Bitnomial prediction markets are leading the way in the evolution of trading and financial forecasting, especially following the recent CFTC no-action letter that has effectively lifted burdensome regulations for crypto derivatives exchanges. This significant development allows Bitnomial to offer event contracts without the typical reporting requirements, facilitating an environment ripe for rapid transactions—often involving thousands of swaps daily. As investors increasingly look to alternative avenues, engaging with prediction market trends offers unique opportunities for capitalizing on upcoming events. By ensuring that all positions are collateralized, Bitnomial also prioritizes user security, helping to safeguard liquidity in this dynamic market. As blockchain technology continues to reshape the financial landscape, investing in prediction markets becomes a compelling choice for those seeking innovative investment strategies.

The realm of forecasting financial outcomes is gaining traction through platforms like Bitnomial, which specialize in trading within prediction markets. These platforms, often referred to as event contracts or outcome markets, enable participants to wager on various future events, thus turning speculation into a structured investment format. With the backing of regulatory bodies, such as the recent no-action letter from the CFTC, the appeal of exchanges offering these financial instruments is on the rise. Observers note that such developments are indicative of a broader trend towards embracing these innovative trading frameworks. As traditional polling and prediction methodologies face scrutiny, the rise of these advanced trading networks points to a future where data-driven decision-making becomes paramount.

Understanding the CFTC No-Action Letter and Its Impact on Bitnomial

The recent CFTC no-action letter granted to Bitnomial marks a significant milestone for crypto derivatives exchanges. This letter allows Bitnomial to operate more flexibly by offering event contracts without being burdened by the stringent reporting requirements typically imposed on swap transactions. Such leniency is essential for fast-paced platforms where numerous swaps can happen within a single day, enabling them to deliver seamless trading experiences to users. As regulators begin to adapt to innovative financial technology, this development signifies a step towards integrating cryptocurrencies with traditional finance.

However, Bitnomial is still required to adhere to specific regulations, including the need for transparency on their platform. This means that despite the leniency granted by the CFTC, Bitnomial must continue to provide valuable data like timestamps and sales figures to users and regulators. Moreover, ensuring that all positions are fully collateralized is crucial to prevent potential liquidity issues and protect the platform’s health and integrity. The CFTC’s willingness to support Bitnomial not only bolsters this particular exchange but also indicates a broader acceptance of prediction markets in the evolving financial landscape.

Exploring Event Contracts in Prediction Markets

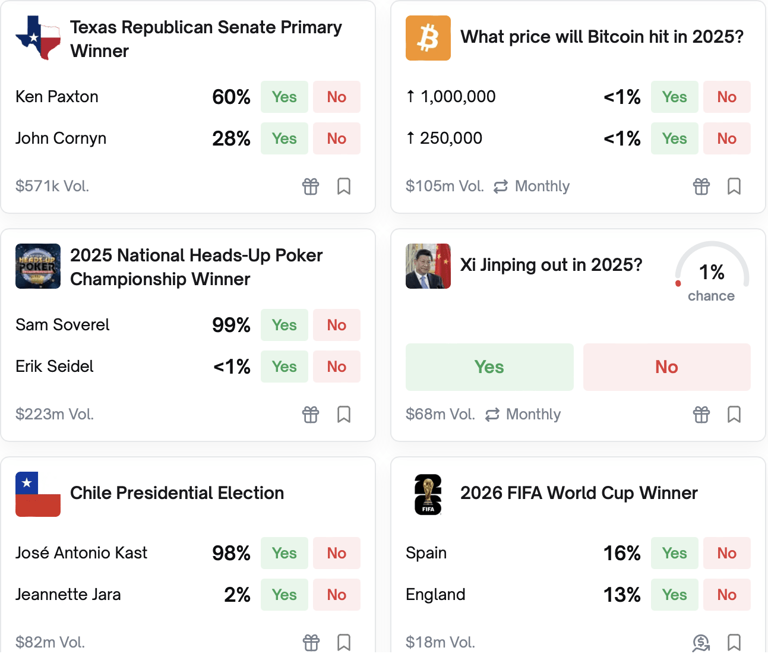

Event contracts emerge as a pivotal innovation within prediction markets, allowing traders to speculate on the outcome of specific events. These contracts are designed to mature based on a definable outcome, such as election results or sports outcomes, providing a structured way to wager on the future. The introduction of event contracts at platforms like Bitnomial helps democratize trading, granting access to a wider audience interested in forecasting events. This mechanism harnesses collective intelligence, arguably offering more accurate predictions compared to traditional polling methods.

