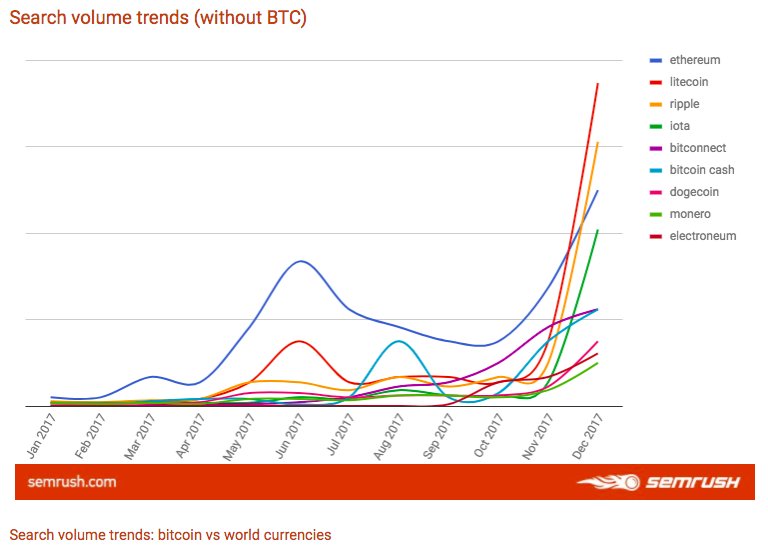

Bitcoin search volume has seen a significant uptick recently, particularly as the price of the asset dipped to the crucial $60,000 threshold, garnering attention from both seasoned investors and new entrants in the cryptocurrency market. Google search interest in Bitcoin has spiked, indicating a strong correlation between price fluctuations and retail interest, especially during critical market movements such as the descent below $100,000 for the first time in months. As analysts conduct Bitcoin price analysis, they emphasize that these search trends can reveal valuable insights into cryptocurrency sentiment and influence potential forecast trends. The crypto market is notoriously volatile, and such spikes in search volume can often anticipate major movements or shifts in investor behavior. With Bitcoin’s price rebounding back to roughly $70,740, the current surge in search volume suggests a renewed curiosity, highlighting the dynamic pulse of the cryptocurrency landscape.

The recent uptick in searches for Bitcoin reflects a growing fascination with the digital currency amidst fluctuating market conditions. This interest is often closely monitored as it offers clues about retail engagement and the overall mood of cryptocurrency trading. Analysts frequently use tools like Google search statistics to analyze the relationship between Bitcoin’s price volatility and consumer interest, which acts as a barometer for broader crypto market trends. As traders witness the asset’s movements, they turn to online platforms to gain insights and engage with discussions related to the current price dynamics. This surge in public curiosity underscores the ongoing evolution of Bitcoin as a leading player within the cryptocurrency sphere.

| Key Point | Details |

|---|---|

| Surge in Search Volume | Google search volume for ‘Bitcoin’ has surged following a drop in its price. |

| Significant Price Drop | Bitcoin’s price briefly fell to $60,000, marking its first time below this level since October 2024. |

| Previous Peak in Interest | The highest search interest was recorded at a score of 95 during the week of Nov. 16–23 when Bitcoin fell below $100,000. |

| Retail Interest Indicators | Crypto analysts often use search interest as a gauge of retail interest in Bitcoin, which spikes during significant price changes. |

| Current Market Sentiment | Despite the price fall, some argue that the current price range is drawing the attention of a broader retail audience. |

| Caution Among Investors | According to sentiment indicators, many investors remain cautious, indicating potential buying opportunities. |

Summary

Bitcoin search volume has seen a significant increase recently, reflecting heightened public interest following the cryptocurrency’s recent price fluctuations. As Bitcoin’s value dipped to around $60,000, this triggered a surge in searches that analysts believe signifies a renewed interest from retail investors. Even with Bitcoin’s notable drop of 15.51% over the past week, the current market dynamics indicate that many see potential for growth, especially amid volatility. The interplay of these factors suggests that the search volume for Bitcoin will likely remain a critical metric for gauging public sentiment and investment interest in the months to come.

