As we delve into Bitcoin price predictions for 2025, the cryptocurrency landscape offers intriguing insights that merit attention. While forecasts have generated considerable enthusiasm, many are now grappling with the reality of Bitcoin’s market performance. According to recent analyses, the projected trading price of Bitcoin has been revisited, estimating a potential value around $88,000 by the end of 2025, which marks a 6% decrease from the previous year. Financial experts from institutions like BlackRock and Standard Chartered have put forth varying forecasts, some projecting significant hikes towards $200,000, while others have tempered expectations. Thus, a thorough Bitcoin market analysis reveals a complex interplay of optimism and caution, shaping the future of Bitcoin as it meanders through evolving cryptocurrency trends for 2025.

Exploring the potential trajectory of Bitcoin’s valuation by 2025 reveals both optimism and skepticism among investors and analysts alike. The Bitcoin forecast for 2025 is influenced by a blend of market behaviors and strategic institutional investments, making it a focal point for cryptocurrency enthusiasts. As we assess the outlook for this digital currency’s price, it’s crucial to consider expert predictions from leading financial entities, which add layers to the ongoing discourse about Bitcoin’s viability. With cryptocurrency trends for 2025 being heavily scrutinized, industry leaders are continuously updating their predictions based on market fluctuations and investor sentiment. This exploration not only enriches the understanding of Bitcoin investment strategies but also prompts discussions about the overall evolution and reliability of Bitcoin as a financial asset.

Analyzing Bitcoin Price Predictions for 2025

The current landscape of Bitcoin price predictions for 2025 reveals a complex picture, one that many investors are closely examining. Despite initial bullish trends and forecasts suggesting that the price of Bitcoin could surpass $200,000, the reality has turned out to be less optimistic. As of December 2025, Bitcoin’s trading price sits at approximately $88,000, marking a 6% decline for the year. This stark contrast between expectations and reality illustrates the inherent volatility of cryptocurrencies, making thorough market analysis pivotal for traders and long-term investors alike.

Institutions such as BlackRock and Standard Chartered have made ambitious claims surrounding Bitcoin’s potential. BlackRock’s CEO Larry Fink suggested that Bitcoin could skyrocket to $700,000 if large investors begin to allocate capital heavily into the cryptocurrency. However, Standard Chartered has had to temper their predictions, seeing the price drop after reaching an October peak of $126,000. This demonstrates a crucial lesson for the cryptocurrency market: while optimistic forecasts hold potential for investment appeal, they must also align with realistic market conditions and data.

Understanding Cryptocurrency Trends Leading to 2025

The cryptocurrency market is known for its rapid changes and evolving trends, which significantly influence price predictions for Bitcoin and other digital assets. In 2025, we can observe that economic factors, regulatory developments, and market adoption rates are crucial to understanding these trends. For instance, the increasing interest from institutional investors and major corporations in Bitcoin can lead to a surge in demand, potentially affecting prices positively. On the other hand, adverse regulations or market corrections can quickly reverse these gains, emphasizing the need for proactive market analysis.

Recent predictions highlight not only the optimistic forecasts but also the cautious adjustments made by analysts. Investment firms, like Bitwise and Fundstrat, have laid out various scenarios indicating that Bitcoin may exceed the $200,000 mark in 2025. However, the fluctuating price and bearish sentiments from other sectors call for a deeper exploration of both the bullish and bearish pressures in the market. As we approach the midpoint of the decade, understanding the broader cryptocurrency trends becomes essential for meeting investment goals in this hyper-competitive landscape.

