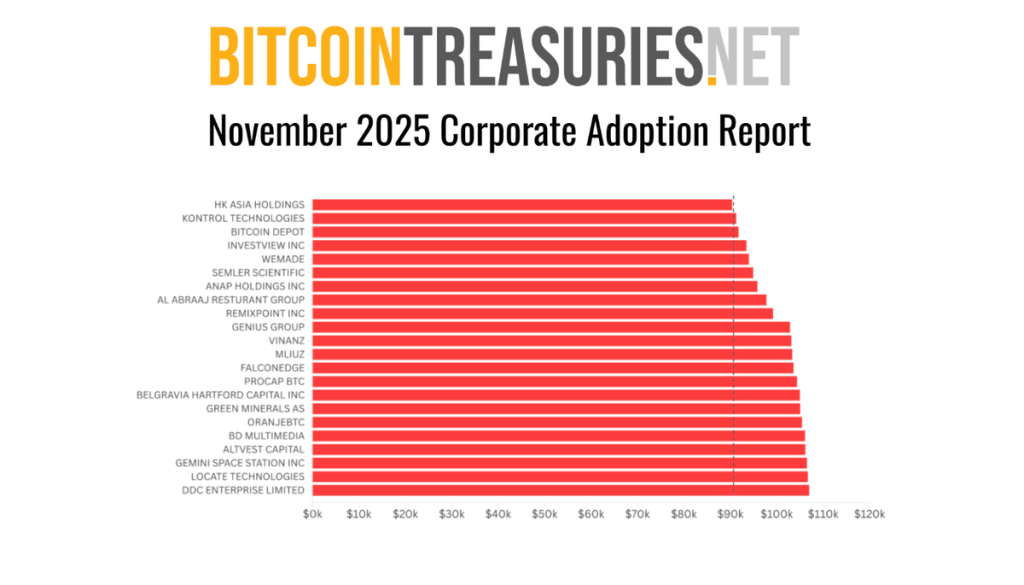

Bitcoin treasury losses have become a headline concern as the cryptocurrency‘s value plummeted, hitting an alarming low of $60,233 before recovering to $65,443. This drop has significantly affected Bitcoin treasury companies, leading to unrealized losses topping nearly $10 billion across several major players holding more than 850,000 BTC. Among the most impacted is Strategy, formerly MicroStrategy, which alone carries an unrealized loss of $6.85 billion as a result of their large-scale Bitcoin investments. With the Bitcoin price drop contributing to this downturn, investors are left grappling with the implications of their holdings in an increasingly volatile market. As market dynamics shift, detailed Bitcoin market analysis is required to navigate the tumultuous waters of current crypto trends and help mitigate ongoing risks in Bitcoin treasuries.

The landscape of Bitcoin treasury management is currently marred by major financial setbacks, often referred to as losses incurred by Bitcoin reserves. As these strategic players grapple with the diminishing value of their assets, the economic notion of treasury value becomes increasingly complex. The recent declines in Bitcoin investment indicate not just a fallout from previous highs but a broader crypto market downturn affecting numerous organizations. Evaluating Bitcoin treasury setbacks, particularly among leading entities, underscores issues of timing and strategic capital acquisition in a market that once appeared favorable. As stakeholders analyze these newly emerging challenges, they must consider alternative strategies to safeguard their holdings amid ongoing Bitcoin fluctuations.

| Company | BTC Held | Average Purchase Price | Current Value | Unrealized Loss | Unrealized Loss (%) |

|---|---|---|---|---|---|

| Strategy (MicroStrategy) | 713,502 BTC | $76,047 | $65,443 | $6.85 billion | 12.6% |

Summary

Bitcoin treasury losses have dramatically impacted several significant companies in the cryptocurrency landscape. As Bitcoin’s value fluctuated, many firms, particularly those that heavily invested in Bitcoin at peak prices, have reported substantial unrealized losses, totaling nearly $10 billion across eight entities. This situation exemplifies the difficulties of navigating a volatile market, particularly for those holding large Bitcoin treasuries. Companies such as MicroStrategy have found themselves significantly underwater, and if Bitcoin’s price continues to decline, the losses for these organizations may increase alarmingly, highlighting the risks associated with high-cost acquisitions in a bear market.

