Bitcoin price prediction is becoming increasingly critical for investors as they navigate the volatile cryptocurrency landscape. With the recent downturn affecting market confidence, speculations around the future of Bitcoin are buzzing, especially concerning milestones like the $100,000 mark. Market analysts are closely watching Bitcoin trading odds, which show a stark contrast between the bullish expectations and the bearish actions observed in the market. Predictions suggest varying probabilities of Bitcoin reaching significant price levels by June 2026, such as dropping to or recovering from towards the $80,000 level first. Engaging in comprehensive cryptocurrency market analysis is essential for investors aiming to understand the dynamics behind these predictions and to make informed trading decisions in an unpredictable environment.

Exploring Bitcoin price forecasts is essential for anyone interested in the future trajectory of cryptocurrencies. As Bitcoin continues to capture the imagination of both seasoned traders and newbies, alternative terminologies like BTC valuation forecasts and digital asset projections come into play. The emerging trend of BTC prediction markets reflects traders’ sentiments, shaping expectations for price movements and potential bull markets. Analysts are using various tools and platforms to uncover insights into Bitcoin’s journey, whether it involves reaching new heights or facing temporary downturns. Understanding the intricacies of these market signals will be crucial for anyone looking to make strategic investments in the ever-evolving digital currency space.

| Key Point | Details |

|---|---|

| BTC Price Chances Before June | Less than 10% for hitting $100,000 before February 1, according to prediction markets. |

| Traders’ Predictions | Most don’t expect Bitcoin to reach $100,000 before June; 65% chance it will break $100,000 before June 2026. |

| Current Price Trends | The last high was $97,900 in January; predictions indicate a potential drop to $80,000 before any recovery. |

| Bear Market Signals | 75% chance BTC trading below $75,979, the average cost basis. |

Summary

Bitcoin price prediction suggests a challenging outlook for the cryptocurrency in the coming months. With traders betting against a substantial price rally, the overall sentiment points to lower expectations for reaching the $100,000 milestone soon. Factors such as recent market behavior and prediction trends contribute to a broader bearish outlook, indicating that BTC may struggle to regain its former peak.

Bitcoin Price Prediction Analysis for June 2026

The outlook for Bitcoin’s price leading up to June 2026 suggests a nuanced picture shaped by current market sentiment and prediction strategies. Based on recent data, traders’ expectations indicate a growing belief that Bitcoin may reach the pivotal $100,000 mark within the next few years, with various prediction markets weighing in on this likelihood. Current BTC prediction markets are reflecting a 65% chance that Bitcoin may surpass this landmark by June, suggesting a potential shift as traders initiate strategic bets on an upcoming rally in the cryptocurrency market.

