The recent Bitcoin price surge has captivated both investors and analysts as the cryptocurrency shows signs of a revival in early 2026. Following a tumultuous December, a range of structural indicators, as detailed in a thorough Bitcoin price prediction, suggests that we may see Bitcoin soar past $125,000. With fresh inflows into Bitcoin ETFs and reduced systemic leverage, key Bitcoin analysis for January 2026 indicates that the market is stabilizing. This upward momentum is further supported by encouraging trends within the broader crypto market recovery, as well as a noticeable divergence in Ethereum performance, which could enhance investor sentiment across the board. As traders navigate this critical phase, understanding these dynamics is essential for anyone looking to capitalize on the potential of Bitcoin in the near future.

The landscape for Bitcoin is shifting as momentum builds, sparking discussions around its recent price fluctuations. This resurgence may hint at a transformative period not just for Bitcoin, but for the entire digital currency ecosystem. Key factors such as institutional investments through ETFs, alongside comprehensive market analysis, reveal an encouraging narrative for Bitcoin and its resilience. Enhanced liquidity and cautious optimism within crypto markets now pave the way for potential performance highs. As traders and analysts delve deeper into these evolving trends, the implications for Bitcoin’s trajectory become increasingly significant.

Bitcoin Price Surge: What to Expect in Q1

The anticipation around a Bitcoin price surge, especially as the first quarter unfolds, is palpable. Analysts are predicting that Bitcoin could surge beyond $125,000 predominantly due to a combination of favorable conditions in the market. With a notable increase in Bitcoin ETF flows alongside a decrease in systemic leverage, investors are regaining confidence. This revitalization is crucial because it suggests that institutional investors are starting to feel more secure, which in turn could lead to further investment and a subsequent price increase.

Additionally, order book liquidity improvements are also painting a favorable landscape for Bitcoin’s price trajectory. As order books become more robust, they allow for larger transactions without significant price fluctuations. The recent uptrend in liquidity, coupled with a stabilizing macroeconomic environment, forms a solid foundation for the anticipated Bitcoin price surge in Q1. With the combination of increasing interest from institutional investors and a healthier market structure, Bitcoin’s prospects seem to be moving towards the bullish side.

The Role of Bitcoin ETF Flows in Market Recovery

As Bitcoin ETF flows continue to exhibit signs of recovery, they play a critical role in shaping the narrative surrounding Bitcoin’s performance this quarter. The initial inflows observed at the beginning of January were promising, reflecting a cautious but compelling interest from institutional investors. Despite some fluctuations, the overall trend suggests that investors are ready to re-engage with Bitcoin, which is essential for bolstering confidence and stabilizing prices in a recovering crypto market.

These evolving ETF flows can also be interpreted through the lens of wider market trends. The performance of Ethereum during the same period—with significant net inflows—highlights the potential for broader adoption and investment in cryptocurrencies. By analyzing the ongoing movements within Bitcoin ETFs, investors can gauge market sentiment, helping them make informed predictions about future price surges and the overall recovery of the cryptocurrency market.

Understanding Bitcoin Price Predictions for January 2026

Bitcoin price predictions for January 2026 indicate a variety of potential outcomes, largely shaped by market dynamics and investor sentiment. Analysts have pointed toward a potential price point ranging between $70,000 and $125,000, presenting three distinct scenarios: a bullish, base, and bearish case. The optimistic bull case hinges on continuous positive ETF flows and robust order book depth, suggesting that Bitcoin could exceed $125,000 if conditions align favorably.

On the other hand, the base case assumes mixed flows and slow leverage rebuilding, which could keep Bitcoin’s price in a more conservative range. Furthermore, bearish sentiments reflect the potential for outflows from ETFs to weigh negatively on price momentum. By closely monitoring these predictions and underlying factors such as ETF flows and systemic leverage, traders and investors can better position themselves to navigate the complexities of Bitcoin’s market behavior.