The Surge in Google Search Volume for Bitcoin

In recent days, the Google search volume for Bitcoin has seen a significant increase, particularly as the cryptocurrency’s price dipped to the $60,000 mark. This surge in search interest reflects heightened awareness and concern among investors as Bitcoin’s price fluctuates. Such peaks in search metrics are often correlated with major price movements, indicating that retail interest can be heavily influenced by the fluctuations in Bitcoin’s value. During the last week, the interest reached a notable score of 95, which signifies a strong engagement level from potential investors and curious onlookers alike.

The timing of this surge in Bitcoin search volume aligns with a notable drop in its price, highlighting the psychological connection that exists between price drops and increased investigation into Bitcoin’s market trends. As investors seek information to understand the dynamics of the crypto market, they often turn to trusted search engines to decipher the potential for a rebound or further decline. With Bitcoin’s rollercoaster journey, the search interest will likely continue to reflect real-time market sentiment, making it a critical metric for understanding broader cryptocurrency market trends.

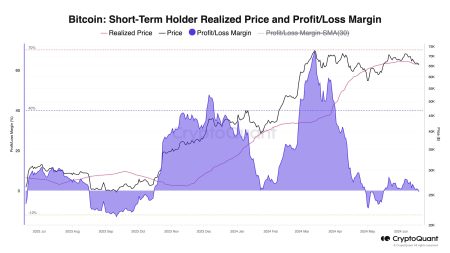

Bitcoin Price Analysis amid Market Trends

The recent Bitcoin price analysis reveals a volatile landscape as the asset experienced a dip below the crucial $60,000 threshold for the first time in months. This trend reflects a considerable shift for investors who have seen Bitcoin hover around $81,500 just days prior. Analysts are paying close attention to these movements, particularly because they align with other bearish signals in the crypto market. The current prices have provided a unique opportunity for informed buyers, prompting discussions about long-term strategies despite recent declines.

Market analysts are also observing that these price shifts are accompanied by fluctuating sentiment within the cryptocurrency space. Notably, the Alternative.me Crypto Fear & Greed indicator has seen a drop, often interpreted as a signal for investors to consider entering the market. As Bitcoin dips, some analysts argue that this could be a prime time for retail investors to capitalize on lower prices that might precede significant upswings. The intricate relationship between Bitcoin’s price analysis and broader market dynamics serves as a reminder of the ever-evolving trends in the cryptocurrency domain.

Retail Interest in Bitcoin and Crypto Market Psychology

As Bitcoin’s volatility captures the attention of retail investors, market sentiment plays a crucial role in shaping the perceptions of potential buyers. Recent reports suggest a growing retail interest toward Bitcoin as prices fluctuate within the $60,000 to $70,000 range. According to industry insight from figures like André Dragosch of Bitwise, there is an observable trend indicating that retail participation in the crypto market is reviving. This resurgence mirrors historical patterns seen during previous market cycles, where price corrections often draw in the retail crowd eager to buy in at lower levels.

With retail investors now eyeing Bitcoin, the overall psychology of the crypto market may shift dramatically. Market participants remain cautious, primarily due to prevailing negative sentiments and fear associated with substantial price drops. However, as noted by crypto analyst Ran Neuner, the simultaneous uptick in search interest illustrates potential optimism amidst the backdrop of current fears. This juxtaposition of fear and potential opportunity may be pivotal in determining future price trajectories and ultimately aid in increasing Bitcoin’s retail engagement.