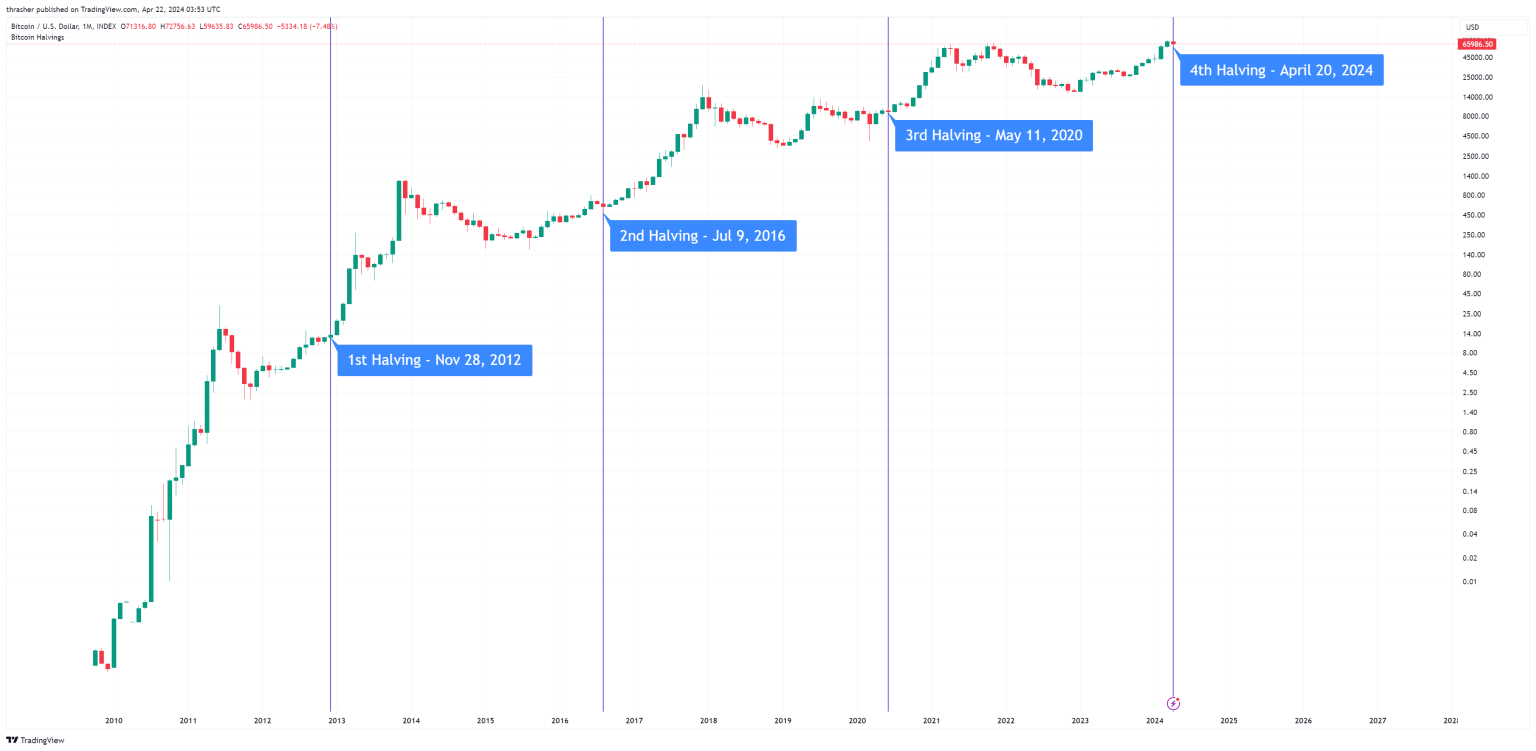

Despite short-term undervaluations and bearish signals, such as reaching lows of $58,000, the medium-term horizon presents opportunities for growth. Should Bitcoin’s trajectory align with historical performance patterns, traders could witness dramatic increases as investors look to capitalize on the next Bitcoin bull market cycle, driven by institutional adoption and macroeconomic factors. As June approaches, market analysis will become even more critical to gauge whether Bitcoin could break above $100,000.

Understanding Bitcoin Trading Odds and Market Sentiment

The current trading dynamics of Bitcoin reveal significant hesitation among investors concerning the asset’s near-term performance. With traders assigning less than 10% odds that BTC will manage to rebound above $100,000 before February, the market sentiment indicates a cautious approach. Analysts emphasize that these trading odds often reflect broader market health and liquidity, highlighting the connection between investor psychology and price movements within the cryptocurrency ecosystem.

As traders analyze BTC prediction markets, many are assessing key indicators that may impact future price movements. The combination of economic uncertainty and fluctuating regulatory landscapes adds complexity to Bitcoin trading odds, which makes traditional analysis methods less applicable. Ultimately, remaining agile and informed is essential for participants in this volatile market, where strategic betting on Bitcoin’s movements can yield significant rewards in the long run.

Recent calculations suggest a 75% likelihood that Bitcoin will trade below troubling average cost bases, reinforcing the need for in-depth cryptocurrency market analysis. Traders will have to adapt quickly to the evolving trading landscape as they navigate these odds, weighing the risks against potential payoffs.

Examining the Impact of Recent Market Trends on Bitcoin

As Bitcoin navigates the currents of market activity, it faces pressures that challenge its ability to achieve record-breaking highs. The widespread post-October crash vibes have led to reduced confidence among traders, making it critical to segment market trends for clearer insights. One prominent trend includes the bearish sentiment hinting at a price drop below established milestones, potentially impacting how traders approach upcoming investment opportunities.

This fluctuation underscores the importance of understanding how external economic indicators can influence the cryptocurrency market. Factors such as inflation rates, geopolitical tensions, and technological developments remain crucial in shaping trader perspectives on Bitcoin’s long-term value. Savvy investors will keep these trends in mind, closely monitoring any changes that could sway Bitcoin’s potential trajectory.

Strategies for Investing in Bitcoin Amid Market Uncertainty

With Bitcoin’s uncertain position in the market, investors are devising varied strategies to navigate the possible ups and downs. Many traders are focusing on dollar-cost averaging to mitigate risks as they continue purchasing Bitcoin, planned with the belief that long-term holding can average out short-term volatility. This method allows investors to accumulate BTC gradually without the stress of trying to time the market.

Furthermore, understanding the importance of diversification within a portfolio becomes increasingly crucial, especially during times of potential downturns. Incorporating other assets and cryptocurrencies can provide a buffer against Bitcoin’s price fluctuations while still allowing exposure to its potential upside as more predictions lean toward a revival in 2026. Engaging with these strategies can prepare investors for either a resurgence in Bitcoin’s price or minimize losses during stagnation.

The Role of Prediction Markets in Cryptocurrency Analysis

Prediction markets have emerged as pivotal tools for understanding Bitcoin’s future price movements, offering valuable insights based on collective trader sentiments. Sites like Polymarket and Kalshi host betting platforms where traders create and trade contracts based on anticipated Bitcoin prices. The aggregated data from these markets can provide a snapshot of average trader expectations, influencing decision-making processes for cryptocurrency investors.

