Bitcoin realized loss has emerged as a pivotal topic among cryptocurrency investors, especially following recent findings from CryptoQuant. The on-chain data analysis firm has revealed that Bitcoin holders are experiencing net realized losses for the first time since October 2023, a concerning trend that signals potential shifts in market dynamics. As Bitcoin market trends in 2024 evolve, many investors remain keenly aware of the implications of such losses; with January 2024 marking a significant downturn. This transition from profit-taking to loss realization reflects broader on-chain data analysis Bitcoin strategies that reveal where holders stand in this volatile market. The insights provided by CryptoQuant highlight not just individual losses, but an overall market sentiment that could steer the crypto landscape towards a bear market phase if trends continue to deteriorate.

The recent phenomenon of Bitcoin holders facing net losses, as posited by analysts, has raised eyebrows within the digital currency community. Often referred to as realized losses, this shift indicates a changing landscape for crypto holders who may now find themselves in unfavorable positions. With data emerging from CryptoQuant’s comprehensive report, the investigation of on-chain movements uncovers the underlying challenges faced by investors since the early weeks of 2024. As analysts sift through the implications of on-chain data, it is essential to recognize the broader strokes of market transitions, particularly as we observe fluctuations that mirror the conditions seen during earlier significant bear market phases. As discussions of crypto profit versus loss continue, investors are urged to remain vigilant and informed about the unfolding Bitcoin market trends.

| Key Points |

|---|

| CryptoQuant reports Bitcoin holders are realizing net losses, a first since October 2023. |

| The market has shifted from ‘taking profits’ to ‘realizing losses’, indicating a change in trend. |

| Since January 2024, realized profit momentum for Bitcoin has weakened, with profit peaks declining. |

| By December 23, 2025, Bitcoin holders had incurred cumulative losses of about 69,000 BTC. |

| The current trend resembles the market shift during the bull-to-bear transition in 2021-2022. |

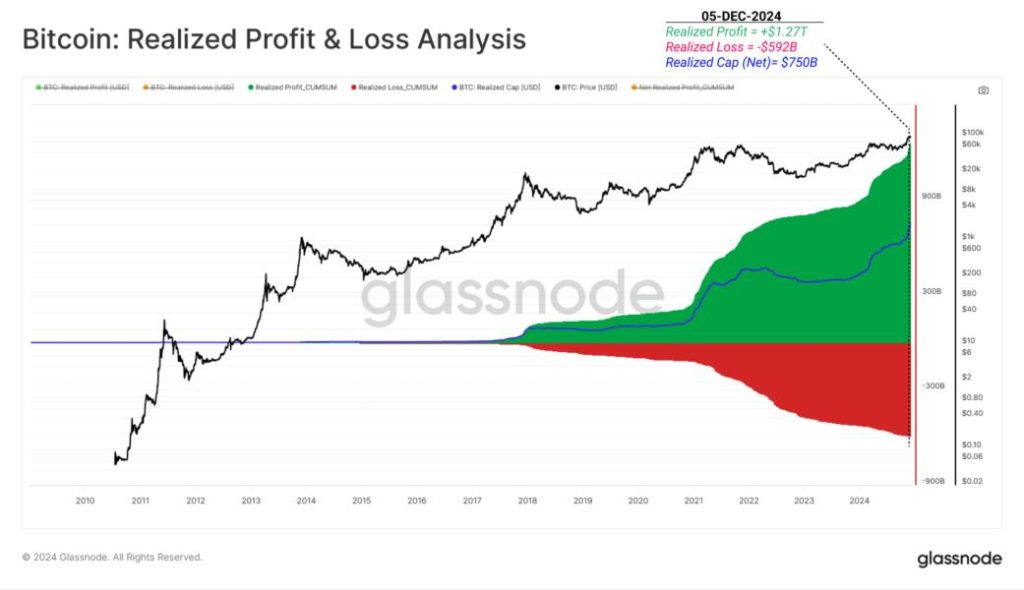

| Realized profits and losses are calculated based on on-chain transfer data compared to previous transfers. |

Summary

Bitcoin realized loss has become a critical focus as holders transition into a phase of net realized losses, a significant indicator of market sentiment. This shift highlights the evolving landscape of Bitcoin profitability and raises questions about the sustainability of the current market trends. As Bitcoin continues to face declining realized profits, the potential end of the current bull market looms larger, suggesting investors should remain vigilant.

Understanding Bitcoin Realized Loss: A Shift in Market Dynamics

The recent analysis from CryptoQuant reveals a significant turning point in Bitcoin’s market dynamics, as holders have begun to experience net realized losses for the first time since October 2023. This indicates a shift from a phase of profit-taking to one of loss realization. With the price action of Bitcoin stagnating and even reversing, many investors are forced to reevaluate their positions. The data collected over the last 30 days suggests a troubling trend, where the once stable momentum of realized profits is waning. As Bitcoin holders find themselves in the red, understanding the underlying factors influencing this loss becomes paramount.