Trading event contracts can be seen as a blend of betting and investment strategies, where investors analyze potential outcomes and place trades based on their insights and market sentiment. With platforms gaining traction, especially during significant events like the 2024 U.S. elections, investing in prediction markets is becoming more attractive to both retail and institutional investors. As understanding of these markets grows, they can play a crucial role in enhancing market liquidity and delivering fresh insights into public sentiment.

The Rise of Prediction Market Trends in 2024

In recent years, prediction markets have witnessed a surge in popularity, particularly during the 2024 U.S. elections. Investors and analysts alike have started taking a keen interest in these markets for their ability to provide insights that often surpass traditional polling data. As political events unfold, the aggregation of individual opinions through prediction markets not only forecasts outcomes but also reflects the pulse of the public sentiment regarding various issues. This trend has had significant implications for how political campaigns are strategized and how citizens engage with electoral processes.

Platforms like Polymarket and Kalshi have become household names, signifying a cultural shift toward embracing prediction markets as valid forecasting tools. The captivating coverage during the election cycle has drawn in institutional investors, resulting in increased liquidity and engagement on these platforms. The recognition and mainstream acceptance of prediction markets are evident, further bolstered by popular media mentions and significant investments, such as the ones seen during the election season.

Investing in Prediction Markets: Opportunities and Challenges

As more investors recognize the potential within prediction markets, opportunities for growth and profit become increasingly apparent. The unique nature of prediction markets—where outcomes are determined by the collective betting of participants—allows investors to leverage market sentiment to inform their trading decisions. This process not only benefits individual traders but also creates an ecosystem where more accurate predictions can drive better outcomes.

However, there are challenges to be aware of when investing in prediction markets. Regulatory uncertainties can pose risks, particularly as lawmakers and financial institutions continue to assess and adapt to this evolving landscape. Investors must also remain vigilant about the dynamics of market sentiment, as public opinion can shift dramatically based on current events. Nonetheless, as platforms mature and gain institutional backing, the holistic view of investing in prediction markets becomes more viable for strategic investment portfolios.

How Bitnomial Stands Out in the Crypto Derivatives Market

Bitnomial’s establishment in the crypto derivatives exchange space is particularly noteworthy given its recent CFTC no-action letter. Unlike traditional exchanges, Bitnomial leverages blockchain technology to facilitate the trading of event contracts, offering a unique blend of transparency and efficiency that can attract both seasoned investors and newcomers to the market. By allowing fast and seamless trading experiences, Bitnomial positions itself as an innovative player amid conventional financial platforms.

What further differentiates Bitnomial is its emphasis on collateralization. Every position taken on the platform is backed 1:1, minimizing the risk of cascading liquidations—a common issue that can destabilize more leveraged trading platforms. This distinction not only enhances investor confidence but also solidifies Bitnomial’s reputation as a reliable player in the derivatives market, nurturing a community of informed and responsible traders.

The Cultural Relevance of Prediction Markets in Modern Society

Prediction markets have transcended their financial origins and entered the cultural fabric of society. Their rise to prominence, especially highlighted by media representations like South Park, signals an increasing recognition of their influence in shaping public narratives and conversations around current events. With episodes dedicated to these platforms, the portrayal of prediction markets as tools for entertainment and speculation reflects broader societal engagement with forecasting.

Moreover, the impact of such cultural relevance extends beyond mere entertainment. They have become platforms for critical discussions on politics, sports, and general societal trends, making them a nexus for communal sentiment and decision-making. As these platforms integrate into everyday dialogues, they enhance public awareness of event contracts and the complexities surrounding them, leading to a more informed society.

Navigating Regulatory Landscapes in Prediction Markets

As prediction markets continue to evolve, understanding regulatory landscapes becomes paramount for traders and platforms alike. The recent no-action letter by the CFTC exemplifies the ongoing negotiations between regulatory bodies and innovative financial enterprises like Bitnomial. While these regulations aim to protect investors and maintain market integrity, they can also impose restrictions that hinder rapid growth and innovation.

The success of prediction markets hinges on finding a balance between compliance and operational flexibility. For platforms venturing into this space, it is essential to stay abreast of evolving regulations, ensuring that they meet requirements without stifling innovation. As acceptance grows among regulators, it may pave the way for clearer guidelines that facilitate the further development of prediction markets and safeguard the interests of all stakeholders involved.

The Future of Prediction Markets Post-CFTC No-Action Letter

The CFTC’s no-action letter paves the way for a bright future for prediction markets like those offered by Bitnomial. With the regulatory clarity provided, we can expect an influx of new players entering the market, ultimately increasing competition and innovation within the sector. As traditional finance grapples with blockchain technology, the expansion of prediction markets signifies a merging of the two worlds, potentially leading to diversified financial products that attract a wider investor base.

