| Company | Total Bitcoin Purchased (BTC) | Investment Amount (USD) | Price per Bitcoin (USD) | Total Holdings (BTC) |

|---|---|---|---|---|

| Strategy (formerly MicroStrategy) | 22,305 | $2.125 billion | $95,284 | 709,715 |

| DayDayCook | 200 | $17.8 million | $88,998 | 1,383 |

| BHODL | 1 | $100,000 | $97,800 | 159.295 |

| Total by Public Companies | 22,506 | $2.15 billion | 959,810 |

Summary

Bitcoin purchases by public companies have seen a significant uptick recently, with a total of $2.15 billion invested in Bitcoin last week by globally traded companies. Strategy led the charge with a substantial purchase, increasing its total Bitcoin holdings to an impressive 709,715 BTC. This trend reflects the growing adoption and acceptance of Bitcoin among large corporations, signaling a shift in the perception of cryptocurrency as a viable investment.

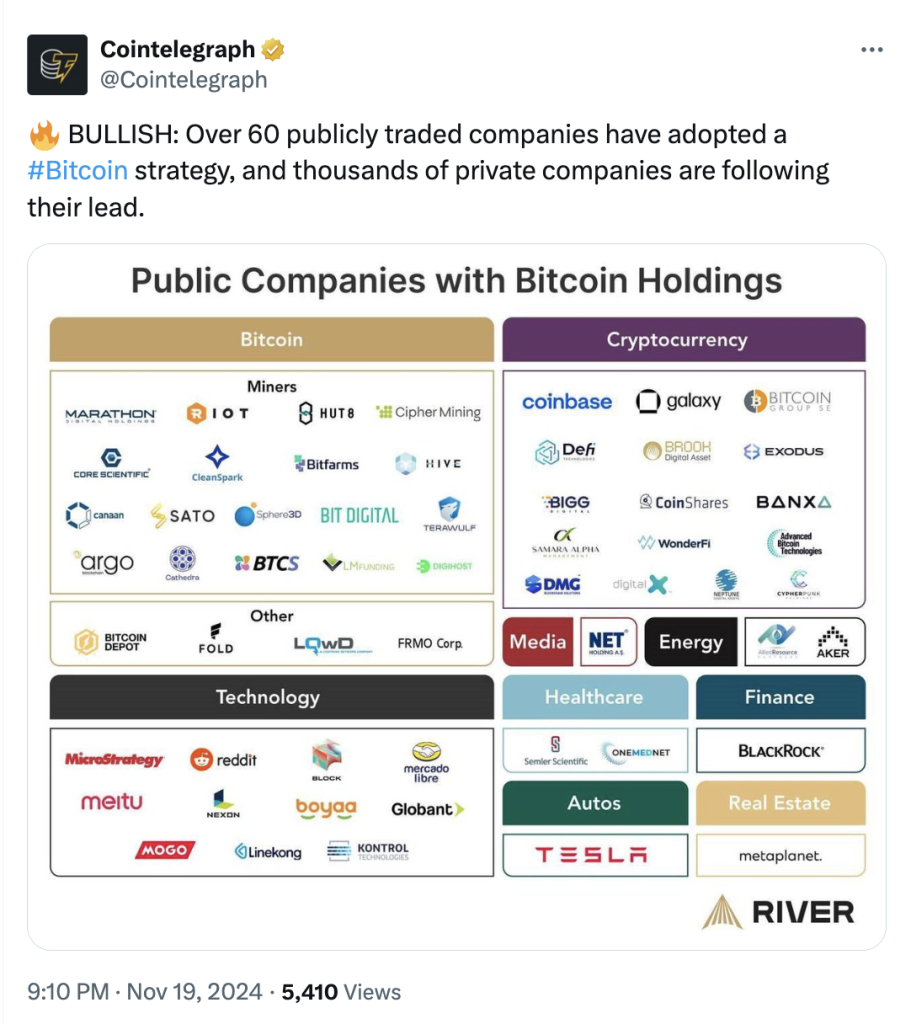

Bitcoin purchases by public companies have become a remarkable trend in the financial landscape, signaling a growing acceptance of cryptocurrency within traditional markets. Just last week, globally traded companies netted an impressive $2.15 billion in Bitcoin acquisitions, showcasing significant Bitcoin adoption amongst these entities. Notably, Strategy, formerly MicroStrategy, made headlines with a striking investment of $2.125 billion to secure 22,305 bitcoins, which reinforces its position as a heavyweight in the Bitcoin investment news arena. As more publicly traded companies Bitcoin begin to integrate digital assets into their balance sheets, the landscape of corporate investment is rapidly evolving. This surge in interest from cryptocurrency companies reflects an intriguing shift towards innovative financial strategies and long-term Bitcoin investment aspirations.