The Impact of Google Searches on Bitcoin Trends

The correlation between Google searches and Bitcoin trends is becoming increasingly significant as market dynamics change. As Bitcoin prices experience significant fluctuations, the volume of searches on platforms like Google often correlates very closely with these price changes. For instance, the sharp decline to $60,000 triggered a flood of queries reflecting the urgency among investors to comprehend the causes and potential outcomes of such a dip. This pattern demonstrates how retail interest is often driven by real-time price actions, reinforcing the importance of search volume as an indicator of market sentiment.

On a broader scale, understanding the impact of Google search trends on Bitcoin provides valuable insight into investor behavior. High search volumes can indicate not only immediate concern over price drops but also a potential rallying of interest that may precede significant buy-in from retail investors. As cryptocurrency sentiment fluctuates, tracking Google searches serves as a timely tool for analysts looking to gauge the pulse of the market and anticipate future movements. The relationship between search behavior and market trends ultimately illustrates the intricate psychological factors at play within the evolving landscape of cryptocurrency.

Crypto Market Trends: Analyzing Bitcoin Movements

The crypto market is notoriously volatile, and the recent shifts in Bitcoin’s movement are emblematic of this reality. Following the price drop below $60,000, market analysts are keenly observing the broader trends emerging within the crypto space. The burst of activity among investors, marked by a noticeable increase in search volumes, indicates a potential pivot point that could lead to renewed interest or prolonged caution. Furthermore, as investors analyze the current dynamics, they’re also considering the implications of significant price ranges on overall market health.

In conjunction with Bitcoin, other cryptocurrencies are also experiencing fluctuations that can influence trading decisions. The interconnectedness of these assets often means that movements in Bitcoin prices can impact investor sentiment broadly across the cryptocurrency landscape. The market’s response to Bitcoin’s recent price changes may shape trading patterns for altcoins and influence overall market trends. As this interplay unfolds, both new and experienced investors must remain vigilant about understanding these trends to make informed decisions in the unpredictable world of cryptocurrency.

Understanding Cryptocurrency Sentiment and Investor Behavior

At the core of cryptocurrency trading lies investor sentiment, which can drastically affect market dynamics. The recent downturn in Bitcoin’s price has sparked various reactions among traders and potential investors, leading to a notable shift in how sentiment is perceived. Tools like the Fear & Greed index illustrate that when Bitcoin’s price sees a major correction, overall market sentiment often turns fearful, leading to a subdued appetite for risk. Understanding these sentiments is paramount as they drive decisions about when to enter or exit positions, ultimately shaping the direction of market trends.

Moreover, as sentiment fluctuates due to market volatility, analysts are noting a shift towards the optimistic side among retail investors. This sentiment analysis is essential for gauging market cycles and predicting potential recoveries within the cryptocurrency space. As interest in Bitcoin grows alongside search volumes, understanding investor behavior will be vital in shaping future assessments of market cycles and potential re-entries into an increasingly adaptive market landscape. Ultimately, the intersection between sentiment and market actions underlines the psychological elements that make cryptocurrency trading so complex and intriguing.

Cautious Optimism: Retail Investors Eyeing Bitcoin

As Bitcoin fluctuates around key price levels, a cautious optimism is emerging among retail investors. Many are beginning to perceive the current price range as a possible entry point that may lead to substantial gains if Bitcoin rebounds. The observed increase in Google search interest reflects the growing excitement and exploratory behavior from the retail sector, signaling a potential shift as investors search for the right moment to engage with the market. Such behavior is indicative of the retail market’s resilience and eagerness to capitalize on opportunities, even amid price volatility.

However, this optimism is tempered by general market apprehension, particularly as many investors recall the fluctuations that preceded previous market highs and lows. The mixed sentiments captured in sentiment indicators portray a cautious but interest-driven approach by retail investors. Indeed, while some bidders are prepared to take action, they remain acutely aware of the historical risks associated with Bitcoin investments. Striking a balance between enthusiasm and caution will be essential as market conditions evolve, highlighting the important role investor sentiment plays in shaping market realities.

