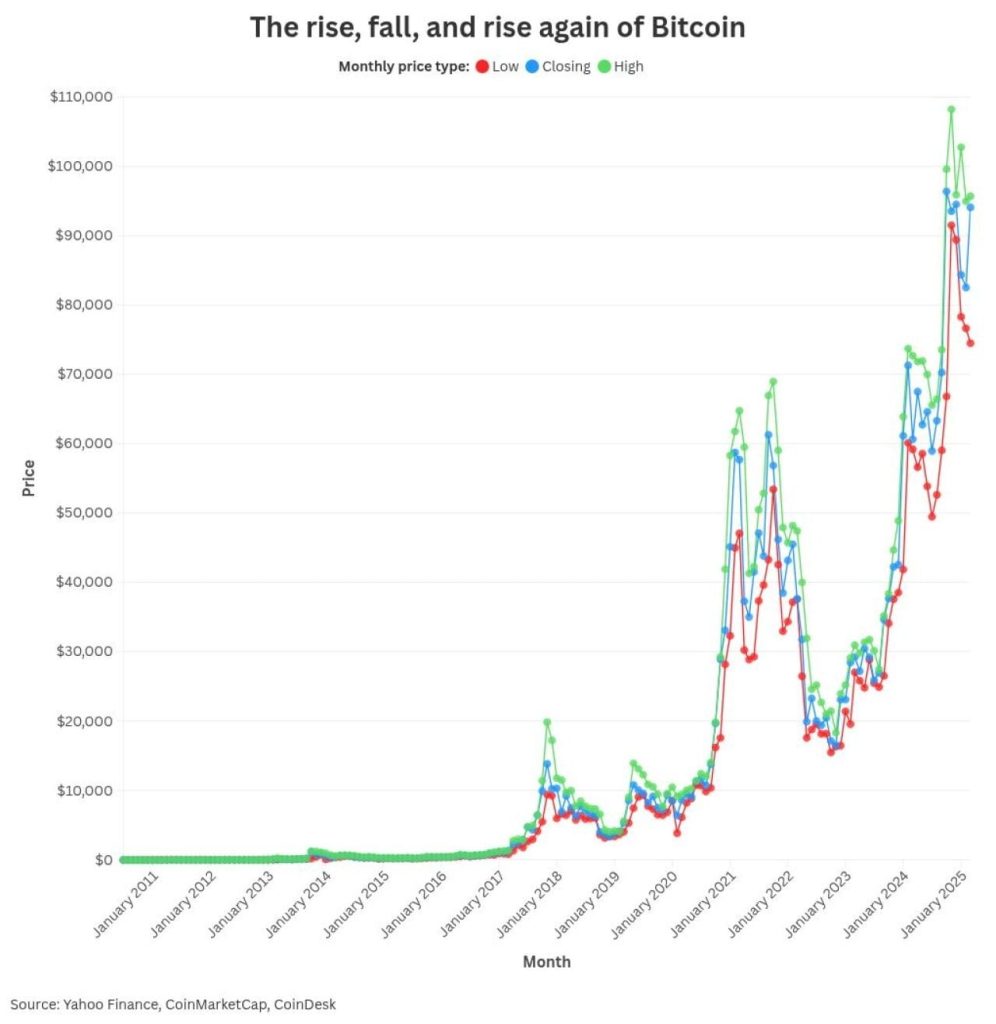

In the world of cryptocurrency, understanding Bitcoin price levels is pivotal for developing a robust trading strategy. Recent insights from crypto market analysis indicate that several key thresholds exist that could dictate Bitcoin’s future trajectory. Notably, the $50,000 mark stands as a crucial psychological barrier; a drop below this level could reignite the narrative suggesting that “BTC is dead.” Alongside this, other significant price levels, such as $58,000, $70,000, and $80,000, merit attention as potential pivots in the current bear market Bitcoin faces. As traders navigate these tumultuous waters, assessing these price levels is essential to formulate an effective Bitcoin trading strategy and to mitigate risks associated with volatile crypto price levels.

In the expansive realm of digital currencies, pinpointing crucial Bitcoin valuation thresholds is essential for investors and analysts alike. The current market dynamics highlight various pivotal points, such as important liquidity zones and psychological benchmarks that could influence trader behavior. Observations from the financial community reveal that levels like $50,000 may serve as a significant floor, while others such as $58,000 and $70,000 could exhibit resistance. The fluctuating nature of Bitcoin mirrors broader trends in crypto markets, especially when considering the implications of a bear market. Therefore, a nuanced understanding of these valuation metrics is not just beneficial—it’s imperative for navigating the complexities of cryptocurrency trading.

| Key Price Level | Description |

|---|---|

| $80,000 | Low point from November 2025, marking the local low of this bear market. |

| $74,000 | Low from April 2025, coinciding with ‘tariff panic’ low, slightly below the Strategy cost basis of $76,000. |

| $70,000 | Top end of the $50,000-$70,000 range, close to highs of 2021. |

| $58,000 | 200-week Simple Moving Average (SMA) and on-chain cost basis. |

| $50,000 and below | Psychological bottom price level; falling below this level could revive the ‘BTC is dead’ narrative. |

Summary

Bitcoin price levels are crucial for understanding the current market dynamics. As outlined by Chris Burniske, significant price levels such as $80,000, $74,000, and $70,000 highlight past market behavior and resistance points. The $58,000 level represents the critical 200-week SMA, while $50,000 acts as a psychological threshold; dropping below this could reignite negative sentiment surrounding Bitcoin. Investors should pay close attention to these levels as they navigate the evolving cryptocurrency landscape.