The on-chain data analysis conducted by CryptoQuant shows that Bitcoin holders have realized losses amounting to approximately 69,000 BTC as of late December 2025. Such a drastic realization of losses reflects broader market sentiments and potentially signals a bearish trend. By diving into the movements of on-chain data during January 2024, it becomes evident that the bullish momentum, which was once a hallmark of the market, is now overshadowed by vast sell-offs and liquidations. This trend could indicate a approaching transition similar to the bearish conditions witnessed in 2021–2022, urging investors to exercise caution.

On-Chain Data Analysis of Bitcoin Performance

On-chain data plays a crucial role in interpreting Bitcoin’s market trends, especially during pivotal moments such as the current situation where holders face realized losses. The CryptoQuant report serves as a valuable resource, shedding light on how the profitability structure for Bitcoin has evolved over recent months. By analyzing transfer data against price movements, it becomes possible to ascertain the profitability of Bitcoin transactions. As more holders transition to realizing losses, it raises questions about future market conditions and the sustainability of current price levels.

Moreover, on-chain data not only highlights the losses being incurred but also reveals potential patterns that could guide future investment decisions. By examining the timestamps and price comparisons of previous Bitcoin transfers, insights can be gleaned about the market’s psychological barriers and pivotal points. When Bitcoin holders realize losses collectively, it can signify a psychological hurdle for future market rebounds or dips. This crucial data analysis could be particularly useful for discerning behavioral patterns among investors and anticipating market reactions leading up to potential transitions in the bull-bear cycle.

Bitcoin Market Trends of 2024: What to Expect

The Bitcoin market trends of 2024 are shaping up to be particularly volatile, as recent shifts indicate a changing landscape for crypto investors. With the ongoing noted losses among Bitcoin holders, analysts are beginning to predict the potential continuation of bearish trends. CryptoQuant’s latest report suggests that the once-promising upward price action is becoming less certain, with profit peaks consistently declining. This observation raises questions regarding future price movements and investor confidence going forward.

As we delve deeper into Bitcoin market trends for 2024, it will be essential for investors to stay informed about emerging patterns and potential shifts. Coupled with the realization of losses experienced by many holders, the prevailing sentiment in the crypto space may gravitate towards caution. Investors are urged to consider the implications of these trends and reflect on historical data, particularly regarding the bull-to-bear transitions observed in previous cycles. Understanding these dynamics will be pivotal for making educated decisions that align with market expectations and personal investment strategies.

The Bull to Bear Market Transition: Lessons from History

Historically, the transition from bull to bear markets has been a significant event in the cryptocurrency space, with Bitcoin often leading the charge. The recent findings from CryptoQuant suggest that we may be on the cusp of a similar transition as many holders face net realized losses for the first time since late 2023. This situation raises critical questions regarding investor behavior and market resilience, as past experience suggests that a large-scale realization of losses can alter market sentiment and drive prices down further.

Key lessons can be drawn from previous bear market transitions, including the importance of understanding market cycles and the psychological impacts of loss realization. The shift observed in the Bitcoin market may reflect broader trends not just limited to one currency but across the crypto landscape. Markets oscillate between periods of growth and contraction, and recognizing these patterns through diligent observation and data analysis is crucial for investors looking to navigate the potential downturn effectively.

Impact of Economic Factors on Bitcoin Holding Losses

The impact of broader economic factors on Bitcoin holding losses cannot be overstated, particularly as the market experiences a paradigm shift from profit-taking to loss realization. Inflation rates, global economic stability, and regulatory news can greatly influence investor confidence and the decisions surrounding asset holdings. As observed in the CryptoQuant report, these external factors contribute significantly to the overall sentiment of the cryptocurrency market, causing many to rethink their positions as losses mount.

In the context of January 2024, economic uncertainties may be amplifying the pressure on Bitcoin holders. The declining price momentum has already led to an increased number of sell-offs, which not only results in individual losses but may also engender a broader fear of further depreciation. Investors are advised to consider these external economic variables and their effects on market behavior to enhance their strategic approach in the volatile cryptocurrency environment.

Bitcoin Holder Sentiment Amidst Realized Losses

The sentiment among Bitcoin holders has shifted significantly with the onset of realized losses as reported by CryptoQuant. Initially buoyed by the bullish trends and profit-taking activities, many holders are now grappling with the emotional and financial implications of transitioning into a loss position. This drastic change in sentiment highlights the psychological factors at play in the cryptocurrency realm, where market emotions can substantially impact trading behaviors and decisions.

As fears about potential downturns proliferate, it’s vital for current Bitcoin holders to assess their emotional responses and adopt strategies to mitigate panic selling. The historical precedent indicates that market sentiment can oscillate rapidly, with regained confidence potentially allowing for recovery after the initial shocks of loss realization. Thus, understanding the psychological aspects of market sentiment amidst adverse conditions can provide investors with an edge in navigating turbulent times.

