Bitcoin volatility has been a significant topic within the cryptocurrency landscape, marked by intriguing price fluctuations and shifts in market stability. Over the past few years, institutional investment in Bitcoin has surged, particularly with the introduction of Bitcoin ETFs, which allow traditional investors to engage more seamlessly within the crypto market trends. While Bitcoin’s realized daily volatility reached a historic low of 2.24% in 2025, signifying a maturation in its market dynamics, the sharp price drop in October from $126,000 to $80,500 still reflects its capacity for substantial swings. This seeming contradiction illustrates how Bitcoin can experience decreased volatility in a broad sense yet maintain the potential for significant price movements, particularly amid evolving corporate treasury strategies and increased liquidity. Ultimately, these developments indicate that Bitcoin’s market is adjusting, becoming more stable without sacrificing its inherent volatility, thus attracting a diverse array of investors.

When exploring the complexities of Bitcoin’s price movements, one cannot overlook the impact of its fluctuating nature described as crypto volatility. The recent emergence of Bitcoin investment vehicles like ETFs has reshaped the landscape, enabling new avenues for market participation that enhance Bitcoin market stability. Investors are now witnessing a transition where the digital currency manages to exhibit reduced volatility while attracting unprecedented institutional interest. This trend suggests a fundamental shift in how cryptocurrencies are perceived, with implications for broader market integration and acceptance. As Bitcoin continues to evolve, its role might transform, becoming seen as a staple within diversified investment portfolios despite its historical preference for dramatic price changes.

