In a significant development in the finance sector, BlackRock cryptocurrency deposits have made waves by transferring 3,948 BTC and 5,734 ETH into Coinbase, totaling a staggering $272 million. This bold move is gaining attention amidst the latest BlackRock Bitcoin news, as investors seek insights into the potential impact on the Bitcoin market analysis. With BlackRock’s entrance, the landscape for Ethereum deposits becomes particularly intriguing, suggesting a shift in institutional investment strategies. As the firm navigates the complex waters of crypto investment insights, many are watching closely for the implications this could have on Coinbase crypto transactions and the broader market. These deposits not only signify BlackRock’s commitment to digital assets but also spark curiosity about the future of cryptocurrencies in traditional finance.

The recent activity surrounding BlackRock’s foray into digital currencies marks a pivotal moment in the integration of traditional finance with blockchain technology. By facilitating substantial transactions in both Bitcoin and Ethereum, BlackRock has positioned itself at the forefront of institutional cryptocurrency investment. This strategic partnership with platforms such as Coinbase not only highlights the growing acceptance of cryptocurrencies but also indicates a shift in market sentiment among major financial players. As the industry evolves, the prominence of Bitcoin and Ethereum continues to rise, particularly in the context of investment strategies devised by asset management giants. Enthusiasts and analysts alike are eager to dissect the broader implications of these high-stakes cryptocurrency maneuvers.

| Key Point | Details |

|---|---|

| Total Deposits | 3,948 BTC and 5,734 ETH totaling $272 million |

| BTC Value | $261 million |

| ETH Value | $11.04 million |

| Date of Deposit | February 6, 2026 |

| Monitoring Source | Onchain Lens |

| Future Deposits | Possibility of more assets being deposited |

Summary

BlackRock cryptocurrency deposits have been marked by a significant transaction involving 3,948 BTC and 5,734 ETH into Coinbase, amounting to a total of $272 million. This move highlights BlackRock’s increasing engagement in the cryptocurrency market, potentially influencing future trends in institutional investment. The detailed breakdown of the asset values indicates robust interest and strategic positioning by BlackRock in digital assets.

BlackRock Cryptocurrency Deposits: A New Era of Digital Finance

In a significant move towards embracing digital assets, BlackRock has reportedly deposited 3,948 BTC and 5,734 ETH into Coinbase, accumulating a total value of approximately $272 million. This deposit has garnered attention not only due to the sheer volume of assets but also because it marks a pivotal point in the institutional adoption of cryptocurrencies. As one of the world’s largest asset managers, BlackRock’s engagement with the cryptocurrency market signals a shift that could strongly influence Bitcoin price movements and reshape the overall landscape of crypto investment.

This development comes at a time when Bitcoin is experiencing volatile market conditions, sparking discussions around targeted investments and strategic asset allocation. By opting for Coinbase, BlackRock seems to be leveraging the platform’s robust trading infrastructure, enhancing crypto transaction efficiencies, and potentially tapping into the growing retail investor base. Such large-scale deposits could activate increased trading volume on exchanges, leading to enhanced liquidity and price stability in the cryptocurrency market.

Understanding BlackRock’s Strategy in Bitcoin Market Analysis

The recent deposit action by BlackRock has sparked interest among investors and analysts who are keen on understanding the company’s strategies within the crypto space. BlackRock’s foray into Bitcoin certainly suggests a calculated approach towards asset diversification. As institutional players analyze Bitcoin market trends, it becomes essential to note how such big players enter and withdraw from the market, impacting the supply-demand dynamics. This strategic investment could be interpreted as a bullish signal amid evolving market conditions.

Furthermore, market analysts are closely monitoring how this investment could influence Bitcoin’s market cap. With BlackRock’s considerable assets and expertise in financial markets, many expect their Bitcoin investment to facilitate more substantial analytical insights. Such actions not only help in demystifying the crypto investment space but also provide essential benchmarks for other institutional investors contemplating entry into the digital assets market.

Ethereum Deposits by BlackRock: A Closer Look

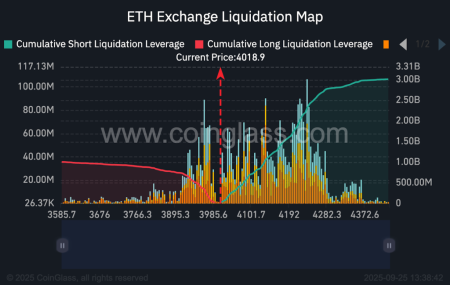

In addition to its significant Bitcoin investment, BlackRock’s deposit of 5,734 ETH projects its confidence in Ethereum as a powerful player in the decentralized finance (DeFi) ecosystem. As institutional interest in Ethereum grows, driven by the platform’s continuous upgrades and expanding use cases, BlackRock’s involvement could indicate a bullish trend for ETH prices. The diversity in BlackRock’s crypto asset portfolio could prove advantageous, as investors are increasingly seeking stable return options that include alternative assets.

With Ethereum poised for continued innovation through its smart contracts and decentralized applications, BlackRock is likely positioning itself to harness strategic advantages amid the ongoing market evolution. As the cryptocurrency landscape matures, understanding Ethereum’s price movements alongside Bitcoin is vital for making informed investment decisions.

Coinbase Crypto Transactions: Validating Institutional Adoption

BlackRock’s choice of Coinbase for executing its crypto transactions speaks volumes about the platform’s reputation within the financial community. As one of the leading cryptocurrency exchanges, Coinbase offers a secure and compliant environment for institutional investors. This strategic partnership allows BlackRock to enjoy direct access to the crypto market while benefiting from Coinbase’s advanced trading tools and deep liquidity.