These prediction platforms have been particularly illustrative for analyzing Bitcoin’s potential peak values, as many traders utilize them to forecast how BTC might respond to market conditions. By tracking predictions related to Bitcoin’s ascent to or descent from levels like $100,000, investors can make more informed choices about buying or selling their holdings, taking advantage of the market’s ever-evolving sentiment.

Future Prospects: Will Betting Markets Correctly Predict Bitcoin’s Rise?

As we look forward, the question remains whether prediction markets will hold true to their forecasts for Bitcoin’s potential rises or falls. With a notable portion of traders betting on Bitcoin reclaiming a six-figure price by June 2026, the outcome will be closely monitored. Historical patterns suggest a pattern of recovery following major price drops, leaving room for optimism among traders adjusting their positions. However, the challenge lies in whether external variables will align favorably for BTC.

Moreover, the confidence inspired by prediction markets hinges largely on real-time data analysis and past market trends. As Bitcoin’s trajectory continues to be uncertain, the reliance on accurate predictions from these markets is vital for strategizing investors hoping to leverage price movements. Achieving robust price increases typically requires a cocktail of market enthusiasm, adoption, and strategically timed investments, all of which will depend heavily on improvements in current market conditions.

Market Trends: Factors Influencing Bitcoin’s Potential

Analyzing Bitcoin’s trajectory requires a keen understanding of influencing market trends and external pressures that could manipulate price levels. As prediction markets indicate, BTC’s potential rise is intrinsically tied to market dynamics, regulatory developments, and macroeconomic factors. Increased institutional investments often correlate with price surges, while factors such as regulatory scrutiny can pose risks to the cryptocurrency landscape.

In essence, the cryptocurrency market operates under its unique ecosystem that is noticeably influenced by both digital and traditional market forces. Investors must understand historical patterns and current trends, determining how these elements could project Bitcoin toward its next milestone. The careful observation of these market movements could yield pivotal insights for predicting Bitcoin’s next significant price level.

The Importance of Risk Management in Bitcoin Investments

While betting on Bitcoin’s price fluctuations offers potential rewards, it also comes with inherent risks that require careful management. As many traders engage with prediction markets, a critical aspect of their strategy involves calculating risk-to-reward ratios based on current trading odds and forecasts. This prudent approach allows investors to navigate volatility effectively, ensuring that they are not disproportionately affected by sudden market drops.

Furthermore, enhancing risk management through diversified investments can serve to stabilize overall portfolio performance. By not placing all resources into Bitcoin alone, traders can safeguard against dramatic market downturns while still capitalizing on any upward price movements. This strategic thinking is necessary as Bitcoin continues to shape its path within the uncertain realm of cryptocurrency markets.

Analyzing the Bear Market Sentiment Amid Bitcoin’s Fluctuations

The prevailing bear market sentiment surrounding Bitcoin adds an essential layer to the analysis of its current status. Recent declines in price have transitioned trader beliefs, indicating an anticipated downward trend that could challenge Bitcoin’s ability to maintain its previous heights of $100,000. Monitoring this sentiment offers insights into broader economic dynamics and trader psychology that directly affect market behavior.

Additionally, as traders project the likelihood of Bitcoin dipping to alarming lows such as $58,000, it highlights the immediate need for proactive strategies. Investors should embrace a mindset that remains flexible and prepared for market corrections, aiming to capitalize on potential rebounds that may emerge from such a bearish cycle. Understanding market sentiment is just as crucial as analyzing price data, as it enhances overall comprehension of the ever-changing landscape surrounding Bitcoin.

Frequently Asked Questions

What are the Bitcoin price predictions for June 2026?

Current predictions for Bitcoin price in June 2026 suggest a 65% chance of BTC retaking the $100,000 mark. However, traders anticipate possible declines to $70,000 or $80,000 before any significant recovery.

How do BTC prediction markets forecast Bitcoin price movements?

BTC prediction markets utilize collective insights from traders to estimate future price movements for Bitcoin. For instance, Polymarket currently indicates a low chance of BTC exceeding $100,000 before February, reflecting bearish sentiment.

What are the current Bitcoin trading odds for hitting $100,000?

As of January 2023, Bitcoin trading odds show approximately 6-7% for BTC reaching $100,000 before January ends. This highlights a pessimistic outlook among traders regarding short-term price rallies.

Is there a possibility of a Bitcoin bull market in 2026?

While some traders remain optimistic about a Bitcoin bull market by mid-2026, the ongoing market analysis suggests potential price declines to $58,000 before a recovery, indicating mixed sentiments on a bull market.

What does cryptocurrency market analysis say about Bitcoin’s future?

Cryptocurrency market analysis indicates that Bitcoin may face further declines, with odds suggesting up to a 75% chance of trading below key cost bases in 2026. Traders still anticipate ongoing purchases, forecasting an accumulation of BTC.