Bitcoin recovery patterns after down years have captivated the attention of investors and analysts alike, particularly as traders look to the future. Historically, Bitcoin has demonstrated a remarkable ability to rebound sharply following down years, often achieving price rebounds that exceed 100%. With the recent decline of 6.36% at the end of 2025, many are wondering if history will repeat itself and spark a rally in 2026. Examining the historical Bitcoin returns reveals that after the previous down years in 2014, 2018, and 2022, substantial gains followed. As we delve into the cryptocurrency investment strategies geared toward leveraging these trends, one can only ponder how Bitcoin market trends may influence predictions for 2026.

The cyclical nature of Bitcoin’s performance showcases intriguing recovery trends after years of decline, often leading to significant price surges. The concept of Bitcoin’s price rebound serves as a cornerstone for understanding historical performance, as each dip has historically paved the way for substantial gains. As investors strategize for the future, the focus shifts toward the anticipated price movements expected in 2026 and beyond. Various analysts suggest that the patterns gleaned from past data could offer valuable insights for navigating the volatile waters of cryptocurrency. Therefore, exploring these market dynamics and the associated investment strategies could yield fruitful outcomes for those looking to capitalize on Bitcoin’s remarkable potential.

Understanding Bitcoin Recovery Patterns After Down Years

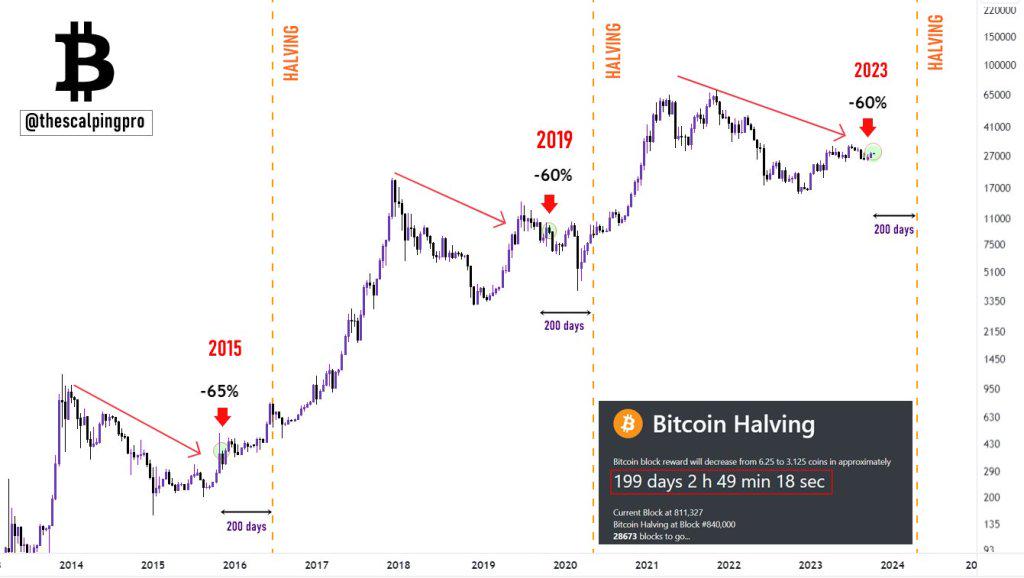

Bitcoin has a notorious reputation for its dramatic price fluctuations, often characterized by sharp declines followed by staggering recoveries. Historically, after each of the notable down years – 2014, 2018, 2022, and the most recent in 2025 – Bitcoin has demonstrated a robust rebound, averaging close to 100% gains. This consistent recovery pattern underscores the importance of understanding market trends and the cyclical nature of Bitcoin investments for both current and prospective investors.

As we look ahead to 2026, many traders and analysts are optimistic about the potential for another significant rebound. The cryptocurrency has proven resilient over time, and the tendency to recover from down years gives credence to forecasts that project Bitcoin nearing a $300,000 valuation. Investors who recognize these recovery patterns are likely to stay vigilant in monitoring market indicators to capitalize on potential rebounds.

