The Bitcoin Spot ETF has recently made headlines with a staggering net inflow of $471 million in just one day, showcasing its rising prominence within the cryptocurrency landscape. Leading this surge is BlackRock’s IBIT, which captured a remarkable $287 million, further solidifying its status in Bitcoin investments. With Fidelity’s ETF FBTC also contributing significantly with an inflow of $88.08 million, the overall interest in crypto investments is clearly escalating. As of now, the total net asset value of Bitcoin Spot ETFs stands at an impressive $116.95 billion, reflecting a robust market for institutional investors. This increasing adoption points to a bright future ahead for Bitcoin Spot ETFs, as they continue to attract substantial Bitcoin inflows and redefine the investment landscape.

In the realm of digital assets, the Bitcoin Spot ETF represents a revolutionary financial instrument that allows investors to gain exposure to Bitcoin’s price movements. Known by various terms, such as exchange-traded funds for cryptocurrencies, these investment vehicles are designed to make crypto investments more accessible to the public. Recent data highlights the remarkable engagement with these ETFs, particularly with major players like BlackRock and Fidelity making significant strides in this market. The impressive net asset value of these ETFs illustrates a burgeoning sector within financial markets, attracting both seasoned and new investors alike. As the crypto landscape evolves, understanding the dynamics of these investment tools becomes essential for anyone looking to navigate this exciting field.

The Growth of Bitcoin Spot ETFs in 2023

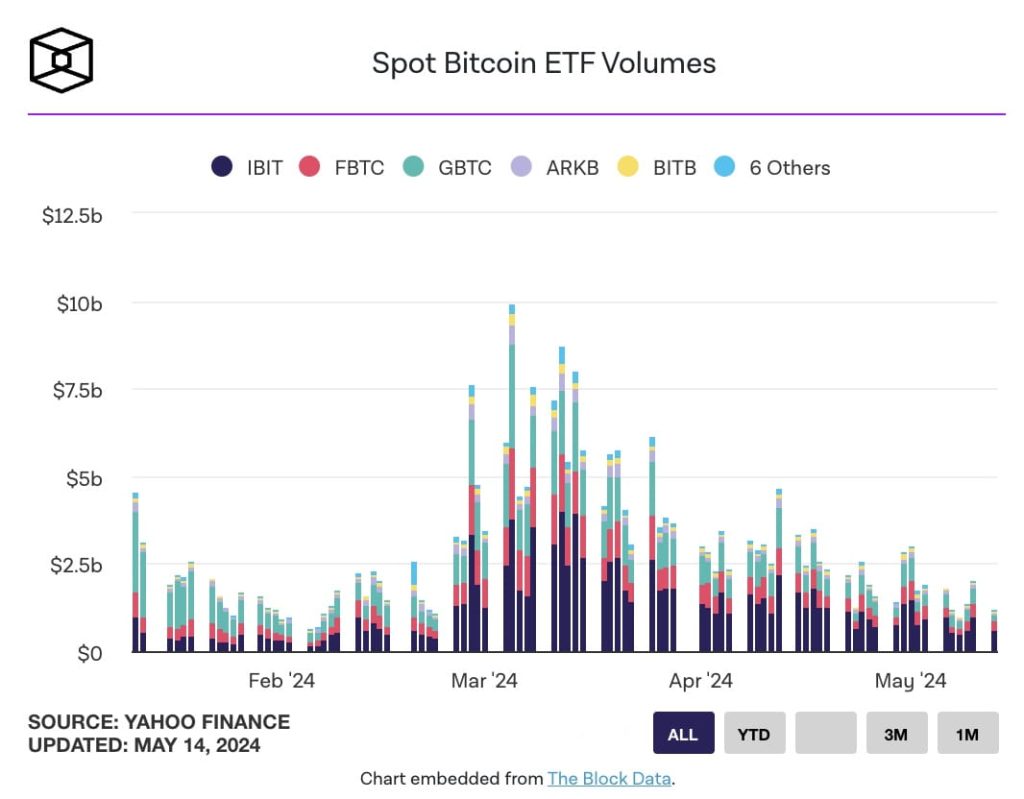

The Bitcoin Spot ETF market has experienced remarkable growth in 2023, attracting significant capital inflows that indicate a robust interest from investors. As of January 2nd, Bitcoin Spot ETFs reported a staggering total net inflow of $471 million. This substantial figure not only underscores the rising demand for crypto investments but also highlights the confidence investors have in Bitcoin as a valuable asset class. Key players like BlackRock’s IBIT, which led the way with a remarkable $287 million net inflow, are paving the path for institutional investment in cryptocurrencies.

Fidelity’s ETF, FBTC, also contributed to this influx with an impressive net inflow of $88.08 million, further showcasing the growing appeal of Bitcoin Spot ETFs among individual and institutional investors alike. With a total net asset value now sitting at $116.95 billion, Bitcoin Spot ETFs are swiftly becoming a prominent vehicle for investors seeking exposure to the digital currency market. This growth trend is not just isolated; it reflects a broader acceptance of cryptocurrency as a legitimate investment option.

