Bitcoin price predictions for the coming years are creating buzz in the financial markets, with expectations fluctuating amidst recent trading activities. Currently, Polymarket traders assign only a 21% chance of Bitcoin reaching an impressive $150,000 this year despite optimistic forecasts from various analysts. Many industry experts propose that the year 2026 could be a pivotal moment for the cryptocurrency, potentially ushering in a significant Bitcoin bull run. This period may offer various Bitcoin trading strategies as market analysis indicates a 45% probability that prices could surge to $120,000 while still falling short of the all-time high. As enthusiasts speculate on the future of cryptocurrency, understanding these Bitcoin market analyses and crypto predictions for the upcoming years will be vital for informed investing.

The landscape of Bitcoin valuation is dominated by fluctuating forecasts, stirring considerable debate among investors and analysts alike. As experts dissect the evolving cryptocurrency environment, alternative phrases such as Bitcoin market outlook and Bitcoin valuation trends come into play. These elements highlight the disparate predictions related to Bitcoin’s price trajectory and its influential factors, particularly as we approach potential regulatory changes and shifts in market sentiment. The anticipation surrounding Bitcoin’s future extends to alternative crypto predictions for the years leading up to 2026, as stakeholders examine various angles and strategies for trading. By decoding these market dynamics, one can better grasp the potential highs and lows that await Bitcoin and similar assets in the increasingly volatile digital currency space.

Market Sentiment: Bitcoin Price Predictions and Traders’ Perspectives

The current market sentiment surrounding Bitcoin reveals a degree of caution among traders. According to Polymarket, there is only a 21% chance that Bitcoin will achieve the ambitious price point of $150,000 this year. This statistic indicates a significant divergence between trader expectations and the more optimistic forecasts from various analysts. While many foresee a potential Bitcoin bull run as early as 2026, the bearish undertones in this year’s predictions reflect the uncertainty permeating the market. This sentiment can influence overall trading strategies, as investors remain wary of potential losses in the volatile crypto environment.

