Bitcoin price prediction is a hot topic among crypto enthusiasts as analysts scrutinize market trends and future movements. Recently, insights from seasoned traders suggest that Bitcoin may bottom out at $88,000 in the upcoming cycle if the last CME gap remains unfilled. With current prices hovering around $90,205, the cryptocurrency seems to be navigating critical support levels that could determine its next trajectory. As Bitcoin fills one of its two open futures gaps and retests moving averages, experts are closely watching how these price cycles unfold. A thorough cryptocurrency analysis indicates that understanding both support and resistance markers is essential for making informed investment decisions in this volatile market.

The forecast for Bitcoin’s future valuation sparks intrigue as market participants look to gauge its potential ascent or decline. Indicators such as Bitcoin futures and the ongoing examination of CME gaps play crucial roles in shaping trader sentiments. With Bitcoin presently fluctuating around $90,205, analysts are particularly focused on support levels that may signify pivotal points of price stabilization. As the digital currency experiences fluctuations, discussions revolve around the critical nature of the BTC price cycle, inviting stakeholders to evaluate their strategies amid the uncertainty. This burgeoning field of cryptocurrency analysis continues to evolve, highlighting the importance of data-driven assessments for navigating the intricacies of Bitcoin’s pricing landscape.

Understanding Bitcoin Price Prediction

Bitcoin price predictions hinge on various factors, including market sentiment, trading patterns, and technical analytics. Recent analyses suggest that Bitcoin may experience a bottoming out at around $88,000 in the next price cycle if the unfilled CME gap persists. Traders and analysts closely monitor these predictive indicators to better grasp potential future movements of Bitcoin prices, which are notoriously volatile and influenced by a myriad of scenarios ranging from regulatory changes to macroeconomic trends.

A comprehensive Bitcoin price prediction involves scrutinizing historical price cycles and identifying recurring behaviors. As per the observations made by seasoned traders, filling the second CME gap serves as a pivotal moment that could establish a foundation for Bitcoin’s rise. Such predictions emphasize the relevance of technical analysis in cryptocurrency analysis where the interplay of support levels and market resistance often sets the stage for price movements.

The Role of Bitcoin Futures in Price Dynamics

The Bitcoin futures market, particularly represented by CME Group, plays a significant role in determining short-term Bitcoin price movements. When analysts reference Bitcoin futures gaps, they indicate the price differences between current trading levels and prior future contracts that have not yet been settled. In this context, traders watch these gaps as potential indicators for potential bullish or bearish trends within the market.

Understanding the implications of Bitcoin futures is crucial for navigating the cryptocurrency landscape. The filled and unfilled gaps help traders identify support levels that are critical for price stabilization. If the unfilled gap at approximately $88,200 is resolved in a bullish manner, Bitcoin could gain momentum and initiate a substantial price rally, reinforcing the significance of future contracts in shaping price trajectories.

Analyzing Bitcoin Support Levels and Resistance Markers

Bitcoin support levels are areas where prices typically struggle to fall below, acting as a foundation for potential recoveries. Current analyses highlight $89,000 and $92,000 as key support and resistance markers. These levels are essential for traders looking for entry points and for assessing risk management in their strategies. A drop below these levels may trigger further selling, while stabilizing above them can signal potential upward price movement.

Analyzing these key price levels within the larger context of Bitcoin’s trading range allows traders to develop informed strategies. The close alignment of Bitcoin’s price with the 21-day moving average adds another layer to this analysis. As Bitcoin remains within this critical range, watching how it interacts with these support and resistance markers will provide traders with glimpses into imminent price action.

How CME Gaps Influence Bitcoin Market Sentiment

CME gaps draw significant attention as they can often indicate the market’s future behavior. When Bitcoin prices dip below a certain threshold, like the recent movement toward $90,205, it raises market sentiment and trader behavior considerations. The presence of unfilled gaps often breeds caution and leads traders to speculate on potential retracements, which can either solidify or undermine support levels.

The sentiment surrounding unfilled CME gaps reflects a broader apprehension in the cryptocurrency market where volatility reigns. Traders must assess how these gaps serve not just as price markers but also as psychological barriers influencing collective trading decisions. Understanding the sentiment tied to these market dynamics can help bolster strategic foresight in Bitcoin trading.

The Importance of Cryptocurrency Analysis in Trading

In the rapidly evolving landscape of cryptocurrency, rigorous analysis is paramount. Traders rely not only on price charts but also on advanced tools like cryptocurrency analysis to forecast potential market movements. This analysis often includes assessing volume trends, market cap fluctuations, and macroeconomic indicators that influence Bitcoin price dynamics.

