In a notable shift within the cryptocurrency market, the recent Bitcoin spot ETF net inflow has garnered attention with a remarkable figure of $54.7896 million as reported on December 5. Leading the pack was the ARK Invest and 21Shares ETF, ARKB, which boasts a staggering daily inflow of $42.7938 million, elevating its total net inflow to an impressive $1.75 billion. Following closely was Fidelity’s ETF, FBTC, securing a daily net inflow of $27.2884 million, contributing to a historical total of $12.091 billion. However, the landscape isn’t all positive, as Blackrock’s ETF IBIT faced a significant outflow of $32.4928 million. Overall, the total net asset value of Bitcoin spot ETFs stands at an impressive $117.109 billion, underscoring the growing interest and investment within this innovative sector.

The recent developments in the market for Bitcoin exchange-traded funds (ETFs) illustrate significant financial movements as investors navigate their options. The latest data reveals staggering figures related to daily inflows for Bitcoin ETFs, with major players like ARK Invest and Fidelity leading the way. Notably, while certain ETFs experience remarkable gains, others like Blackrock’s ETF have seen net outflows, highlighting the volatility of investor sentiment. As the total net asset value of these Bitcoin investment vehicles continues to rise, tracking metrics like cumulative inflows remains crucial for market analysts and enthusiasts. Understanding these dynamics is essential for anyone looking to explore the burgeoning cryptocurrency investment landscape.