Understanding Bitcoin Volatility in 2025

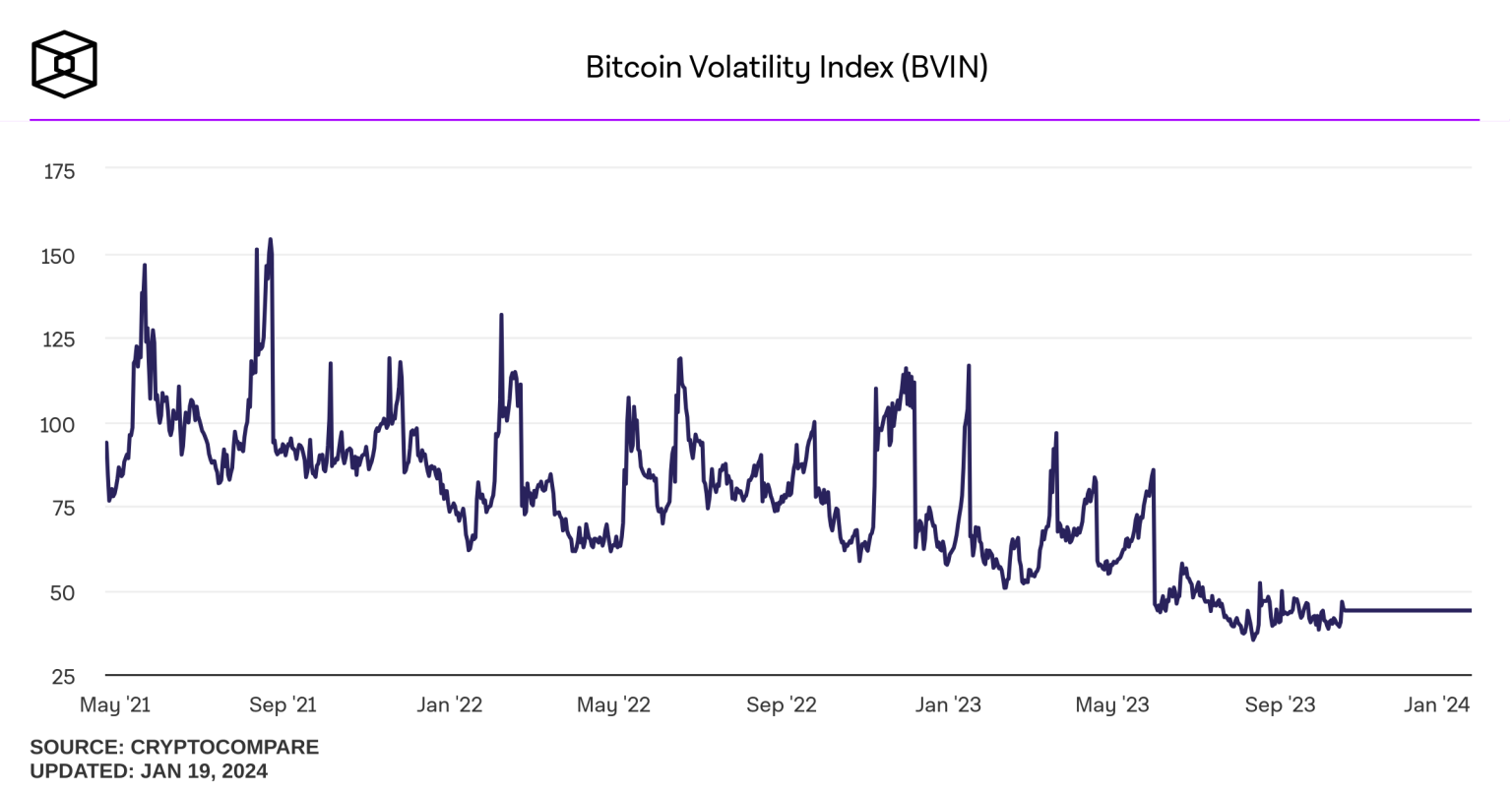

In 2025, Bitcoin’s volatility reached an all-time low, evidenced by a realized daily volatility of just 2.24%. This marked a significant decrease from 3.34% in 2022 and 2.80% in 2024, showcasing a trend towards greater market stability. This decline in fluctuation is underpinned by emerging market dynamics that have allowed Bitcoin to absorb large capital flows without severe price swings. As institutional investment continues to rise, the Bitcoin market is displaying signs of maturity, evidenced by its resilience during high-pressure sell-offs.

The paradox of low volatility amid significant price changes, like the dramatic drop from $126,000 to $80,500, reflects a complex market structure. While these swings appear drastic, the overall stability is underpinned by strategic investments from corporate treasuries and the introduction of Bitcoin ETFs. These developments have changed the landscape, allowing Bitcoin to maintain a level of liquidity that absorbs volatility effectively. As a result, Bitcoin has become less susceptible to sharp price corrections, enhancing its attractiveness to institutional investors.

Frequently Asked Questions

What factors contribute to Bitcoin’s volatility in the current market?

Bitcoin’s volatility is influenced by several factors, including market liquidity, institutional investment in Bitcoin, and the introduction of Bitcoin ETFs. The substantial capital flows from institutional investors have contributed to a stabilization of price fluctuations, making Bitcoin’s market stability more pronounced despite significant absolute price movements.

How does Bitcoin’s recent price fluctuations compare to other assets like Nvidia?

In 2025, Bitcoin demonstrated lower volatility than Nvidia, with a realized daily volatility of 2.24%. This marks Bitcoin’s most stable year, showcasing a shift toward a more mature market that can absorb substantial capital movements without drastic price changes.

Are Bitcoin ETFs contributing to the stabilization of Bitcoin’s market volatility?

Yes, Bitcoin ETFs have played a crucial role in stabilizing market volatility. By attracting institutional investments, they have introduced a structured framework for trading Bitcoin, which has helped reduce daily price fluctuations and enhance overall market liquidity.

What does the decline in Bitcoin volatility indicate about the crypto market trends?

The decline in Bitcoin’s volatility suggests a maturing market that can handle large capital inflows and outflows without succumbing to extreme price changes. This indicates a potential shift in Bitcoin’s perception as a core macro asset rather than a purely speculative investment.

Can a reduction in Bitcoin volatility lead to its increased integration into traditional portfolios?

Absolutely. As Bitcoin’s volatility decreases, it may be seen as a more stable investment option, making it more attractive for institutional investors and potentially leading to its broader integration into traditional investment portfolios.

How do long-term holders impact Bitcoin price fluctuations?

Long-term holders can impact Bitcoin price fluctuations by reallocating their assets into structured custodians, which contributes to smoother daily returns. This behavior can reduce the overall volatility observed in the Bitcoin market during significant price movements.

Why is Bitcoin’s price drop from $126,000 to $80,500 considered less volatile?

Despite the harsh drop of nearly $46,500, Bitcoin’s overall market structure allowed for a resilient absorption of this capital outflow. The liquidity improvements and institutional involvement helped reduce the perception of volatility, even during dramatic price changes.

What role does regulatory change play in Bitcoin’s market stability?

Regulatory changes significantly influence Bitcoin’s market stability by establishing clearer guidelines for trading and investment. These changes can attract more institutional investors, thereby supporting liquidity and reducing volatility in the Bitcoin market.

| Key Point | Details |

|---|---|

| Lowest Annual Volatility | Bitcoin’s daily volatility hit 2.24% in 2025, the lowest in its history. |

| Consistent Decline | Volatility has decreased over the years: 3.34% in 2022, 2.80% in 2024. |

| Capital Flows | Despite low volatility, Bitcoin attracted larger investments and showed significant price movements. |

| Market Resilience | The market absorbed capital flows without severe price declines, demonstrating strong liquidity. |

| Institutional Influence | Increased institutional participation through ETFs and corporate treasuries contributed to lower volatility. |

| Future Outlook | Ongoing structural changes may further decrease volatility, improving Bitcoin’s mainstream acceptance. |

Summary

Bitcoin volatility has notably decreased over recent years, reaching record lows in 2025. The market has shown an impressive ability to absorb significant capital flows while maintaining relatively stable price movements. This transformation highlights a maturing market that is evolving beyond mere speculation and into a recognized asset class. Continued structural adjustments may lead to even lower volatility, allowing Bitcoin to be incorporated into traditional portfolios and enhancing its acceptance among institutional investors.