Furthermore, the continuous interest in event contracts during major occurrences, such as elections and significant sports events, will likely fuel the growth of prediction markets. Investors are becoming more comfortable navigating these platforms, and educational resources will make it easier for new participants to join. The potential for predictive analytics derived from trading data will also grow, leading to enhanced forecasting models that could revolutionize not only market predictions but also various sectors reliant on data-driven decision-making.

The Role of Institutional Investors in Prediction Markets

Institutional investors have begun to recognize the value of prediction markets, as evidenced by significant investments in platforms like Polymarket. With their deep resources and analytical capabilities, these investors can influence market trends and liquidity, transforming the landscape of prediction markets into a more serious financial sector. Their involvement is indicative of a growing belief that prediction markets can provide genuine forecasts that add value to financial portfolios.

Moreover, the entry of institutional players into prediction markets can further legitimize these platforms, attracting additional retail investors. This dual investment dynamic can result in an upsurge in trading volumes, enhancing overall market efficiency and sophistication. As institutional backing mounts, it’s expected that more robust developments in regulatory compliance and technological advancements will follow suit, making the prediction market ecosystem more resilient and enduring.

Frequently Asked Questions

What is the significance of the CFTC no-action letter for Bitnomial prediction markets?

The CFTC no-action letter allows Bitnomial prediction markets to operate event contracts without facing stringent reporting requirements typically associated with asset swaps. This regulatory relief is crucial for Bitnomial’s ability to handle a high volume of transactions efficiently, enhancing its appeal as a crypto derivatives exchange.

How do event contracts work in Bitnomial prediction markets?

Event contracts in Bitnomial prediction markets are contracts that pay out based on the outcome of specific events, such as elections or financial results. These contracts allow users to invest in predictions about future events, providing a platform for informed speculation and trading.

What are the risks of investing in prediction markets like Bitnomial?

Investing in prediction markets like Bitnomial carries risks, including market volatility and the potential for loss. Since all positions must be collateralized at a 1:1 ratio, investors should understand that while leverage is not allowed, liquidity concerns can still affect market stability.

What trends are emerging in prediction markets, particularly after the latest CFTC regulations affecting Bitnomial?

With the CFTC’s favorable stance towards Bitnomial prediction markets, trends indicate increased institutional interest and participation. The success of other platforms like Polymarket and Kalshi suggests a broader acceptance and integration of prediction markets into mainstream financial practices.

How are prediction markets viewed in the context of the 2024 elections and beyond?

Prediction markets like Bitnomial gained traction during the 2024 elections, with many believing they offer superior forecasting capabilities compared to traditional polls. This growing acceptance is evident as these markets become part of cultural discussions, further legitimizing their role in event prediction.

What are the implications of the Intercontinental Exchange’s investment in Polymarket for the future of Bitnomial prediction markets?

The Intercontinental Exchange’s investment in Polymarket indicates significant institutional support for prediction markets, which could bolster investor confidence in platforms like Bitnomial. This trend may lead to increased innovation, market growth, and more regulatory clarity in the prediction markets space.

How is Coinbase’s acquisition of The Clearing Company expected to impact prediction markets?

Coinbase’s acquisition of The Clearing Company marks a strategic expansion into prediction markets, likely enhancing Bitnomial’s competitive landscape. This acquisition is expected to stimulate trading volume and attract new participants, particularly around key events such as the midterm elections in 2026.

| Key Point | Description |

|---|---|

| CFTC No-Action Letter | Allows Bitnomial to offer event contracts and prediction markets without stringent reporting requirements. |

| Consumer Transparency Requirements | Bitnomial must provide consumer-facing data including timestamps and sales data. |

| Collateralization Requirement | All positions must be backed 1:1, ensuring no leverage to maintain liquidity. |

| Regulatory Acceptance | The letter indicates growing acceptance of prediction markets by U.S. regulators. |

| Popularity During Elections | Prediction markets gained traction during the 2024 elections, offering better forecasts. |

| Cultural Impact | Prediction markets featured in popular media, reflecting their societal relevance. |

| Recent Investments | ICE invested $2 billion in Polymarket, significantly boosting its valuation. |

| Coinbase Acquisition | Coinbase to acquire The Clearing Company to expand its presence in prediction markets. |

Summary

Bitnomial prediction markets have gained significant traction in the evolving landscape of crypto derivatives. The recent no-action letter from the CFTC heralds a new era for such platforms, easing regulatory burdens and fostering transparency. As interest in prediction markets continues to grow, especially around significant events like elections, it becomes evident that they serve as valuable tools for accurate forecasting, bolstered by substantial investments and mainstream media recognition.

Related: More from Regulation & Policy | EU Crypto Taxes: Practical Implications Explained | UK FCA to Consider Cryptos for Gambling Payments