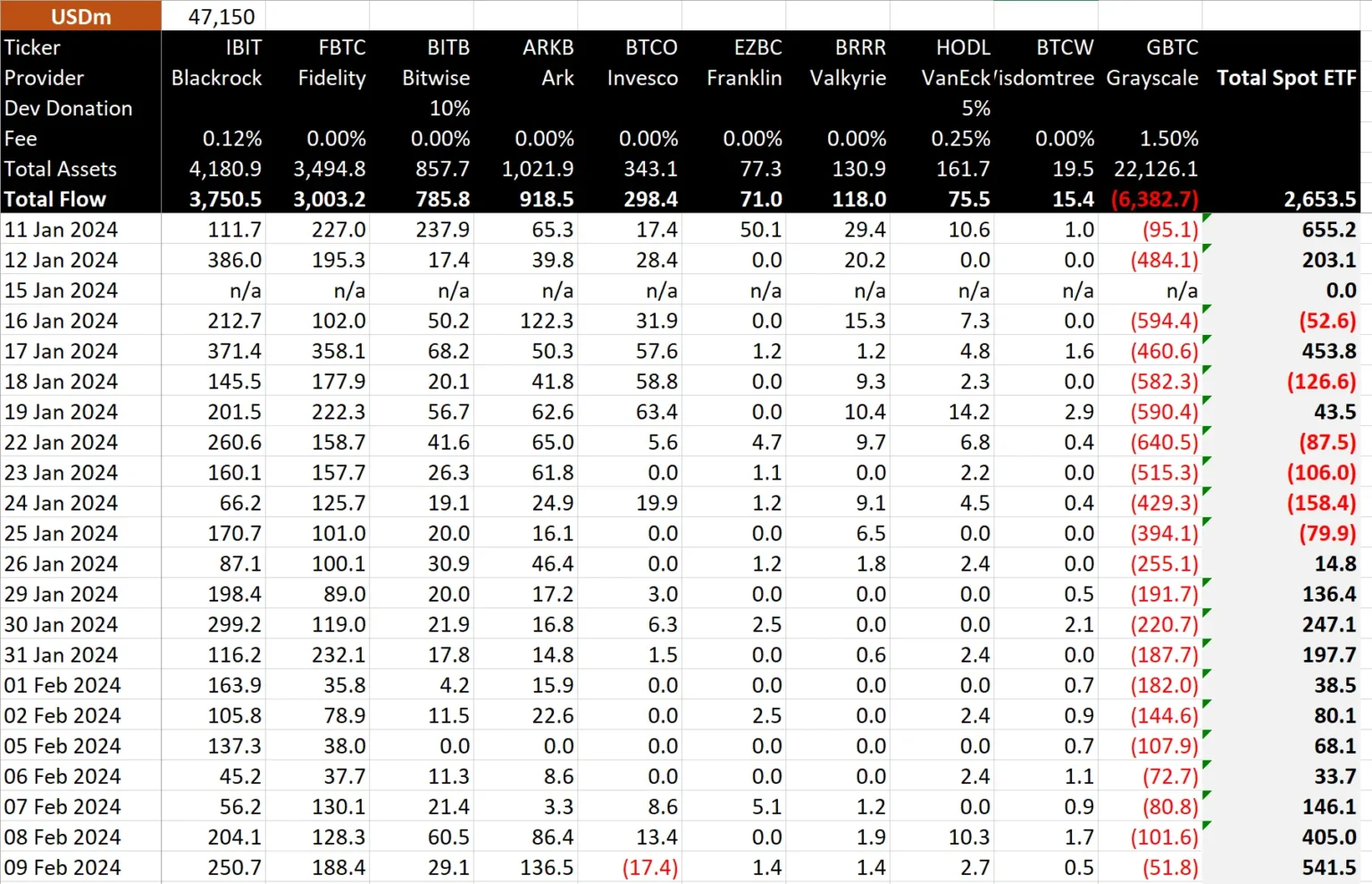

Understanding Bitcoin Spot ETF Net Inflow

In recent developments, the Bitcoin spot ETF net inflow reached a significant milestone, totaling $54.7896 million as of December 5, as per SoSoValue data. This influx is a strong indicator of growing institutional interest in Bitcoin, particularly through regulated financial products such as exchange-traded funds (ETFs). The Bitcoin ETF daily inflow not only reflects market trends but also showcases investor confidence in Bitcoin as a robust asset class.

The dynamics of Bitcoin spot ETFs are notably influenced by major players in the market. For instance, the ARK Invest and 21Shares ETF, known as ARKB, commanded the highest net inflow yesterday with $42.7938 million. This robust inflow adds to ARKB’s historical total, bringing it to an impressive $1.75 billion. Such substantial inflows from reputable firms like ARK Invest enhance the overall credibility and appeal of Bitcoin ETFs among both retail and institutional investors.

Key Players in the Bitcoin ETF Market

The arena of Bitcoin ETFs is increasingly shaped by prominent investment firms. The latest data reveals that Fidelity’s ETF, identified as FBTC, also contributed to the strong inflows with a daily net addition of $27.2884 million, bringing its historical total net inflow to an astounding $12.091 billion. Fidelity’s presence in the market is pivotal, as its strategies are closely watched by investors keen on diversifying into cryptocurrencies through regulated channels.

On the other hand, not all firms saw positive trends. Blackrock’s ETF, IBIT, experienced a notable net outflow of $32.4928 million. Despite this setback, it still maintains a large historical total net inflow of $62.517 billion. This contrasting performance highlights the volatile nature of ETF investments and the influence of market sentiment on the inflows and outflows within this niche.

The Impact of Institutional Interest on Bitcoin ETFs

Institutional interest is playing a crucial role in influencing Bitcoin ETF activities. With the total net inflow reaching $54.7896 million, this trend underscores a broader recognition of Bitcoin as an investment vehicle. The significant daily contributions from ETFs like ARKB and FBTC indicate increasing confidence from institutional investors, who often seek out such products for their regulatory clarity and potential for long-term gains.

Moreover, the historical cumulative net inflow for Bitcoin ETFs has ascended to $57.617 billion, signaling a robust appetite for these vehicles in the investment community. This rising tide of institutional backing not only bolsters Bitcoin’s perceived value but also impacts its overall market dynamics, creating a more attractive environment for potential investors looking to enter the cryptocurrency space.

Analyzing Bitcoin ETF Daily Inflows

Examining the Bitcoin ETF daily inflows presents a nuanced picture of market sentiment and investor behavior. As mentioned, the total daily inflow reached $54.7896 million with ARKB leading the charge. The dynamic between various ETFs, including Fidelity’s FBTC and Blackrock’s IBIT, illustrates the shifting landscape where investor preferences are continually evolving in response to market conditions.

The fluctuations in daily inflows are closely linked to broader macroeconomic trends and cryptocurrency market movements. For instance, positive news surrounding regulatory developments or Bitcoin’s price performance can catalyze substantial inflows. Understanding these daily movements is essential for investors looking to capitalize on the trends within the Bitcoin ETF space.

The Role of ETF Asset Ratios in Bitcoin Investments

The ETF net asset ratio, which currently stands at 6.57% relative to Bitcoin’s total market value, offers insights into how much of the cryptocurrency’s market capitalization is held within ETFs. This ratio serves as a benchmark for examining the growth and adoption of Bitcoin as an investment vehicle compared to its overall market performance.

As the total net asset value of Bitcoin spot ETFs reaches $117.109 billion, the significance of this asset ratio cannot be understated. Such figures highlight how ETFs are becoming increasingly integrated into the cryptocurrency investment landscape, thereby contributing to Bitcoin’s liquidity and overall market viability. Investors often look to these ratios as indicators of market health and potential growth opportunities.

Evaluating the Performance of Leading Bitcoin ETFs

Evaluating the performance of leading Bitcoin ETFs provides valuable insight for potential investors. For example, the ARK Invest’s ARKB ETF has proven to be a leader in terms of daily inflow, consistently attracting investor capital due to its innovative investment strategies and strong market positioning. Its robust performance can serve as a model for other ETFs aiming to capture market share in the rapidly evolving cryptocurrency space.

Conversely, examining the performance of ETFs that experience net outflows, such as Blackrock’s IBIT, can reveal underlying issues that may affect investor confidence. The market reacts to the overall performance and strategies of these ETFs, and as more investors weigh the options available to them, only those that can sustain positive net inflow momentum are likely to thrive.

