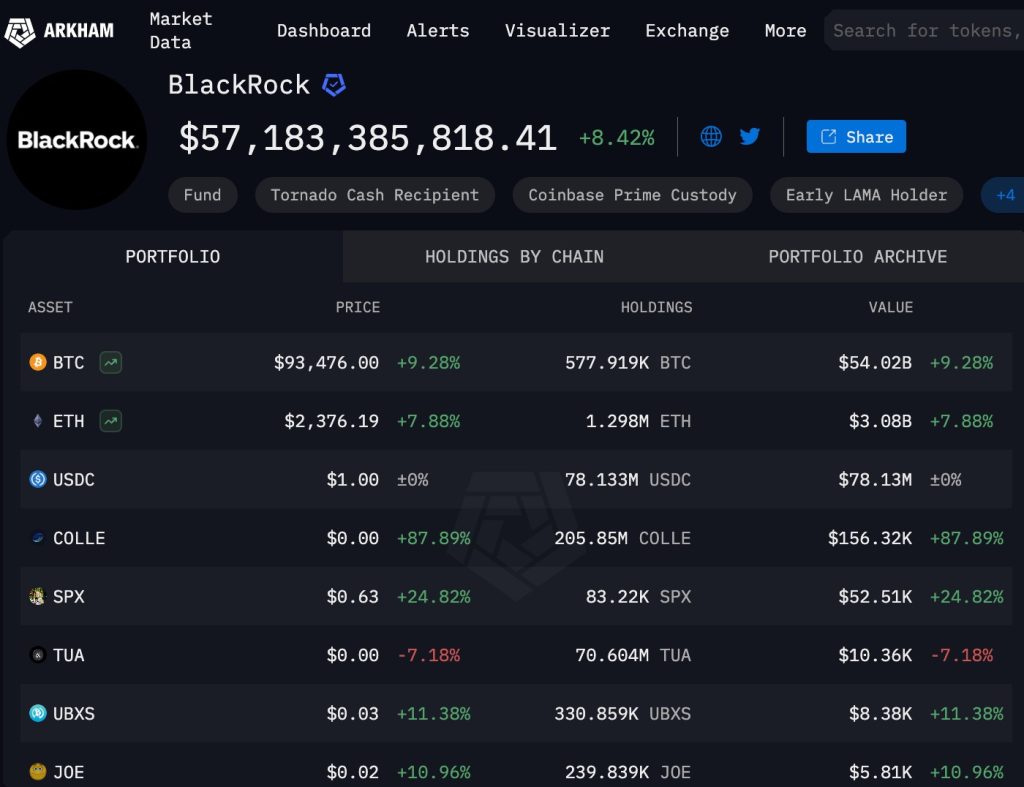

BlackRock cryptocurrency investment has recently taken a significant leap with a substantial deposit into Coinbase Prime. By investing 2,201 BTC, which is valued at an impressive $192 million, alongside 7,557 ETH worth approximately $22.12 million, BlackRock demonstrates its bullish stance on digital assets. This bold move aligns with their broader Bitcoin investment strategy, emphasizing the increasing importance of cryptocurrency in traditional financial portfolios. With growing interest in Ethereum investments and diversified crypto holdings, BlackRock is setting a precedent for institutional engagement in the digital currency market. The implications of this investment could resonate throughout the industry, influencing both retail and institutional investors regarding their cryptocurrency allocations.

The recent activity from BlackRock, a titan of asset management, highlights the company’s commitment to diversifying its investment offerings with significant digital currency purchases. Their strategic allocation includes a notable deposit of Bitcoin and Ethereum, marking a pivotal moment in the integration of cryptocurrency within established financial frameworks. Such initiatives not only reflect a forward-thinking approach to investment but also signal a growing acceptance of digital currencies like Bitcoin and Ethereum among institutional investors. As firms increasingly explore platforms like Coinbase Prime for their crypto transactions, the evolution of traditional investment strategies takes shape. This shift points toward a future where cryptocurrency holds a central role in wealth management, shaping how investors build and manage their portfolios.

BlackRock’s Strategic Cryptocurrency Investments

In a bold move signaling institutional confidence in the cryptocurrency market, BlackRock has deposited a significant amount of Bitcoin and Ethereum into Coinbase Prime. Specifically, the asset management giant has injected 2,201 BTC, valued at around $192 million, alongside 7,557 ETH, which amounts to approximately $22.12 million. This strategic allocation highlights BlackRock’s commitment to diversifying its investment portfolio and exploring new avenues for growth, particularly in the rapidly evolving digital currency landscape.

The contributions made by BlackRock represent a noteworthy trend among institutional investors who are increasingly recognizing the potential of cryptocurrencies as a viable asset class. By engaging in this Bitcoin investment strategy, BlackRock not only aims to enhance returns but also to hedge against inflation and currency fluctuations. The utilization of Coinbase Prime, known for its robust trading tools and custodial services, indicates that BlackRock is taking a cautious yet optimistic approach to digital asset management.

