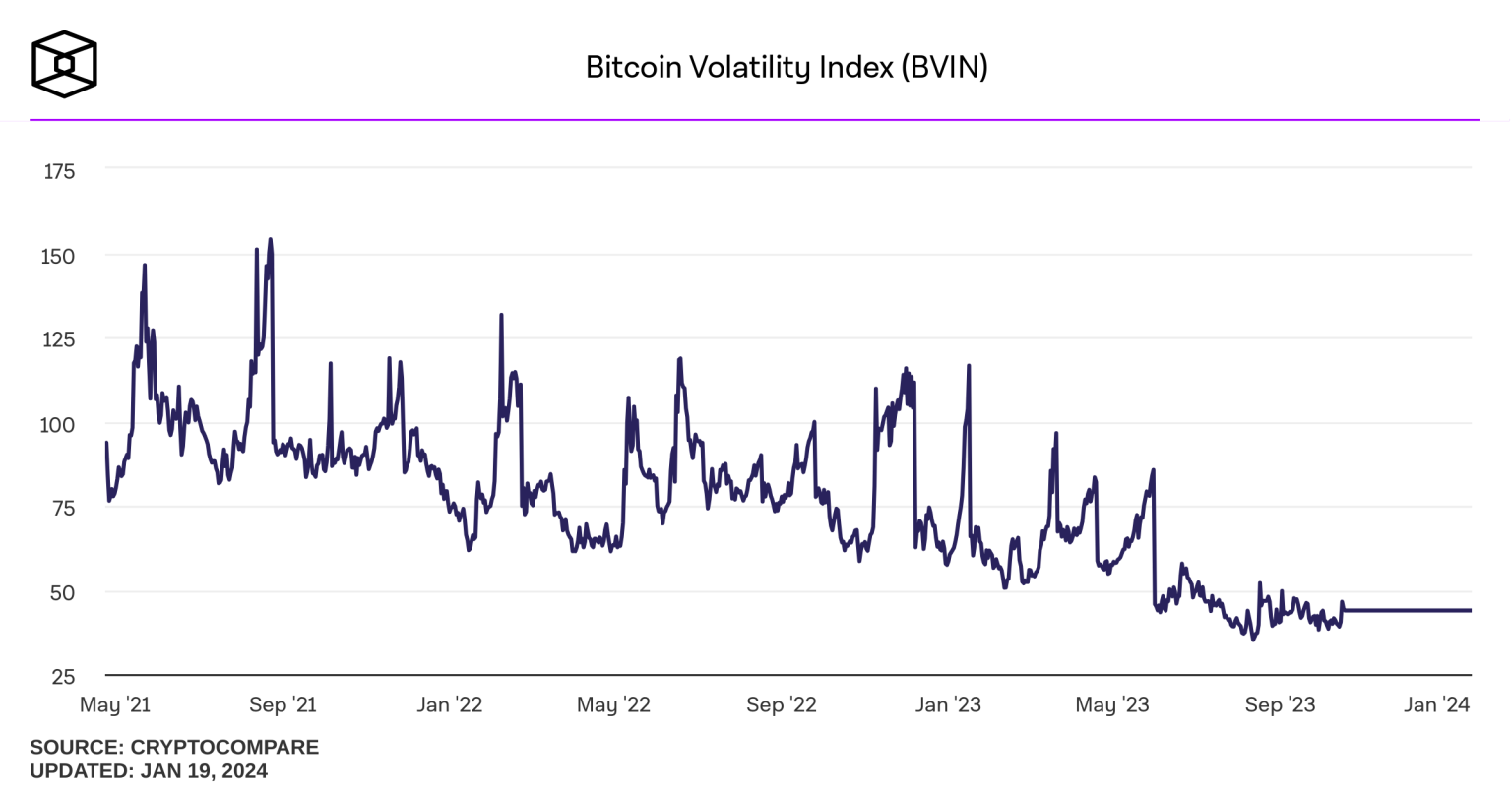

Bitcoin volatility has become a defining characteristic of the cryptocurrency landscape, particularly as it responds to shifting macroeconomic signals and regulatory pressures. Recent developments, such as comments from Federal Reserve Chair Jerome Powell regarding the influence of political forces on central bank decisions, highlight the profound uncertainties now shaping the Bitcoin market. Investors are closely monitoring these dynamics, given that their perceptions of Bitcoin’s stability are increasingly tied to central bank policies and broader economic indicators. Such volatility becomes even more pronounced as crypto market news evolves, with analysts predicting how these changes may affect Bitcoin and other digital assets in the coming years. As we look ahead to 2026 Bitcoin predictions, the interplay between regulatory influence and market trust will undoubtedly play a pivotal role in determining the trajectory of Bitcoin’s price.

