Bitcoin prices have been on a rollercoaster ride as market dynamics shift dramatically beneath the surface. Recent analyses reveal that while consumers are eager to acquire this leading cryptocurrency, factors such as leveraged trading and synthetic exposure are reshaping the landscape. Understanding Bitcoin price analysis has become essential for investors looking to navigate this unpredictable terrain. With the influence of Bitcoin derivatives and growing crypto market volatility, traditional trading strategies may no longer suffice. As we delve deeper into the trends and forces influencing Bitcoin prices, it becomes evident that both opportunistic buyers and seasoned traders must adapt to survive in this volatile ecosystem.

The valuation of Bitcoin, often referred to as its market price, is subject to an array of influencing factors that extend beyond mere supply and demand. Cryptocurrency trends, especially those concerning the Bitcoin ecosystem, come into play as investors look to refine their trading strategies amid fluctuating conditions. The interplay of Bitcoin’s scarcity and the rapid creation of derivatives can create significant market movements. Consequently, understanding how various elements impact the Bitcoin trading landscape is crucial for market participants. As we explore these diverse dynamics, from order book behavior to the underlying forces driving price changes, we can form a more comprehensive perspective on this volatile asset.

| Key Points | Details |

|---|---|

| Bitcoin’s Supply Limit | There will only ever be 21 million Bitcoin, but the market can trade much more due to synthetic exposure. |

| Market Microstructure | Price is influenced by derivatives trading modes rather than just spot trading which involves actual Bitcoin exchange. |

| Derivatives Trading Volume | On Feb 3, the perpetual-to-spot volume ratio was 7.87, showing significant dominance of derivatives in trading. |

| Liquidity Dynamics | Displayed bids can be misleading due to the rapid pace and volume of derivatives trading overpowering spot activity. |

| ETF Flows Impact | ETF flows can diverge from impact on spot prices, as they don’t directly translate into Bitcoin transactions when derivatives dominate. |

| Exchange Reserves | An increase in Bitcoin on exchanges points to market supply that is separately managed from scarcity. |

| Scarcity Model | Bitcoin’s traditional scarcity needs to be understood alongside rapid synthetic trading and derivatives impact. |

Summary

Bitcoin prices are influenced by a complex interplay of market dynamics, particularly the dominance of derivatives trading over spot trading. Despite Bitcoin’s capped supply at 21 million coins, the market can exhibit volatility driven by leveraged positions in futures and perpetual contracts. This results in a situation where actual demand for Bitcoin in the spot market does not straightforwardly translate to its price movements. Consequently, understanding the relationship between different trading venues—spot, derivatives, and ETF flows—is crucial for grasping why Bitcoin prices experience fluctuations, even amidst high demand.

Understanding Bitcoin Prices in a Volatile Market

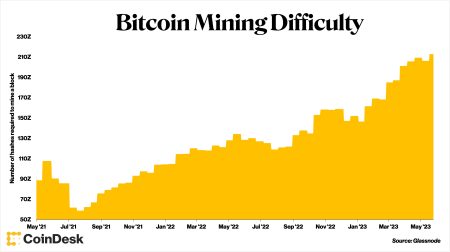

Bitcoin prices have been on a rollercoaster ride lately, reflecting significant volatility in the crypto market. This volatility is primarily driven by the complex interplay of supply, demand, and the influence of derivatives trading. For instance, while the hard cap of Bitcoin is set at 21 million coins, the actual trading volume often exceeds this limit due to the presence of synthetic exposure. This disparity creates an environment where Bitcoin can experience fluctuations that seem counterintuitive to its fundamental scarcity.

Recent data shows that despite spot demand remaining relatively strong, Bitcoin prices continue to slide. Factors such as leveraged liquidations and the dominance of derivatives in trading volumes compel traders to adjust their positions rapidly. As more focus is drawn to trading strategies involving leverage, this can create a cascading effect that further depresses prices, leaving long-term holders puzzled about the ongoing decline.

The Role of Derivatives in Bitcoin Market Dynamics

Derivatives play a crucial role in shaping Bitcoin market trends, often overshadowing the traditional spot market. Tools like perpetual contracts and futures allow traders to gain exposure to Bitcoin without actually owning the asset. This not only adds liquidity but also introduces additional risks, particularly when market sentiment shifts rapidly. As observed recently, the Binance BTC/USDT perpetual futures have outpaced spot trades significantly, indicating a market orientation that favors speculative trading.