Understanding BlackRock’s Role in Bitcoin and Ethereum Investments

BlackRock’s entry into the cryptocurrency sector, particularly with its significant Bitcoin and Ethereum investments, reflects a larger movement towards the acceptance of digital currencies in traditional financial markets. The investment giant’s deposits into Coinbase Prime serve not just as a financial strategy but also as a statement of confidence in the long-term sustainability of blockchain technologies. With Bitcoin and Ethereum being the leading cryptocurrencies by market capitalization, their growth trajectories are closely monitored by investors worldwide.

Moreover, BlackRock’s activities may serve to encourage other institutional investors to consider similar strategies. As the cryptocurrency environment becomes increasingly regulated and mainstream, companies are finding new ways to leverage digital assets for profit. This shift is critical as investors start to explore options beyond traditional stocks and bonds, with a clear focus on the potential benefits of a balanced portfolio that includes cryptocurrencies. BlackRock’s recent moves will likely impact future investment strategies and could pave the way for increased Bitcoin and Ethereum deposits among major financial players.

Why Institutional Investment is Key for Crypto Growth

Institutional investment is a crucial driver of growth in the cryptocurrency market, and BlackRock’s involvement exemplifies this trend. As traditional financial entities begin to allocate resources to digital assets, the perception of cryptocurrencies as risky or speculative investments is shifting. When a reputable firm like BlackRock deposits substantial amounts of Bitcoin and Ethereum into Coinbase Prime, it sends a powerful message to the market: digital currencies are becoming integral to financial portfolios.

This institutional interest not only boosts confidence among retail investors but also enhances market stability. The influx of funds from established entities may lead to increased demand for Bitcoin and Ethereum, driving their prices higher and further legitimizing their use as viable investment options. In this evolving landscape, BlackRock’s global reach and expertise could play a pivotal role in shaping the future of cryptocurrency investments, ultimately encouraging more organizations to explore comprehensive Bitcoin investment strategies.

Exploring BlackRock’s Bitcoin Investment Strategy

BlackRock’s Bitcoin investment strategy illustrates a thoughtful approach to entering the cryptocurrency market. By allocating a portion of its assets to Bitcoin through Coinbase Prime, BlackRock is positioning itself to benefit from potential price appreciation while managing risk through diversification. This calculated entry is indicative of how traditional financial giants assess and react to the changing dynamics of investment opportunities.

Furthermore, BlackRock’s strategic focus on Bitcoin aligns with the growing trend of major institutional players turning towards cryptocurrencies. As they navigate the complexities of the market, understanding the nuances of digital assets like Bitcoin becomes paramount. BlackRock’s investments serve as a case study in crafting a comprehensive cryptocurrency strategy, highlighting the importance of robust security measures, regulatory compliance, and ongoing market analysis to maximize returns in this volatile landscape.

Ethereum Investments: BlackRock’s Perspective

In addition to its Bitcoin holdings, BlackRock’s deposit of Ethereum reflects an expanding interest in the potential applications of blockchain technology. Ethereum’s smart contract capabilities have made it a popular choice among developers and enterprises looking to innovate. By investing in ETH, BlackRock acknowledges the platform’s potential to disrupt numerous industries and enhance operational efficiencies.

Moreover, investing in Ethereum aligns with BlackRock’s vision of adding value through diversified investments. As various sectors explore the utility of Ethereum’s blockchain, the growth of decentralized finance (DeFi) and non-fungible tokens (NFTs) could provide robust opportunities for returns. BlackRock’s Ethereum investments highlight its forward-thinking approach, positioning itself as a key player in the evolving landscape of digital finance.

Coinbase Prime: Facilitating BlackRock’s Cryptocurrency Deposits

The choice of Coinbase Prime as the custodian for BlackRock’s cryptocurrency holdings underscores the platform’s reputation for security and reliability in the digital asset space. Coinbase Prime is tailored for institutional investors, offering advanced trading solutions and custodial services that meet the compliance and security requirements of major financial institutions. This partnership enables BlackRock to manage its cryptocurrency assets effectively while leveraging Coinbase’s expertise in the sector.

Furthermore, with the rapid growth of cryptocurrency trading volumes on exchanges like Coinbase Prime, BlackRock’s decision to deposit Bitcoin and Ethereum there speaks volumes about its confidence in the platform. The relationship between traditional asset management firms and cryptocurrency exchanges is vital in bridging the gap between conventional finance and the digital currency ecosystem. As BlackRock engages more deeply with Coinbase, this collaboration may lead to further innovations in how cryptocurrencies are traded and held by institutional investors.

Risk Mitigation in BlackRock’s Cryptocurrency Strategy

As BlackRock dives into the world of cryptocurrencies, a fundamental component of its strategy involves robust risk mitigation measures. The inherent volatility in the cryptocurrency market necessitates a careful evaluation of investment decisions, particularly for large-scale institutional players. Leveraging methods such as diversification across different digital assets, including Bitcoin and Ethereum, BlackRock aims to balance potential gains with associated risks.

