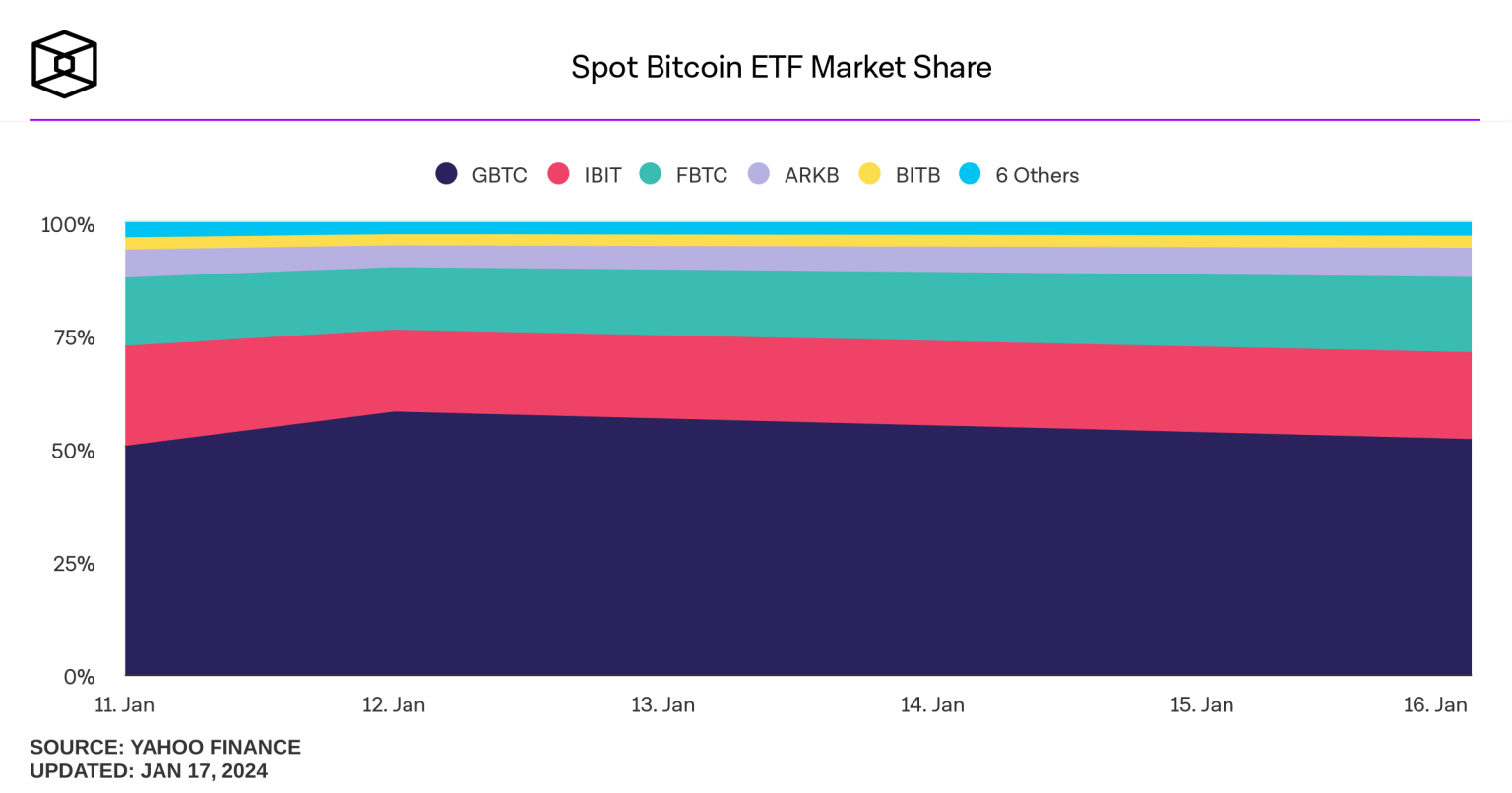

The Bitcoin spot ETF is gaining significant traction in the financial markets, evidenced by an impressive net inflow of $355 million yesterday alone. This surge marks a notable shift from the previous week’s net outflows, attracting attention from both institutional and retail investors alike. Notably, the Blackrock ETF IBIT led the charge with a remarkable net inflow of $144 million, amplifying its total net inflow to a staggering $62.192 billion. Following closely, the Ark Invest ETF, in collaboration with 21Shares, recorded a net inflow of $110 million, lifting its historical total to $1.710 billion. As the landscape for cryptocurrency investment continues to evolve, the Bitcoin spot ETF stands at the forefront, showcasing a total net asset value of $114.439 billion and a Net Asset Ratio of 6.52%.