The Historical Growth of Bitcoin ETF Inflows

The historical growth of Bitcoin ETF inflows is a testament to the increasing acceptance of cryptocurrencies by traditional investors. Accumulating a staggering historical total of $57.617 billion in net inflows demonstrates the institutional drive toward Bitcoin as a viable asset class. This trend reflects a larger societal shift as more investors seek exposure to digital assets through regulated channels.

Comparing this with daily inflow data shows a consistent pattern of growth, particularly from leading firms such as ARK Invest and Fidelity. The sustained interest in these ETFs suggests a broader trend of diversification among investors who are looking for innovative ways to include Bitcoin in their portfolios without directly holding the cryptocurrency.

Institutional Strategies Behind Bitcoin ETF Investments

Institutional strategies behind Bitcoin ETF investments are critical to understanding market behavior. The inflows from funds like ARKB and FBTC indicate that institutional players are crafting tailored strategies for cryptocurrency investments, reflecting their long-term outlook on Bitcoin’s potential. These strategies focus not just on immediate gains but also on cultivating a presence in an asset class that is increasingly seen as essential for diversification.

Moreover, firms like Fidelity and ARK Invest are pioneering new investment methodologies that can adapt to the evolving crypto landscape. Their proactive approaches to fund management in this volatile market are indicative of a sophisticated understanding of risk, an essential factor for successful institutional participation in Bitcoin investment.

Future Prospects for Bitcoin ETFs

The future prospects for Bitcoin ETFs appear bright as institutional investment continues to grow. As seen with the substantial net inflows and the rising historical values of ETFs, it is evident that confidence in Bitcoin as an investment tool is solidifying. The influx of institutional capital is likely to enhance the stability and maturity of the cryptocurrency market, making it a more attractive option for both individual and institutional investors alike.

Looking ahead, the ability of Bitcoin ETFs to adapt and innovate will be crucial. Trends such as increased regulatory clarity or the introduction of new financial products may further drive the acceptance of Bitcoin in mainstream finance. As long as the momentum shifts positively, the relationship between Bitcoin and ETF performances is bound to strengthen, creating numerous opportunities for savvy investors.

Frequently Asked Questions

What was the Bitcoin spot ETF net inflow on December 5, 2023?

On December 5, 2023, the Bitcoin spot ETF net inflow reached $54.7896 million according to SoSoValue data.

Which Bitcoin ETF had the highest daily inflow recently?

The ARK Invest and 21Shares ETF (ARKB) had the highest daily inflow, totaling $42.7938 million on December 5, 2023.

How much has Fidelity’s Bitcoin ETF inflow increased?

Fidelity’s Bitcoin ETF, FBTC, saw a daily inflow of $27.2884 million, bringing its historical total net inflow to $12.091 billion.

What is the current net asset value of Bitcoin spot ETFs?

As of now, the total net asset value of Bitcoin spot ETFs stands at $117.109 billion.

What was the net outflow for Blackrock’s Bitcoin ETF yesterday?

Blackrock’s ETF (IBIT) experienced a net outflow of $32.4928 million on December 5, 2023.

How does the Bitcoin total net asset value relate to its ETF net inflow?

The Bitcoin total net asset value reflects the current value of Bitcoin in ETFs, which, as of now, is $117.109 billion, with historical cumulative net inflow reaching $57.617 billion.

What percentage of Bitcoin’s total market value is represented by Bitcoin ETFs?

Bitcoin spot ETFs represent 6.57% of Bitcoin’s total market value, indicating their growing significance in the market.

What are the historical cumulative net inflows for Bitcoin spot ETFs?

The historical cumulative net inflow for Bitcoin spot ETFs has reached $57.617 billion, highlighting the significant interest in these investment vehicles.

| Description | Value |

|---|---|

| Total Net Inflow of Bitcoin Spot ETFs (Dec 5) | $54.7896 million |

| Highest Net Inflow ETF | ARK Invest and 21Shares ETF (ARKB) – $42.7938 million |

| ARKB Historical Total Net Inflow | $1.75 billion |

| Second Highest Net Inflow ETF | Fidelity ETF (FBTC) – $27.2884 million |

| FBTC Historical Total Net Inflow | $12.091 billion |

| Largest Net Outflow ETF | Blackrock ETF (IBIT) – $32.4928 million |

| IBIT Historical Total Net Inflow | $62.517 billion |

| Total Net Asset Value of Bitcoin Spot ETFs | $117.109 billion |

| ETF Net Asset Ratio | 6.57% |

| Historical Cumulative Net Inflow | $57.617 billion |

Summary

The Bitcoin spot ETF net inflow reached a significant total of $54.7896 million on December 5, showcasing strong investor interest in these financial products. ARK Invest and 21Shares’ ETF, ARKB, led the market with a notable inflow of $42.7938 million, reflecting its popularity and trust among investors, while Fidelity’s FBTC also contributed with $27.2884 million. However, Blackrock’s IBIT experienced the largest outflow of $32.4928 million, suggesting shifts in investor preferences. Overall, Bitcoin spot ETFs demonstrate a growing market presence, as evidenced by their total net asset value of $117.109 billion.