Understanding Bitcoin Treasury Losses Amid Market Volatility

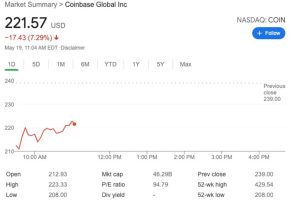

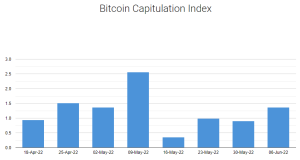

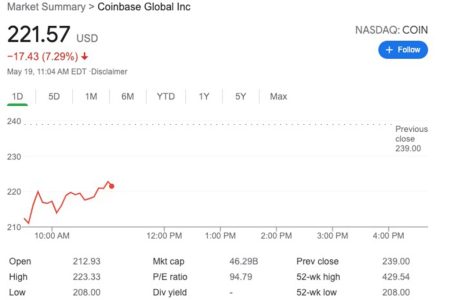

The recent plunge in Bitcoin’s price to $60,233 has sent shockwaves through the halls of dedicated Bitcoin treasury companies, leading to significant unrealized losses. Currently, these firms are grappling with nearly $10 billion in collective losses on their holdings. As the market fluctuates, the implications of these losses extend beyond mere numbers; they represent the volatility and risks associated with Bitcoin investments at such a scale. The overarching question remains: how will these firms navigate the complexities of treasury management amidst such a turbulent crypto market downturn?

Companies such as Strategy, Metaplanet, and Twenty One Capital highlight the stark reality faced by many in the Bitcoin ecosystem. With Strategy reporting an unrealized loss of $6.85 billion on its substantial Bitcoin treasury, the pressure mounts. This scenario exemplifies the challenges that large holders encounter when Bitcoin’s value dips significantly. Their heavy investment positions now depend on future price recoveries, perpetuating a cycle where each fluctuation impacts their financial health. The need for strategic approaches in managing Bitcoin treasuries has never been more critical.

Frequently Asked Questions

What are Bitcoin treasury losses and how do they impact companies?

Bitcoin treasury losses refer to the unrealized losses experienced by companies holding significant amounts of Bitcoin, especially during price declines in the crypto market. As Bitcoin’s price drops, the value of these holdings decreases, leading to substantial financial losses for companies like Strategy and Metaplanet, which have reported losses totaling billions due to the recent Bitcoin price drop.

How has the Bitcoin price drop led to treasury losses for Bitcoin investment firms?

The recent Bitcoin price drop has resulted in unrealized treasury losses for Bitcoin investment firms as their accumulated assets lose value. For instance, Strategy holds a large Bitcoin position that has decreased in value, leading to an approximate unrealized loss of $6.85 billion. Such losses can significantly affect a company’s financial standing and investment strategies in the volatile crypto market.

What is the significance of the unrealized losses reported by Bitcoin treasury companies?

The unrealized losses reported by Bitcoin treasury companies signify the current market struggles and the risks associated with holding large amounts of Bitcoin. These losses not only record the immediate impact of a falling Bitcoin price but also highlight potential operational challenges for companies when seeking to raise capital or maintain investor confidence amidst a crypto market downturn.

How do Bitcoin market analysis and treasury losses correlate in today’s economic climate?

Bitcoin market analysis shows a clear connection between current price trends and treasury losses for Bitcoin companies. As analysts predict further declines, the implications for company treasuries become more pronounced, with existing unrealized losses expected to balloon if Bitcoin drops to critical support levels.

What should companies holding Bitcoin treasuries consider during a crypto market downturn?

During a crypto market downturn, companies holding Bitcoin treasuries should consider their financial strategies carefully. They may need to evaluate whether to hold their assets, realize losses for operational needs, or manage their acquisition strategies to mitigate further risks associated with market volatility and potential increases in their existing unrealized losses.

What are the risks if Bitcoin continues to drop below $60,000 regarding treasury losses?

If Bitcoin continues to drop below $60,000, companies like Strategy may face drastic increases in their unrealized losses. For instance, every additional price decline could lead to losses expanding by billions, impacting their financial viability and operational decisions. This scenario could result in companies being trapped in unfavorable positions where they must hold at losses or risk further capital constraints.

How do Bitcoin treasury losses affect market-to-net-asset-value (mNAV) ratios?

Bitcoin treasury losses negatively influence market-to-net-asset-value (mNAV) ratios, as companies with underwater treasure holdings may trade at a discount. This reflects market sentiment regarding their assets, where lower mNAV ratios indicate diminished investor confidence and increased costs for new capital, thereby compounding the issues tied to ongoing losses.

Which Bitcoin treasury companies have reported the most significant losses and why?

Companies like Strategy and Metaplanet have reported significant treasury losses due to their substantial Bitcoin holdings bought at high prices. With Bitcoin’s current value substantially lower than their acquisition prices, these firms face unrealized losses that illustrate the risks of investing heavily in Bitcoin during peak market conditions.

What strategies might successful Bitcoin treasury companies employ during a downturn?

Successful Bitcoin treasury companies might employ strategies such as diversifying their assets, adjusting their acquisition tactics, or liquidating portions of their holdings to safeguard their financial health. Additionally, companies that aren’t heavily underwater, like Next, can strategically realize gains to support operations even amidst broader market challenges.

What does the future hold for Bitcoin treasury losses in an uncertain market?

The future for Bitcoin treasury losses appears precarious in an uncertain market. If Bitcoin prices continue to decline, treasury losses could escalate dramatically, affecting companies’ market positions and operational strategies. Ongoing market volatility will require companies to adapt proactively to mitigate risks associated with their Bitcoin holdings.