In recent developments, the exchange-traded fund centered around Bitcoin has seen a remarkable uptick in investment activity, with yesterday’s reported inflow of $355 million marking a significant recovery. This resurgence in capital flow highlights the growing interest in Bitcoin-focused funds, especially from prominent financial players like the Blackrock ETF IBIT and Ark Invest’s offerings. These funds are becoming pivotal in channeling investments into the cryptocurrency space, contributing to a broader acceptance of digital currencies in traditional finance. The increase in net Bitcoin inflows not only reflects investor confidence but also positions these ETFs as vital instruments for market participation. With the rapid evolution of digital asset management, the Bitcoin spot ETF is redefining investment strategies for both seasoned investors and newcomers alike.

Understanding Bitcoin Spot ETF Inflows

The Bitcoin spot ETF has recently made headlines with a remarkable net inflow of $355 million in just one day, marking a significant shift in market dynamics. This influx indicates renewed confidence in Bitcoin as an investment vehicle, particularly amidst fluctuating market conditions. The total net inflow for Bitcoin spot ETFs is a crucial metric for investors, as it reflects the growing interest in cryptocurrency investments and the evolving landscape of digital asset management.

The influx of funds into the Bitcoin spot ETF can be attributed to several factors, including institutional adoption and increased accessibility for retail investors. Firms such as Blackrock with their IBIT ETF and Ark Invest’s ETFs are instrumental in driving these net inflows. Their strategic positions and trust within the financial community encourage more participants to invest in Bitcoin, thus validating the demand for spot ETFs in the cryptocurrency sector.

The Impact of Blackrock ETF IBIT on Bitcoin Investments

The Blackrock ETF IBIT has emerged as a leader in the Bitcoin spot ETF space, boasting a net inflow of $144 million yesterday alone. This impressive figure adds to its historical total net inflow, now standing at an astounding $62.192 billion, reinforcing its status as a dominant player in cryptocurrency investments. By effectively managing these assets, Blackrock has set a benchmark for other ETFs, attracting more investors eager to capitalize on Bitcoin’s potential.

The role of the Blackrock ETF IBIT is pivotal, as it not only showcases a lucrative opportunity for institutional investors but also enhances the credibility of Bitcoin in traditional finance. This ETF’s success can stimulate further net inflows into the cryptocurrency market as real-time data and performance metrics demonstrate the viability of Bitcoin investments. As other ETFs, like Ark Invest’s offerings, strive for similar success, the landscape of cryptocurrency investments continues to evolve.

The Role of Ark Invest ETF in Bitcoin Growth

Ark Invest’s ETF, known for its innovative approach to investment, reported a significant net inflow of $110 million, contributing to its total historical net inflow of $1.710 billion. This performance highlights Ark Invest’s commitment to expanding its portfolio to include leading cryptocurrencies. Their analytical methodologies and emphasis on disruptive technologies resonate well with forward-thinking investors, ensuring consistent influxes to their ETFs.

Moreover, the success of Ark Invest’s ETF emphasizes the growing trend of institutional funds flowing into Bitcoin and other digital assets. As more investors recognize the potential of cryptocurrency investments, platforms like Ark Invest serve as critical entry points, offering diversified portfolios that mitigate risks while exploring the crypto market. Their approach exemplifies the blend of traditional investment strategies with modern digital asset management.

Total Net Asset Value of Bitcoin Spot ETFs

As of the latest data, the total net asset value of Bitcoin spot ETFs has reached $114.439 billion. This figure indicates not only the current state of investment within these assets but also a reflective measure of market sentiment towards the overall cryptocurrency environment. The significant valuation suggests that Bitcoin remains a strong attraction for both institutional and retail investors.

