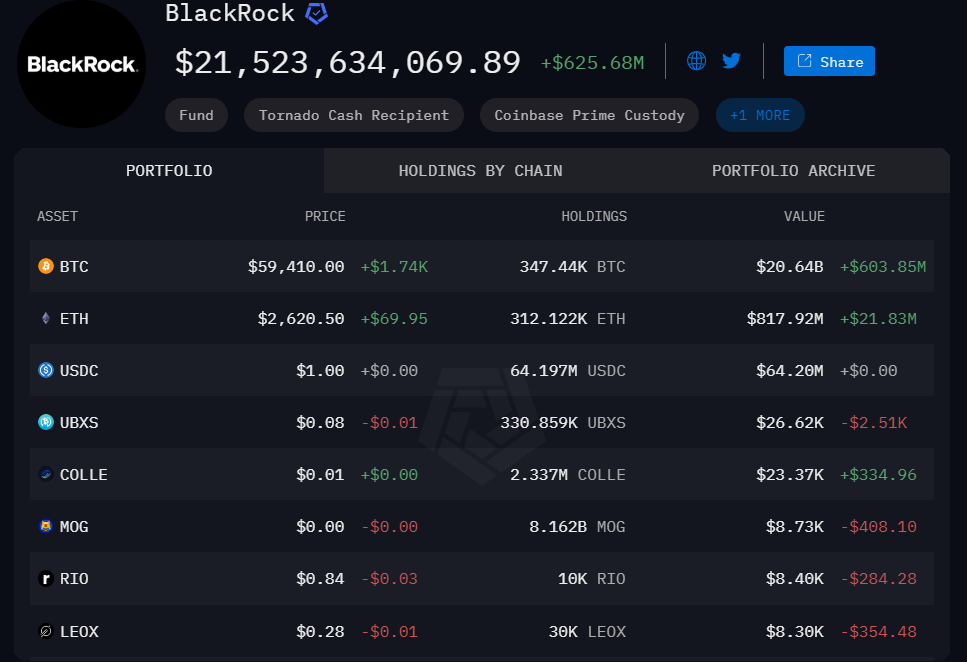

In a noteworthy development within the cryptocurrency landscape, BlackRock cryptocurrency deposits have made headlines recently with a staggering investment of $195 million in Bitcoin (BTC) and $71.43 million in Ethereum (ETH) through Coinbase. This bold maneuver signals a significant shift towards institutional investment in crypto, reflecting the growing confidence in digital assets among major financial players. As BlackRock continues to engage with cryptocurrency market trends, their actions could pave the way for wider adoption and innovative investment strategies in the sector. Reports surrounding BlackRock BTC deposit news indicate that this is just the beginning, with expectations of additional digital asset allocations in the coming months. The implications of such large-scale investments by a powerhouse like BlackRock could resonate throughout the cryptocurrency ecosystem, making it crucial for investors to stay informed about their Bitcoin investment initiatives and the evolving landscape of cryptocurrency.

Recently, the world of digital currencies witnessed a pivotal moment when a leading financial institution took significant strides into the crypto domain. BlackRock, a titan in global asset management, has made substantial Ethereum and Bitcoin investments, notably through its substantial deposits on exchange platforms. These strategic moves not only highlight BlackRock’s growing embrace of cryptocurrencies but also set a precedent for other institutional investors to explore this burgeoning market. As large firms dive into ETH transactions and BTC deposits, the impact on cryptocurrency market dynamics becomes increasingly pronounced. Analysts are keenly observing how these developments will influence the broader narrative surrounding institutional adoption and investment within the blockchain ecosystem.

BlackRock Cryptocurrency Deposits: A Game Changer in Institutional Investment

BlackRock’s recent cryptocurrency deposits mark a significant milestone in the landscape of institutional investment in crypto. With a staggering $195 million dedicated to Bitcoin (BTC) and an additional $71.43 million allocated to Ethereum (ETH) through Coinbase, BlackRock is solidifying its position as a leader in the rapidly evolving cryptocurrency market. This move not only reflects a growing acceptance of digital assets among traditional financial institutions but also sets a precedent for other investment entities to explore similar opportunities. As the cryptocurrency market continues to mature, analysts speculate that such large-scale investments could lead to increased volatility and innovation within the sector.

The implications of BlackRock’s cryptocurrency deposits extend beyond mere investment figures; they signal a broader trend towards mainstream acceptance of digital currencies. Many institutional investors have been hesitant to enter the crypto market due to regulatory concerns and volatility, but BlackRock’s bold move could encourage others to follow suit. Furthermore, as the largest asset manager globally, BlackRock’s participation could potentially attract a wave of institutional interest towards Bitcoin and Ethereum, reshaping market dynamics and driving up demand for these cryptocurrencies.

Analyzing Cryptocurrency Market Trends Post BlackRock’s Investment

In light of BlackRock’s recent deposits, the cryptocurrency market is poised for interesting trends. Market analysts are keeping a close eye on Bitcoin (BTC) and Ethereum (ETH) prices as institutions begin to increase their holdings. Historically, significant investments by large players like BlackRock have led to upward price movements, creating a bullish sentiment among investors. Moreover, as the public becomes aware of these institutional investments, it may prompt retail investors to enter the market, potentially contributing to increased trading volumes and price appreciation in the coming months.