The Future of Bitcoin Beyond 2025

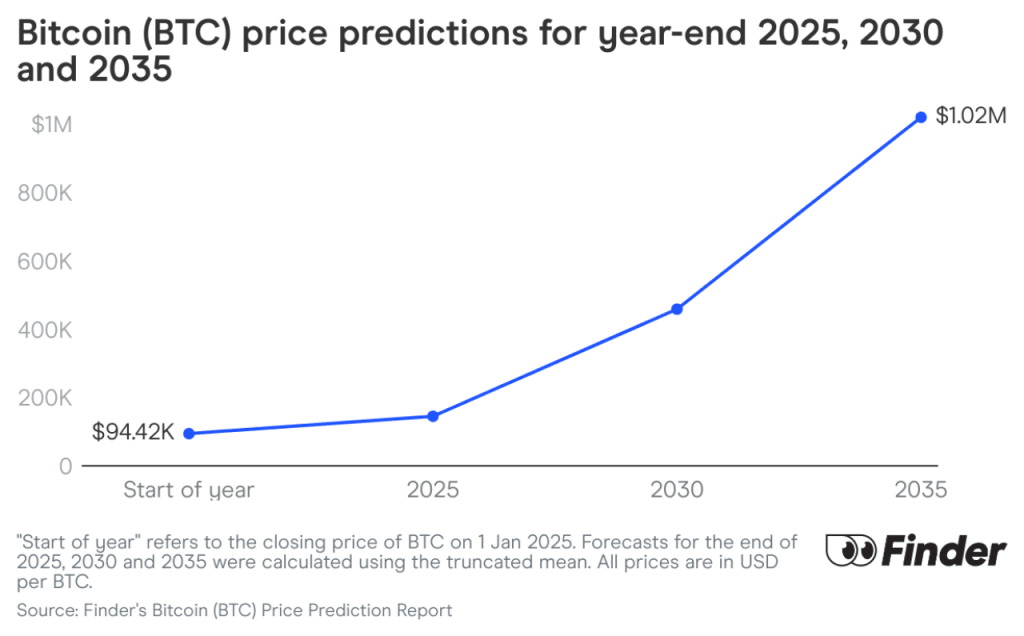

Considering the long-term trajectory of Bitcoin and its price potential beyond 2025 is essential for any cryptocurrency investment strategy. While current forecasts show a modest trading price of $88,000, many analysts remain optimistic that Bitcoin could rebound and achieve significant price milestones. The views from investment leaders like Cathie Wood of ARK Investment Management, who revised her projections from $1.5 million to $1.2 million for 2030, suggest that the long-term outlook for Bitcoin remains bullish despite short-term corrections.

This projected growth reflects broader trends in the cryptocurrency market, including increased technology adoption, institutional investment, and a potential global shift toward digital assets. As Bitcoin evolves, it is crucial for investors to remain vigilant about market developments, regulatory changes, and technological advances that could reshape the future of cryptocurrency investments. Understanding these dynamics will be vital for successful navigation through the anticipated volatility of Bitcoin’s market.

Investment Strategies for Bitcoin in 2025 and Beyond

Investing in Bitcoin requires not only an understanding of its current market position but also strategic planning for the future. Given that predictions indicate a potential price range between $100,000 and $200,000 by late 2025, investors must consider various strategies to mitigate risks while capitalizing on potential gains. One common approach is dollar-cost averaging, which involves steadily purchasing Bitcoin over time, thereby reducing the impact of price volatility on overall investment.

Moreover, staying informed on cryptocurrency trends and market analysis is key. Investors should regularly review expert predictions and adapt their strategies accordingly. As Bitcoin faces challenges, such as regulatory scrutiny and market competition, diversifying investment portfolios by including other cryptocurrencies or assets can also provide a balanced approach. By leveraging these strategies, investors can enhance their chances of gaining favorable returns as they navigate the evolving cryptocurrency landscape.

Key Factors Influencing Bitcoin’s Price in 2025

Several key factors influence Bitcoin’s price trajectory as we move toward 2025. Market sentiment plays a significant role, often swayed by news, institutional involvement, and technological advancements in the blockchain space. A lack of confidence or negative news can swiftly result in price drops, while positive developments may drive prices upwards. For instance, the varying predictions from firms like Bernstein and Fundstrat illustrate how differing sentiments can affect expectations and investor perception.

Additionally, macroeconomic factors such as inflation, interest rates, and the overall performance of traditional markets can impact Bitcoin’s price. As more investors see Bitcoin as a hedge against inflation, its demand may increase, supporting higher price levels. Therefore, for those analyzing the Bitcoin market, understanding these key factors is vital to making informed predictions and investment decisions.

The Role of Major Institutions in Bitcoin’s Future

Major institutions have been increasingly influential in shaping Bitcoin’s future and overall market dynamics. High-profile endorsements from firms like BlackRock or ARK Investment have validated Bitcoin’s legitimacy as a financial asset. Their predictions often carry significant weight within the investment community, impacting market sentiment and driving interest from both retail and institutional investors. As institutions continue to allocate funds into Bitcoin, they play a pivotal role in establishing long-term price stability and growth.

However, as witnessed with recent adjustments in forecasts, institutional predictions can also reflect the tumultuous nature of the Bitcoin market. For instance, BlackRock’s optimistic price target of $700,000 is met with contrast from more conservative estimates, highlighting the unpredictability of cryptocurrency investments. Thus, while institutions can stabilize and legitimize Bitcoin, their varying outlooks will continuously engage investors to reassess their strategies in response to the fluid market conditions.

Leveraging Market Analysis for Better Bitcoin Investments

Market analysis is crucial for anyone looking to invest in Bitcoin, as it provides a clear understanding of trends and potential future movements. Employing tools such as technical analysis and sentiment analysis allows investors to gauge market sentiment accurately and predict potential price movements. By analyzing chart patterns, trading volumes, and news cycles, traders can identify the best times to enter or exit their positions, thus optimizing their investment strategies.