Analyzing Historical Bitcoin Returns and Market Trends

The historical performance of Bitcoin shows distinct patterns that can be valuable for market predictions. Analyzing past returns reveals that significant recovery phases typically follow downturns. For instance, after Bitcoin’s decline in 2018, subsequent years yielded extraordinary growth, illustrating the potential for recovery even after prolonged periods of loss. These historical insights are critical when considering future price movements and strategies for investment.

Market trends suggest that Bitcoin’s price behavior is not merely a function of speculative trading but is influenced by broader economic forces and liquidity conditions. In 2026, many analysts expect the cryptocurrency market’s dynamics to shift positively, especially if liquidity increases and supports higher valuations. Therefore, understanding historical trends plays a vital role in developing cryptocurrency investment strategies that align with long-term growth potentials.

What Lies Ahead: 2026 Bitcoin Predictions Based on Historical Data and Trends

Frequently Asked Questions

What are historical Bitcoin recovery patterns after down years?

Historically, Bitcoin has demonstrated a strong recovery pattern after down years, averaging close to 100% gains in the year following a negative return. This trend is evident from past down years in 2014, 2018, and 2022, culminating in substantial rebounds, making 2026 a year of interest for traders anticipating similar patterns.

How did Bitcoin price rebound after previous down years?

After experiencing down years like those in 2014, 2018, and 2022, Bitcoin typically rebounded dramatically. These recoveries averaged around 95%, rounding up to a benchmark of 100% in historical returns, highlighting a trend that traders are closely monitoring as we approach 2026.

What are the projections for Bitcoin market trends in 2026?

Predictions for Bitcoin’s market trends in 2026 suggest a significant target range between $200,000 and $300,000. Analysts attribute this to Bitcoin’s historical tendency to recover sharply after down years, alongside improved liquidity conditions that could support these price levels.

What is the significance of Bitcoin’s negative return in 2025 for future recovery?

The modest -6.36% return in 2025 is significant as it reflects a typical pattern where negative annual performances are followed by robust price rebounds, influencing traders’ expectations for a possible Bitcoin price rebound in 2026, based on historical recovery patterns.

What cryptocurrency investment strategies should be considered following a down year for Bitcoin?

In light of Bitcoin’s historical recovery patterns, investors may consider strategies that capitalize on buying during down years, anticipating substantial gains in subsequent years. Diversification and cautious monitoring of market trends in 2026 can also help mitigate risks as Bitcoin’s past performance suggests strong rebound potential.

What indicators suggest Bitcoin’s recovery momentum for 2026?

Short-term momentum indicators show Bitcoin’s recent subdued performance, with a low 30-day average return. However, historically, transitional phases like these often precede significant market recoveries, leading to optimistic expectations for Bitcoin’s performance in 2026, given its historical recovery patterns.

How reliable are past Bitcoin performance patterns for predicting 2026 outcomes?

While historical performance patterns suggest Bitcoin average close to 100% recoveries following down years, it is essential to note that past performance does not guarantee future results. Market conditions, liquidity cycles, and broader economic factors will significantly influence Bitcoin’s price trajectory heading into 2026.

| Key Metrics | Details |

|---|---|

| Average Gains after Down Years | ~100% return in the following year |

| Recent Down Years | 2014, 2018, 2022, 2025 |

| Projected Valuation for 2026 | Between $200,000 and $300,000 |

| Current Price at End of 2025 | $88,000 |

| Short-term Indicators (Volatility) | High at 0.018, indicating price sensitivity |

| Sharpe-like Ratio | Around 0.09, close to neutral |

Summary

Bitcoin recovery patterns after down years are notably promising, as historical data suggests that following a down year, Bitcoin has averaged close to 100% gains. The last recorded down year was 2025, which ended with a modest loss of 6.36%. Given the historical trend of substantial rebounds observed after years of losses, many traders are optimistically eyeing 2026 for potential profits, especially with projected targets soaring between $200,000 and $300,000. However, caution is advised due to current market conditions, including high volatility and a neutral Sharpe-like ratio, implying that while the potential for a recovery exists, patience may still be necessary.

Related: More from Bitcoin News | Gold, AI, Tech Stocks Lead as Bitcoin Fades | UBS Slides on US Stocks: Bitcoin’s Fate?