Historical Bitcoin Analysis: Lessons for Future Performance

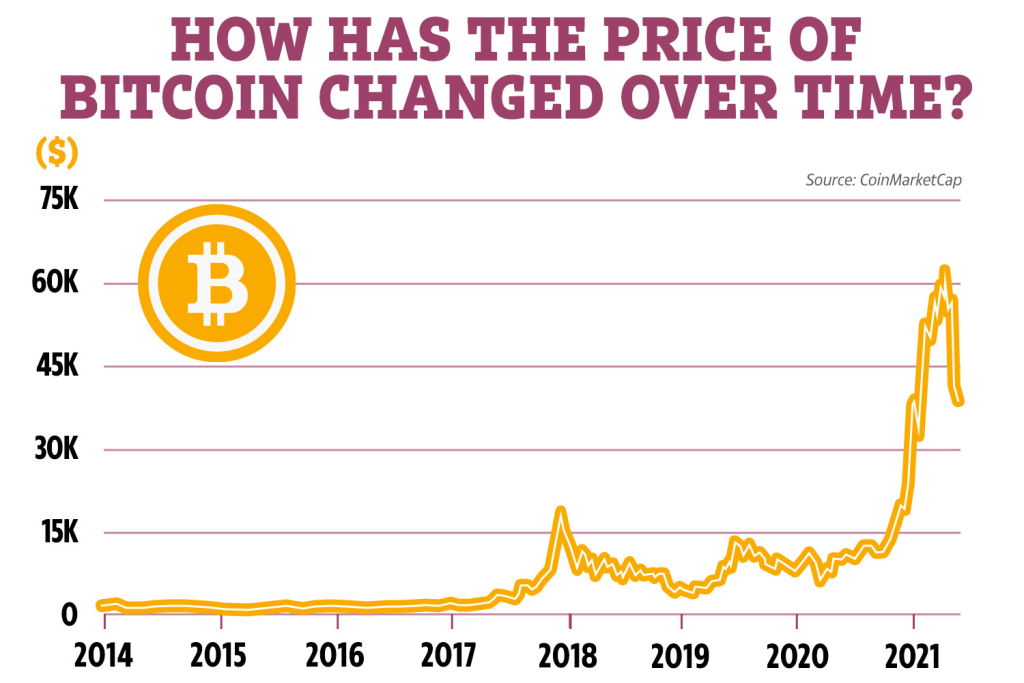

Understanding historical Bitcoin analysis provides valuable insights into potential future performance. Past market responses to similar structural indicators can help in forecasting the likelihood of a price surge above $125,000. For instance, prior recoveries have often been preceded by robust inflow patterns into both Bitcoin and Ethereum ETFs, reinforcing the notion that strong institutional backing can catalyze significant price movements.

Moreover, examining previous leverage resets reveals that periods of declining leverage often correlate with subsequent price increases. By analyzing historical patterns and comparing them to current market conditions, investors can derive lessons that inform their expectations for Bitcoin price movements over the coming months.

Impact of Market Liquidity on Bitcoin Price Movement

Market liquidity serves as a critical gauge for Bitcoin’s price movement potential. Enhanced liquidity in Bitcoin’s order books, with recent metrics showing a notable rise, indicates a readiness to absorb larger flows of transactions without causing excessive price volatility. This liquidity is essential for supporting future price increases, as it creates a more stable trading environment.

A consistent presence of two-way liquidity signals a healthy market, allowing for prolonged upward trends and minimizing the risk of abrupt downturns. As stablecoin supply also rises, bolstered by recent inflows, the overall liquidity scenario appears positive, laying the groundwork for what may become a key factor in Bitcoin prices surging past established resistance levels.

Ethereum’s Performance and Its Influence on Bitcoin

Ethereum’s recent performance is noteworthy, especially given its considerable inflows compared to Bitcoin in early 2026. As a higher-beta asset, Ethereum often reflects broader market sentiments and can serve as a leading indicator for Bitcoin. A robust Ethereum performance suggests increased risk appetite from investors, which could spill over into Bitcoin’s market behavior, potentially contributing to price surges.

Investors frequently look to Ethereum as a benchmark for gauging overall market health. If ETH maintains consistent inflows and performs well, it is likely to bolster confidence in Bitcoin, leading to stronger ETF investments in BTC. This relationship emphasizes the interconnectedness of crypto assets, making Ethereum’s strength a critical component of Bitcoin’s potential for significant price increases.

Leverage and Its Effect on Bitcoin’s Price Stability

The relationship between leverage and Bitcoin’s price stability cannot be overstated. Elevated leverage often triggers market volatility, primarily through cascading liquidations during downturns. However, recent data suggests that Bitcoin is in a healthier position as systemic leverage has declined. This is a promising sign that can pave the way for safer trading conditions and a potential price surge as investor confidence returns.

By mitigating the risks associated with high leverage, the market becomes less susceptible to dramatic downturns, allowing for a steadier climb in prices. This transformation is critical as it fosters an environment conducive to sustained growth, contributing to the argument that Bitcoin could effectively surge past its previous highs in the near future.

Waiting on Macro Environment Factors for Bitcoin’s Future

While analyzing Bitcoin’s price potential in Q1, it’s equally important to consider the macroeconomic factors that can influence market movements. Global economic stability, inflation rates, and monetary policies can all impact investor behavior in the crypto market. A favorable macro environment could lead to increased institutional investment in Bitcoin, driving prices higher.

