investment not only in cryptocurrency solutions but also in overall user experience enhancements. As Block continues to unveil its strategic plans in the coming quarters, the industry will watch closely to gauge its success in reshaping its business model.

The Competitive Landscape: How Block Inc Stands Out

In the competitive fintech landscape, Block Inc’s ability to adapt and innovate contributes significantly to its differentiation from other players in the market. As the company works on integrating its services, such as Cash App and traditional payment solutions, it sets itself apart by offering a seamless customer experience. While many competitors are focused solely on transaction processing, Block embodies a holistic approach that incorporates cryptocurrency and AI-driven services.

This multi-faceted strategy is anticipated to allow Block not only to thrive during traditional financial contingencies but also to harness the potential of emerging digital currencies. By fostering an environment of innovation and customer-centric solutions, Block is well-positioned to maintain a competitive edge, even amid industry disruptions. As the company prepares to release its next financial results, stakeholders will be keen to see how these competitive advantages are reflected in its bottom line.

Frequently Asked Questions

What are the reasons behind Jack Dorsey’s Block layoffs in 2024?

The Jack Dorsey-led Block Inc. is reportedly implementing layoffs due to a broader restructuring effort aimed at enhancing operational efficiency and aligning its product lines, specifically integrating Cash App with Square’s merchant services.

How many employees are expected to be affected by the Block Inc layoffs?

According to reports, Block Inc. may cut as much as 10% of its workforce during its annual performance reviews as part of the company’s business overhaul.

What is the impact of Block’s restructuring on Cash App performance?

Block’s restructuring is expected to improve Cash App performance by better aligning it with Square’s services, potentially boosting overall efficiency and user experience within the payment ecosystem.

How is Bitcoin revenue affecting Block’s financial performance amidst layoffs?

Despite the layoffs, Bitcoin revenue remains a significant contributor to Block’s financial performance, generating around $1.97 billion in Q3, making it the company’s second-largest revenue stream.

When is Block Inc. expected to announce its quarterly earnings amid the layoffs?

Block Inc. is scheduled to release its quarterly earnings on February 26, 2024, which will provide insights into the impact of the recent layoffs and restructuring on the company’s financial health.

What initiatives is Block pursuing alongside the layoffs?

In addition to the layoffs, Block is expanding initiatives such as its Bitcoin mining division and an AI project called Goose, indicating a strategic pivot towards growth areas.

How did Block’s stock perform following the announcement of potential layoffs?

Following the announcement of potential layoffs, Block’s shares increased nearly 5%, reflecting some investor optimism despite the restructuring efforts.

What are the potential benefits of Block’s restructuring for its services?

The restructuring may lead to more streamlined services between Cash App and Square, enhancing user experience and operational efficiency while potentially increasing customer engagement.

What performance metrics did Block miss during the third quarter that raised concerns?

In its third quarter report, Block’s performance metrics included a net income of $461.5 million and $6.11 billion in revenue, but some earnings and growth expectations did not meet Wall Street estimates, prompting concerns.

How does the integration of Bitcoin payments with Square affect Block’s business strategy?

The integration of Bitcoin payments through Square’s services allows merchants to accept BTC directly at checkout, which supports Block’s strategy of expanding its cryptocurrency offerings and enhancing user options.