The Role of On-Chain Data in Crypto Investment Decisions

On-chain data has increasingly become a critical tool for investors seeking clarity in the tumultuous cryptocurrency markets. As demonstrated by CryptoQuant’s findings, analyzing on-chain metrics can help investors make informed decisions by illustrating real-time network behaviors, transaction volumes, and realized loss metrics. These indicators are instrumental in understanding market trends and making educated predictions regarding future Bitcoin performance.

By leveraging on-chain data effectively, investors can gain insights into market psychology and the broader economic factors influencing price movements. This data-driven approach may guide investment strategies, enabling holders to recognize pivotal moments for entry and exit points, particularly during historically volatile calculations of profits and losses. Understanding how to interpret on-chain analysis will be integral to successfully navigating the uncertainties of the Bitcoin market in the coming year.

Strategies for Bitcoin Investors in a Declining Market

In light of the recent trends indicated by CryptoQuant, Bitcoin investors must adopt robust strategies to navigate the complexities of a declining market. As realized losses mount and market sentiment falters, it’s crucial for investors to develop a comprehensive game plan that includes risk management and psychological preparation for potential downturns. Implementing a diversified portfolio approach that balances Bitcoin holdings with other assets may help ease the financial burdens incurred during market corrections.

Additionally, investors should consider employing dollar-cost averaging strategies to mitigate the impacts of volatility. By gradually purchasing Bitcoin instead of attempting to time the market, holders can reduce the emotional pressure associated with price fluctuations. This strategy allows investors to build a position over time, potentially enhancing the average purchase price. Staying abreast of market conditions and adjusting strategies accordingly is paramount for those involved in Bitcoin investment to ensure sustainability amidst changing market landscapes.

Future of Bitcoin Amidst Ongoing Loss Realizations

The future of Bitcoin amidst ongoing loss realizations poses both challenges and opportunities for crypto enthusiasts and investors alike. Investors are currently faced with crucial decisions that could greatly influence their financial outcomes in the coming months. Understanding the potential for a market recovery or continued decline will be pivotal as they navigate this uncertain landscape. The insights gleaned from CryptoQuant may serve as a guide to recognizing patterns that precede significant market movements.

As the crypto community adjusts to the realities of the market, it becomes increasingly important for investors to remain flexible and informed. Future price trends could shift rapidly based on emerging economic indicators, regulatory shifts, or shifts in investor sentiment. Therefore, cultivating an adaptive investment mindset will be essential, as the dynamic nature of Bitcoin and broader market conditions necessitate a proactive approach to navigating the intricacies of cryptocurrency investments.

Frequently Asked Questions

What is Bitcoin realized loss and how is it affecting Bitcoin holders?

Bitcoin realized loss refers to the losses that holders incur when they sell their Bitcoin at a price lower than the price they originally paid. According to a recent CryptoQuant report, Bitcoin holders are experiencing a net realized loss for the first time since October 2023, indicating a shift in market sentiment from profit-taking to loss realization.

How has on-chain data analysis indicated trends in Bitcoin realized loss in January 2024?

On-chain data analysis by CryptoQuant has highlighted that Bitcoin holders have recorded significant realized losses in January 2024. This analysis shows the transition in the Bitcoin market, marking a pivotal moment where profit-taking has shifted to realizing losses, with cumulative losses amounting to 69,000 BTC as of late December 2023.

Are the Bitcoin market trends in 2024 signaling a future decline based on realized losses?

Yes, the Bitcoin market trends observed in early 2024, characterized by holders realizing losses, suggest that we might be nearing the end of the current bull market. CryptoQuant’s data shows patterns akin to the transition between bull and bear markets, similar to those experienced in 2021-2022.

What factors contribute to the Bitcoin holders’ realized losses as reported by CryptoQuant?

The realized losses among Bitcoin holders, as indicated by CryptoQuant, stem from declining profit peaks and a weakening profit momentum observed since the start of 2024. The on-chain transfer data reveals that holders are selling their Bitcoins at lower prices than their acquisition costs, thereby realizing losses instead of profits.

How does the concept of bull-bear market transition relate to Bitcoin realized loss?

The concept of bull-bear market transition is closely related to Bitcoin realized loss, as the observed losses by holders in early 2024 resemble the patterns seen during previous transitions. The decline in profit realization suggests that the market sentiment is shifting, which may imply an impending bear market following a prolonged bull phase.

How can the calculations of Bitcoin realized loss inform investors about market conditions?

Calculating Bitcoin realized loss involves analyzing on-chain transfer data and comparing prices at different transfers. This analysis can help investors gauge market conditions, indicating when holders are more likely to sell at losses, reflecting overall market sentiment and possibly predicting future price movements.