NYSE-Listed Exodus Posts Solid Third-Quarter Lift as Bitcoin Revenue Climbs

Exodus, a leading cryptocurrency software platform, recently made headlines after its latest earnings report showed impressive gains for the third quarter, driven largely by an uptick in bitcoin-related revenue. Listed on the New York Stock Exchange (NYSE), Exodus has become a bellwether for the digital currency industry’s performance amid fluctuating market dynamics.

Solid Financial Performance

During the third quarter, Exodus reported a significant increase in revenue and profitability, attributed primarily to the surge in bitcoin trading volumes. The company, known for its highly intuitive user interface and robust security features, has capitalized on the growing interest in cryptocurrency investments among both retail and institutional investors.

Exodus’s revenue from bitcoin transactions saw a notable rise, which the company attributes to several factors. Firstly, the increasing acceptance of bitcoin as a legitimate investment class has propelled more users towards platforms that offer reliable and secure transaction capabilities. Exodus has benefitted from this trend due to its longstanding reputation and trustworthiness in the crypto community.

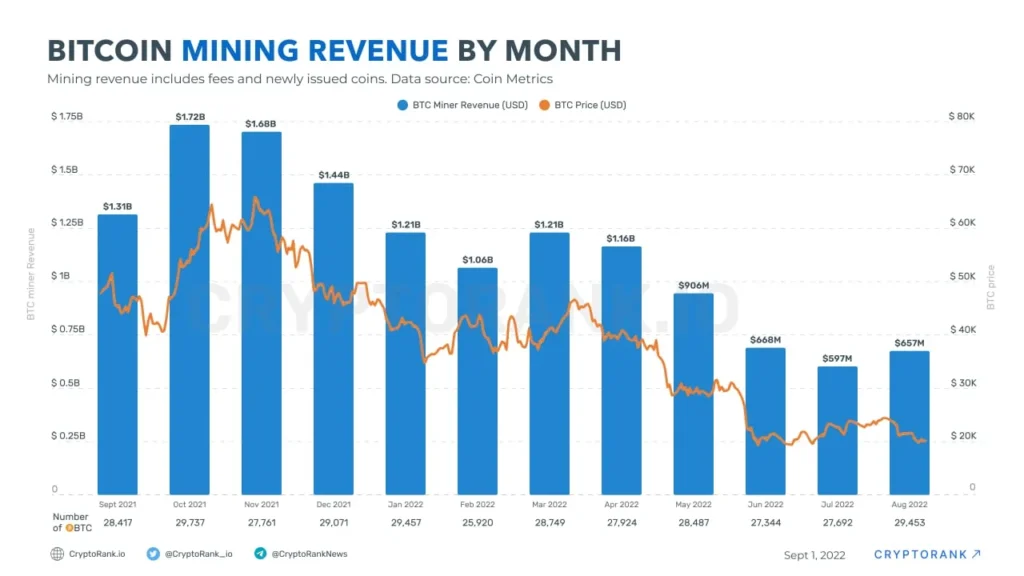

Additionally, the broader market recovery in bitcoin prices, which saw significant recovery from earlier lows, helped boost the volume of transactions processed through the Exodus platform. As bitcoin continues to demonstrate resilience and potential for high returns, more investors are flocking to platforms like Exodus to get a slice of the digital currency pie.

Strategic Developments and Future Outlook

Aside from its financial achievements, Exodus has been actively involved in strategic partnerships and product innovations aimed at consolidating its market position and enhancing user experience. Recent updates to its software have improved transaction speeds and expanded its offerings to include more cryptocurrencies, thus broadening its market appeal.

Looking forward, Exodus is focusing on tapping into new demographic segments by enhancing its educational resources to help novice traders understand the intricacies of cryptocurrency trading. The company is also exploring advanced features like staking, lending, and borrowing services to diversify its revenue streams and provide more value to its users.

Moreover, with the regulatory environment around cryptocurrencies becoming clearer, Exodus is positioning itself to comply with future regulations and standards. This proactive approach is expected to shield the company from potential legal and operational risks associated with the evolving crypto landscape.

Market Reaction and Industry Implications

The market has reacted positively to Exodus’s strong third-quarter performance. The company’s stock has seen an uplift, reflecting investor confidence in its growth trajectory and strategic direction. This performance is not only a testament to Exodus’s operational excellence but also signals a maturing cryptocurrency market that is becoming increasingly integrated into mainstream financial systems.

For the broader digital currency industry, Exodus’s success serves as an encouraging indicator of wider acceptance and viability of cryptocurrencies as a long-term investment class. As platforms like Exodus continue to evolve and adapt to user needs and regulatory requirements, the potential for cryptocurrencies to revolutionize financial systems becomes more tangible.

Conclusion

Exodus’s impressive third-quarter performance underscores the company’s adaptability and strategic foresight in navigating the complex and dynamic cryptocurrency market. With its strong focus on user experience, security, and compliance, Exodus is well-positioned to capitalize on the growing global interest in cryptocurrencies. As the market landscape continues to evolve, Exodus’s ongoing commitment to innovation and excellence is likely to keep it at the forefront of the cryptocurrency services industry.