Additionally, the infusion of capital from established institutions like BlackRock could pave the way for more regulatory clarity and stability within the cryptocurrency market. As large financial entities embrace digital currencies, their lobbying efforts could result in favorable legislation, thereby enhancing the overall health of the cryptocurrency ecosystem. It is essential for market participants to observe how BlackRock’s involvement might influence other hedge funds and institutional investors, driving them towards embracing cryptocurrencies as viable investment instruments.

The Future of Institutional Investment in Crypto Following BlackRock’s Move

BlackRock’s recent engagement with the cryptocurrency market indicates the potential for a broader shift in how institutional investment is approached in the coming years. This pivot towards Bitcoin and Ethereum signifies that institutional investors are not only beginning to incorporate cryptocurrencies into their portfolios but are also acknowledging their potential as a hedge against traditional financial market volatility. As larger firms get involved, we may expect to see more institutional products and financial instruments designed specifically for crypto assets, designed to cater to institutional needs while ensuring security and compliance.

Looking ahead, the question remains: what will be the long-term impact of these strategic investments on cryptocurrency regulations and market structure? If more major players enter the fray, the pressure on governments to regulate and define cryptocurrency assets will likely increase. This could lead to a more stable investment environment, enhancing confidence among institutions looking to engage with cryptocurrencies. The future may see a landscape where digital currencies are fully integrated into traditional finance, driven by the momentum established by market leaders like BlackRock.

Coinbase ETH Transactions Trend after BlackRock’s $71 Million Deposit

Following BlackRock’s significant deposit of $71.43 million in Ethereum (ETH), Coinbase is poised to see an uptick in ETH transactions. As one of the leading cryptocurrency exchanges, Coinbase will likely benefit from increased trading activity driven by this institutional investment. The visibility it provides not only legitimizes Ethereum’s status as a prominent digital asset but also encourages other crypto investors to consider including ETH in their portfolios. As market sentiment shifts towards optimism, traders may begin to speculate heavily on Ethereum’s future performance, mirroring the trends set by BTC under similar circumstances.

Moreover, with BlackRock’s investment acting as an endorsement for Ethereum, more institutional investors may feel inclined to look into ETH for its potential growth and utility in decentralized finance (DeFi) applications. Such a shift could lead to more innovative financial products and strategies centered around ETH on platforms like Coinbase. Increased liquidity and demand for Ethereum assets would not only solidify its positioning in the market but could also foster broader acceptance and usability of cryptocurrencies in traditional financial services.

Understanding the Impact of BlackRock BTC Deposit News on Market Psychology

BlackRock’s deposit of 2,164 BTC, valued at $195 million, is a crucial event that has reverberated across the cryptocurrency landscape. Such news creates waves in market psychology, influencing investor sentiment and behavior. When institutional giants like BlackRock make moves in the crypto space, it generates a sense of legitimacy and confidence among individual investors who may have once been skeptical. This psychological shift can lead to a surge in demand, as more participants enter the market fueled by the belief that if BlackRock is investing in Bitcoin, it must be an asset worth considering.

Furthermore, this positive psychological impact extends beyond just Bitcoin; it encompasses the entire cryptocurrency ecosystem. Investors may begin to reassess their portfolios, considering allocating a portion of their assets into crypto in light of BlackRock’s endorsement of BTC. This ripple effect can enhance liquidity and stability across the market, fostering an environment where more people are willing to invest in digital assets. The news serves as a catalyst for discussions around the future of cryptocurrencies, further embedding BTC into mainstream investment narratives.

The Role of Institutional Investment in Shaping Cryptocurrency Market Trends

As institutional interest in cryptocurrencies continues to grow, it becomes increasingly clear that their investments are playing a pivotal role in shaping market trends. The addition of significant assets like those deposited by BlackRock signals a fundamental change in how digital currencies are perceived. Once dismissed as speculative and volatile, cryptocurrencies are now being viewed through the lens of institutional legitimacy, which may directly affect their market pricing and stability. The relationship between institutional investment in crypto and market performance cannot be understated, as larger players often provide the capital needed for sustained growth and development.

Moreover, the trend towards institutional investment could lead to enhanced operational infrastructure within the cryptocurrency market. Larger institutions typically demand higher levels of security and regulatory compliance, which can result in improved systems for storage and trading of digital assets. This burgeoning interest from established players like BlackRock suggests a future where cryptocurrencies might become integrated into retirement funds, pension plans, and other long-term investment vehicles, bringing unprecedented legitimacy and stability to the market.