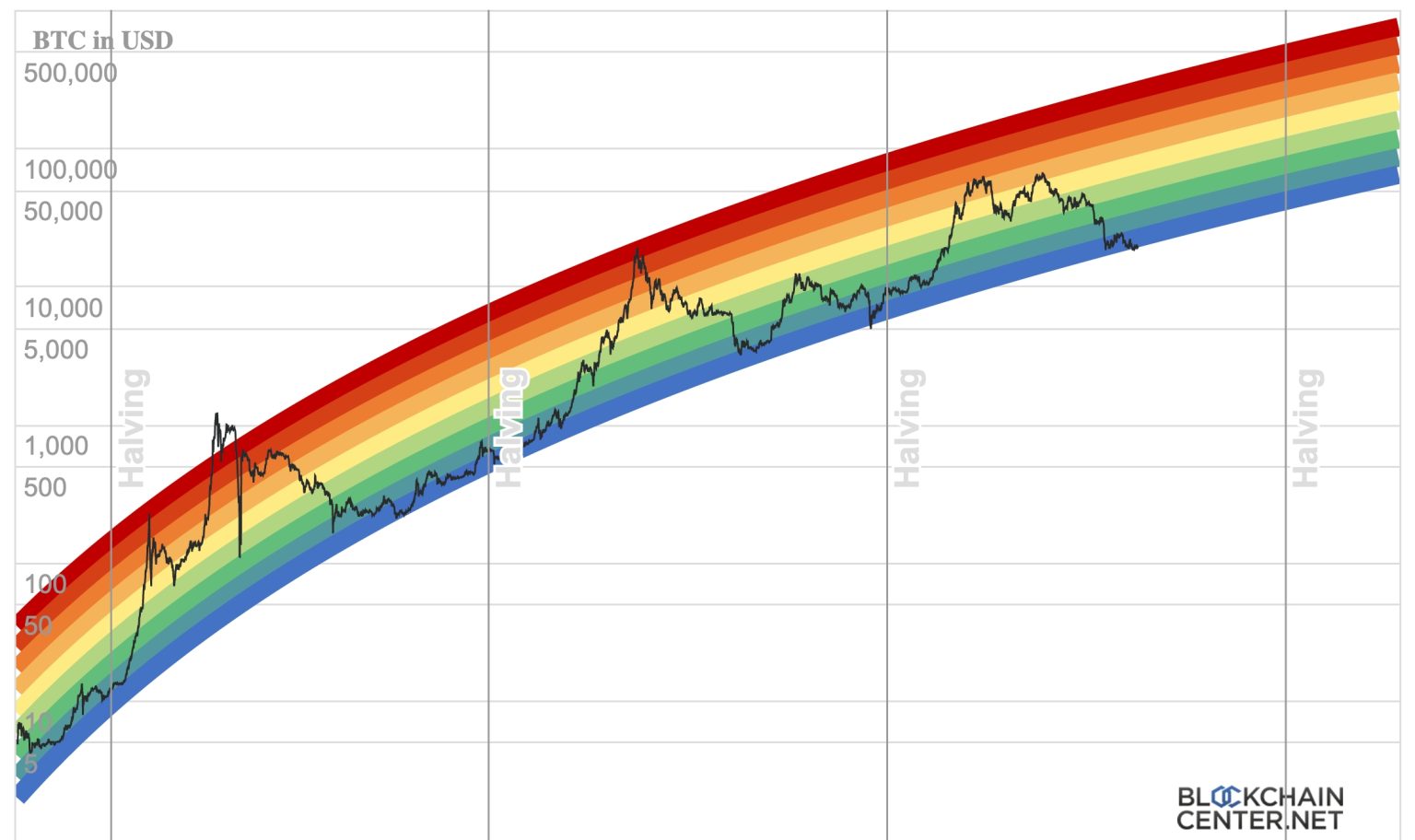

Moreover, the predictions about Bitcoin’s price movements are often informed by historical patterns, such as the four-year cycle associated with halving events. Some traders are holding back, hoping to see clearer market signals before committing to substantial investments in Bitcoin. The analytical perspective shifts from a short-term price increase to long-term expectations, focusing on the larger trend of gradual adoption and market maturation. Thus, Bitcoin price predictions should also be contextualized within the broader framework of cryptocurrency market analysis, including regulatory developments and macroeconomic factors.

Bitcoin Market Analysis: Understanding the Four-Year Cycle

The four-year cycle in Bitcoin’s market behavior has long been a topic of discussion among cryptocurrency enthusiasts and analysts alike. Traditionally, this cycle correlates with halving events that reduce the supply of new Bitcoin entering circulation. The conclusion of this cycle has prompted some traders to re-evaluate their positions, particularly considering how the previous cycle ended negatively in 2025. Analysts argue that historical performance during these cycles can provide valuable insights into future Bitcoin trading strategies and potential price targets.

As the market adjusts to the perceived end of the four-year cycle, new patterns may emerge that challenge traditional expectations. For instance, many traders are analyzing the potential impacts of upcoming regulatory legislation, such as the GENIUS Act, which could shape the landscape for cryptos moving forward. Understanding these influences is crucial for traders and investors who aim to optimize their decision-making in the context of Bitcoin market analysis and future crypto predictions.

Fundamental Drivers: Influences on Bitcoin Price Forecasts

Several fundamental factors could significantly impact Bitcoin price forecasts in the coming years. Speculation surrounding potential changes in leadership at the US Federal Reserve, especially with anticipated interest rate cuts, has stirred optimism among analysts and investors alike. Such macroeconomic changes could facilitate a more favorable environment for Bitcoin and the broader cryptocurrency market, potentially fortifying the bullish stance for Bitcoin’s expected price trajectory. Analysts from firms like Standard Chartered have already posited that Bitcoin could reach $150,000 or more by 2026, primarily driven by these external influences.

However, not all analysts share the same buoyancy regarding these forecasts. While some predict a bullish surge driven by significant institutional adoption and regulatory clarity, others caution against potential pitfalls. The introduction of the CLARITY Act, along with legislative movements aimed at addressing cryptocurrency regulation, could influence market dynamics. The interplay between these developing factors and Bitcoin’s historical price movements will be paramount in shaping traders’ strategies and future predictions.