Moreover, the company likely employs advanced analytics and monitoring tools to keep its digital assets secure and compliant with regulatory standards. This emphasis on risk management not only safeguards their investments but also fosters greater confidence among stakeholders. As the cryptocurrency landscape continues to evolve, it will be essential for firms like BlackRock to adapt their strategies to efficiently address potential risks while capitalizing on investment opportunities.

The Future of Cryptocurrency Investments with BlackRock

Looking ahead, BlackRock’s involvement in cryptocurrency investments is poised to influence the future of digital finance significantly. As more institutional players enter the market, there will likely be increased scrutiny and demand for innovative investment strategies surrounding Bitcoin and Ethereum. BlackRock’s early adoption could position it as a leader, setting trends and best practices for managing digital assets.

The company’s ongoing research and exploration into the potential of cryptocurrencies may also lead to the development of new financial products, allowing everyday investors to gain exposure to these assets. By paving the way for more transparency and institutional-grade services, BlackRock could help democratize access to cryptocurrency investments, shaping the market for years to come. The future appears promising as the lines between traditional finance and cryptocurrency continue to blur.

Investing in Digital Assets: Insights from BlackRock’s Moves

BlackRock’s strategic moves in the cryptocurrency sector provide valuable insights for investors looking to explore digital assets. The significant deposits of Bitcoin and Ethereum indicate a broader trend of institutional acceptance and interest in cryptocurrencies as a legitimate asset class. This shift not only enhances market legitimacy but also encourages a more diversified approach to investing.

Investors can learn from BlackRock’s cautious yet bold approach to cryptocurrency investment. By clearly defining investment parameters and focusing on risk management, BlackRock sets an example for other firms entering the digital asset space. As the landscape of investment continues to evolve, understanding how institutions navigate these changes will be key for both retail and institutional investors alike.

Frequently Asked Questions

What is BlackRock’s cryptocurrency investment strategy?

BlackRock’s cryptocurrency investment strategy involves leveraging institutional-grade platforms like Coinbase Prime to invest in Bitcoin and Ethereum. Recently, BlackRock made headlines by depositing 2,201 BTC and 7,557 ETH into Coinbase Prime, showcasing their commitment to digital assets.

How much Bitcoin and Ethereum has BlackRock invested?

BlackRock has invested significantly in cryptocurrencies, recently depositing 2,201 BTC valued at $192 million and 7,557 ETH worth $22.12 million into Coinbase Prime.

What does BlackRock’s investment in Coinbase Prime mean for the cryptocurrency market?

BlackRock’s investment in Coinbase Prime signals growing institutional interest in cryptocurrency investment, particularly in Bitcoin and Ethereum. This move may contribute to increased market confidence and further validation of the cryptocurrency sector.

Why is BlackRock investing in Bitcoin?

BlackRock is investing in Bitcoin as part of a broader cryptocurrency investment strategy, aiming to provide clients with diversified investment options. With a significant deposit of 2,201 BTC, they demonstrate their belief in Bitcoin’s long-term potential.

Are BlackRock’s Ethereum investments significant?

Yes, BlackRock’s Ethereum investments are significant. They recently deposited 7,557 ETH into Coinbase Prime, indicating their recognition of Ethereum’s value and its role in the growing blockchain ecosystem.

What role does Coinbase Prime play in BlackRock’s cryptocurrency investments?

Coinbase Prime serves as a secure custody solution for BlackRock’s cryptocurrency investments, allowing them to manage their Bitcoin and Ethereum assets effectively. This platform is designed for institutional investors, enhancing the safety of BlackRock’s digital asset portfolio.

How can investors benefit from BlackRock’s cryptocurrency investment insights?

Investors can benefit from BlackRock’s insights on cryptocurrency investment by observing their strategies and market movements. As a leading asset manager, BlackRock’s foray into Bitcoin and Ethereum may provide valuable signals about the future direction of cryptocurrency markets.

What are the potential risks of BlackRock’s cryptocurrency investments?

While BlackRock’s cryptocurrency investments in Bitcoin and Ethereum bring opportunities, there are inherent risks including market volatility, regulatory changes, and liquidity challenges that could impact their strategies and investor returns.

| Asset Type | Amount | Value (USD) |

|---|---|---|

| Bitcoin (BTC) | 2,201 | $192 million |

| Ethereum (ETH) | 7,557 | $22.12 million |

Summary

BlackRock cryptocurrency investment has taken a significant step with the recent deposit of 2,201 BTC and 7,557 ETH into Coinbase Prime. This action, valued at approximately $192 million and $22.12 million respectively, demonstrates BlackRock’s commitment to investing in digital assets. By engaging with major cryptocurrency exchanges, the firm is positioning itself at the forefront of a rapidly evolving financial landscape. As institutional interest in cryptocurrencies continues to grow, investments like these are likely to pave the way for broader acceptance and integration of digital currencies within traditional financial markets.