Navigating the Future: Predictions for Bitcoin and Ethereum after BlackRock’s Investments

With BlackRock’s multi-million dollar investments in Bitcoin and Ethereum, many are eager to predict the trajectory of these cryptocurrencies in the near future. Analysts and market experts frequently cite these moves as indicative of bullish trends, with expectations of price rallies and increased adoption. In the wake of such significant institutional investment, speculation around Bitcoin reaching new all-time highs is gaining traction, particularly if Bitcoin adoption continues to spread among institutions, fueling further demand.

Additionally, Ethereum’s position appears fortified by these investments, especially amidst ongoing developments in smart contracts and decentralized applications. Investors are keenly aware of Ethereum’s scalability solutions and the potential for future upgrades, which could ultimately bolster its utility and market value. As institutions like BlackRock actively participate in the crypto narrative, the larger market could see a rise in innovative projects and broader acceptance, paving the way for both Bitcoin and Ethereum to play integral roles in the financial landscape.

The Ripple Effect of BlackRock’s Investment on the Wider Crypto Ecosystem

The ripple effect of BlackRock’s strategic investments extends well beyond Bitcoin and Ethereum, impacting the entire cryptocurrency ecosystem. As institutional funds flow into major cryptocurrencies, smaller altcoins may also benefit from an influx of liquidity and attention. Investors may begin exploring various projects that demonstrate robust technology and strong fundamentals, creating opportunities for the wider market to flourish. This could lead to a scenario where lesser-known cryptocurrencies gain traction, driven by increased visibility and investor interest spurred by large institutional endorsements.

Furthermore, as the cryptocurrency market continues to evolve, the influence of institutional investment can catalyze technological advancements and innovation within the crypto space. These movements often lead to a renewed focus on security, blockchain scalability, and regulatory compliance, which can improve investor confidence and encourage broader acceptance. BlackRock’s willingness to invest is a clear indicator that the future of cryptocurrencies holds significant promise, not only for established assets like Bitcoin and Ethereum but also for the ongoing development of the digital currency ecosystem as a whole.

Frequently Asked Questions

What recent investment has BlackRock made in cryptocurrency deposits?

Recently, BlackRock deposited a significant amount of cryptocurrency, including 2,164 BTC valued at $195 million and 22,902 ETH worth $71.43 million, to Coinbase. This move reflects their increasing interest in institutional investment in crypto.

How does BlackRock’s cryptocurrency deposit affect the market trends?

BlackRock’s substantial cryptocurrency deposits are likely to influence cryptocurrency market trends by attracting more institutional investors. As a major player in finance, their entry into the crypto space can signal confidence and potentially lead to increased investment in assets like Bitcoin and Ethereum.

Is BlackRock planning to increase its cryptocurrency deposit holdings?

Yes, according to recent reports, there is a possibility that BlackRock may deposit additional cryptocurrency assets in the future. This indicates their potential commitment to expanding their portfolio in the digital currency space.

What is the significance of BlackRock’s Bitcoin investment for institutional adoption of crypto?

BlackRock’s Bitcoin investment, marked by their recent BTC deposits, demonstrates a significant step toward institutional adoption of cryptocurrency. As one of the largest asset managers worldwide, their involvement can pave the way for broader acceptance of cryptocurrencies among other institutions.

How do BlackRock’s transactions on Coinbase affect crypto liquidity?

BlackRock’s transactions, including their recent cryptocurrency deposits to Coinbase, can enhance liquidity in the market. Their large-scale investments may signal strong demand, leading to more trading activity and potentially impacting the overall pricing of cryptocurrencies.

What are the implications of BlackRock’s cryptocurrency deposits for future investments?

BlackRock’s cryptocurrency deposits could indicate a broader strategy to integrate digital assets into their investment framework. As institutional interest in crypto grows, these deposits may encourage other firms to explore cryptocurrency investment opportunities.

What assets did BlackRock deposit to Coinbase?

BlackRock deposited 2,164 BTC and 22,902 ETH to Coinbase, marking a substantial investment in Bitcoin and Ethereum as part of their cryptocurrency strategy.

Why is BlackRock’s BTC deposit news important for investors?

BlackRock’s BTC deposit news is crucial for investors because it highlights a major institutional player’s confidence in cryptocurrencies, potentially influencing market perceptions and encouraging other investors to consider cryptocurrency allocations.

| Cryptocurrency | Amount Deposited | Value | Exchange | Future Deposits Possible |

|---|---|---|---|---|

| Bitcoin (BTC) | 2,164 BTC | $195 million | Coinbase | Yes |

| Ethereum (ETH) | 22,902 ETH | $71.43 million | Coinbase | Yes |

Summary

BlackRock cryptocurrency deposits have made headlines with the recent transfer of significant amounts of Bitcoin and Ethereum to Coinbase. This move positions BlackRock as a major player in the cryptocurrency space, potentially paving the way for future investments and a deeper involvement in digital assets. With $195 million in Bitcoin and $71.43 million in Ethereum deposited, the firm is signaling confidence in the growth of cryptocurrencies while also indicating an openness to further asset acquisitions.

Related: More from Bitcoin News | Stablecoin Strength Pressures Bitcoin Treasury | Analysts: No Evidence of Jane Street Bitcoin Manipulation, ETF Demand Soars