The complexity and volatility of Bitcoin trading necessitate a well-rounded approach to cryptocurrency analysis. By integrating tools that highlight market sentiment with the understanding of trends, traders can better navigate through price fluctuations. Informed analysis can significantly enhance strategic trading decisions, especially during periods of uncertainty following market corrections.

Key Price Cycles in Bitcoin Trading History

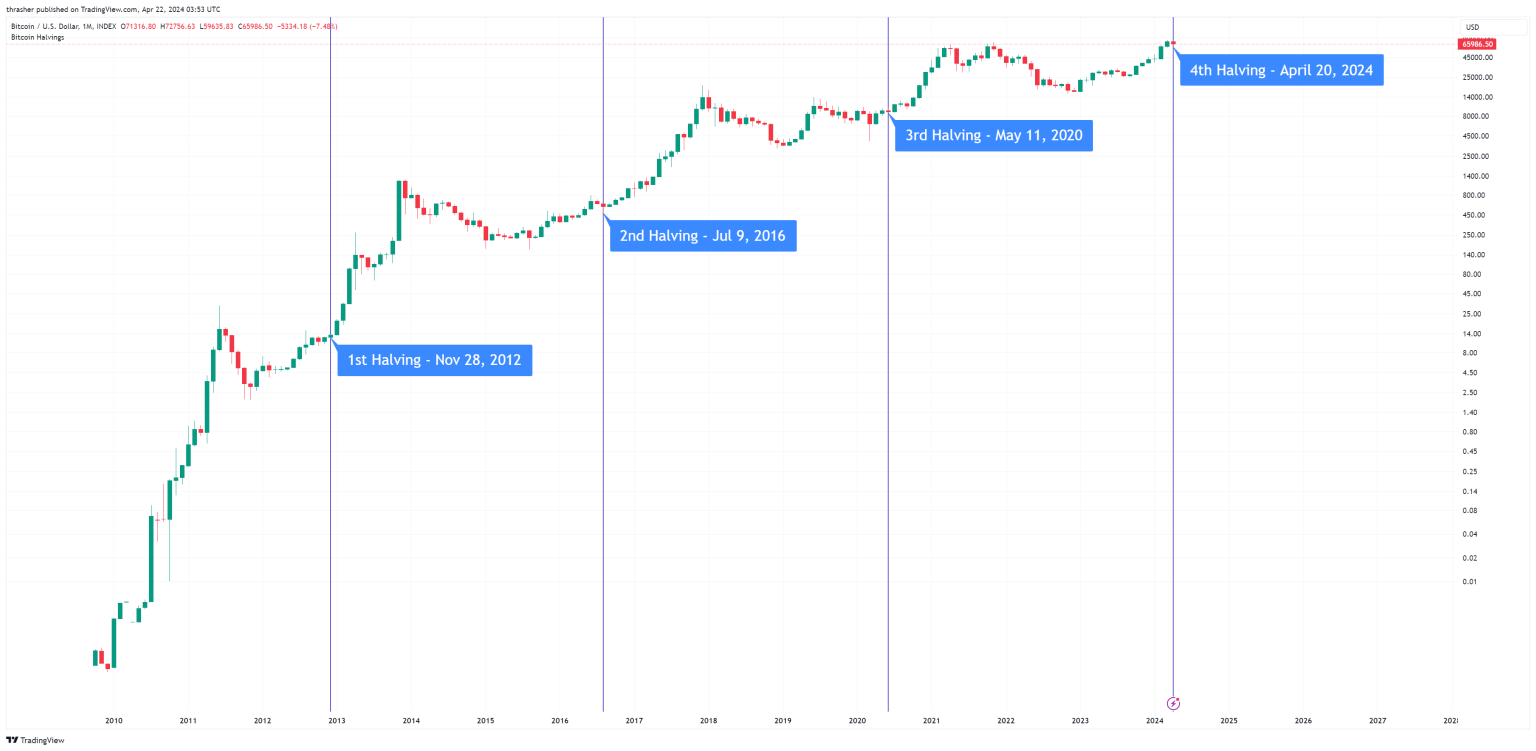

Understanding Bitcoin price cycles can substantially aid traders in predicting potential market conditions. Historically, Bitcoin has experienced cycles of rapid growth followed by corrections, and recognizing these cycles allows traders to align their strategies accordingly. The current analysis indicates that the market may have entered another BTC price cycle, suggesting a potential bottom at key levels, which can serve as a launching pad for the next rally.

Price cycles not only showcase the historical trends but also reveal critical insights into future movements. As Bitcoin nears crucial thresholds, observing these cycles becomes essential for traders aiming to capitalize on anticipated trends. The cyclical nature of Bitcoin trading is integral to developing a responsive trading strategy that can adapt to changing market conditions.