The recent surge in Bitcoin buying activity from corporate giants highlights a transformative moment in how businesses perceive digital currencies. Companies listed on stock exchanges are increasingly viewing Bitcoin not just as a speculative asset, but as a strategic tool for financial growth and stability. As the mindset shifts, initiatives to onboard Bitcoin into corporate treasury strategies become commonplace, reflecting a broader trend in digital finance. From substantial Bitcoin buys by established brands to emerging players entering the fray, the narrative surrounding public company cryptocurrency engagements is quickly evolving. This growing interest marks a critical point in the mainstream acceptance of Bitcoin, paving the way for a new era of financial innovation.

Bitcoin Purchases by Public Companies Surge

In a remarkable display of confidence in cryptocurrency, global publicly traded companies collectively made substantial Bitcoin purchases, totaling $2.15 billion last week alone. This unprecedented amount highlights the growing trend of Bitcoin adoption within traditional finance, as more corporations recognize the potential of Bitcoin as a store of value and a hedge against inflation. Leading this charge was Strategy, which invested a staggering $2.125 billion to secure 22,305 bitcoins, reinforcing its position as a frontrunner in corporate Bitcoin investments.

The increasing participation of publicly traded companies in Bitcoin investments signals a broader shift in the market landscape. With the total holdings of Bitcoin among these companies now at approximately 959,810 bitcoins, valued at around $87.32 billion, the integration of cryptocurrency into their financial strategies is becoming essential. This trend reflects the growing acceptance of Bitcoin not just as a speculative asset but as a legitimate component of corporate treasury management.

Strategy’s Bold Bitcoin Investment Strategy

Strategy, formerly known as MicroStrategy, has emerged as a pivotal player in the Bitcoin investment arena, continually expanding its substantial holdings. By acquiring 22,305 bitcoins at an average price of $95,284 per coin, the company has demonstrated a clear strategy focused on incorporating Bitcoin into its long-term financial vision. This calculated approach to Bitcoin investment aligns with broader trends, where cryptocurrency companies and public entities are increasingly integrating digital assets into their operations.

The firm’s persistent accumulation of Bitcoin underlines the company’s belief in the cryptocurrency as a crucial asset for future growth and stability. As Bitcoin adoption continues to gain momentum within the corporate sector, other publicly traded companies might take a cue from Strategy’s blueprint, exploring similar investment opportunities that allow them to capitalize on the increasing valuation of Bitcoin. As seen in the investments from companies like DayDayCook and BHODL, the ripple effect of Strategy’s initiatives is pushing more companies to consider their own cryptocurrency strategies.

Impact of Cryptocurrency Companies on Bitcoin Market

Cryptocurrency companies play a vital role in shaping the future of Bitcoin and its market dynamics. As institutions and publicly traded companies funnel investments into Bitcoin, the demand for this digital asset continues to soar, resulting in significant price movements. Such companies not only facilitate the purchasing process but also provide essential services that help institutions manage their Bitcoin investments more effectively.

This synergy between cryptocurrency companies and publicly traded firms is fostering a deeper integration of Bitcoin into the mainstream financial system. Companies like Strategy are leading the way, illustrating how a strategic approach to Bitcoin investment can yield substantial returns. The ongoing evolution in the relationship between traditional finance and cryptocurrency companies is indicative of a shift towards a more interconnected economic environment.

The Growing Trend of Bitcoin Adoption Among Corporations

The recent surge in Bitcoin adoption by corporations showcases a significant shift in how businesses perceive cryptocurrencies. The fact that many publicly traded companies are openly investing substantial sums in Bitcoin not only legitimizes the asset but also highlights its potential role in driving future corporate strategies. The integration of Bitcoin as a component of corporate portfolios reflects a growing acknowledgment of its value as a digital asset.

As corporations like Strategy do trailblazing work in this space, more businesses are expected to follow suit. The increasing dialog around digital asset management within boardrooms signals a new era for corporate finance, where Bitcoin and other cryptocurrencies are gradually becoming essential elements of financial strategies. By leveraging these assets, companies can not only enhance their balance sheets but also appeal to a tech-savvy investor base that values innovation.

Recent Bitcoin Investment News Highlights

Recent Bitcoin investment news features a mix of major corporate actions and smaller but significant moves by companies entering the cryptocurrency space. While Strategy dominated headlines with its enormous purchase, smaller players like DayDayCook and BHODL also made their mark by investing millions in Bitcoin, highlighting that the attraction of cryptocurrency investments is widespread across various corporate sizes.

The diversification of Bitcoin purchases among different companies indicates varying levels of commitment to cryptocurrency as an investment strategy. This democratic spread of investment reflects not only the growing interest in Bitcoin but also emphasizes the need for tailoring strategies that reflect each company’s risk appetite and market objectives. With increasing discourse on cryptocurrency investments, more companies are likely to consider how they can best leverage Bitcoin in their financial strategies.

The Market Value of Bitcoin Held by Public Companies

As of the latest reports, the total market value of Bitcoin held by globally listed public companies has reached approximately $87.32 billion. This staggering figure not only underscores the serious financial commitment these companies have made towards Bitcoin but also illustrates its significance within the broader market ecosystem. With these holdings accounting for around 4.8% of the circulating market value of Bitcoin, it is apparent that corporations are playing a crucial part in the digital currency’s support and stability.