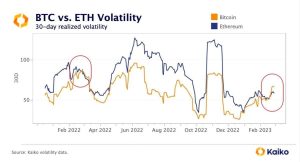

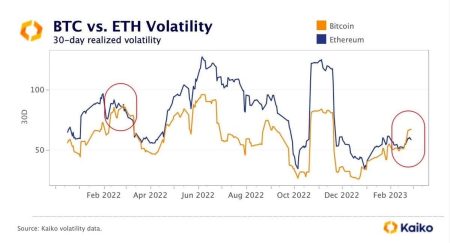

With the perpetual-to-spot volume ratio reaching alarming levels, the behavior of these derivatives tends to dictate Bitcoin’s price movements. For instance, during times of higher futures trading, we often see greater volatility in the underlying asset’s price. This spike in derivatives activity can lead to liquidations that cascade through the market, further driving prices down even as spot buyers are eager to acquire BTC. Thus, understanding the derivatives landscape becomes essential for anyone looking to navigate Bitcoin trading strategies effectively.

Analyzing Bitcoin Price Trends Amid Liquidity Changes

Analyzing Bitcoin price trends requires close attention to liquidity dynamics across various trading platforms. The recent market data indicates a notable imbalance, with significant volumes transacted in the derivatives market compared to the spot market. For instance, a rapid growth in exchange reserves, coupled with declining spot prices, highlights that liquidity may not always translate into stable prices. This disconnection is particularly evident during market stress, where liquidity shifts can lead to rapid price adjustments.

As Bitcoin reserves on exchanges increased recently while prices fell, it’s critical to see how these liquidity metrics interact with trading behavior. The visible support on order books might suggest strength, but it’s often superficial when faced with overwhelming derivatives activity. Traders must, therefore, consider these liquidity factors alongside broader market conditions and price analysis to formulate robust trading strategies.

Bitcoin Trading Strategies in the Current Climate

In today’s volatile market, implementing effective Bitcoin trading strategies is more important than ever. Many traders are pivoting toward strategies that take advantage of the rapid shifts in the market, often utilizing derivatives for leveraged positions. For example, understanding the market’s behavioral response to derivatives liquidations can inform timing on entry and exit points, whether through day trading or longer-term investments.

However, relying solely on derivatives can be perilous, especially during times of increased market volatility. A balanced approach that incorporates spot trading along with derivatives can allow traders to hedge their risks effectively. Staying informed about Bitcoin’s price analysis, as well as the overall market trends, enables traders to make better-informed decisions and capitalize on the ever-changing dynamics of the crypto market.

Impact of Bitcoin Derivatives on Price Discovery

The impact of Bitcoin derivatives on price discovery remains a critical area of focus for investors and traders alike. As highlighted, when a substantial amount of trading occurs within the derivatives market, the actual prices of BTC can be significantly influenced by these synthetic exposures rather than real supply and demand fundamentals. This often leads to rapid re-pricing of assets, where the last traded price reflects broader market speculation rather than the intrinsic value derived from actual Bitcoin in circulation.

As traders navigate these fluctuating prices, understanding how derivative markets impact price movements is essential. Price discovery is usually driven by the larger trading volumes in derivatives, leading to adjustments in Bitcoin prices even when underlying supply remains constant. Due to the nature of futures contracts and perpetual swaps, market participants can manipulate the price by increasing or decreasing their exposure rapidly, further complicating the landscape for traditional holders.

Spot Market Dynamics Amidst Derivative Dominance

Understanding the distinction between spot market dynamics and derivative trading is vital in today’s Bitcoin landscape. The spot market reflects actual Bitcoin transactions, while dependent derivative markets often dictate short-term price movements. Traders engaging in spot market activities may feel the pressure from the ongoing dominance of derivatives, where the sheer volume of trades and leveraged positions can overshadow true market trends.

This competitive environment leads to unique behavior from traditional spot buyers as they react to the rapid changes orchestrated by derivative trades. While the spot market may signal a favorable trend, it can be misled by derivative actions that create a disconnect between the perceived value and the actual selling price of Bitcoin, resulting in confusion among investors.