Conversely, unfavorable economic conditions could deter investment and create uncertainty that hampers market growth. Therefore, as crypto enthusiasts and traders look ahead, factoring in potential macro developments will be crucial in determining Bitcoin’s trajectory and the likelihood of achieving a price surge above $125,000.

Preparing for Potential Scenarios in the Bitcoin Market

Investors in the Bitcoin market should be prepared for multiple potential scenarios as Q1 unfolds. The analysis outlines three cases: the bullish scenario with ETF flows positively influencing price, the base scenario reflecting mixed flows, and the bearish outcome where outflows dominate. This strategic foresight equips traders to navigate market uncertainties more effectively.

By remaining adaptable and informed about the prevailing conditions, investors can better position themselves to capitalize on opportunities or mitigate risks. The inherent volatility of the crypto space necessitates a proactive approach, particularly as Bitcoin approaches critical price thresholds that could trigger substantial movements.

Frequently Asked Questions

What factors contribute to the Bitcoin price surge predictions for January 2026?

The Bitcoin price surge predictions for January 2026 are influenced by several key factors. Fresh inflows into spot ETFs indicate a positive shift in institutional interest, while systemic leverage has decreased, creating a healthier market environment. Improved order book liquidity and a balanced options sentiment further support the possibility of a price bounce. Overall, these factors suggest that the correction has been a temporary setback rather than a fundamental change in the market.

How do Bitcoin ETF flows impact the price surge of Bitcoin?

Bitcoin ETF flows play a crucial role in determining the price surge of Bitcoin by reflecting institutional risk appetite. Positive net inflows into spot Bitcoin ETFs can signal increased demand and market confidence, driving the price upwards. Conversely, consistent outflows may hinder price recovery. Monitoring these flows is essential for understanding potential price movements, especially in relation to broader market dynamics.

What is the significance of a potential Bitcoin price surge in the context of crypto market recovery?

A potential Bitcoin price surge is significant as it could mark the beginning of a broader crypto market recovery after a significant sell-off. Improved liquidity, reduced leverage, and positive sentiment could encourage investors to re-enter the market, contributing to overall stability and growth in the cryptocurrency space. A strong recovery from Bitcoin can also lead to positive momentum in other cryptocurrencies, including Ethereum.

How does systemic leverage affect Bitcoin’s price stability and surge potential?

Systemic leverage directly affects Bitcoin’s price stability and surge potential. A lower ratio of futures open interest to market capitalization indicates a healthier market environment, less prone to volatile sell-offs triggered by liquidations. Reductions in excessive leverage can create conditions conducive to a price surge, as it allows for more stable upward movements without the fear of cascading sell-offs.

What are the implications of Bitcoin’s order book liquidity for its price surge predictions?

The liquidity of Bitcoin’s order book is critical for its price surge predictions. Enhanced order book liquidity allows the market to absorb large trades without significant price fluctuations. Improved liquidity during periods of increased buying pressure can facilitate a sustained price rise, as a well-balanced market can maintain momentum. Monitoring order book depth is vital for assessing the likelihood of a successful price surge.

What scenarios are outlined for Bitcoin’s price in Q1 of 2026?

For Q1 2026, three scenarios are outlined for Bitcoin’s price trajectory: The Bull Case, predicting a surge to $105,000–$125,000, assumes consistent positive ETF flows and rising order book depth; the Base Case projects a price range of $85,000–$105,000 with mixed flows and slowly rebuilding leverage; and the Bear Case suggests a decline to $70,000–$85,000 if ETF outflows persist and liquidity worsens. These scenarios reflect varying market conditions and investor sentiment.

| Key Point | Description |

|---|---|

| Cautious Re-risking via ETFs | US-listed spot Bitcoin ETFs saw mixed inflows, totaling $40 million. Ethereum ETFs performed better with $200 million in net inflows, indicating institutional interest. |

| Leverage Reset | Bitcoin’s systemic leverage is at 3.4%, suggesting a healthier market, while Ethereum’s leverage is higher at 10.8%. December’s sell-off has set a stable foundation for future price movements. |

| Liquidity and Market Structure | Bitcoin’s order book depth increased to $631 million, indicating improved liquidity which is essential for price stability and extended upward movement. |

| Expected Scenarios for Q1 | Three potential price scenarios: Bull Case ($105k–$125k), Base Case ($85k–$105k), Bear Case ($70k–$85k) based on ETF flows and market leverage. |

Summary

The Bitcoin price surge is anticipated in Q1 as various indicators suggest recovery following December’s market corrections. Factors such as increased inflows into ETFs, reduced systemic leverage, enhanced market liquidity, and the dynamics of the options market play crucial roles in shaping the potential for Bitcoin to surpass the $125,000 mark. As market conditions stabilize, the cryptocurrency landscape appears poised for a significant rebound, drawing the attention of institutional and retail investors alike.