Moreover, the choice of a well-established exchange like Coinbase not only minimizes risks associated with crypto transactions but also marks a deeper acceptance and validation of cryptocurrencies by traditional financial institutions. For investors, this opens the gateway to consider more complex investment strategies involving crypto assets as a means to balance their portfolios against traditional market risks.

The Potential Impact of BlackRock Bitcoin News on the Market

As news of BlackRock’s substantial deposits into cryptocurrency platforms circulates, observers anticipate potential ripple effects throughout the market. When industry giants like BlackRock engage in the Bitcoin ecosystem, it can influence trader sentiment dramatically. Market participants often react to news of significant institutional involvement by adjusting their strategies, which can lead to price fluctuations and increased volatility.

In essence, the broader market’s response to BlackRock Bitcoin news not only reflects immediate changes but also sets a precedent for future institutional investments. As cryptocurrency projects continue to evolve, sentiments reinforced by major players can serve as an indicator of growing acceptance, encouraging further investment inflows from both retail and institutional investors.

Insights on Crypto Investment: Analyzing BlackRock’s Moves

Analyzing BlackRock’s entry into the cryptocurrency market provides vital insights into the strategic thinking of institutional investors regarding diversification. Their substantial holdings in Bitcoin and Ethereum underline the importance of these digital assets within a diversified investment strategy. Through these investments, BlackRock signals to its clients and the market that cryptocurrencies are becoming a legitimate asset class worth considering.

Understanding BlackRock’s investment rationale in relation to overall market trends can yield valuable crypto investment insights. As the firm continues to navigate the complexities of the crypto market, it will likely explore additional investment opportunities within decentralized finance and related blockchain innovations, shaping the future landscape of digital asset management.

The Future of Cryptocurrency with Institutional Players like BlackRock

The growing presence of institutional players such as BlackRock in the cryptocurrency market heralds a transformative future for digital assets. As traditional finance meets the rapidly evolving crypto space, the integration of institutional capital can lead to greater legitimacy and stability in the markets. This paradigm shift not only creates opportunities for investors but also lays the groundwork for more advanced financial products and services surrounding cryptocurrencies.

Looking ahead, it is imperative to observe how BlackRock and similar firms innovate in catering to growing client demand for alternative investments. The influence of these institutional entrants will define the regulatory landscape as well, potentially leading to clearer frameworks for cryptocurrency trading and investment in the future.

The Role of Market Analysts in Monitoring BlackRock’s Crypto Investments

Market analysts play a crucial role in assessing the implications of BlackRock’s cryptocurrency investments. With their ability to analyze vast data sets and identify emerging trends, analysts can help investors gauge the potential risks and rewards associated with such institutional movements. Their insights into BlackRock’s strategies are invaluable, especially as they track developments within the Bitcoin and Ethereum markets.

Furthermore, analysts provide a crucial feedback loop, influencing how other institutions might approach cryptocurrency investments as they observe the reactions instigated by BlackRock’s transactions. By opening the floor for dialogue among market participants, analysts help create a more robust understanding of the digital asset landscape.

Risk Management Strategies for Institutional Investors in Crypto

As institutional investors like BlackRock begin to dip their toes into the cryptocurrency arena, the need for astute risk management strategies becomes increasingly paramount. The volatile nature of digital assets necessitates a comprehensive understanding of market dynamics, asset volatility, and regulatory landscapes. By employing sophisticated risk analytics and portfolio management techniques, BlackRock can better protect its investments against the inherent risks associated with cryptocurrency fluctuations.

Additionally, diversifying across different crypto assets and employing strategic hedging techniques could serve as effective mitigation strategies for risks tied to investments in Bitcoin and Ethereum. This proactive stance on risk management will enable BlackRock to capitalize on the opportunities presented by the crypto market while minimizing potential downsides.

Frequently Asked Questions

What recent BlackRock cryptocurrency deposits have been reported?

Recently, BlackRock has made significant cryptocurrency deposits, including 3,948 BTC valued at approximately $261 million and 5,734 ETH worth around $11.04 million into Coinbase. These movements reflect BlackRock’s continued interest in the crypto market.

How do BlackRock’s cryptocurrency deposits impact Bitcoin market analysis?

BlackRock’s recent deposits of 3,948 BTC into Coinbase can influence Bitcoin market analysis by potentially increasing demand and market liquidity. Such large transactions often signal institutional confidence, which could sway trader sentiment and market dynamics.

What role does Coinbase play in BlackRock’s crypto investment strategy?

Coinbase serves as a key platform for BlackRock’s cryptocurrency transactions. By depositing 3,948 BTC and 5,734 ETH into Coinbase, BlackRock leverages the exchange’s infrastructure for security and access to the crypto market, enhancing its investment strategy.

Are there any insights into Ethereum deposits by BlackRock?

Yes, BlackRock has also deposited 5,734 ETH into Coinbase, reflecting its strategy to diversify investments in digital assets. This move highlights BlackRock’s interest in Ethereum as part of its broader cryptocurrency investment portfolio.

What can investors learn from BlackRock’s crypto investment insights?

BlackRock’s recent deposits of nearly $272 million in cryptocurrencies offer important insights for investors: institutional investments may drive market confidence, and monitoring such activity can provide clues about emerging trends in Bitcoin and Ethereum markets.

How often does BlackRock make cryptocurrency transactions?

While specific transaction frequency can vary, BlackRock’s deposit of 3,948 BTC and 5,734 ETH into Coinbase indicates that the firm is actively exploring cryptocurrency investments, suggesting potential for ongoing activity in the market.

What does the BlackRock Bitcoin news mean for the future of cryptocurrency?

The recent development that BlackRock deposited large amounts of Bitcoin indicates a sustained interest in digital assets, which may encourage other institutional investors to follow suit and potentially lead to increased mainstream adoption of cryptocurrency.