Market Sentiment and Bitcoin Price Fluctuations

Market sentiment plays a central role in the fluctuations of Bitcoin prices. Investor emotions often sway Bitcoin’s market dynamics, causing rapid changes based on news events, regulatory updates, or macroeconomic news. The current state of market psychology reflects caution and speculation, given Bitcoin’s recent struggles at pivotal support and resistance levels, particularly around the $90,000 mark.

Interpreting market sentiment alongside technical indicators allows traders to make educated decisions. For instance, as Bitcoin hovers near the lower end of its trading range, the potential for breakout patterns emerges. A shift in sentiment could lead to either bullish rallies or further corrections, reiterating the importance of monitoring both sentiment and fundamental factors influencing Bitcoin’s price.

Future Implications of Bitcoin Price Movement

The future implications of current Bitcoin price movements are enormous, particularly in the context of emerging trading strategies. As Bitcoin approaches critical support levels identified at $88K, the decisions made in the coming weeks can shape the cryptocurrency landscape for the next cycle. Traders must stay vigilant to anticipate market reactions to unfilled CME gaps and other significant events.

Additionally, understanding how these movements influence broader market behavior will provide traders with predictive insights. As analysts continue to dissect the reasons behind price fluctuations, the emphasis on strategic planning grows paramount in positioning oneself favorably in the next bullish or bearish trend. Therefore, future Bitcoin price movements will undoubtedly probe analysts and traders alike to adapt swiftly to changing conditions.

Strategizing for Bitcoin Investment Success

Successful trading in Bitcoin requires a detailed and adaptable strategy that considers market trends, historical cycles, and analysis of support levels. With the market’s current volatility, investment strategies must accommodate sudden shifts in price dynamics. Whether to hold, trade, or set stop-loss orders can all hinge on the trajectory indicated by imminent price behavior.

Importantly, continual education and research within cryptocurrency analysis can enhance trading acumen. As new information emerges, being adaptable and proactive is essential for maintaining capital and reaping potential gains from Bitcoin’s unpredictable nature. Building a resilient strategy that factors in the complexities of market sentiment and price predictions can foster long-term investment success in the cryptocurrency domain.

Frequently Asked Questions

What is the significance of Bitcoin futures in Bitcoin price prediction?

Bitcoin futures play a crucial role in Bitcoin price prediction as they provide insights into market expectations and sentiment. Analysts often look at Bitcoin futures gaps, especially those created by the CME, to forecast potential price movements and identify support levels.

How do CME gaps affect Bitcoin price prediction?

CME gaps impact Bitcoin price prediction significantly. When Bitcoin futures gaps remain unfilled, it suggests potential price floors or ceilings. Currently, analysts believe that if the remaining CME gap, around $88,200, is not filled, the Bitcoin price may bottom at $88K in the next cycle.

What are the current critical support levels for Bitcoin price prediction?

Recent cryptocurrency analyses indicate that Bitcoin’s critical support levels for price prediction are around $89,000 and $88,900. Holding above these levels may stabilize Bitcoin’s price, while a drop below could lead to further declines.

How does the BTC price cycle influence current price predictions?

The BTC price cycle heavily influences current price predictions by setting target levels based on historical performance. Analysts suggest that if Bitcoin holds above crucial support zones, it may indicate the start of a bullish cycle, while failure to do so could signal further bearish trends.

What role does cryptocurrency analysis play in Bitcoin price prediction?

Cryptocurrency analysis is vital for Bitcoin price prediction as it helps traders evaluate market trends, key support and resistance levels, and potential price cycles. Analysts utilize various indicators, including moving averages and futures gaps, providing a comprehensive approach to predicting Bitcoin’s future trajectory.

| Key Point | Details |

|---|---|

| Current Bitcoin Price | $90,205, with local lows of $89,530 observed. |

| Moving Average Analysis | Retested 21-day moving average at $88,900; holding above this may stabilize prices. |

| Key Levels to Watch | $89,000 is support, $92,000 is resistance; sideways trading expected. |

| CME Gaps | One gap filled, other remains at around $88,200; critical for short-term price movements. |

| Future Predictions | Failure to fill the second gap indicates potential bottom around $88K. |

Summary

Bitcoin price prediction suggests that the cryptocurrency could potentially see a bottom at $88K next cycle if the remaining CME gap is not filled. Current market dynamics, including critical support and resistance levels, indicate a cautious approach as Bitcoin trades near $90K. Analysts are watching key indicators such as movement averages and futures market gaps for insights into future price movements. As always, thorough research and strategic planning are essential in navigating the volatility of the cryptocurrency market.

Related: More from Bitcoin News | Stablecoin Strength Pressures Bitcoin Treasury | Analysts: No Evidence of Jane Street Bitcoin Manipulation, ETF Demand Soars