Bitcoin staking is rapidly gaining traction as a formidable way to maximize the potential of one of the most influential cryptocurrencies. This innovative approach allows users to actively engage in decentralized finance (DeFi) by utilizing their Bitcoin as collateral for lending, thus unlocking new financial opportunities within the blockchain ecosystem. With the recent funding of $15 million acquired by Babylon, a key player in Bitcoin lending, the landscape for leveraging Bitcoin through mechanisms like staking continues to expand. By introducing BABY tokens to enhance its infrastructure, Babylon aims to mitigate the challenge of dormant Bitcoin, ensuring that this valuable asset can serve as a functional component within DeFi. As the partnership with Aave Labs progresses, the prospect for a streamlined Bitcoin staking experience becomes more attainable, potentially revolutionizing how Bitcoin is utilized in the finance sector.

The evolution of Bitcoin utilization through staking and lending represents a pivotal shift in cryptocurrency economics. As financial institutions and decentralized platforms explore blending traditional banking with blockchain technology, terms like Bitcoin lending and on-chain collateralization become increasingly relevant. The initiative by Babylon Labs to create a Bitcoin-native ecosystem for collateral-backed loans is a testament to the growing demand for secure and efficient financial products. With innovations such as the injection of BABY tokens and collaborations with industry leaders like Aave Labs, the future of Bitcoin as a staking asset looks promising. This development not only addresses the liquidity issues of Bitcoin but also provides users with greater control and engagement in a rapidly expanding DeFi market.