BlackRock IBIT: Leading the Charge in Bitcoin Investments

BlackRock’s IBIT has emerged as a dominant force in the Bitcoin Spot ETF sector, embodying the surge in institutional interest in cryptocurrency. With a historical total net inflow soaring to $62.38 billion, IBIT’s impressive performance demonstrates the fund’s appeal among both institutional investors and retail traders. The recent net inflow of $287 million only adds to BlackRock’s reputation as a leader in navigating the rapidly evolving landscape of crypto investments, pointing to a growing belief that Bitcoin is not just a speculative asset, but a viable alternative for traditional investments.

As the largest asset management firm globally, BlackRock’s involvement in Bitcoin has significant implications for the cryptocurrency market. The firm’s strategic approach towards Bitcoin Spot ETFs affirms its commitment to providing investors with robust and compliant avenues for Bitcoin exposure. This proactive stance promotes a broader understanding and acceptance of Bitcoin, potentially leading to increased adoption and further robust inflows into BlackRock’s IBIT as well as other crypto-focused financial instruments.

Fidelity ETF’s Contribution to Bitcoin Market

Fidelity’s ETF FBTC has emerged as a significant participant in the Bitcoin Spot ETF market, highlighting increasing institutional interest in cryptocurrency. With a single-day net inflow of $88.08 million and a historical total net inflow of $12.20 billion, Fidelity’s entry into this space is a testament to the growing recognition of Bitcoin’s potential. These figures suggest that investors are increasingly viewing Bitcoin as a strategic addition to diversified portfolios, signaling a shift in market perceptions and encouraging further crypto investments.

The sustained inflows into Fidelity’s ETF reflect a broader trend of institutional adoption of Bitcoin. Fidelity, known for its dedication to innovation in financial products, has successfully attracted a diverse range of investors who seek exposure to the cryptocurrency market while maintaining the regulatory safeguards offered by ETFs. As competition in the ETF space grows, Fidelity’s progressive approach will likely drive more contributions to the overall net asset value of Bitcoin ETFs, reinforcing the momentum of Bitcoin’s evolving role in investment strategies.

The Significance of Bitcoin Inflows for Future Markets

The recent spike in Bitcoin inflows signifies a pivotal moment for the cryptocurrency market, as higher funds signify not only investor confidence but also a shift in market dynamics. The total net inflow of $471 million for Bitcoin Spot ETFs indicates a vibrant market environment where both institutional and retail investors are willing to engage with Bitcoin actively. This influx not only supports Bitcoin’s price stability but also enhances its credibility as an asset class, providing a foundation for future growth and investment.

Moreover, the cumulative net inflows reaching $57.08 billion highlight a growing trend towards cryptocurrencies as a whole, which may influence future market regulations and the adoption of additional financial products related to digital assets. As Bitcoin inflows continue to rise, we can expect to see innovative financial products emerging, further integrating cryptocurrencies into traditional investment portfolios and enhancing their legitimacy in the financial ecosystem.

Understanding ETF Net Asset Value in Bitcoin Investments

The total net asset value of Bitcoin Spot ETFs is currently pegged at $116.95 billion, a figure that showcases the industry’s growth and the increasing value assigned to cryptocurrency investments. This substantial net asset value is critical for understanding the health of the cryptocurrency market, as it reflects investor dedication to Bitcoin as compared to other crypto investments. Furthermore, the ratio of an ETF’s net asset value to the total market cap of Bitcoin, currently at 6.53%, underscores the relative scale of ETF products versus the entire cryptocurrency ecosystem.

For investors, understanding ETF net asset value is essential when assessing the performance and potential return of Bitcoin investments. The NAV provides insights into market sentiment around bitcoin and can be used as an indicator for making informed investment decisions. As the market evolves, monitoring changes in ETFs’ net asset values will be vital for both investment strategies and predicting future trends in Bitcoin and cryptocurrency markets at large.

The Future of Bitcoin Spot ETFs and Investment Opportunities

The future of Bitcoin Spot ETFs appears bright as they continue to attract significant inflows. With institutions like BlackRock and Fidelity leading the charge, these ETFs are reshaping the investment landscape for cryptocurrencies. As these ETFs gain traction, investors will have a broader array of opportunities to participate in the crypto market while enjoying the regulatory and operational benefits associated with traditional investment vehicles.

As Bitcoin’s acceptance grows, we can expect to see more innovative products entering the market, designed to cater to both traditional and digital asset investors. The increasing participation of institutions signals a maturing market that could lead to more stable price movements and reduced volatility. By following the trends in Bitcoin Spot ETFs, investors can position themselves to capitalize on upcoming opportunities while managing risks effectively.