Understanding Bitcoin Price Levels in 2026

In the current landscape of cryptocurrency, understanding Bitcoin price levels is crucial for both investors and traders alike. As reported by Chris Burniske, notable price points such as $80,000 and $74,000 represent significant historical lows from previous market cycles. These price levels serve not only as potential buy signals for informed traders but also as psychological barriers that can influence market sentiment. For example, reaching $80,000 could signify a reversal from the ongoing bear market, stirring positive narratives around Bitcoin’s resilience.

Additionally, the $70,000 mark stands out as part of a crucial range between $50,000 and $70,000, marking the highs seen in 2021. This threshold can be pivotal for traders implementing technical strategies. If Bitcoin consistently trades above this level, it may affirm bullish sentiments and signal a potential recovery in the broader Bitcoin market. Traders equipped with strategies that incorporate these price levels may find themselves better positioned to capitalize on market fluctuations.

The Psychological Barrier of $50,000 for Bitcoin

The $50,000 price level serves as a significant psychological barrier in Bitcoin trading strategies. Falling below this threshold might trigger the infamous ‘BTC is dead’ narrative, impacting market psychology drastically. Many investors have expressed concerns that breaching this level could signal a prolonged downturn, prompting them to reconsider their positions or liquidate their assets. Understanding this psychological impact is critical for navigating the current climate of uncertainty in the crypto market.

Despite this negative outlook, some experts like Burniske reflect a more optimistic perspective on Bitcoin’s long-term potential. The perception surrounding the $50,000 price mark can create volatility in trading but also offers buying opportunities for savvy investors. If Bitcoin’s price sustains above this critical barrier, it could deter bearish sentiment, leading to renewed investor confidence and potentially attracting new capital to the market.

Evaluating Bitcoin Market Analysis During Bear Markets

Market analysis during a bear market for Bitcoin often emphasizes critical price levels that traders should watch closely. Observing historical low points, such as the $58,000 level associated with the 200-week Simple Moving Average, can provide essential insights into potential reversals or further declines. For traders using Bitcoin trading strategies based on historical data, understanding how these levels interact with current prices is vital for decision-making.

Moreover, such market analysis allows traders to create more refined strategies by integrating both LSI keywords related to Bitcoin, such as psychology and market sentiment. By applying these analyses to a bear market, traders can develop targeted strategies that incorporate watching for breakouts above or confirmations near the once strong support levels. This approach helps position traders to effectively navigate the complexities of market downturns and psychological barriers.

The Role of Bitcoin Trading Strategies in Market Recovery

In developing effective Bitcoin trading strategies, understanding market dynamics and specific price levels takes precedence. Many traders depend on these levels to formulate entry and exit points, particularly during turbulent times like a bear market. Key price points, such as $70,000, indicative of bullish highs in previous cycles, can serve as potential targets when devising a recovery strategy. This forward-looking approach can allow traders to capitalize on market rebounds should they occur.

Moreover, successful strategies often include diversification across specific crypto assets in addition to Bitcoin. Burniske’s insights suggest that during market recoveries, a diversified portfolio can spread risk while maximizing potential returns. By closely monitoring price levels and adjusting strategies accordingly, traders can navigate unpredictable movements in the market effectively.

Evaluating Crypto Price Levels Beyond Bitcoin

While Bitcoin remains at the forefront of market discussions, evaluating other crypto price levels is equally essential for a comprehensive market review. Cryptocurrencies often mirror Bitcoin’s fluctuations, meaning that their respective price levels can indicate market sentiment overall. Understanding how these altcoins react to Bitcoin’s movements can enhance a trader’s strategy and offer insights into potential market trends.

Moreover, identifying correlation between Bitcoin and other digital assets helps traders understand broader market dynamics. As Bitcoin’s price levels fluctuate, so do those of various altcoins, with emerging narratives shaped by Bitcoin’s market behavior. For instance, if Bitcoin stabilizes above critical thresholds like $58,000 or $70,000, confidence may rise in altcoin investments, thus creating potential buying opportunities across the cryptocurrency spectrum.

Current Bear Market Implications for Bitcoin Investors

The implications of the current bear market for Bitcoin investors are profound, as it challenges traditional trading strategies and forces a reevaluation of risk management. While the previous bulls laid down blueprints for success, the realities of sustaining trading positions under bearish conditions require a shift toward caution and adaptability. Investors must incorporate analysis of price levels meticulously and be prepared for impulsive market changes.