Furthermore, keeping an eye on long-term trends can also yield valuable insights. From blockchain technology advancements to growing adoption in payment systems, understanding the macro trends can guide strategic investment decisions in Bitcoin. In an unpredictable market, being informed and flexible with investment strategies will lead to more successful outcomes in the long run.

Impact of Regulatory Changes on Bitcoin’s Price

Regulatory changes are a significant factor that can dramatically affect Bitcoin’s price throughout 2025 and beyond. As governments worldwide develop their approaches to cryptocurrency, the uncertainty surrounding regulations may lead to increased volatility. For example, positive regulatory developments—such as clearer legal frameworks—could provide a boost to Bitcoin prices. Conversely, strict regulations or outright bans can induce negative sentiment, leading to price declines in the market.

Investors must stay attuned to legislative actions affecting Bitcoin to make informed decisions. Continuous monitoring of news related to regulations, tax implications, and government attitudes toward cryptocurrencies will be essential. By understanding how these external factors might influence market dynamics, investors can position themselves effectively to ride out fluctuations and leverage potential opportunities as they arise in the market.

Preparing for Future Bitcoin Market Volatility

Understanding and preparing for market volatility is critical for any serious Bitcoin investor as we move toward 2025. The nature of the cryptocurrency market is highly unpredictable with sudden price fluctuations based on market sentiment, economic conditions, and geopolitical events. Investors must adopt an adaptive mindset and employ risk management strategies, such as setting stop-loss orders and diversifying their portfolios.

Additionally, leveraging historical price movements and trends can aid in anticipating potential market shifts. While past performance is not always indicative of future results, identifying recurring patterns can assist investors in making well-informed decisions. Ultimately, being proactive and prepared for volatility can help investors not only protect their capital but also find new opportunities for growth within the dynamic landscape of Bitcoin.

Frequently Asked Questions

What are the key Bitcoin price predictions for 2025 according to market analysts?

Market analysts have varied predictions for Bitcoin price in 2025. BlackRock’s CEO, Larry Fink, suggests Bitcoin could reach up to $700,000 if institutional investors allocate funds heavily. Other forecasts include Bernstein’s prediction of $200,000, and Standard Chartered’s adjusted target which began at $200,000 but was later lowered to $100,000 due to market fluctuations.

How has the Bitcoin market analysis evolved leading up to 2025?

The Bitcoin market analysis leading to 2025 reflects a range of bullish and bearish sentiment. While major institutions like Bitwise continue to forecast Bitcoin breaking the $200,000 mark, others have revised their targets downward following fluctuations, with Bitcoin peaking at $126,000 before year-end adjustments.

What factors are influencing the future of Bitcoin and its price predictions for 2025?

The future of Bitcoin and its 2025 price predictions are influenced by several factors, including institutional investment interest, overall market sentiment, and regulatory developments. Major institutional forecasts fluctuate based on market performance; for instance, Cathie Wood of ARK Investment Management has modified her long-term prediction to $1.2 million by 2030, reflecting a cautious approach.

How do cryptocurrency trends in 2025 impact Bitcoin investment decisions?

Cryptocurrency trends in 2025 significantly impact Bitcoin investment decisions. With varying predictions from analysts, potential investors must assess market stability, regulatory changes, and institutional interest. The consensus has shifted this year, emphasizing the importance of adaptive investment strategies as Bitcoin’s price experiences ups and downs.

What should investors know about Bitcoin’s forecast for 2025?

Investors looking at Bitcoin’s forecast for 2025 should be aware of the mixed predictions from analysts. While some forecasts are optimistic, projecting prices as high as $200,000, recent adjustments note volatility, with Bitcoin expected to close 2025 around $88,000. Understanding these dynamics can help inform investment strategies.

| Institution | Initial Prediction | Revised Prediction | Current Price Prediction for 2025 |

|---|---|---|---|

| BlackRock CEO Larry Fink | $700,000 | Not revised | Not met expectations |

| Bernstein | $200,000 | Not revised | Not met expectations |

| Standard Chartered | $200,000 | $100,000 | Not met expectations |

| Bitwise | Above $200,000 | Not revised | Not met expectations |

| Tom Lee (Fundstrat) | $200,000 – $250,000 | Above $100,000 | Not met expectations |

| Cathie Wood (ARK Investment Management) | $1.5 million in 2030 | $1.2 million in 2030 | Not met expectations |

Summary

Bitcoin price predictions for 2025 were overly optimistic, with many institutions missing their forecasts. Despite bullish expectations, the price of Bitcoin is projected to remain around $88,000 by year-end, reflecting a 6% decrease. Major forecasts from firms like BlackRock and Standard Chartered had set benchmarks of $700,000 and $200,000 respectively, but these targets have not materialized as expected. This indicates significant volatility and unpredictability in Bitcoin’s market performance, showing the challenges investors face in making accurate long-term predictions.