The Net Asset Ratio of 6.52% demonstrates the proportion of Bitcoin’s market value relative to its total market cap, signaling robust performance despite market volatility. The increase in total net assets underlines a broader trend where both seasoned investors and newcomers are increasingly recognizing Bitcoin as an integral part of their investment strategy. Monitoring these metrics closely can provide valuable insights into future trends in cryptocurrency investments.

Historical Trends of Bitcoin ETF Inflows

Historically, Bitcoin ETF inflows have showcased significant volatility coinciding with market cycles, investor sentiment, and regulatory developments. The cumulative net inflow currently stands at $56.961 billion, which emphasizes a growing acceptance and integration of Bitcoin into mainstream financial portfolios. Understanding these trends is crucial for prospective investors looking to navigate the tides of the cryptocurrency market.

Moreover, the historical patterns of inflows highlight key moments when investor confidence surged or waned, often in response to market events or regulatory changes. Recognizing these patterns allows investors to make informed decisions regarding their cryptocurrency investments, leveraging past data as a foundation for future market strategies. The journey of Bitcoin ETFs thus far presents a compelling narrative of resilience and opportunity.

The Importance of Cryptocurrency Investment in Today’s Market

Cryptocurrency investment has become increasingly crucial in today’s financial landscape, with Bitcoin leading the charge as a viable asset class. The influx of capital into Bitcoin spot ETFs illustrates a shift among investors towards digital assets, driven by the promise of high returns and portfolio diversification. As traditional assets encounter disruptions, cryptocurrencies like Bitcoin offer alternatives that are gaining traction on a global scale.

This trend is further fueled by technological advancements and increased accessibility to crypto trading platforms. Investors are now more equipped to navigate this burgeoning market, with options ranging from direct Bitcoin purchases to investments through ETFs like Blackrock IBIT and Ark Invest. These factors collectively contribute to an expanding universe of cryptocurrency investments, which continue to redefine conventional investment strategies and challenge traditional financial paradigms.

Future Prospects for Bitcoin ETFs and Investments

Looking ahead, the prospects for Bitcoin ETFs appear promising, particularly with the continuous growth in net inflows and market interest. As regulatory frameworks evolve and more institutional players enter the space, Bitcoin is expected to solidify its position as a key asset in diversified portfolios. This expansion may also lead to enhanced liquidity and stability within the market, benefiting both individual and institutional investors alike.

Furthermore, the innovation within cryptocurrency financial products such as spot ETFs is likely to catalyze further investments. As platforms continue to emerge with unique strategies to leverage Bitcoin’s potential, we may see an influx of new investors who recognize the digital asset’s long-term value. Consequently, the future landscape of Bitcoin investments is poised for significant transformation, driven by increasing acceptance and technological advancements.

Investor Strategies for Capitalizing on Bitcoin Spot ETFs

As the Bitcoin spot ETF landscape evolves, investors must develop strategies to maximize their capitalizing potential. Reviewing historical net inflows and assessing which funds, like the Blackrock ETF IBIT and Ark Invest ETF, offer solid growth opportunities is essential for making informed decisions. Investors should analyze the performance metrics alongside market trends, ensuring they stay attuned to changes that may influence their investments.

Additionally, diversifying investments within cryptocurrencies can mitigate risk while enhancing the potential for returns. Taking advantage of Bitcoin spot ETFs allows investors to access the asset class conveniently while benefiting from professional management. By implementing a strategic approach that includes regular portfolio reassessments and adaptability to market shifts, investors can position themselves favorably in the evolving cryptocurrency landscape.

Navigating Market Volatility in Bitcoin Investments

In the unpredictable world of cryptocurrency, market volatility is a constant factor influencing investor behavior. With the Bitcoin spot ETF experiencing significant net inflows, understanding how to navigate these fluctuations is crucial. Awareness of market trends and historical data can empower investors to make calculated decisions during periods of turbulence, ultimately safeguarding their investments. A strong emphasis on research and analysis often yields a better outcome for those engaging with Bitcoin and related assets.