Observing levels such as $50,000 can also act as a waking call for investors who mustn’t rely solely on past performance. Navigating through this bear market phase can provoke fear-based decisions, but those who maintain a focus on the fundamentals and potential for recovery may find strategies that withstand the fluctuating sentiments. As Burniske indicates, opportunities may arise for acquisition in times of decline, adding to the layers of strategy for investors in this challenging market.

The Importance of Historical Price Levels in Bitcoin Trading

Historical price levels are paramount in Bitcoin trading, allowing traders to forecast future trends based on past market behavior. For instance, the lows recorded at $74,000 illustrate a point where strategic adjustments may be warranted. Recognizing these touchpoints can empower traders with a framework for creating actionable strategies and help them navigate the complex cycles of Bitcoin’s value.

Using historical price data also aids in addressing psychological barriers, such as the $50,000 threshold. Traders can refer to past reactions around such significant levels to better anticipate market responses and adjust their approaches accordingly. Through rigorous analysis of these historical price touches, traders can enhance their market positioning and mitigate risks amidst ongoing volatility.

Developing a Comprehensive Bitcoin Trading Plan

Crafting a comprehensive Bitcoin trading plan necessitates a recognition of key price levels and an understanding of market trends. This plan should incorporate a proactive approach to potential downturns and tailor strategies accordingly. By defining specific entry and exit points around price levels such as $58,000 and $50,000, traders can position themselves strategically to capitalize on both upward movements and manage losses effectively.

Moreover, continually reassessing the trading plan in light of market developments is essential. As volatile as the Bitcoin market is, adopting flexibility within your strategy can yield significant advantages. Utilizing technical analysis based on established price levels, traders can more easily navigate through the complexities of market emotions and irrational behaviors prevalent in crypto market dynamics.

Monitoring Market Sentiment in Bitcoin Trading

Market sentiment plays a pivotal role in Bitcoin trading outcomes. Understanding the prevailing mood around Bitcoin—especially when it hovers near critical price levels—can make the difference between success and loss in trading. Factors influencing sentiment include public commentary, market analysis reports like those from Chris Burniske, and broader economic conditions impacting traders’ perceptions of Bitcoin value.

Keeping abreast of market sentiment can help traders manage their expectations and responses. For example, a negative narrative surrounding the price level of $50,000 could evoke fear among investors, prompting large sell-offs. In contrast, conversely, positive sentiment driven by Bitcoin’s recovery trend can lead to increased buying pressure. By continually monitoring sentiment, traders can align their strategies with the emotional landscape of the market.

Strategizing for Future Bitcoin Market Trends

As the Bitcoin landscape continues to evolve, developing strategies that anticipate future market trends becomes ever more critical. Traders should remain attentive to key price levels and ongoing analyses that provide insights into potential movements. Price thresholds—such as those identified by Burniske—are not just markers of past performance but can serve as indicators of future volatility or stability.

Additionally, considering macroeconomic factors can enhance strategic planning. As Bitcoin interacts with global economic events and regulatory changes, incorporating broader trends into trading strategies provides a holistic view of market dynamics. By preparing for various scenarios, traders can position themselves effectively, maximizing opportunities presented by future trends while mitigating possible risks.

Frequently Asked Questions

What are the key Bitcoin price levels to watch in market analysis?

In Bitcoin market analysis, several key price levels are essential to watch. Notable levels include approximately $80,000, which marks a local low from November 2025, and $74,000, the low from April 2025. Additionally, the $70,000 level aligns with the highs of 2021, while the $58,000 level corresponds to the 200-week Simple Moving Average (SMA). The psychological barrier is evident around $50,000, where any drop below could revive bearish sentiments in the market.

How do psychological barriers affect Bitcoin price levels?

Psychological barriers like the $50,000 threshold play a significant role in Bitcoin trading strategy. Falling below this level may lead to increased selling pressure and the narrative that ‘BTC is dead.’ Traders often monitor these psychological price levels, as they can influence market behavior and sentiment, potentially triggering a bearish market response.

What is the significance of the $70,000 price level in Bitcoin trading?

The $70,000 price level is significant as it represents the high end of the previously established range and aligns with highs seen in 2021. This level is frequently analyzed in Bitcoin market analysis, as breaking above could signal bullish momentum, while a decline could indicate a bearish trend in Bitcoin trading strategies.

How do bear markets influence Bitcoin price levels?

Bear markets impact Bitcoin price levels by creating lower lows that traders must navigate. For instance, the price levels such as $80,000 and $74,000 were identified during the recent bear market phases. Understanding these levels aids investors in developing a Bitcoin trading strategy that can capitalize on potential rebounds or minimize losses during downtrends.

What are the implications of Bitcoin trading below the 200-week SMA?

When Bitcoin trades below the 200-week Simple Moving Average (SMA), currently around $58,000, it may indicate a bearish trend. This price level is crucial for Bitcoin market analysis, as it reflects long-term investor sentiment. Staying below the 200-week SMA can lead traders to reassess their strategies and might signal further downward pressure on prices.