Bitcoin Trading Strategies During Uncertain Times

In light of current market conditions, developing sound Bitcoin trading strategies is essential for navigating potential volatility. With a significant portion of traders hesitating to invest due to predictions indicating uncertainty, innovative trading approaches may emerge. For instance, employing strategies that focus on dollar-cost averaging can help mitigate the risks associated with price fluctuations. This method allows traders to accumulate Bitcoin over time, reducing the overall impact of volatility on their investment portfolios.

Traders may also consider diversifying their crypto holdings to spread risk among different assets within the market. Such diversification strategies could include a combination of established cryptocurrencies like Bitcoin alongside emerging altcoins, which may present higher growth potential. By understanding market indicators and employing well-researched trading strategies, investors can better position themselves for whatever direction the Bitcoin market may take in the next few years.

Future of Bitcoin: A Look Ahead to 2026

As we look ahead to 2026, the potential for Bitcoin’s price surge remains a focal point for investors and analysts. Many believe that the culmination of legislative efforts to provide clearer regulatory frameworks could result in a more stable and favorable environment for cryptocurrency investment. Estimates suggesting Bitcoin prices could ascend to $150,000 or beyond have garnered attention, reflecting a culmination of various economic and market forces coming into play.

Additionally, the anticipated revival of interest in the crypto market may coincide with an upswing in adoption rates among mainstream users and institutional investors. If Bitcoin can overcome the prevailing market sentiment that has caused hesitance, it may signal the onset of a new bull run, propelling prices to new all-time highs. The integration of crypto into conventional financial systems, alongside advancements in blockchain technology, will play a pivotal role in shaping the future trajectory of Bitcoin, further influencing predictions and investment strategies.

The Impact of Global Events on Bitcoin Price Predictions

Global events significantly influence Bitcoin price predictions, making it crucial for traders to stay informed. Factors such as geopolitical tensions, economic shifts, and major financial announcements can cause fluctuations in Bitcoin’s value. For instance, any news surrounding monetary policies from central banks can lead to immediate market reactions. As emerging economies start recognizing Bitcoin as a legitimate asset class, increased adoption could further affect Bitcoin’s pricing dynamics.

Moreover, as seen in previous years, significant global events like pandemics or financial crises have prompted increased interest in decentralized assets. These scenarios often lead investors to seek out Bitcoin as a hedge against instability. Consequently, Bitcoin’s price predictions are closely tied not only to market sentiment but also to the broader global economic landscape, making thorough analysis essential for anyone involved in Bitcoin trading.

Institutional Interest: Driving Factors in Bitcoin Adoption

Institutional interest in Bitcoin has surged significantly over recent years, catalyzing many of the bullish predictions seen today. With firms such as MicroStrategy and Tesla adding Bitcoin to their balance sheets, the narrative surrounding Bitcoin’s legitimacy has shifted dramatically. As more institutions consider Bitcoin as a viable asset, predictions of price surges resonate with an increasingly bullish investor base. This shift towards acceptance could pave the way for Bitcoin to achieve price milestones previously deemed improbable.

However, institutional adoption is not solely dependent on market conditions; it also hinges on regulatory clarity. As upcoming laws like the GENIUS Act gain traction, institutional investors are likely to feel more comfortable allocating funds into Bitcoin, further influencing market predictions. Analysts speculate that as institutional players enter the arena, Bitcoin could experience price benchmarks previously thought to be out of reach, such as reaching $200,000 or higher by 2026.

Analyzing the Bull Run Potential for Bitcoin

The prospect of a Bitcoin bull run has been a hot topic among traders and analysts alike. Many individuals are eagerly waiting to see if Bitcoin can break through previous resistance levels, which could trigger a new surge in buying activity. Analysis of market trends and historical data suggests that periods of price appreciation are often followed by speculative buying, leading to accelerated gains. Investigating the characteristics of prior Bitcoin bull runs can provide valuable insights into current trading strategies.

However, the timing of any potential Bitcoin bull run is uncertain, influenced by a variety of factors, including investor sentiment, macroeconomic indicators, and emerging regulatory landscapes. As we approach 2026, the confluence of positive influences could ignite renewed enthusiasm among investors, reinforcing bullish predictions and perhaps leading Bitcoin to significant price milestones. Understanding the mechanisms behind these bull runs is essential for traders looking to capitalize on Bitcoin’s future market movements.