Such a robust acquisition environment driven by publicly traded companies augurs well for Bitcoin’s future value. As these companies continue to hold substantial amounts of Bitcoin, their influence on market trends is likely to grow. The rising visibility and acceptance of Bitcoin among institutional investors and publicly traded companies may contribute to long-term price stability and growth, as they adopt more strategic approaches toward integrating this digital asset into their financial frameworks.

Future Trends in Corporate Cryptocurrency Investments

Looking ahead, the trend of corporate cryptocurrency investments is expected to evolve significantly. As more companies recognize the benefits of incorporating Bitcoin into their teams, we may see a broader acceptance of various digital assets as part of corporate balance sheets. This move not only enhances diversification for company portfolios but also positions them favorably amid the rapidly changing financial landscape.

Furthermore, as technology progresses and the regulatory environment becomes clearer, corporate strategies surrounding cryptocurrency investments will become more refined. Companies will likely invest in educational initiatives to develop internal expertise on digital asset management, ensuring they are well-equipped to navigate the complexities of the cryptocurrency market. Such proactive approaches will be crucial as businesses strive to maximize the potential of Bitcoin and other cryptocurrencies.

Regulatory Challenges for Publicly Traded Companies Investing in Bitcoin

While the adoption of Bitcoin by publicly traded companies is on the rise, navigating the regulatory landscape presents unique challenges. Companies must stay informed about evolving regulations that govern cryptocurrency transactions to ensure compliance and mitigate risks. The lack of a consistent regulatory framework can create uncertainty around Bitcoin investments, impacting corporate strategies and decision-making.

To overcome these hurdles, corporations must engage in proactive dialogue with regulators and industry stakeholders. By advocating for clear guidelines and regulations, publicly traded companies can contribute to a more stable environment for cryptocurrency investment. This collaboration could not only lead to a greater understanding of Bitcoin within regulatory circles but also foster a climate of innovation and security that benefits the entire financial system.

The Impact of Bitcoin Price Volatility on Corporate Strategies

Bitcoin’s notorious price volatility is a significant factor that affects how publicly traded companies approach their investment strategies. The rapid fluctuations in Bitcoin’s value can create opportunities for swift gains but also pose substantial risks. Companies must be equipped to manage these risks while developing their digital asset investment frameworks, which might involve employing advanced financial tools and strategies.

In light of this volatility, some corporations may adopt a more conservative stance, opting for incremental investments into Bitcoin rather than making substantial one-time purchases. Others may leverage financial instruments such as derivatives to hedge against potential losses caused by price swings. Charting an effective course through Bitcoin’s volatility is crucial for corporate sustainability in the crypto-financial landscape as more publicly traded companies consider how they engage with this dynamic asset.

Frequently Asked Questions

What are the recent trends in Bitcoin purchases by public companies?

Recently, global publicly traded companies have shown a significant increase in Bitcoin adoption, net purchasing $2.15 billion in Bitcoin last week. Strategy (formerly MicroStrategy) led with a purchase of $2.125 billion for 22,305 bitcoins, enhancing its investment portfolio in cryptocurrency.

How much Bitcoin has Strategy invested in total?

As of January 2025, Strategy has invested a total of $2.125 billion in Bitcoin to acquire 709,715 bitcoins. This highlights the company’s strong commitment to Bitcoin as a key part of its investment strategy.

Which publicly traded companies have made Bitcoin purchases recently?

In the latest Bitcoin investment news, only two publicly traded companies made purchases last week: DayDayCook invested $17.8 million for 200 bitcoins, while BHODL acquired 1 bitcoin for $100,000. This reflects ongoing interest among cryptocurrency companies to integrate Bitcoin into their portfolios.

What is the total Bitcoin holding of publicly traded companies?

As of January 2025, publicly traded companies (excluding mining companies) hold a total of 959,810 bitcoins. This considerable amount has a current market value of approximately $87.32 billion, showcasing the growing influence of Bitcoin adoption in the corporate world.

How does Bitcoin investment by public companies impact the market?

Bitcoin purchases by publicly traded companies significantly impact the cryptocurrency market by increasing demand and market confidence. With major firms investing, it legitimizes Bitcoin as a viable investment, often leading to price appreciation and broader Bitcoin adoption across different sectors.

What price did Strategy pay for its Bitcoin acquisitions?

Strategy acquired its 22,305 bitcoins at a price of $95,284 each. This recent investment underscores the company’s aggressive strategy in Bitcoin accumulation as part of its long-term financial growth plans.

Are there any notable companies invested in Bitcoin?

Yes, notable companies like Strategy and DayDayCook are heavily invested in Bitcoin, contributing to the overall Bitcoin investment news. Strategy, in particular, has built a massive portfolio, demonstrating how publicly traded companies are leveraging Bitcoin for their strategic financial objectives.

What percentage of Bitcoin’s circulating market value do public companies hold?

Publicly traded companies hold about 4.8% of the circulating market value of Bitcoin, reflecting their substantial impact on the cryptocurrency landscape and reinforcing the legitimacy of Bitcoin as an investment asset.