Understanding Bitcoin Staking and Its Benefits

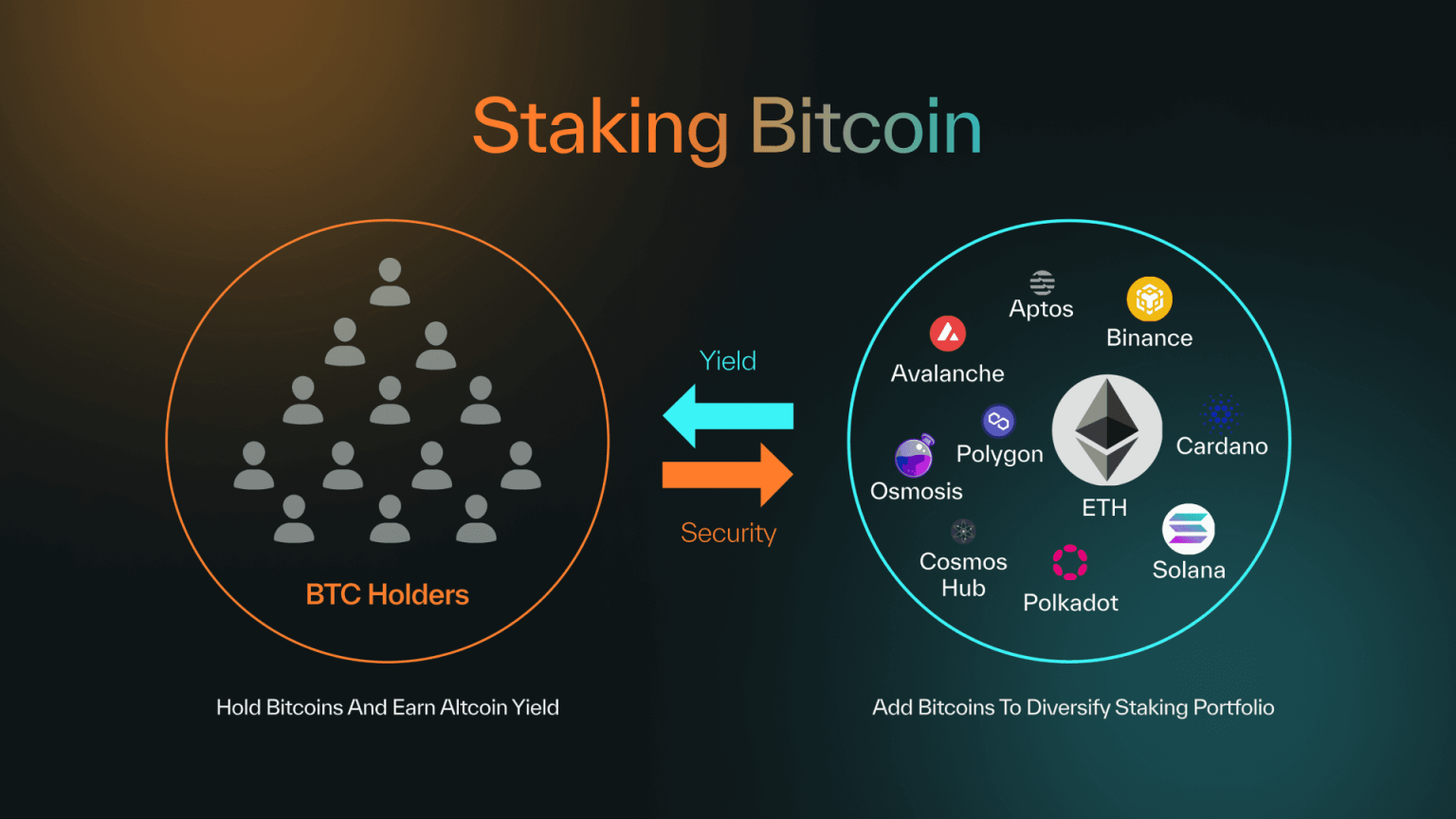

Bitcoin staking is emerging as a promising avenue for cryptocurrency enthusiasts looking to earn passive income while contributing to the security and functionality of the Bitcoin network. As the market evolves, decentralized finance (DeFi) protocols like Babylon are pioneering the integration of native Bitcoin staking, allowing users to stake their Bitcoin directly without needing intermediary platforms. This innovation not only incentivizes Bitcoin holders to actively participate in the network but also enhances the overall liquidity and usability of Bitcoin within the DeFi space.

Furthermore, the concept of staking aligns seamlessly with the principles of decentralization and trustlessness that DeFi champions. By engaging in Bitcoin staking, users can potentially earn rewards while supporting a robust financial ecosystem. The impact of Bitcoin staking goes beyond mere profit generation; it signifies the maturation of Bitcoin as not just a store of value but as an active participant in innovative financial services.

Frequently Asked Questions

What is Bitcoin staking and how does it relate to decentralized finance?

Bitcoin staking refers to the process of participating in the network by holding Bitcoin and earning rewards, similar to earning interest. It plays a crucial role in decentralized finance (DeFi) by providing liquidity and creating opportunities for users to lend their Bitcoin, thus increasing the overall functionality and usability of Bitcoin in DeFi applications.

How can Bitcoin be used as collateral in decentralized finance?

In decentralized finance, Bitcoin can be used as collateral by utilizing platforms like Babylon that allow users to secure loans using their Bitcoin holdings. This method unlocks the potential for Bitcoin to serve as a functional asset, enabling users to access funds without selling their holdings, while maintaining full control over their collateral.

What are BABY tokens and how do they facilitate Bitcoin lending?

BABY tokens are the native tokens of the Babylon protocol, designed to enhance Bitcoin lending functionalities. By investing in these tokens, users can support the development of a decentralized Bitcoin collateral ecosystem and participate in its growing marketplace, thereby enhancing the utilization of Bitcoin within the DeFi landscape.

What role does Aave Labs play in Bitcoin staking and lending?

Aave Labs collaborates with Babylon to integrate Bitcoin-backed lending within Aave’s lending platform. This partnership aims to create a dedicated Bitcoin-backed Spoke in Aave V4, allowing Bitcoin to be used as collateral without the complexities of custodianship or wrappers, thereby enhancing the staking and lending capabilities of Bitcoin within the DeFi ecosystem.

What security measures are being taken in Bitcoin lending following market events like the FTX collapse?

In response to the fallout from the FTX collapse, Bitcoin lending practices have shifted towards greater security, emphasizing full collateralization and stringent custody standards. This evolution aims to mitigate risks such as rehypothecation and excessive leverage, ensuring that Bitcoin holders can lend safely while maintaining the integrity of their assets.

How is the integration of Bitcoin staking expected to change the lending landscape in the coming years?

The integration of Bitcoin staking, exemplified by initiatives like Babylon’s collaboration with Aave Labs, is expected to revolutionize the lending landscape by allowing Bitcoin to be utilized more effectively as collateral. This shift will enhance on-chain capital utilization, driving innovation and liquidity in the decentralized finance sector.

| Key Point | Detail |

|---|---|

| Funding Acquisition | Babylon secured $15 million from a16z Crypto through the purchase of BABY tokens. |

| Purpose of Funding | The funding will enhance the development of a Bitcoin-native lending infrastructure. |

| Decentralized Protocol | Babylon aims to create a trustless Bitcoin collateral ecosystem. |

| Lending Objective | Enable Bitcoin to be used as collateral, unlocking on-chain capital opportunities. |

| Company Founders | Babylon was founded in 2022 by David Tse and Fisher Yu. |

| Partnerships | Babylon has partnered with Aave Labs to introduce Bitcoin-backed lending. |

| Latest Developments | Testing for integration into Aave V4 is set for early 2026. |

| Market Context | Post-FTX, lending practices are shifting towards enhanced security and full collateralization. |

| Token Price Reaction | The price of the BABY token increased by about 5% following the funding announcement. |

Summary

Bitcoin staking is emerging as a transformative force within the decentralized finance landscape, particularly through the efforts of Babylon, a decentralized protocol that facilitates Bitcoin staking and lending. By unlocking the potential of native Bitcoin assets as collateral, Babylon is set to enhance the overall accessibility and usability of Bitcoin in lending markets. The proactive measures taken to secure funding and build partnerships are pivotal in addressing past challenges in the crypto lending space, ensuring that Bitcoin holders can engage in lending with full security and control.

Related: More from Bitcoin News | Gold, AI, Tech Stocks Lead as Bitcoin Fades | UBS Slides on US Stocks: Bitcoin’s Fate?