The unpredictable nature of Bitcoin’s price fluctuations, often termed market volatility, has emerged as a critical focus for traders and investors alike. This term not only encapsulates the inherent risks associated with cryptocurrency investment but also reflects how external factors, such as central bank interventions, can sway market sentiment. With the evolving narrative surrounding financial policy and institutional trust, especially in the wake of statements by figures like Jerome Powell, understanding these shifts is more important than ever. The interplay between economic conditions and Bitcoin’s performance opens intriguing discussions about the future of digital currencies amidst the growing crypto industry. As analysts dissect current trends in the Bitcoin market analysis, it’s evident that volatility won’t merely serve as a backdrop but could shape the very path that cryptocurrencies take moving forward.

Understanding Bitcoin Volatility in 2026

Bitcoin has historically displayed significant volatility, often swayed by macroeconomic factors such as interest rate changes and government policies. As we delve into 2026, shifts in perceptions regarding central bank independence, particularly concerning the Federal Reserve and Jerome Powell’s statements, could lead to unpredictable price movements. Given that Bitcoin often acts as a hedge against inflation and currency degradation, volatility might escalate as investors react to new governance risks linked to political pressures. Therefore, understanding the underlying mechanisms of Bitcoin’s volatility becomes crucial for traders navigating this unpredictable landscape.

As Bitcoin’s volatility intertwines with broader economic indicators, the sentiments surrounding investor confidence will play a pivotal role. With central banks like the Fed under pressure, market participants may be prompted to reassess their positions on Bitcoin, furthering its unpredictable nature. If investors perceive that political influences could dictate monetary policies, it could result in a demand for compensation in the form of higher volatility premiums. Consequently, the environment of uncertainty is likely to remain heightened, with Bitcoin’s price swaying dramatically based on the interplay between market interpretations of political actions and central bank responses.

Frequently Asked Questions

How does Bitcoin volatility relate to central bank influence?

Bitcoin volatility is increasingly linked to central bank influence, particularly as recent events show that political pressures can impact monetary policies. For instance, when the market perceives a threat to the Federal Reserve’s independence, it raises concerns about future interest rates, thereby intensifying Bitcoin’s volatility.

What impact does Jerome Powell’s actions have on Bitcoin market analysis?

Jerome Powell’s statements and actions as Fed Chair play a crucial role in Bitcoin market analysis. His remarks regarding political pressures can drive market sentiment, leading to fluctuations in Bitcoin’s price as traders reassess risks associated with central bank policies.

Why is Bitcoin volatility significant in current crypto market news?

Bitcoin volatility is front and center in current crypto market news as investors navigate uncertainty stemming from changes in central bank strategies. When credibility risks increase, such as those hinted at by the Fed, traders often react by modifying their positions in Bitcoin, resulting in heightened price fluctuations.

What are the 2026 Bitcoin predictions amid rising volatility?

The 2026 Bitcoin predictions are uncertain and closely tied to macroeconomic factors. Analysts suggest that if the Federal Reserve’s independence is questioned, Bitcoin may experience increased volatility and a governance risk premium, which could impact its valuation significantly.

How does the dollar’s performance affect Bitcoin volatility?

The dollar’s performance is a key factor influencing Bitcoin volatility. When the U.S. dollar’s credibility is undermined, or if there are uncertainties about monetary policy, investors turn to Bitcoin as a hedge, which can lead to increased price swings in the cryptocurrency market.

What scenarios are expected to shape Bitcoin volatility in the coming year?

Three scenarios that could shape Bitcoin volatility include: 1) institutions absorbing the impact of legal challenges concerning the Fed; 2) chronic pressure resulting in a persistent governance premium; and 3) a shift in policy that could significantly alter market expectations and Bitcoin’s price dynamics.

How does governance risk influence Bitcoin volatility?

Governance risk, stemming from perceived political pressures on central banks, can significantly influence Bitcoin volatility. As market participants evaluate the potential for policy shifts, uncertainty increases, leading to greater price fluctuations in Bitcoin.

| Key Point | Details |

|---|---|

| Shift in Bitcoin’s Correlation | Bitcoin no longer follows the trend of ‘rates up, Bitcoin down’ due to new political and legal pressures on the Fed. |

| Impact of Political Pressure | Political pressures on the Fed might affect its operations, leading to market reevaluations of Bitcoin’s role. |

| Market Reactions | Gold prices surged, the dollar weakened, and cryptocurrency saw a mixed response as traditional market ‘safety valves’ activated. |

| Three Potential Impacts on Bitcoin | 1. Dollar credibility concerns leading to policy questions. 2. Changes in trust reflected through term premiums. 3. Increased volatility from uncertainties surrounding governance risks. |

| 2026 Scenarios for Bitcoin | Scenario A: Legal battle without market turbulence. Scenario B: Continuous market pressure leading to a governance premium. Scenario C: Anticipation of a shift in policy direction due to legal changes. |

Summary

Bitcoin volatility is increasingly influenced by external factors such as political pressures and central bank credibility. As market participants respond to fears over the Federal Reserve’s independence, understanding Bitcoin’s new volatility channels has become crucial. The ongoing reevaluation of the dollar’s stability alongside potential governance risks introduces a complex landscape for investors. Thus, navigating these changes is essential for those dealing in cryptocurrencies.

Related: More from Bitcoin News | AI, BTC Miners Issue High | Bitcoin Above $69K? Glassnode Weighs In