The Importance of Trading Data and Analytics

In the realm of Bitcoin trading, access to reliable data and analytics plays a crucial role in formulating effective trading strategies. Comprehensive data analysis allows traders to make sense of complex market dynamics and derive insights from fluctuating Bitcoin prices. By tracking key metrics such as the perpetual-to-spot volume ratio and exchange reserve levels, traders can better anticipate market movements and re-adjust their trading strategies accordingly.

Moreover, utilizing tools and platforms that aggregate trading data can help identify patterns that influence price behaviors across different market segments. As seen in the recent trends, data from platforms like Binance provide insights that highlight the disparity in trading volumes between derivatives and spot markets, which can influence decision-making for traders looking to navigate the turbulent Bitcoin landscape.

Spot Buyers vs. Derivatives Traders: Who Shapes Bitcoin Prices?

The tug-of-war between spot buyers and derivatives traders presents a fascinating narrative within the Bitcoin ecosystem. Spot buyers, who are primarily concerned with acquiring Bitcoin to hold or use, play a crucial role in establishing the asset’s fundamental value. However, the reality is that derivatives markets dominate trading volume, which often sets the immediate price for Bitcoin. This imbalance can lead to situations where prices decline despite increased demand from spot buyers.

Recognizing the influence of derivatives traders on Bitcoin’s price movements is key for any active participant in the market. As leverage and speculative trading become prevalent, understanding who truly shapes Bitcoin prices allows traders to develop strategies that align with market behavior, ultimately leading to more informed investment decisions.

Bitcoin’s Scarcity Narrative and Its Market Implications

The scarcity narrative of Bitcoin, anchored in its capped supply of 21 million coins, is a fundamental aspect of its value proposition. However, this narrative faces stark reality when viewed through the lens of market microstructure and derivative volumes. As derivatives trading often overshadows the spot market—from liquidity pools to liquidations—the perceived scarcity can become diluted, causing fluctuations in Bitcoin prices that seem contradictory to long-term holders.

Understanding this paradox is essential for anyone engaged in Bitcoin trading. The relationship between scarcity and market demand often reflects transient factors rather than concrete supply-and-demand dynamics. Consequently, traders must adapt to the evolving landscape, using data to monitor how synthetic exposure and market manipulation can impact short-term price movements while staying true to the long-term vision of Bitcoin’s inherent value.

Frequently Asked Questions

What factors are currently influencing Bitcoin prices in the market?

Bitcoin prices are predominantly influenced by the activity in the derivatives market, which often overshadows spot market actions. Recent observations indicate that high volumes in perpetual futures are creating synthetic exposure that can drive prices even when spot bids are present. Additionally, liquidations and changes in trader positioning also impact Bitcoin prices significantly.

How do Bitcoin trading strategies affect Bitcoin prices?

Bitcoin trading strategies play a crucial role in how investors react to market conditions, often leading to increased volatility. For example, the use of leveraged trading allows for a more aggressive position which can cause substantial swings in Bitcoin prices. These strategies leverage the synthetic exposure available in derivatives, thus affecting overall price dynamics.

What is the relationship between Bitcoin price analysis and market trends?

Bitcoin price analysis is essential for understanding current market trends. Analysts must consider both spot and derivatives markets when interpreting Bitcoin prices, as the latter can amplify market movements. By studying both markets, traders can gain insights into future price trajectories and identify effective trading strategies.

How do Bitcoin derivatives impact the volatility of Bitcoin prices?

Bitcoin derivatives significantly impact price volatility by enabling faster adjustments in market exposure without the need for actual coin transactions. High trading volumes and leveraged positions in futures can lead to abrupt price changes, as traders engage in rapid liquidation or adjustment of their positions, reinforcing market volatility.

Why does Bitcoin sometimes trade at prices contrary to its perceived scarcity?

While Bitcoin has a fixed supply of 21 million coins, its market price can diverge from this scarcity due to the dominance of derivatives trading. Synthetic exposure can inflate liquidity and change perceptions of supply, resulting in price movements that may not align with the fundamental scarcity of the asset. Thus, market microstructure plays a pivotal role in day-to-day pricing.