The Role of Cryptocurrency in Diversified Portfolios

As cryptocurrencies gain a foothold in the financial markets, their role in diversified portfolios is becoming increasingly relevant. Bitcoin, as the premier cryptocurrency, is often viewed as a hedge against inflation and market volatility, making it a desirable asset for a well-rounded investment strategy. The influx of capital into Bitcoin Spot ETFs demonstrates a growing recognition of this potential among investors who are diversifying their portfolios to include digital assets alongside traditional investments.

Incorporating Bitcoin into investment portfolios can enhance overall performance, especially in times of economic uncertainty. With significant inflows into Bitcoin Spot ETFs, investors are starting to embrace the benefits that cryptocurrencies can offer. As institutional interest grows, and more products like Bitcoin Spot ETFs are developed, the narrative around cryptocurrency as a legitimate asset class will likely continue to evolve, solidifying its place in investment strategies.

Tax Implications of Bitcoin Spot Investments

As interest in Bitcoin and Bitcoin Spot ETFs grows, it’s essential for investors to understand the tax implications associated with these cryptocurrency investments. Bitcoin is classified as property by the IRS, which means that transactions can trigger capital gains taxes. This necessity to accurately report gains and losses makes it crucial for investors to stay informed about tax regulations relating to Bitcoin investments. Implementing proper record-keeping practices for any transactions through Bitcoin Spot ETFs will be important for adherence to tax laws.

Furthermore, investors should also consider the tax benefits that can accompany investments in Bitcoin Spot ETFs, such as holding them in tax-advantaged accounts. Strategies for managing tax liabilities can maximize the investment returns and minimize the taxable impact of capital gains. As the market continues to evolve, understanding these tax implications will be critical for investors looking to capitalize on the growing presence of Bitcoin in their investment strategies.

Comparing Bitcoin Spot ETFs and Traditional ETFs

Bitcoin Spot ETFs are often compared to traditional ETFs, particularly regarding their structural differences and the cryptocurrencies they manage. While traditional ETFs typically invest in stocks, bonds, or other securities, Bitcoin Spot ETFs focus solely on Bitcoin, offering investors direct exposure to the leading cryptocurrency. This unique positioning provides a different risk-profile and opportunity for returns that are linked more closely to the volatility of the cryptocurrency market.

Furthermore, with traditional ETFs, investors might experience variations in performance based on the underlying assets different from the assets held by Bitcoin Spot ETFs. As the demand for digital assets increases, more investors are beginning to see Bitcoin Spot ETFs as an alternative to conventional ETFs, primarily due to their potential for high returns and the myriad of options available for investment.

Frequently Asked Questions

What is the significance of the BlackRock IBIT in Bitcoin Spot ETF inflows?

BlackRock’s IBIT has played a crucial role in the Bitcoin Spot ETF landscape, showcasing a significant net inflow of $287 million in a single day. This positions it as a leader among Bitcoin Spot ETFs, reflecting strong interest in crypto investments and increasing effectiveness in capturing Bitcoin inflows.

How do Bitcoin Spot ETFs, including Fidelity’s FBTC, impact market dynamics?

Bitcoin Spot ETFs such as Fidelity’s FBTC influence market dynamics by attracting substantial investor capital. FBTC recorded a net inflow of $88.08 million recently, contributing to its total net inflow of $12.20 billion. These inflows indicate growing acceptance and integration of crypto investments into mainstream finance.

What are the current total net asset values for Bitcoin Spot ETFs?

As of now, the total net asset value for Bitcoin Spot ETFs is approximately $116.95 billion. This figure indicates the collective value of assets held within these ETFs, reflecting the increasing demand for crypto investments within regulated financial markets.

What does the net asset ratio of Bitcoin Spot ETFs signify?

The ETF net asset ratio for Bitcoin Spot ETFs stands at 6.53%, representing the market value of these ETFs compared to Bitcoin’s entire market capitalization. A higher ratio suggests significant investor confidence in Bitcoin Spot ETFs as reliable investment vehicles for crypto assets.

How have historical cumulative net inflows into Bitcoin Spot ETFs changed?

The historical cumulative net inflow into Bitcoin Spot ETFs has reached $57.08 billion, highlighting a robust trend in investor interest and confidence in crypto investments, particularly as ETFs like BlackRock IBIT and Fidelity FBTC lead substantial inflows.

| ETF Name | Single-Day Net Inflow (Million $) | Historical Total Net Inflow (Billion $) |

|---|---|---|

| BlackRock IBIT | 287 | 62.38 |

| Fidelity FBTC | 88.08 | 12.20 |

Summary

The recent activity surrounding the Bitcoin Spot ETF highlights its significant growth, with total net inflows reaching $471 million. As demonstrated by BlackRock’s IBIT leading the charge, the increasing interest from investors underscores the ETF’s potential for growth and its relevance in the cryptocurrency market.

Related: More from Bitcoin News | BTC ETFs See $1.1B Inflows in Three Days, Set for Biggest Week | ETF Holders Preempt Potential Bitcoin Price Drop Below $60K