Bitcoin Hits Key Support; Analysts Warn of Deeper Correction

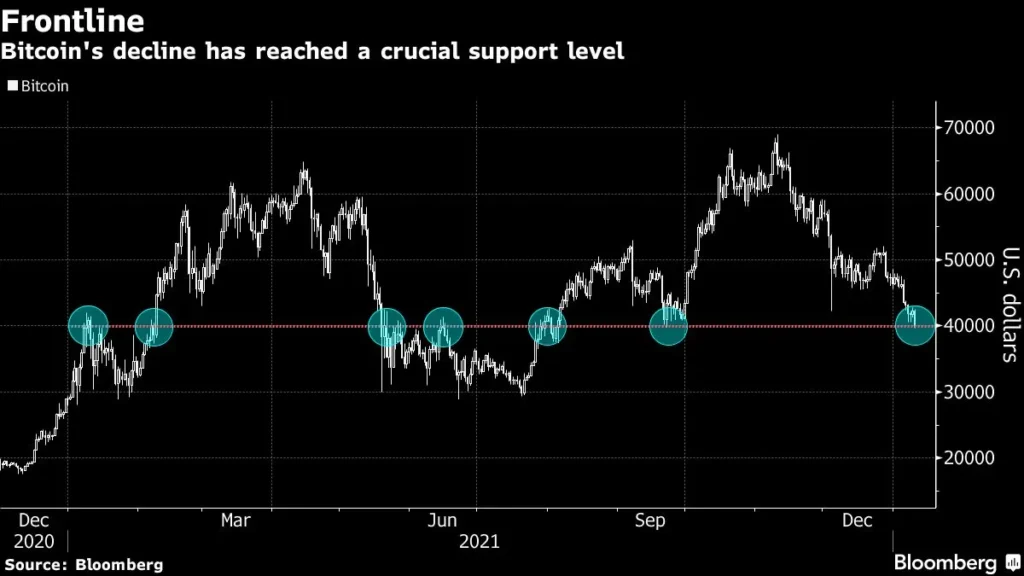

Bitcoin has recently touched a critical support level, inciting various analyses from financial experts and crypto analysts who suggest a potential further decline in its value. The descent poses concerns and speculative opportunities within the cryptocurrency market.

Background and Current Scenario

Bitcoin, the first and most well-known cryptocurrency, has experienced substantial volatility throughout its history. This attribute, while attractive to traders seeking high returns, also contributes to considerable risks. Recently, Bitcoin’s value approached a significant support level, a scenario that historically points toward the market’s sentiment and future price movements.

The Key Support Level

The support level in focus has often acted as a critical threshold in previous market cycles. Once breached, it has led to either robust recoveries or steep declines. This time, as Bitcoin teeters on this precarious edge, market analysts and investors are closely monitoring its behavior for clues on the market’s direction.

Analysts’ Perspectives

Leading financial analysts have expressed concerns over the possibility of a deeper market correction. According to some, the convergence of various economic factors, including inflation concerns, changes in monetary policy by major central banks, and geopolitical tensions, could exacerbate the sell-off in cryptocurrencies, including Bitcoin.

“Bitcoin is facing a tumultuous market landscape influenced by broader economic indicators,” noted one analyst from a prominent financial institution. “Its reaction to the key support level could set the tone for the crypto market in the upcoming months.”

Implications of a Break in Support

If Bitcoin fails to maintain the support level, the implications could be significant. A break below could trigger a sharper sell-off, urging the liquidation of positions across several exchanges. Not only would this affect Bitcoin, but it could also lead to a generalized decline in the value of other major cryptocurrencies, given the correlation within the market.

Conversely, should Bitcoin hold and rebound from this key level, it might restore confidence among investors, potentially initiating a recovery phase. This scenario hinges on various macroeconomic factors and market sentiments that continue to evolve.

Market Sentiment and Investor Behavior

The cryptocurrency market is notoriously responsive to sentiment, often driven by the alternation between fear and greed. Current market sentiments lean towards caution, with a wait-and-see approach prevalent among many investors and traders.

Furthermore, the role of institutional investors cannot be underestimated. Their participation has grown over the years, and their reaction to these developments could influence the market’s next moves significantly.

Conclusion

As Bitcoin approaches this crucial juncture, the cryptocurrency community remains on high alert. The potential for a deeper correction is palpable, and the next few days or weeks could be pivotal in determining the medium-term trajectory of Bitcoin’s market value.

In such uncertain times, prudence and careful analysis are advised for anyone participating in cryptocurrency investments. Monitoring upcoming economic indicators and market responses will be essential in navigating the possible tumultuous waters ahead.

Indeed, the developments surrounding Bitcoin’s approach to key support levels underscore the dynamic and often unpredictable nature of cryptocurrency markets, where opportunities and risks are constantly evolving. As always, staying informed and vigilant will be key for those involved or interested in these digital assets.