Long-Term Strategies for Bitcoin Investors in a Volatile Market

In an unpredictable landscape like cryptocurrency, long-term strategies are becoming increasingly vital for Bitcoin investors. The recent price drops have underlined the importance of patience and informed decision-making, especially given the asset’s propensity for rapid fluctuations. Investors who adopt a long-term perspective may be less reactive to short-term price movements, allowing them to weather volatility and potentially capitalize on eventual rebounds. This strategic mindset encourages comprehensive analysis of Bitcoin’s historical performance compared to its current price action, focusing more on its long-term potential rather than momentary vulnerabilities.

Further, with the rise of retail interest, educational resources are more accessible than ever for investors seeking to refine their investment strategies. An informed approach involves constantly monitoring market trends, analyzing technical indicators, and being attentive to changing investor sentiments. By incorporating these elements, investors can formulate long-term strategies that align with their financial goals while minimizing the emotional impulses often triggered by market dynamics. As volatility persists, an unwavering commitment to strategic investment in Bitcoin may very well distinguish successful traders from those swayed by fear and impatience.

The Role of Market Indicators in Bitcoin Investment Decisions

Market indicators are crucial tools for Bitcoin investors navigating the complexities of cryptocurrency trading. As Bitcoin recently approached the critical $60,000 mark, various indicators such as the Fear & Greed index and price action analysis have informed investor decisions. These indicators help in assessing market conditions, enabling investors to make better-informed decisions during periods of extreme volatility. The interplay between price analytics, search volumes, and investor sentiments influences how investors perceive value and opportunity, thus shaping their trading behavior in real-time.

Moreover, employing a diverse set of market indicators aids in developing a comprehensive view of Bitcoin’s potential trajectory. As cryptocurrency markets become increasingly sophisticated, successful investors are those who leverage both traditional indicators and innovative sentiment analysis techniques. Tracking these indicators enables investors to anticipate movements within the crypto market and create more robust strategies that correlate with market trends. The synergy between informed decision-making and market indicators ultimately contributes to an informed trading environment, fostering increased confidence among Bitcoin investors.

Frequently Asked Questions

What caused the recent surge in Bitcoin search volume?

The recent surge in Bitcoin search volume can be attributed to a significant drop in Bitcoin’s price, which fell to around $60,000, a level not seen since October 2024. This price movement typically sparks increased interest among retail investors and analysts looking to understand the impact on Bitcoin price analysis and crypto market trends.

How does Bitcoin price analysis relate to Google search interest in Bitcoin?

Bitcoin price analysis often aligns closely with Google search interest. When Bitcoin experiences notable price fluctuations, such as significant declines or rallies, search volume usually increases as retail investors seek information and insights on potential market movements and cryptocurrency sentiment.

What impact does Google search interest have on Bitcoin retail interest?

Google search interest is a key indicator of Bitcoin retail interest. A rise in searches often reflects heightened curiosity or concern among retail investors, signaling potential buying or selling behaviors in the crypto market, particularly during times of price volatility.

How does the current Bitcoin search volume reflect crypto market trends?

The current Bitcoin search volume indicates a robust response to market trends, especially as Bitcoin’s price fluctuated sharply recently. High search interest often correlates with key price intervals, reflecting the retail market’s reaction to changes in sentiment and price movements in the cryptocurrency space.

What does an increase in Bitcoin search volume suggest about cryptocurrency sentiment?

An increase in Bitcoin search volume typically suggests rising cryptocurrency sentiment, as it indicates that more individuals are exploring the market and seeking information about Bitcoin’s price movements. This can often signal a shift in retail interest, which may affect future market trends.

Why is the relationship between Bitcoin price and Google search interest significant?

The relationship between Bitcoin price and Google search interest is significant because it serves as a barometer for market sentiment. Analysts and investors monitor search volume as a tool to gauge how retail interest may influence Bitcoin’s price action and overall crypto market trends.