Market Challenges: Navigating Bitcoin’s Price Volatility

Navigating the inherent volatility of the Bitcoin market remains a formidable challenge for both seasoned traders and newcomers alike. Dramatic price swings characterized Bitcoin’s history and can be triggered by a myriad of factors ranging from regulatory news to macroeconomic changes. Consequently, developing robust risk management strategies is vital for traders looking to safeguard their investments. For example, employing stop-loss orders and diversification can help mitigate losses in tumultuous market conditions.

Moreover, it is crucial for traders to develop a thorough understanding of market psychology, as emotional trading behaviors can exacerbate volatility. Awareness of common trading pitfalls, such as fear of missing out (FOMO) or panic selling, can assist traders in making more rational decisions. By educating themselves about the complexities of the Bitcoin market and the various factors influencing price fluctuations, traders can better position themselves for long-term success and optimize their cryptocurrency trading strategies.

Frequently Asked Questions

What are the latest Bitcoin price predictions for 2026?

Many analysts are forecasting a favorable Bitcoin forecast for 2026, suggesting that Bitcoin could hit as high as $150,000, with some even predicting prices around $200,000 to $250,000. This optimism stems from broader market trends and potential regulatory clarity that could boost institutional adoption.

How do Bitcoin market analysis predictions influence trading strategies?

Bitcoin market analysis is critical for developing effective Bitcoin trading strategies. By analyzing market patterns and predictions, such as the likelihood of Bitcoin reaching $100,000 with an 80% chance, traders can make informed decisions on when to enter or exit positions.

Is there a consensus on Bitcoin’s price movement before 2027?

Current predictions indicate a 45% chance of Bitcoin reaching $120,000 before 2027, while more conservative estimates suggest an 80% chance of hitting $100,000. These Bitcoin price predictions highlight the mixed sentiments in the market as traders assess potential outcomes.

What factors are contributing to Bitcoin’s forecasted bullish run in 2026?

Several factors contribute to the bullish outlook for Bitcoin, including anticipated regulatory clarity from new legislation like the GENIUS and CLARITY Acts, as well as speculation about interest rate cuts. These elements are expected to catalyze a potential Bitcoin bull run starting in 2026.

What is the likelihood of Bitcoin hitting $150,000 this year according to market traders?

Traders on Polymarket indicate only a 21% chance of Bitcoin reaching $150,000 this year. This cautious outlook is based on current market conditions and the conclusion of the four-year cycle, which could impact future price movements.

Are there any notable Bitcoin trading strategies based on current price predictions?

Yes, investors are advised to consider dynamic trading strategies that account for current Bitcoin price predictions and market analysis. For instance, anticipating potential resistance at $130,000 or $140,000 can help traders make strategic moves around these key levels.

How does the conclusion of the four-year cycle affect Bitcoin price predictions?

The conclusion of the four-year cycle may signal a change in Bitcoin’s price dynamics, influencing predictions and market sentiment. Historically, this cycle has been associated with potential price increases, and its end may provide space for new trading patterns to emerge.

What are the implications of Bitcoin’s current market conditions on future forecasts?

Bitcoin’s current stagnation, coupled with predictions of a market rally due to regulatory developments and economic factors, suggests mixed implications for future forecasts. While some anticipate aggressive bull runs in 2026, others remain cautious, reflecting the unpredictability of the crypto market.

| Price Target | Probability |

|---|---|

| $150,000 | 21% |

| $140,000 | 28% |

| $130,000 | 35% |

| $120,000 | 45% |

| $100,000 | 80% |

Summary

Bitcoin price predictions suggest a cautious approach among traders, with only a 21% chance of it reaching $150,000 this year. Despite some analysts holding an optimistic view towards a substantial surge by 2026, current sentiments are tempered by market cycle patterns and regulatory expectations. As Bitcoin faces a pivotal moment influenced by market dynamics and potential policy changes in the US, investors are recommended to stay informed and consider the outlined probabilities carefully.