Additionally, employing risk management techniques is paramount in combating volatility’s adverse effects. Diversifying across multiple ETFs and crypto assets can provide a cushion against market downturns, allowing investors to remain anchored even when conditions fluctuate. By embracing a proactive approach towards volatility analysis combined with strategic asset allocation, investors can thrive within the dynamic realm of cryptocurrency investments.

Frequently Asked Questions

What is a Bitcoin spot ETF and how does it relate to cryptocurrency investment?

A Bitcoin spot ETF is an exchange-traded fund that invests directly in Bitcoin, allowing investors to buy shares that represent actual ownership of Bitcoin. This type of ETF supports cryptocurrency investment by making it easier for investors to gain exposure to Bitcoin’s price movements without needing to purchase the cryptocurrency directly.

How did the Bitcoin ETF inflow change recently?

Recently, the Bitcoin spot ETF experienced a significant shift from a net outflow to a net inflow, with a total net inflow of $355 million reported on December 30. This marked a positive trend in investor interest and confidence in Bitcoin ETFs.

What factors contributed to the increase in net inflow for Bitcoin spot ETFs?

The increase in net inflow for Bitcoin spot ETFs, particularly the Blackrock ETF IBIT and Ark Invest ETF, can be attributed to growing institutional interest in cryptocurrency investments, as evidenced by Blackrock’s net inflow of $144 million and Ark Invest’s $110 million in a single day.

How does the Blackrock ETF IBIT compare to other Bitcoin spot ETFs in terms of net inflow?

The Blackrock ETF IBIT had the largest single-day net inflow among Bitcoin spot ETFs, attracting $144 million on December 30. This compares favorably to other ETFs, such as the Ark Invest ETF, which saw a net inflow of $110 million, showcasing strong competitive performance in the market.

What is the total net asset value of Bitcoin spot ETFs currently?

As of December 30, the total net asset value of Bitcoin spot ETFs stands at $114.439 billion, reflecting the growing popularity and investment in this sector of the cryptocurrency market.

What is the historical cumulative net inflow for Bitcoin spot ETFs?

The historical cumulative net inflow for Bitcoin spot ETFs has reached $56.961 billion, indicating strong long-term interest and investment in Bitcoin through these financial instruments.

How does the Net Asset Ratio of Bitcoin spot ETFs impact investor decisions?

The Net Asset Ratio for Bitcoin spot ETFs reached 6.52%, which is the ratio of market value to Bitcoin’s total market cap. This ratio is crucial for investors as it helps them understand the proportion of Bitcoin’s value being captured by the ETFs, influencing their decisions on whether to invest in Bitcoin ETF products.

What are the key advantages of investing in a Bitcoin spot ETF like the Ark Invest ETF?

Investing in a Bitcoin spot ETF, such as the Ark Invest ETF, offers several advantages, including easier access to Bitcoin exposure, potential diversification benefits, and the ability to invest in a regulated financial product without having to manage the complexities of owning Bitcoin directly.

| Metric | Value |

|---|---|

| Total Net Inflow (December 30) | $355 million |

| Top ETF (Blackrock IBIT) Net Inflow | $144 million |

| Cumulative Net Inflow (Blackrock IBIT) | $62.192 billion |

| Second ETF (ARKB) Net Inflow | $110 million |

| Cumulative Net Inflow (ARKB) | $1.710 billion |

| Total Net Asset Value of Bitcoin Spot ETFs | $114.439 billion |

| Net Asset Ratio | 6.52% |

| Historical Cumulative Net Inflow | $56.961 billion |

Summary

The Bitcoin spot ETF experienced a remarkable resurgence with a total net inflow of $355 million yesterday, signaling a shift from prior net outflows. The data indicates significant investor interest, especially in ETFs like the Blackrock ETF IBIT and ARKB from Ark Invest. This trend not only highlights the growing acceptance of Bitcoin in institutional finance but also affirms the increasing market capitalization of Bitcoin spot ETFs, which now stand at a net asset value of $114.439 billion. As Bitcoin continues to evolve, the success of spot ETFs could play a crucial role in shaping its future trajectory.

Related: More from Bitcoin News | BTC Price Revisits Historic Low: Crypto Daybook Americas in Bitcoin | BTC, ETH, SOL Drop; DECR, AI Tokens Surge in Bitcoin